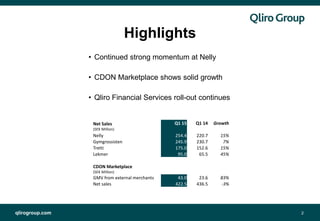

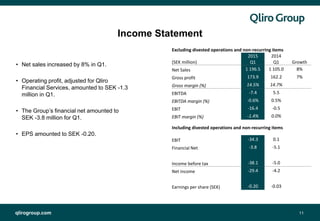

- Qlirogroup reported continued strong growth in the first quarter of 2015, with overall net sales up 8% and growth in three of its four business segments.

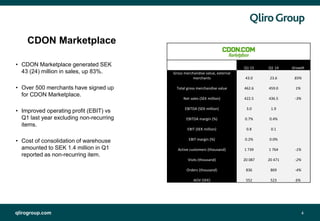

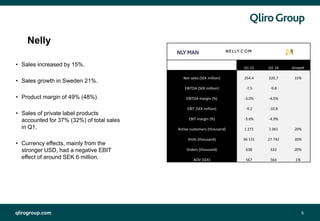

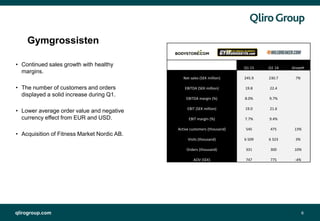

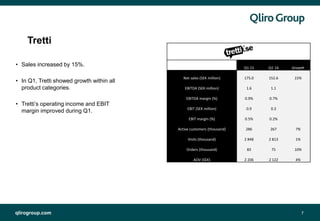

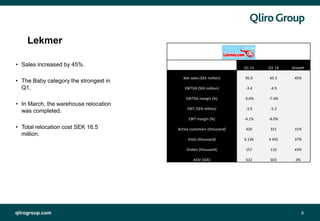

- Nelly sales grew 15% and CDON Marketplace's external merchant sales increased 83%, while Gymgrossisten and Tretti also saw sales growth.

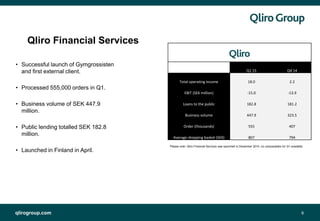

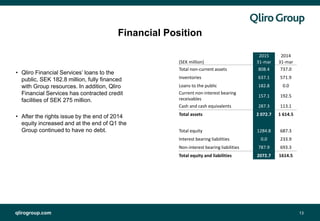

- Qliro Financial Services launched successfully in December 2014 and continued its roll-out in the first quarter, processing over 500,000 orders and growing its business volume to SEK 447.9 million.

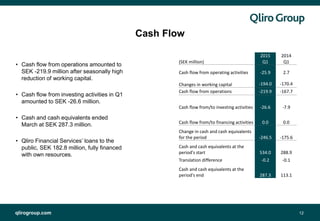

- The company expects further investment in growth across the Nordic region and for Qliro Financial Services to gradually improve earnings and be profitable in 2016.