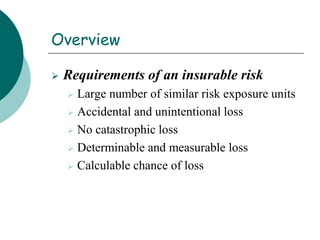

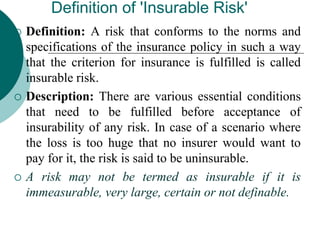

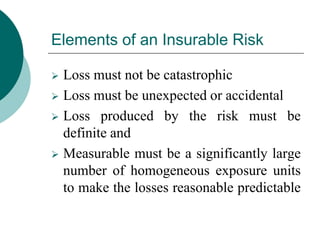

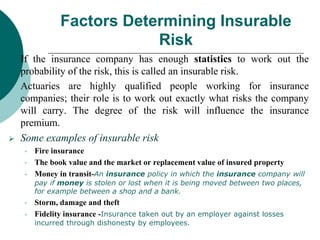

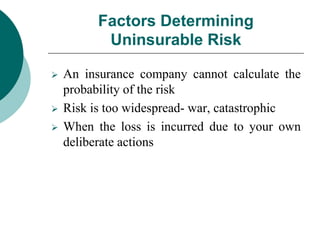

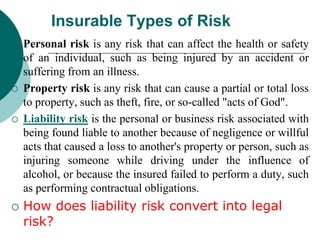

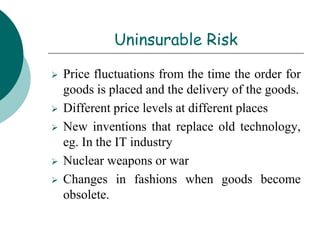

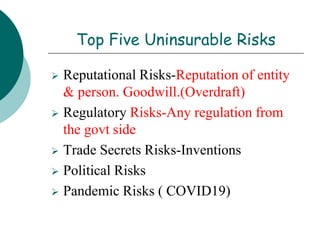

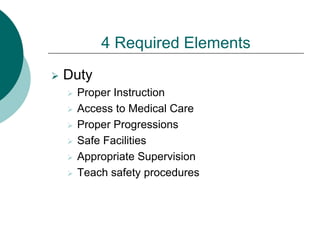

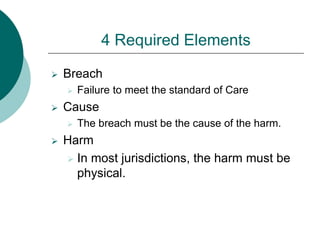

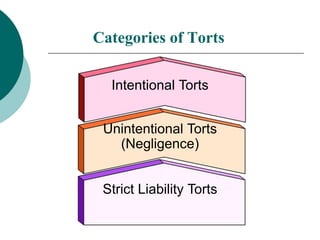

This document summarizes key concepts around insurable risk, risk management, and legal liability for injury. It defines an insurable risk as one that conforms to insurance policy standards. To be insurable, a risk must not be catastrophic, accidental, measurable, and involve a large number of similar exposures. The document outlines different risk management strategies like risk avoidance, retention, and transfer. It also discusses elements required for legal liability claims, including duty, breach of duty, causation, and harm. Tort law provides remedies for civil wrongs like negligence that cause injury.