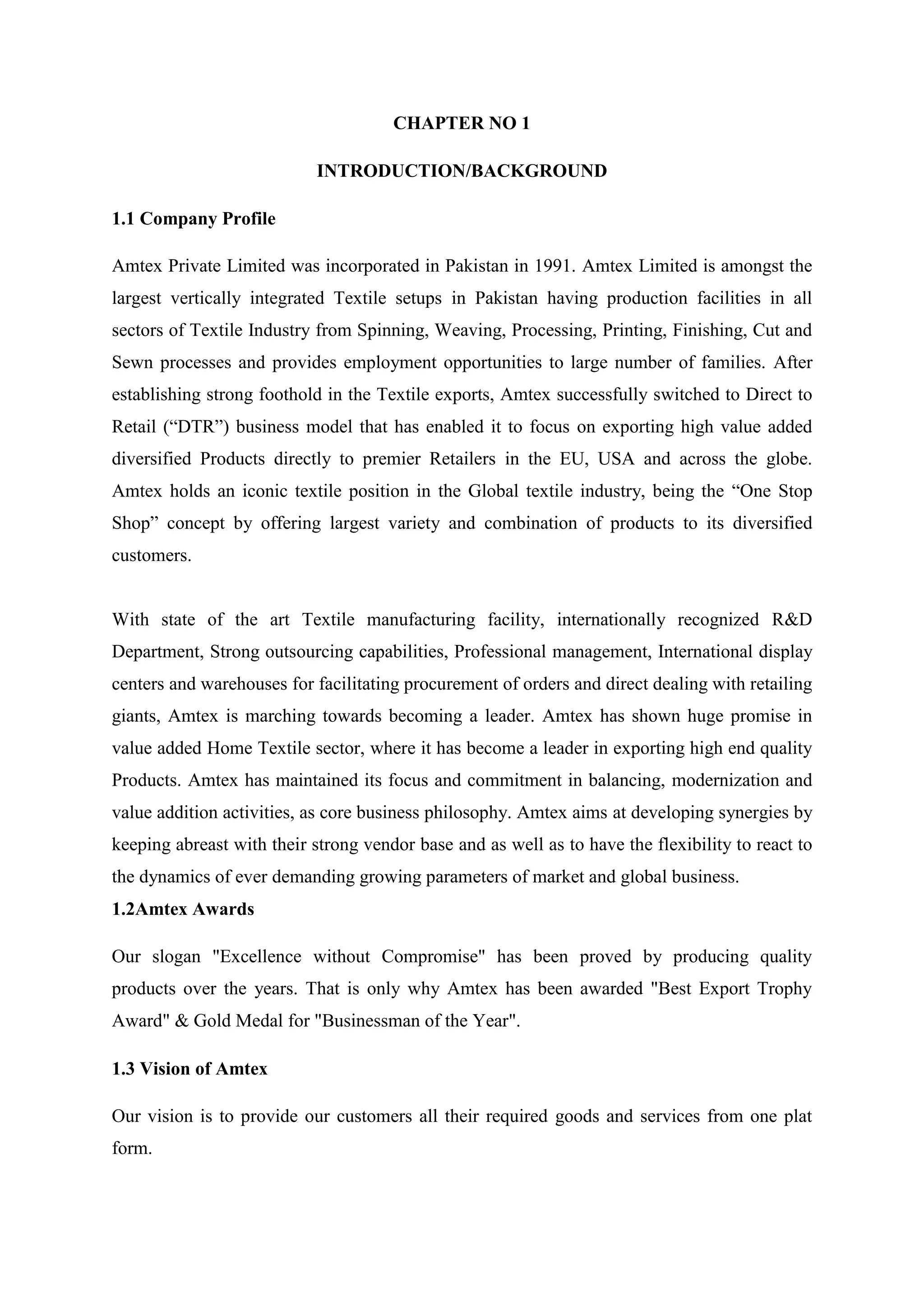

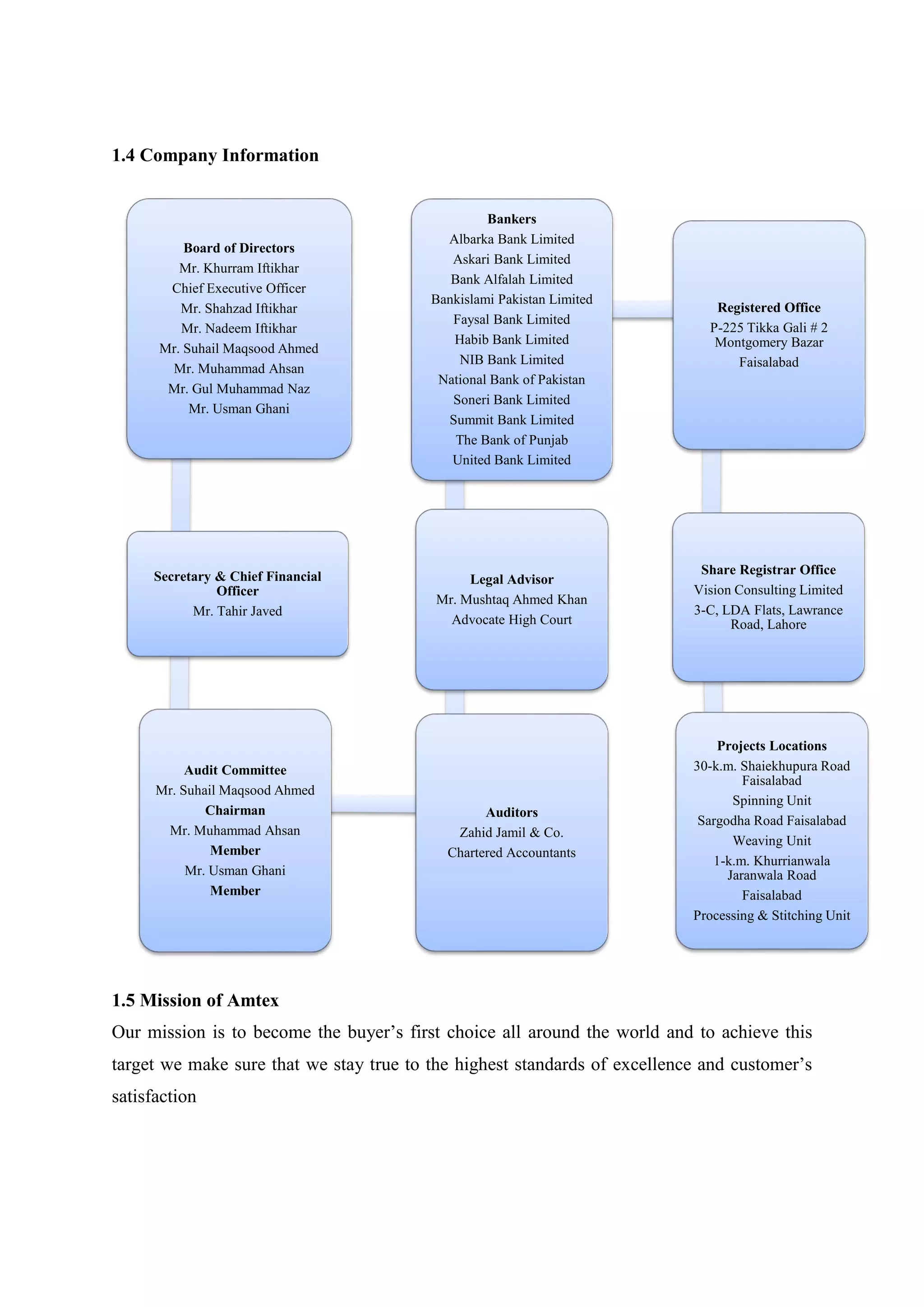

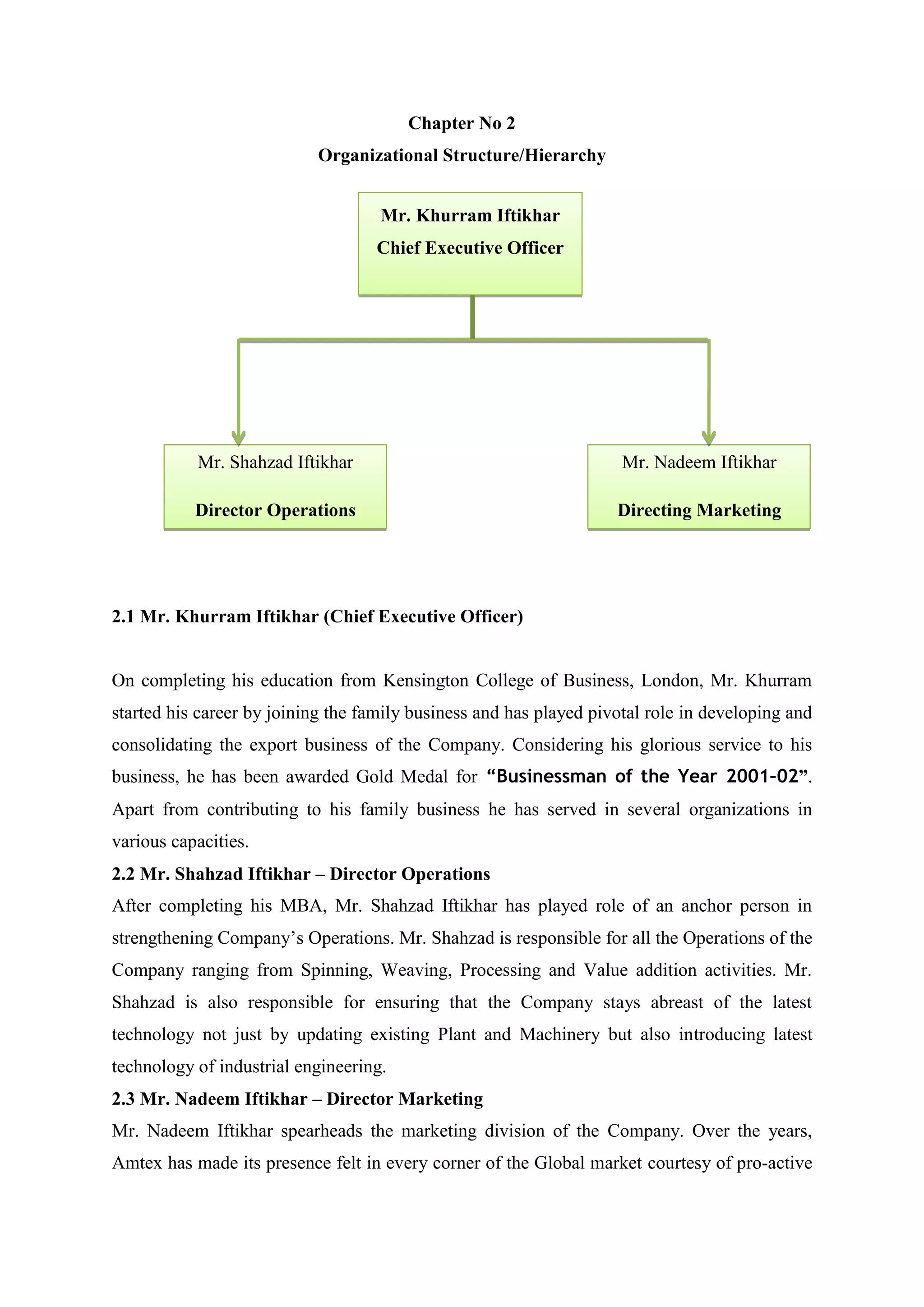

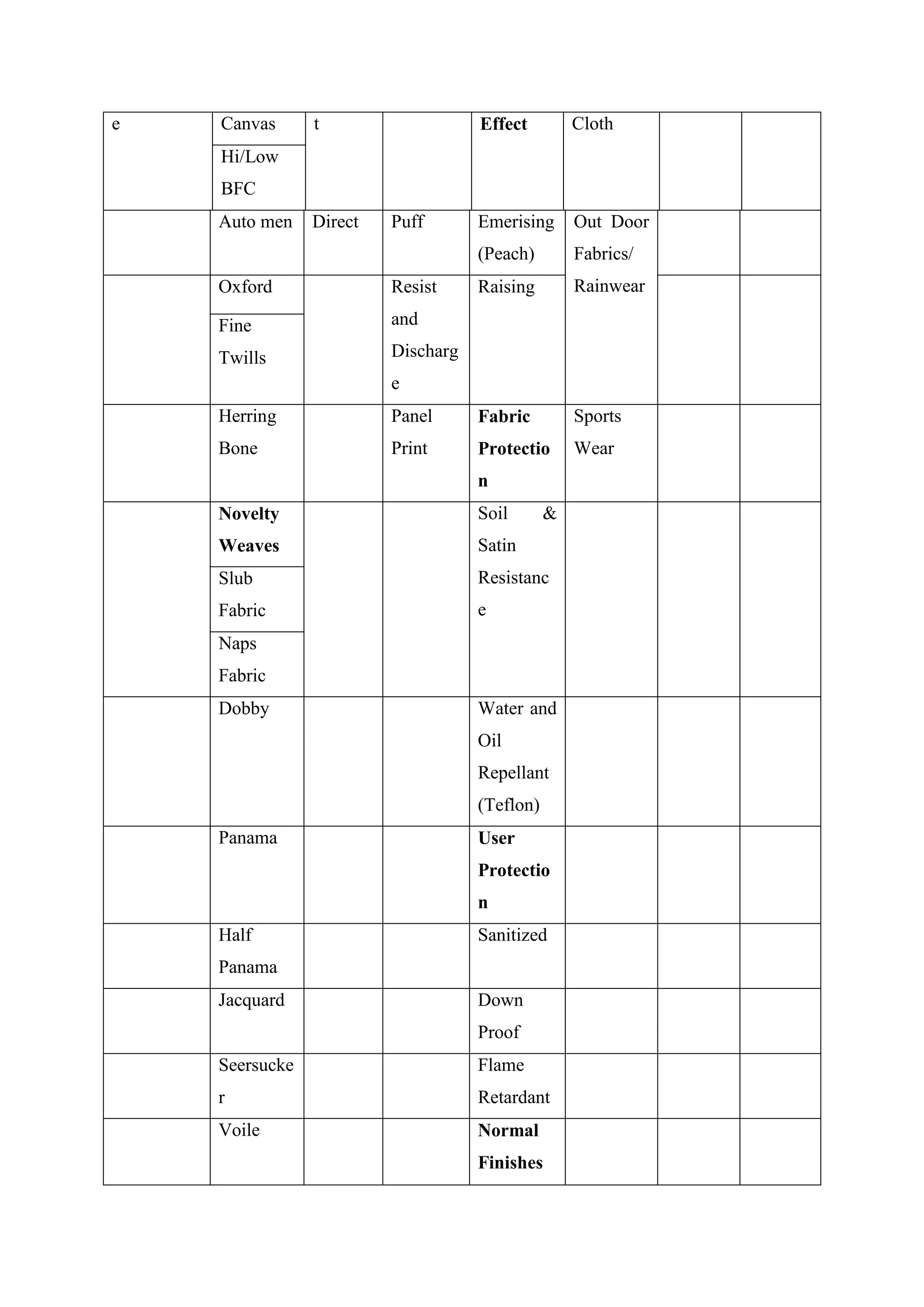

