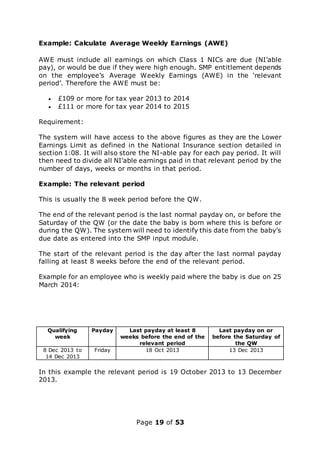

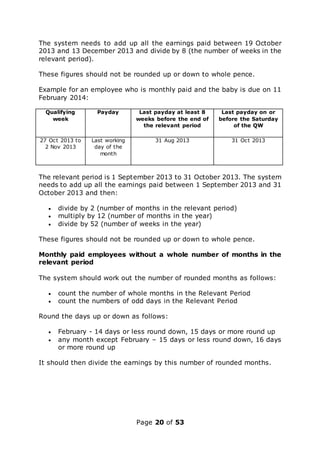

This document provides specifications for a new payroll system for Tyler R Us. The current system is outdated and inadequate for the company's future needs. The new system needs to be modular, flexible to accommodate growth, easy to use, and comply with all legislative requirements. It must store historical payroll data for 7 years and have robust security. Each requirement is assigned a priority level of 1) essential, 2) optional but beneficial, or 3) additional/future need. The document then provides detailed specifications for key payroll modules including employee master files, payments/deductions, pensions, data input, statutory payments, taxes, loans, orders and reports.