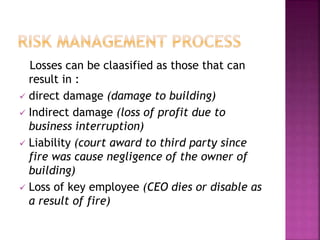

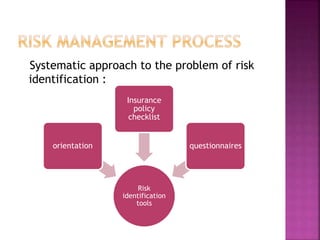

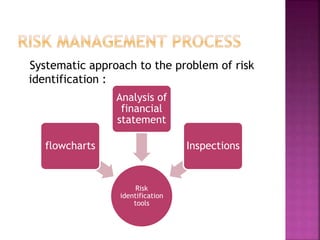

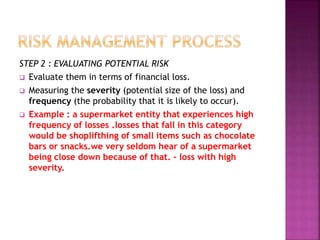

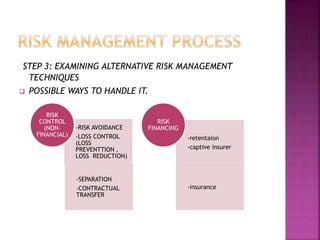

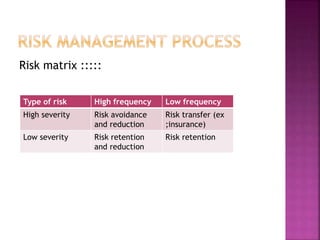

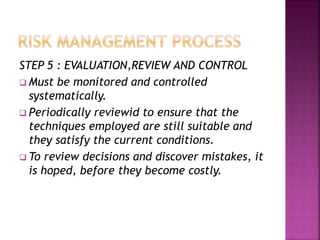

Risk management seeks to address uncertainty and risks that may hinder an organization from achieving its goals. It involves identifying potential risks, evaluating their likelihood and impact, examining options to manage the risks, selecting and implementing a risk management program, and reviewing the program. The goal is to preserve the organization's ability to function and protect employees from harm, while reducing utilization of resources and negative effects of risks.