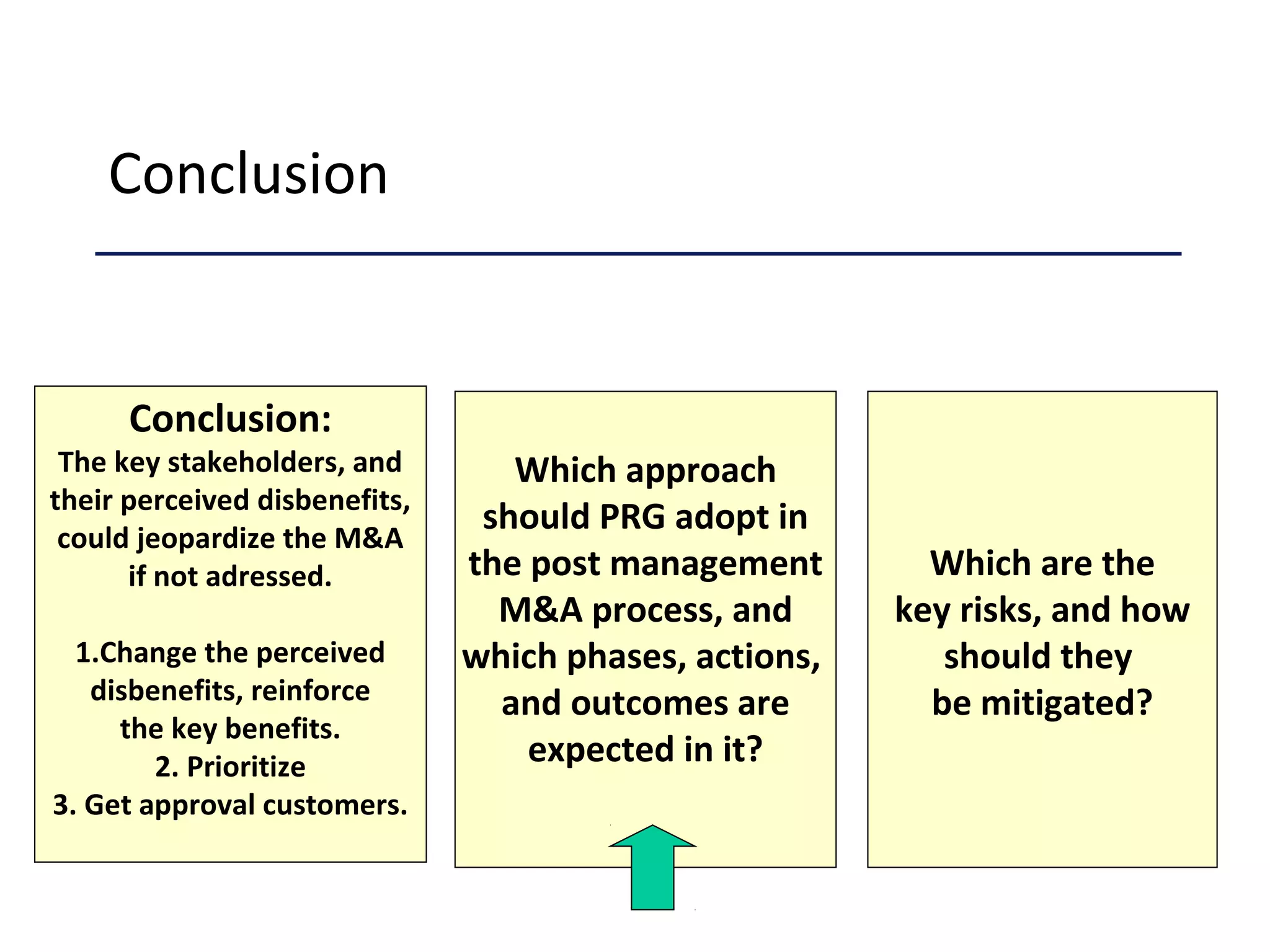

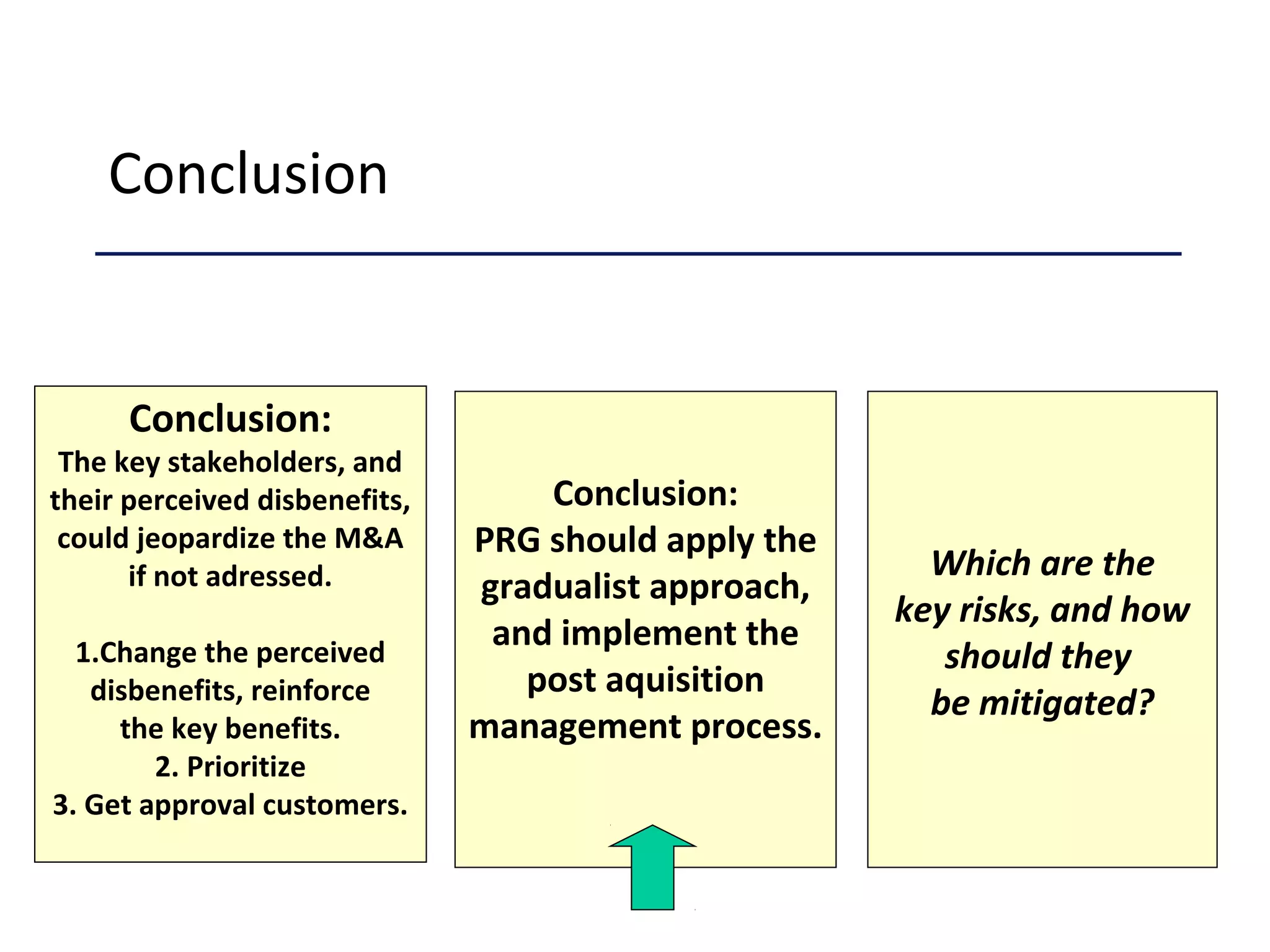

