This document provides a checklist and overview for conducting due diligence for buy-side mergers and acquisitions (M&A). It discusses common M&A pitfalls such as improper target identification, overpaying, unrealistic synergies expectations, and failure to integrate. The checklist covers understanding corporate strategy, performing due diligence, post-acquisition integration considerations, valuation approaches, acquisition financing terms, engaging potential targets, and post-merger success factors. Financial due diligence areas are also outlined. The document aims to help practitioners avoid common M&A failures by taking a logical approach and thorough due diligence.

![Page | 12

OTHER DUE DILIGENCE CONSIDERATIONS

WHY ARE SITE VISITS ESSENTIAL?

While things can look great on paper, most of the time it does not tell the real “story”. An in-

depth probe to the underlying value of the business, rather than a “desktop” approach to

analysis – is oftentimes key to uncovering issues

You think you’re buying this … … but you’re actually buying this

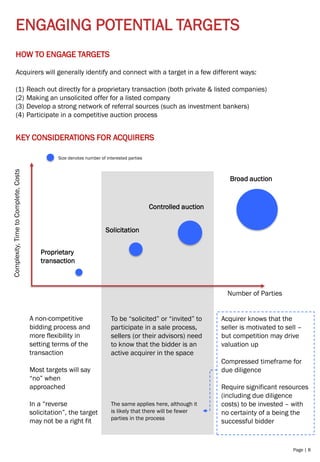

HOW ELSE TO UNDERSTAND THE INDUSTRY?

In most M&A transactions, the acquirer would have an in-depth understanding of the

target’s market landscape and industry trends. However, in certain scenarios, such as a

company acquiring a target in an adjacent industry, or to expand into a new country, the

company itself may not have the necessary industry knowledge.

Among the ways to bridge the gap in industry knowledge includes:

(1) commissioning an in-depth industry report;

(2) discussion with leading industry experts or business leaders, with a view of

appointing them as directors or chairman of the target company;

(3) appointing a financial advisor with deep sector knowledge; or

(4) step-by-step approach of establishing a new business team to gain industry

knowledge prior to engaging in M&As

WHERE IS THE VALUE?

More often than not, there are “key person” risks in mid-

market companies – which may either be the founder or the

CEO. Clearly identifying the “key person”, and making efforts to

retain him or her, is of a paramount priority for a successful

acquisition. For an example, the CEO could be holding all the

key client relationships and can bring his clients to a new firm

when he or she leaves the company.

A lack of strong leadership, pre- and post-acquisition, is a clear

indicator that an M&A transaction will likely fail – the clash of

egos is another (as said in a James Bond movie, “There isn't

enough room [in the elevator] for me and your ego”)

Does the value of the company

go down the elevator as the CEO

leaves the company?](https://image.slidesharecdn.com/buysidemachecklistjuly2018-181211234125/85/Checklist-for-Buy-Side-M-A-12-320.jpg)