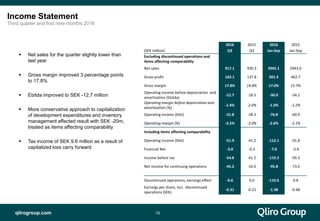

- Gross margin increased 3 percentage points to 17.8% in Q3 2016 compared to Q3 2015. Operating income before depreciation and amortization (EBITDA) improved but was still negative at SEK -12.7 million.

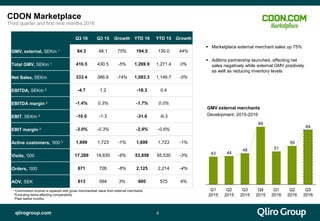

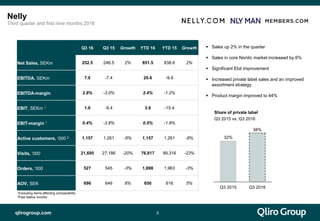

- Nelly significantly improved operating income to SEK 10 million for Q3 2016. CDON Marketplace external merchant sales grew 75% in Q3 2016 compared to Q3 2015.

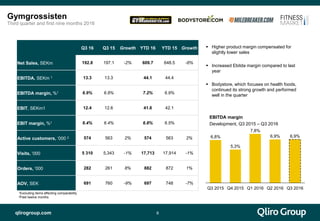

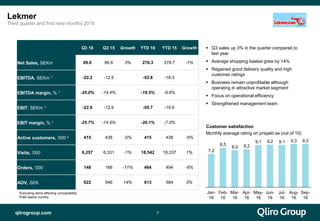

- Gymgrossisten continued to deliver solid profits in Q3 2016 as higher product margins offset slightly lower sales. Lekmer sales grew 3% in Q3 2016 but operating income margins remained negative.

- A strategic review of the group will be completed by the end