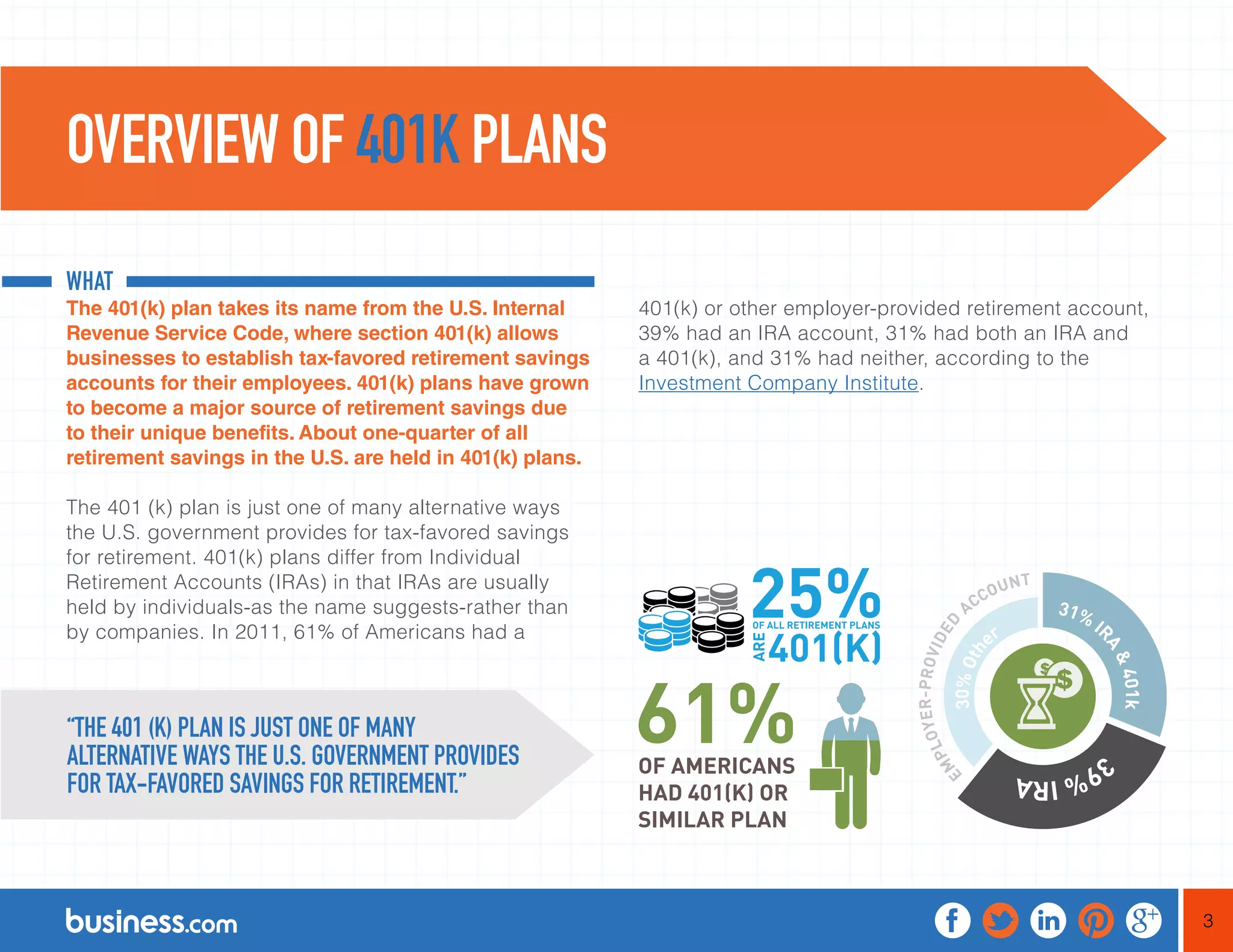

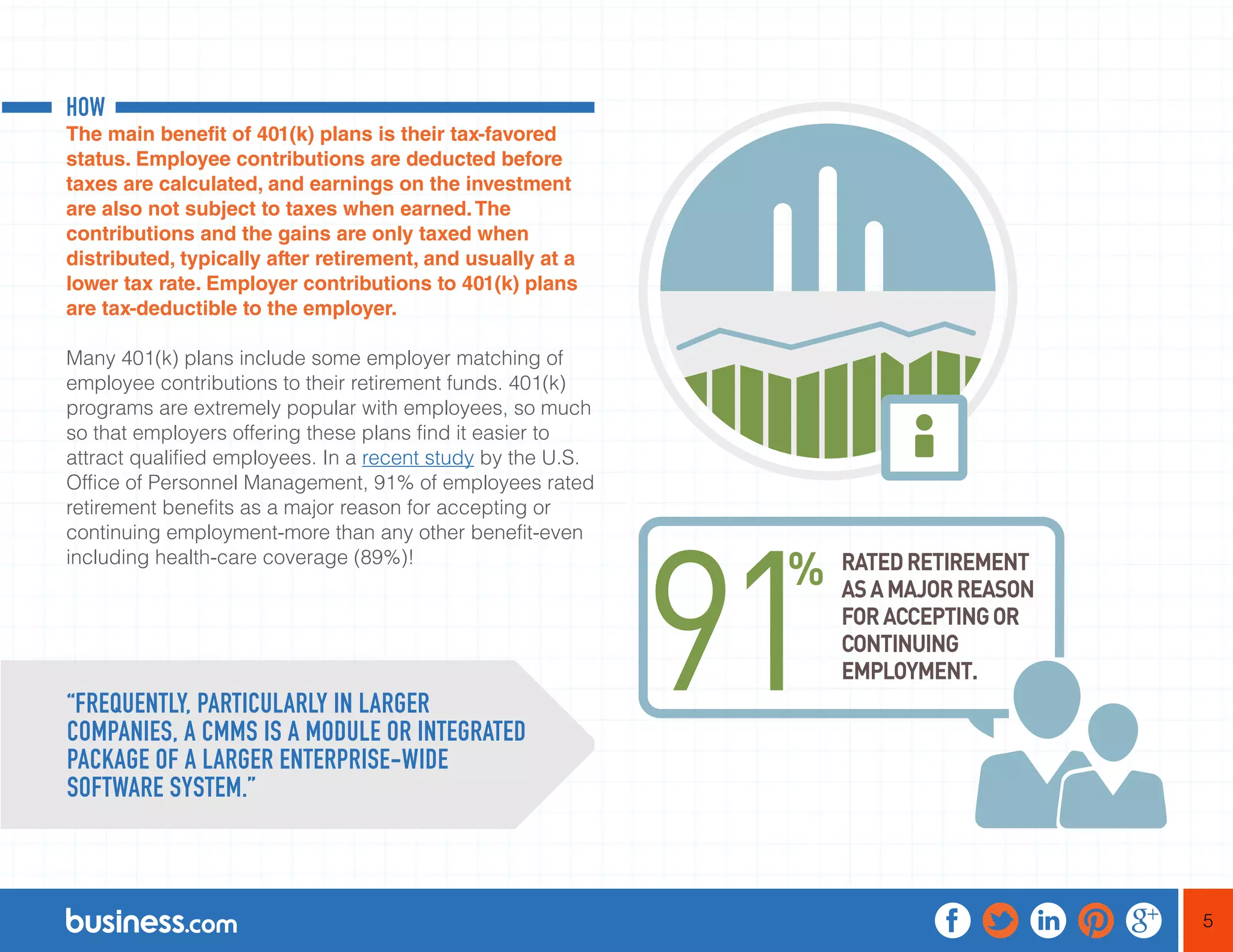

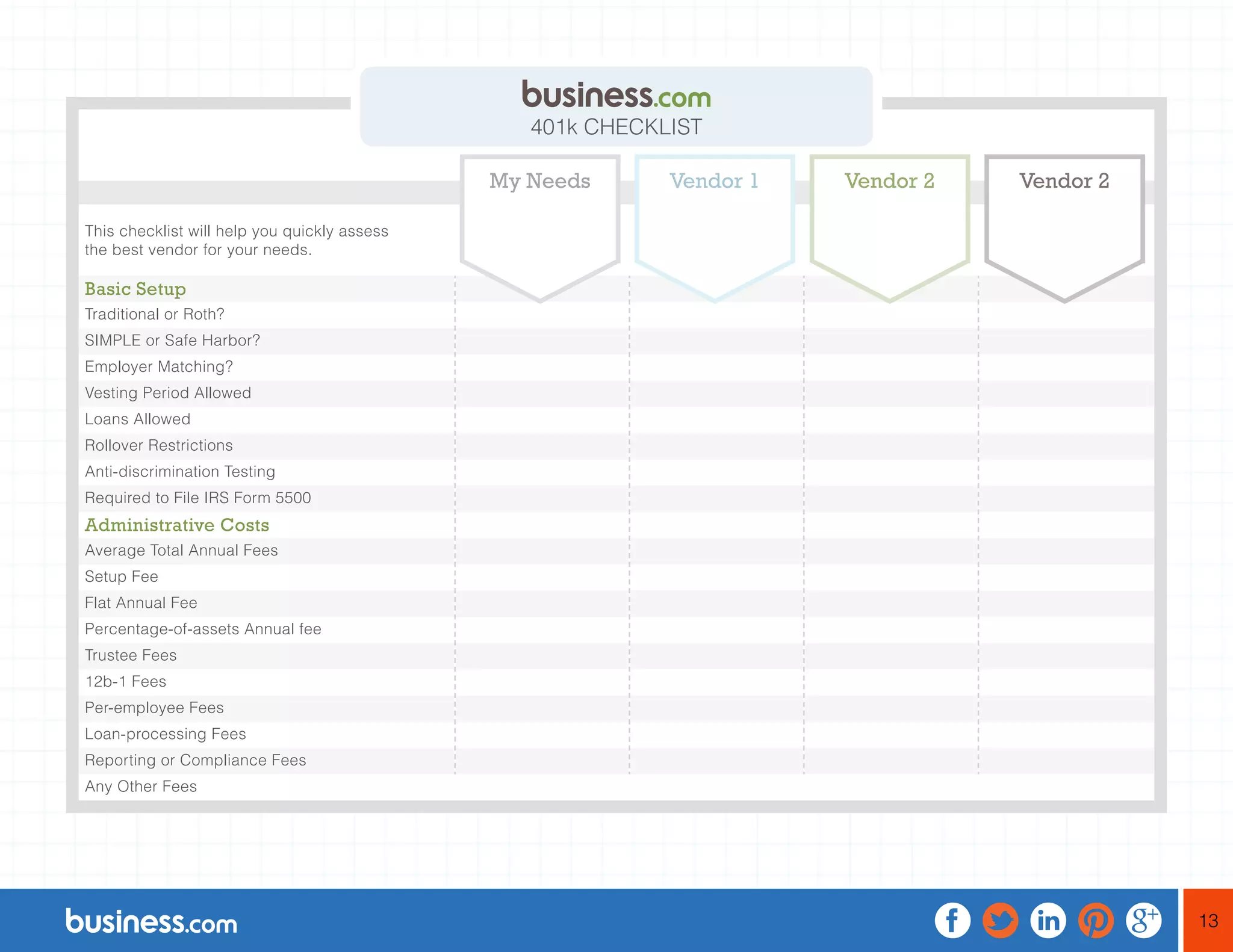

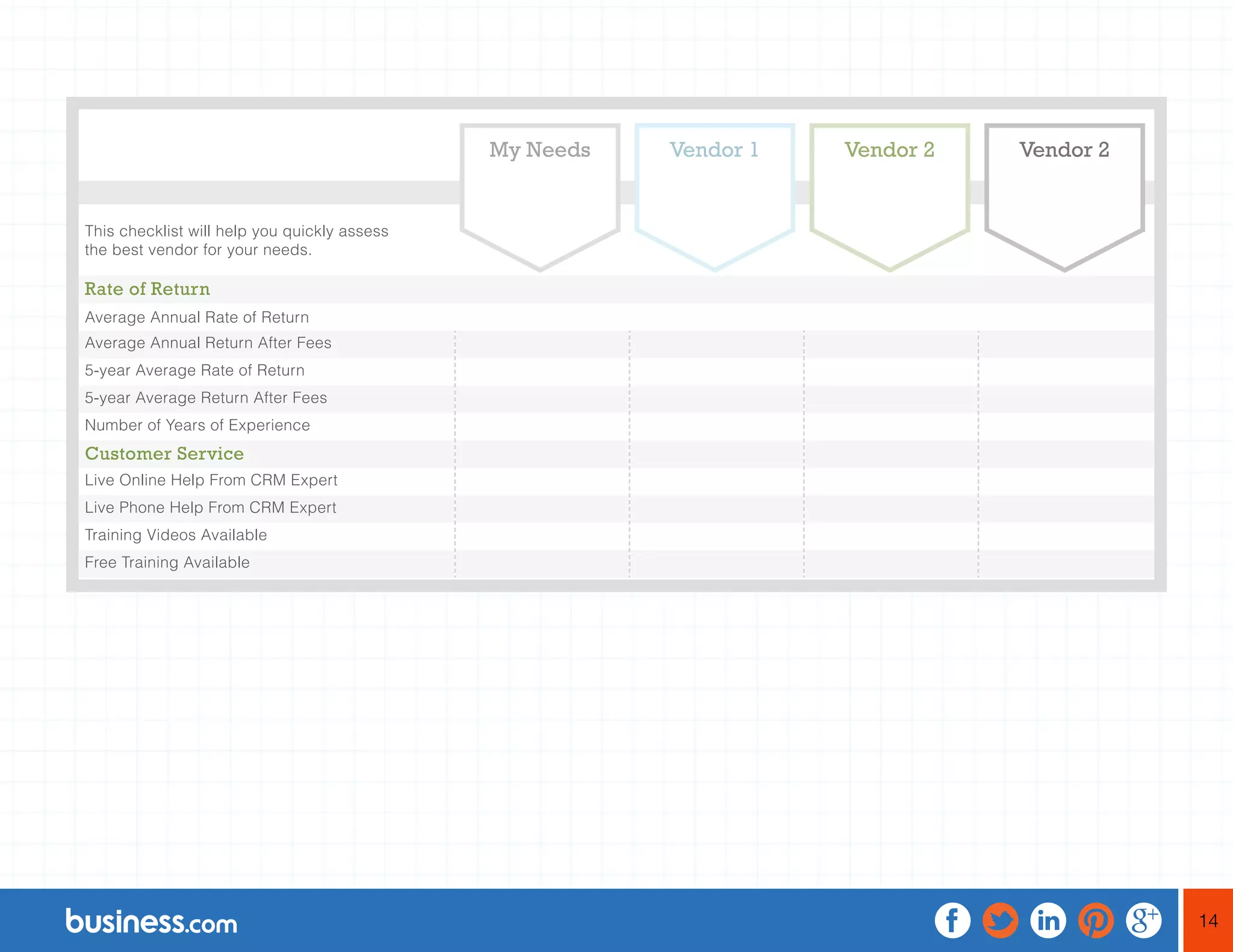

This document provides an overview of 401k retirement plans, including what they are, why they were established, and how they work. It discusses the main types of 401k plans including traditional, Roth, safe harbor, and SIMPLE plans. It also outlines important factors to consider when choosing a 401k plan for a business, such as administrative costs, annual rates of return, available investment options, enrollment procedures, employee training, customer service, and investment advising capabilities.