The presentation defines key stakeholders and their concerns, recommends an approach for post-acquisition management, and outlines the process. It addresses:

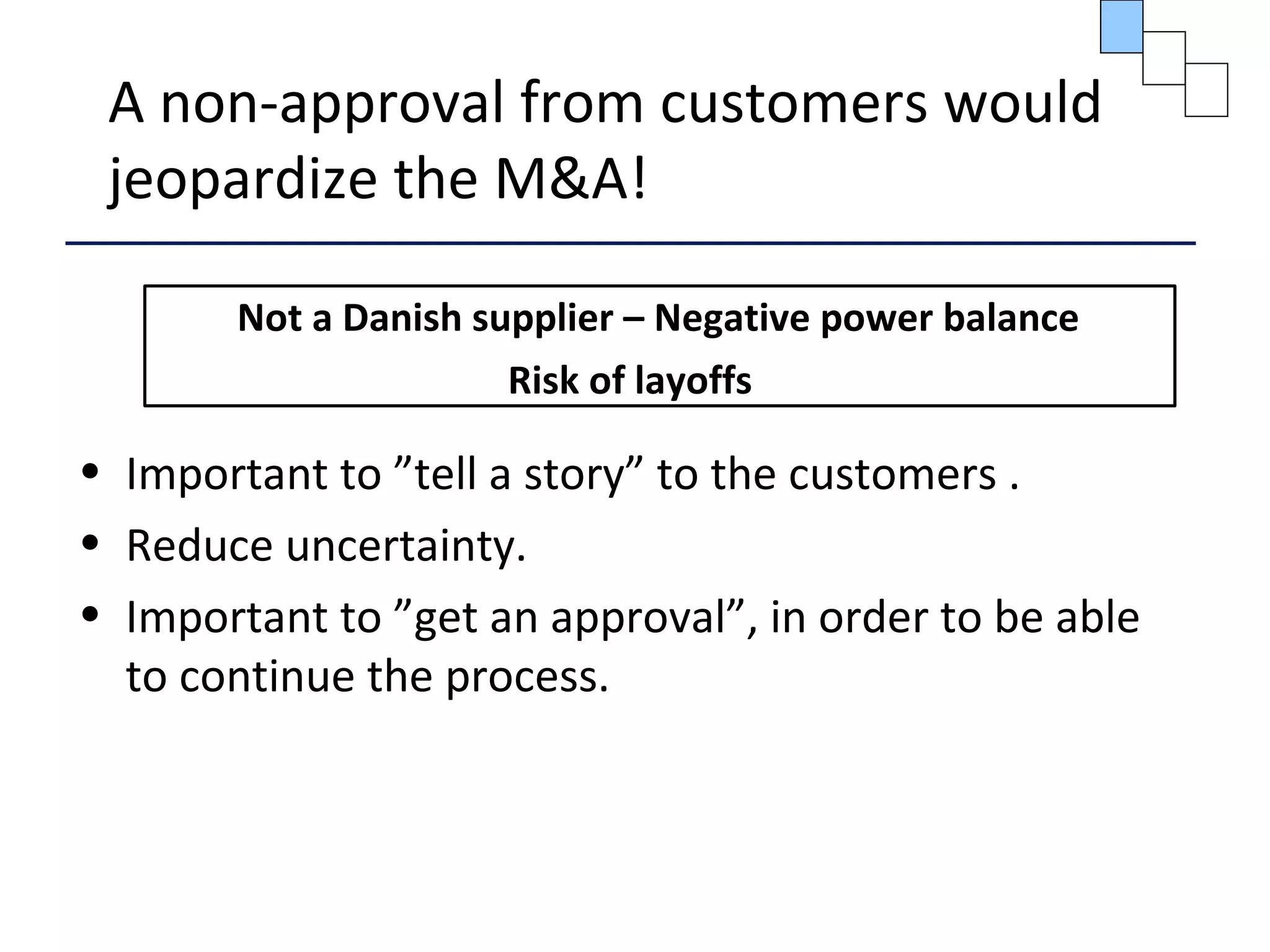

1) Identifying stakeholders' perceived disadvantages and how to address them

