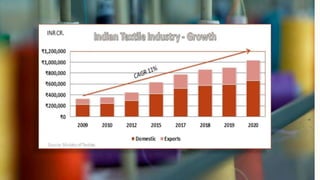

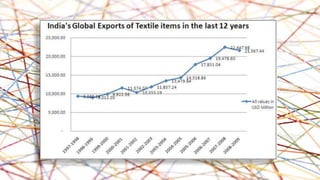

The textile industry is one of India's oldest and largest industries, contributing approximately 11% to exports and 5% to GDP. It employs over 40 million workers directly and 60 million indirectly. The industry has seen significant growth and is expected to reach $223 billion by 2021. It consists of both organized large-scale sectors and unorganized small-scale traditional sectors. The government has implemented several initiatives to support the industry such as increasing market access for handloom products and setting export targets. However, the industry faces challenges from high costs, lack of technology, and pressure from international competition as trade barriers are reduced.