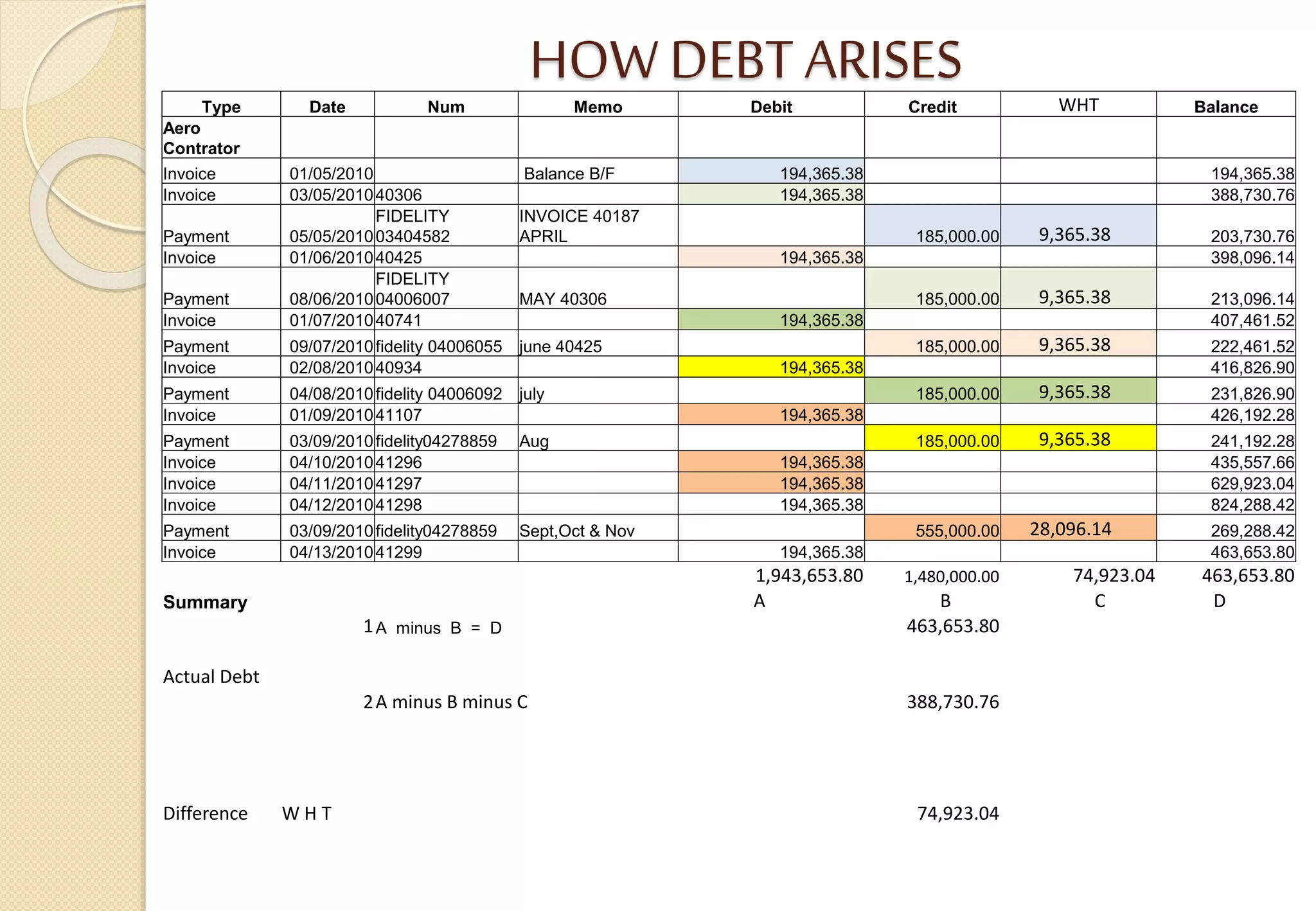

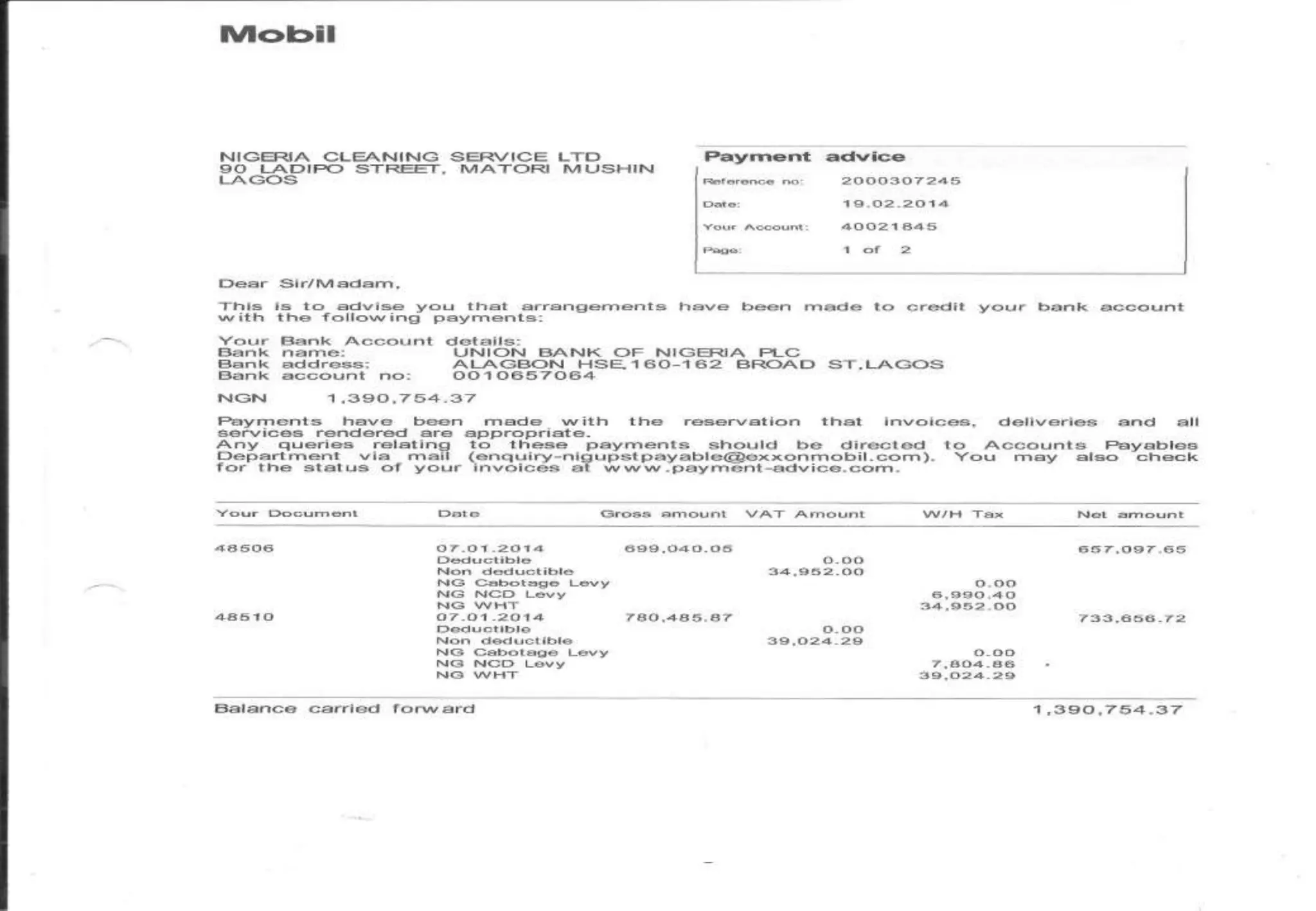

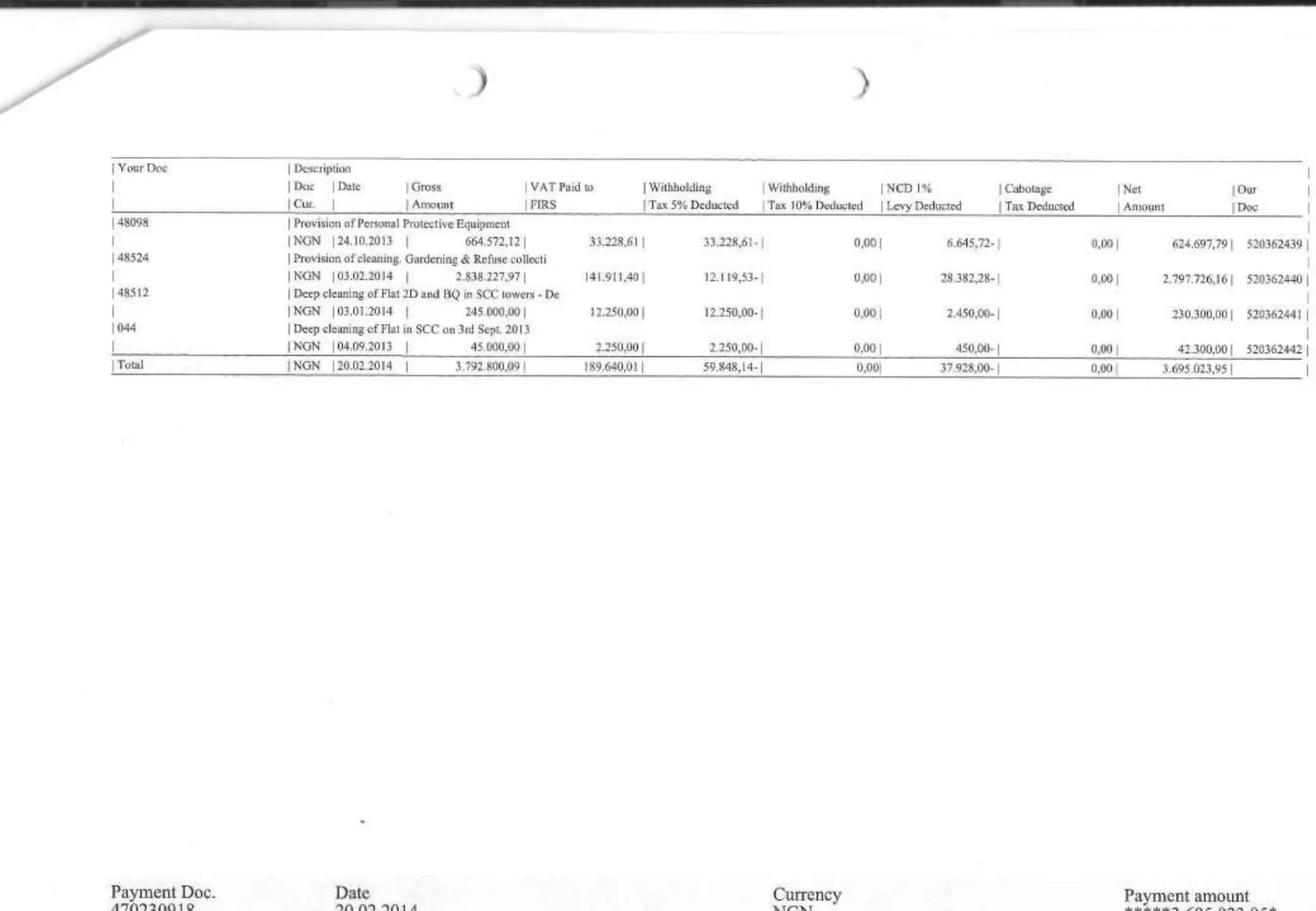

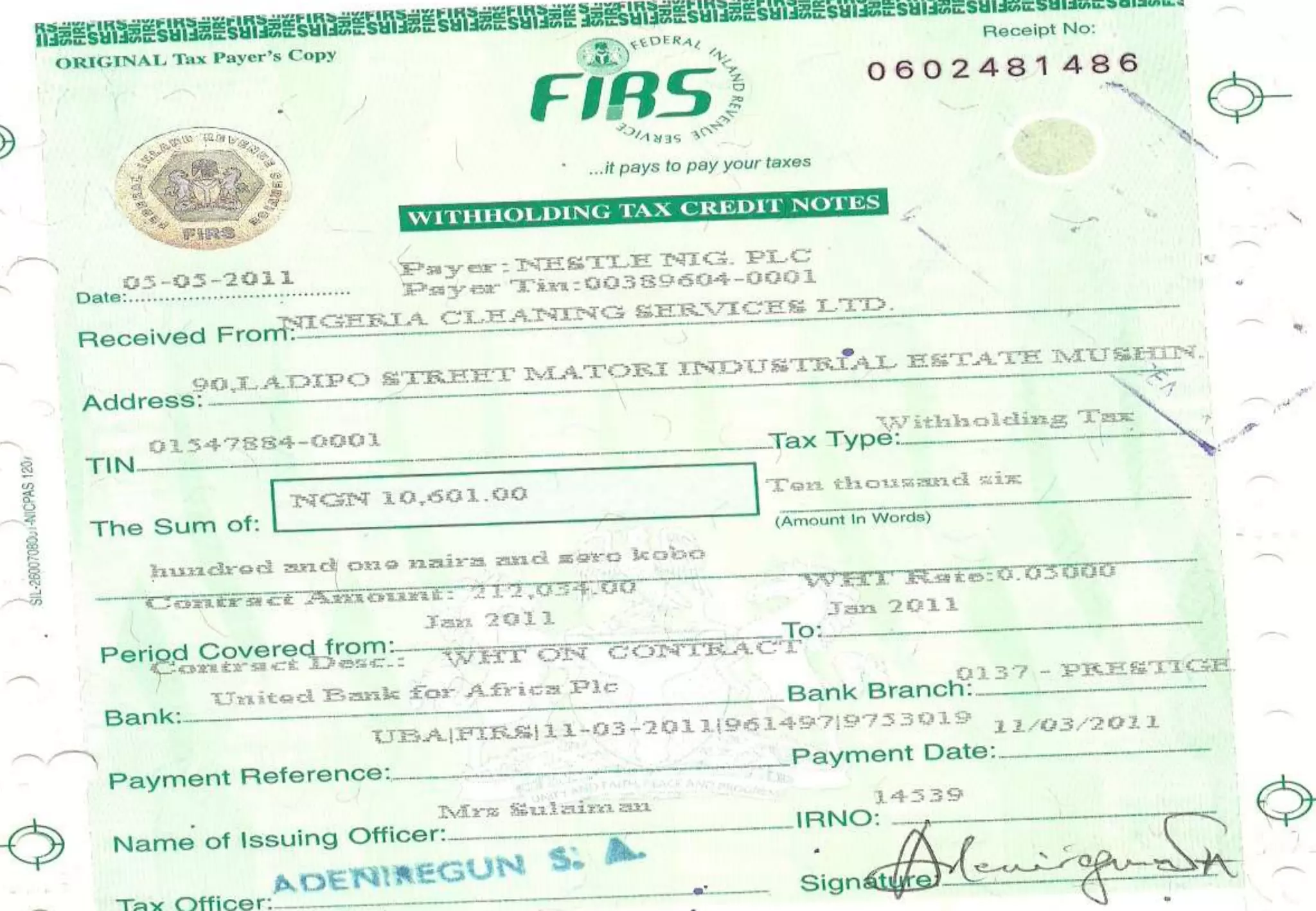

This document outlines responsibilities and procedures related to stock management, budgeting, credit control, and wages/accounts for a field supervisor. It discusses who manages stock and how, including documents used and issuing methods. It defines budgeting and its benefits, and how supervisors can budget. Credit control aims to increase sales by extending credit to qualified customers while minimizing risks. Procedures for credit control include invoice processing and payment monitoring. Wages are defined and composed of basic pay plus allowances. The process for staff to receive wages and open a salary account is also outlined.