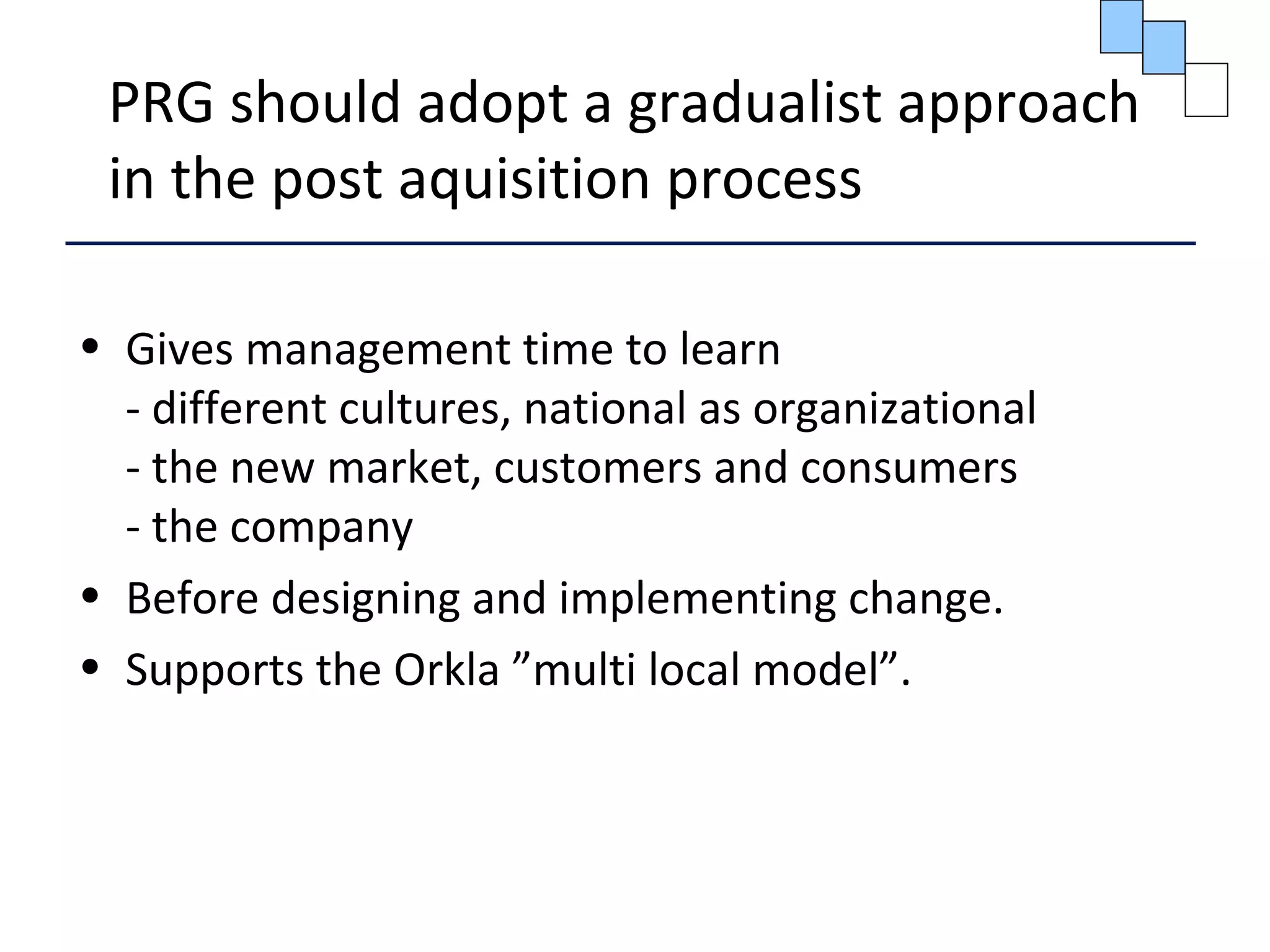

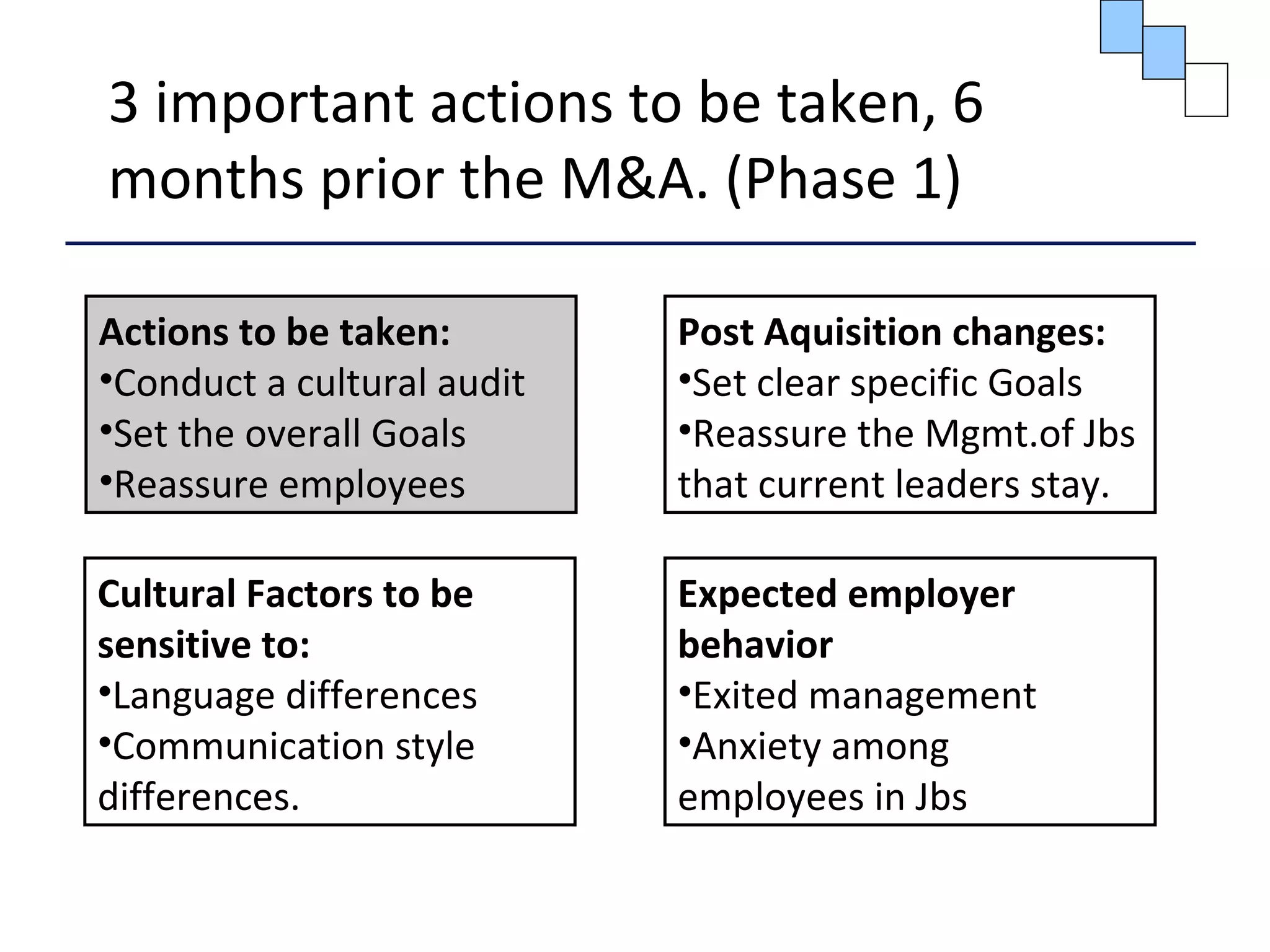