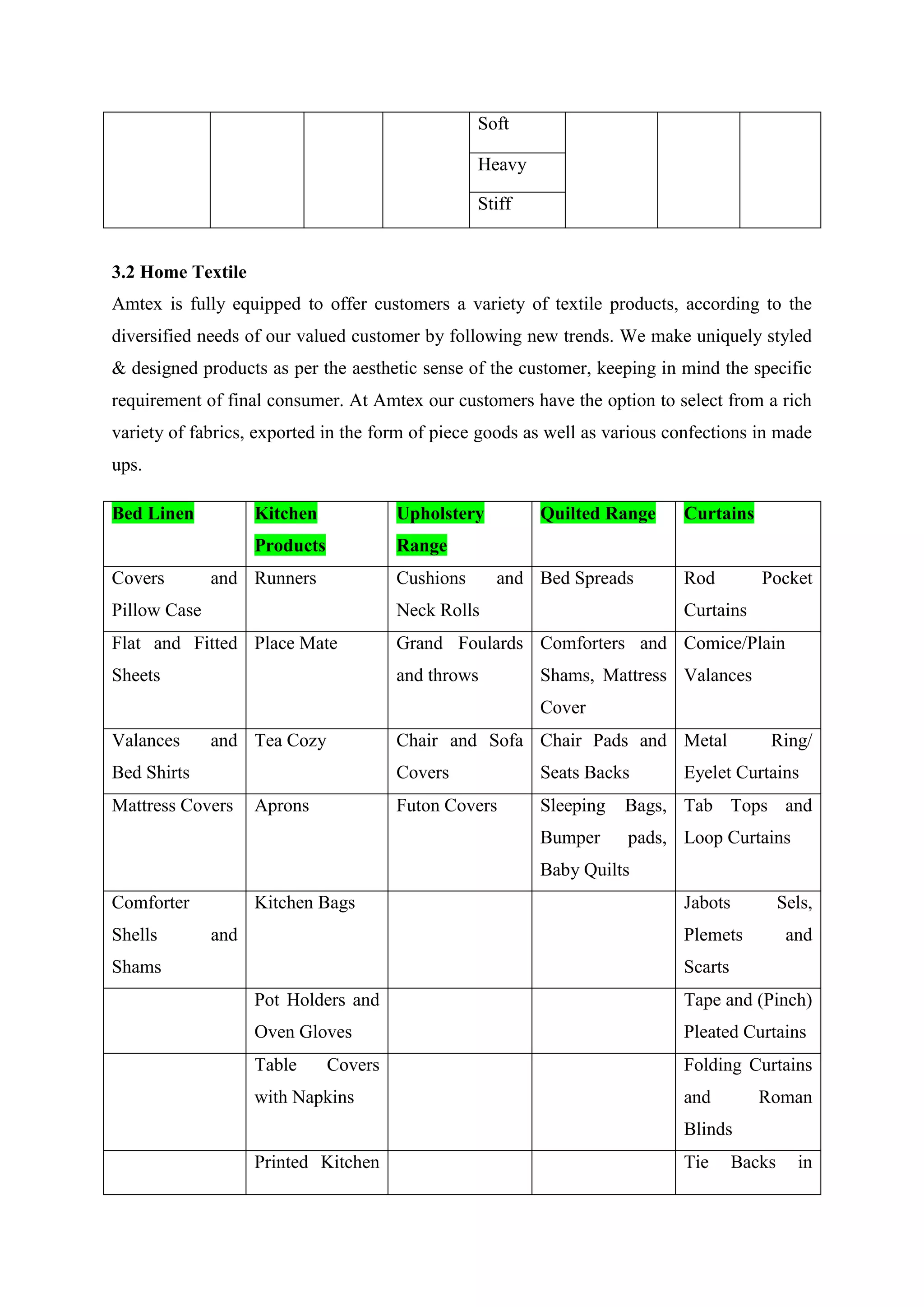

Amtex Private Limited, incorporated in Pakistan in 1991, is a major vertically integrated textile company that has successfully transitioned to a direct retail business model, focusing on exporting diversified high-value products globally. The company aims to lead in the textile industry by offering a vast range of products, maintaining high-quality standards, and integrating modern technology into its operations. With recognition through awards and a clear vision to be the preferred choice for buyers worldwide, Amtex continues to adapt to market dynamics while emphasizing customer satisfaction.