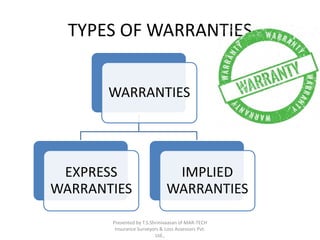

The document discusses key concepts related to insurance. It defines insurance as a cooperative method of spreading risk among a group of individuals. It also defines key principles of insurance such as utmost good faith, indemnity, subrogation, and causation. Additionally, it outlines different types of insurance like life, non-life, marine, fire, motor and engineering insurance.