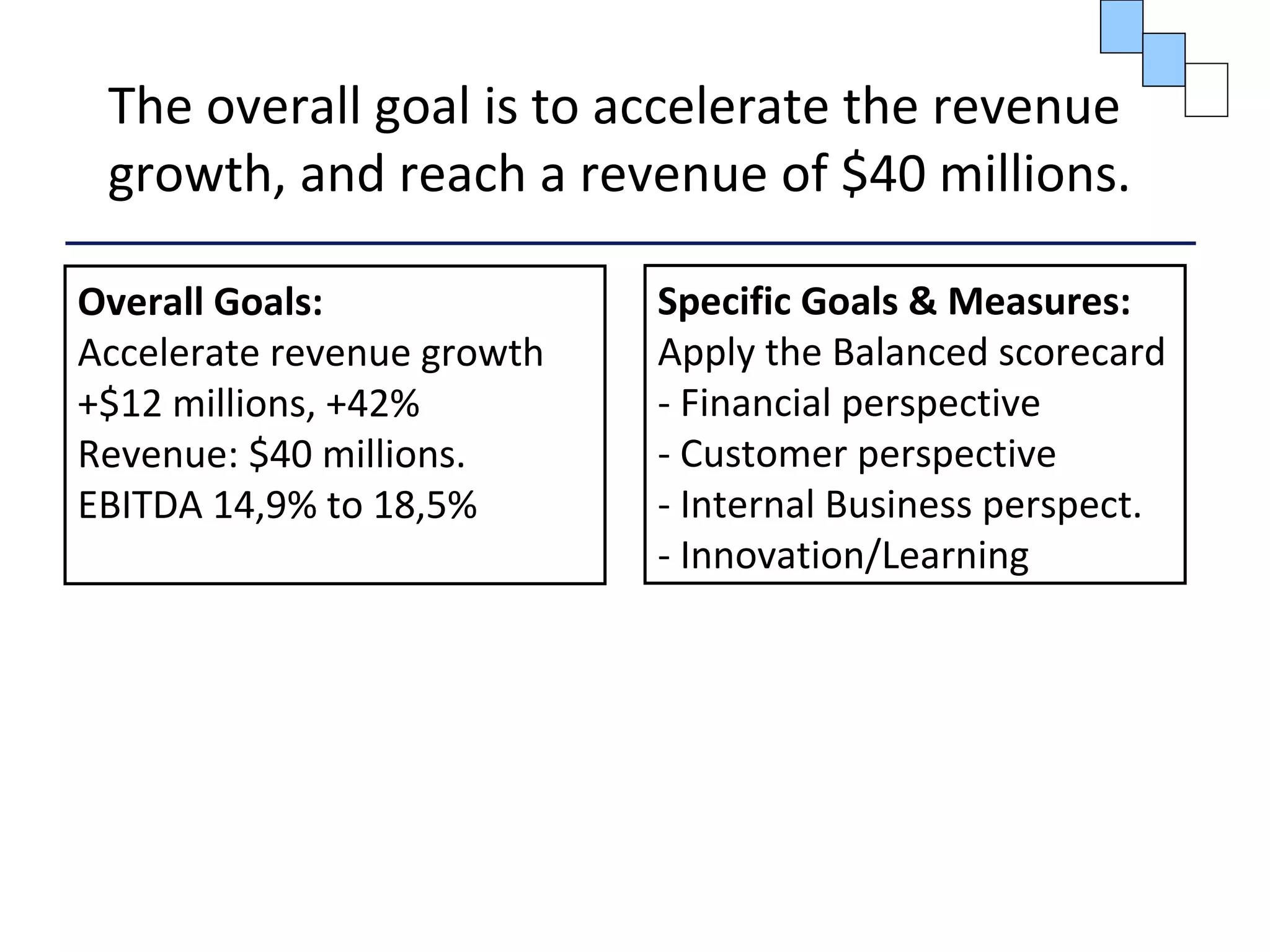

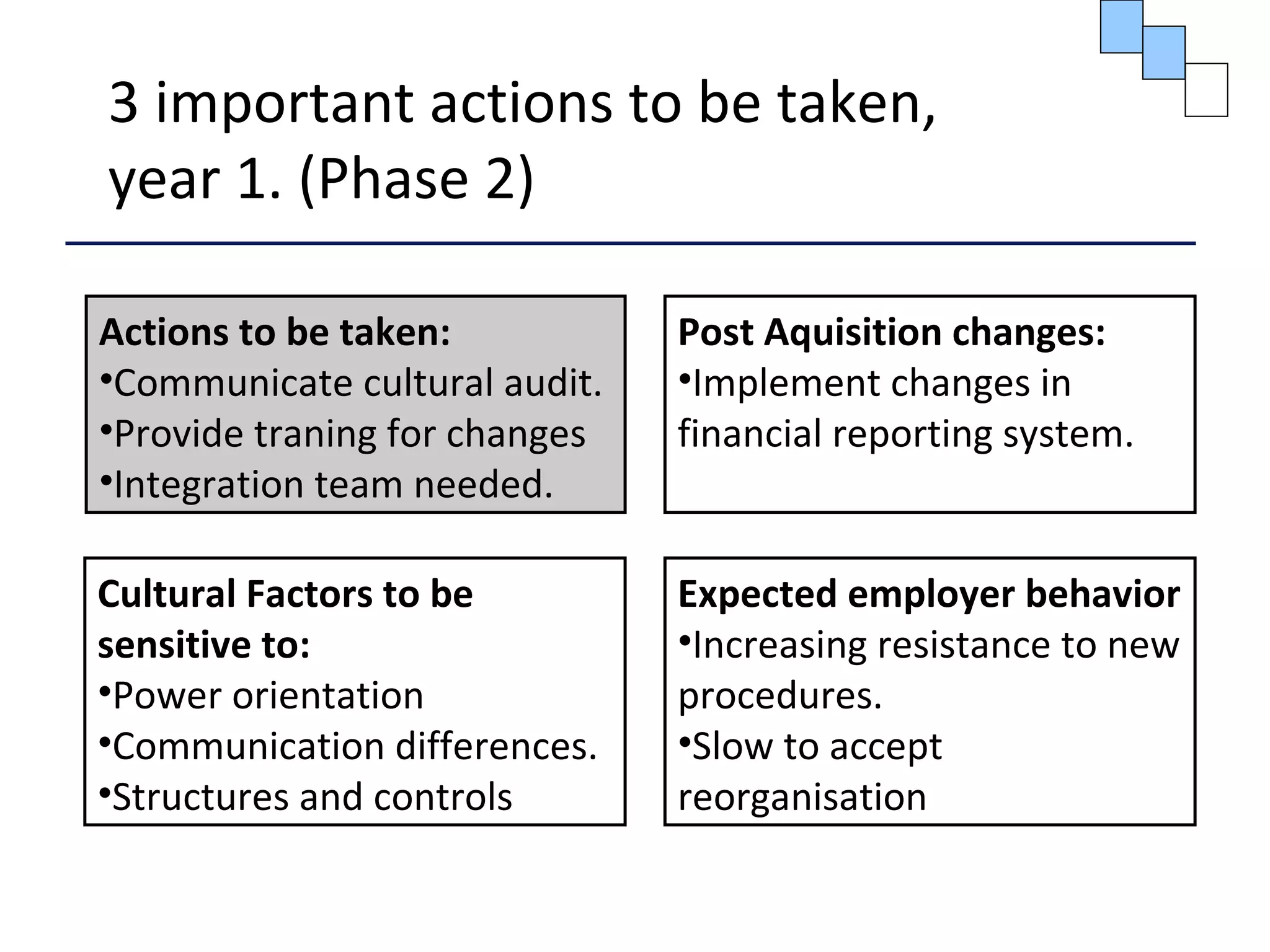

