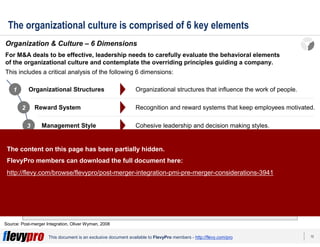

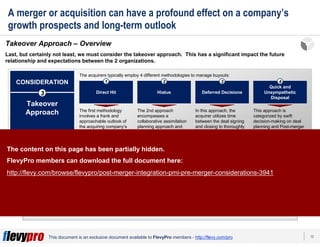

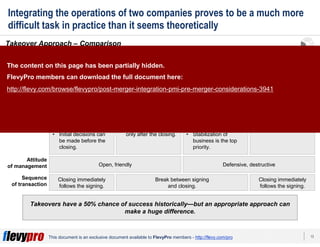

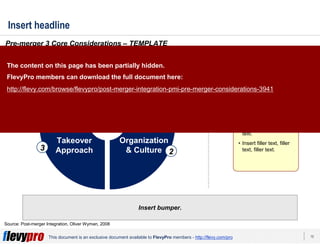

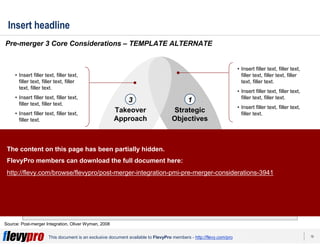

This document is a framework primer for post-merger integration (PMI) targeted at the FlevyPro community, outlining three essential pre-merger considerations: strategic objectives, organization and culture, and takeover approaches. It emphasizes the importance of these considerations in guiding successful integration processes and achieving synergies before and during mergers and acquisitions. Additionally, it provides insights into the methods and strategies for effectively managing the PMI transition, highlighting the significance of organizational cultures and leadership approaches.