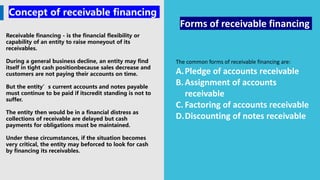

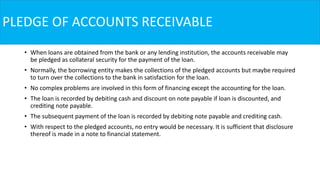

This document discusses receivable financing, which allows a company to raise funds using its accounts receivable. It describes pledge, assignment, and factoring of receivables. Pledging involves using receivables as collateral for a bank loan. The company retains collection rights but may need to remit funds to the bank. Accounting involves recording the loan and subsequent payments. Financial statements must disclose pledged receivables. Illustrations demonstrate journal entries for pledging receivables and repaying a loan.