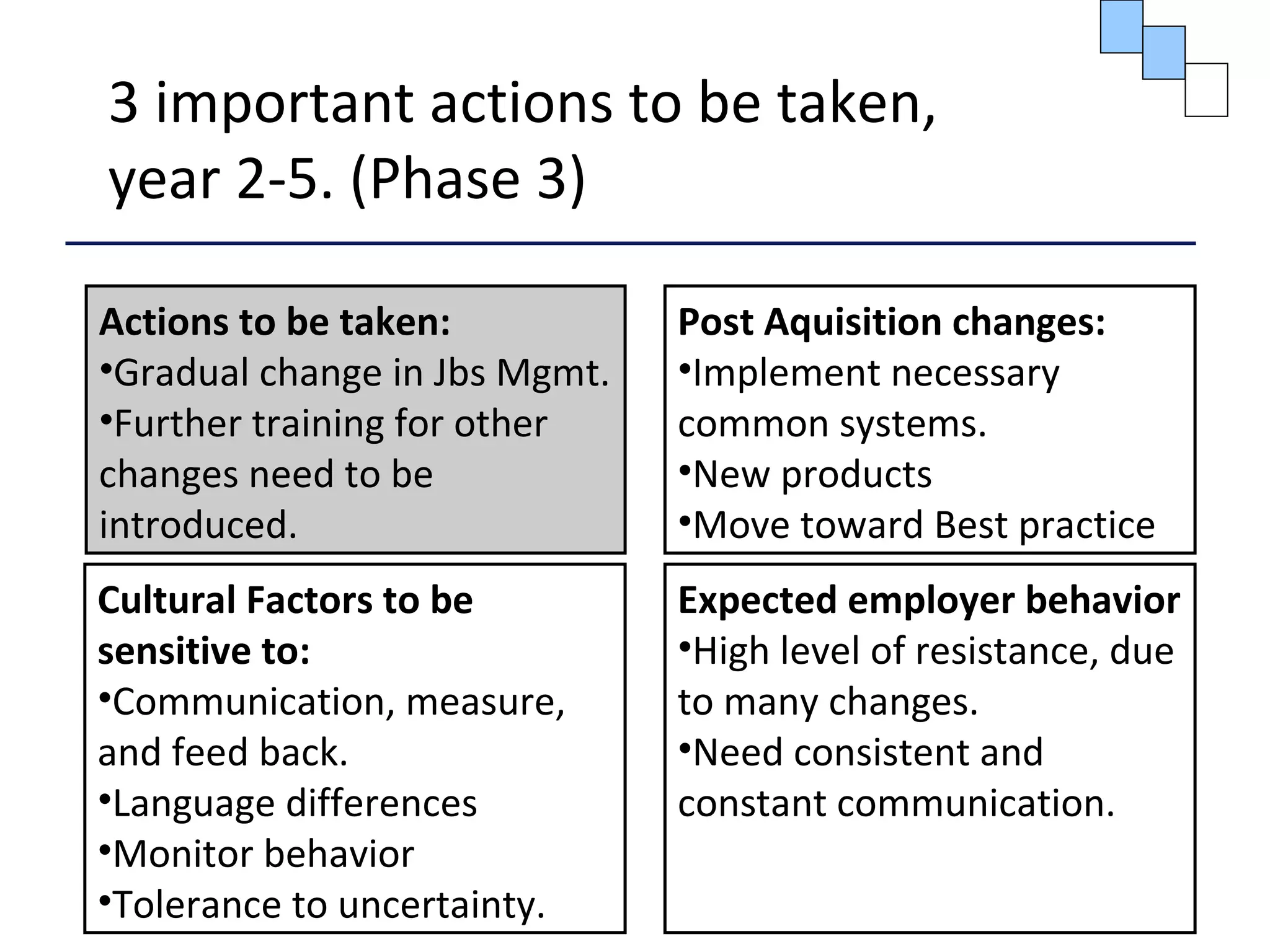

2) Recommending a gradualist approach for post-acquisition management over 3 phases

3) Defining risks and how to mitigate them