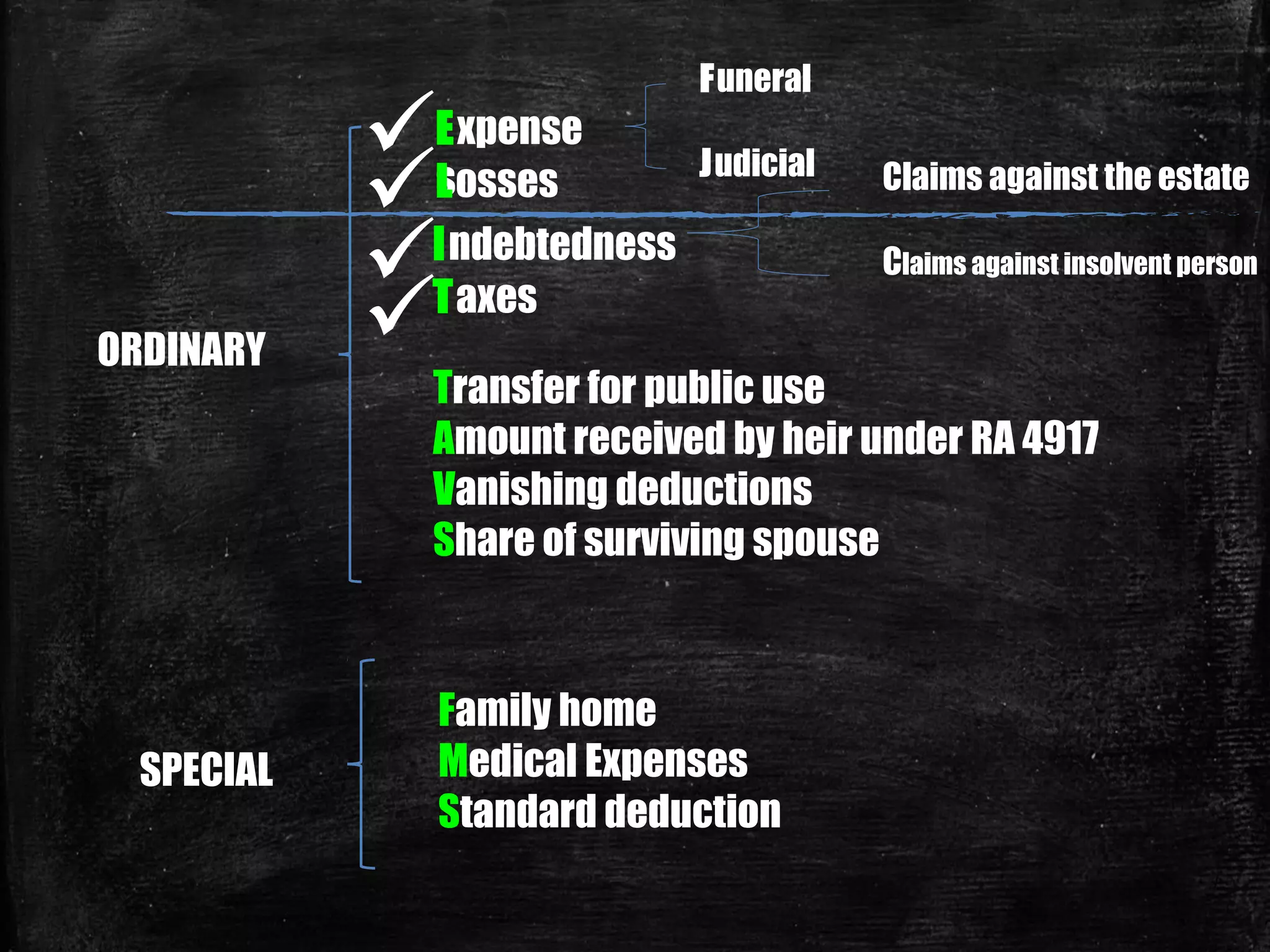

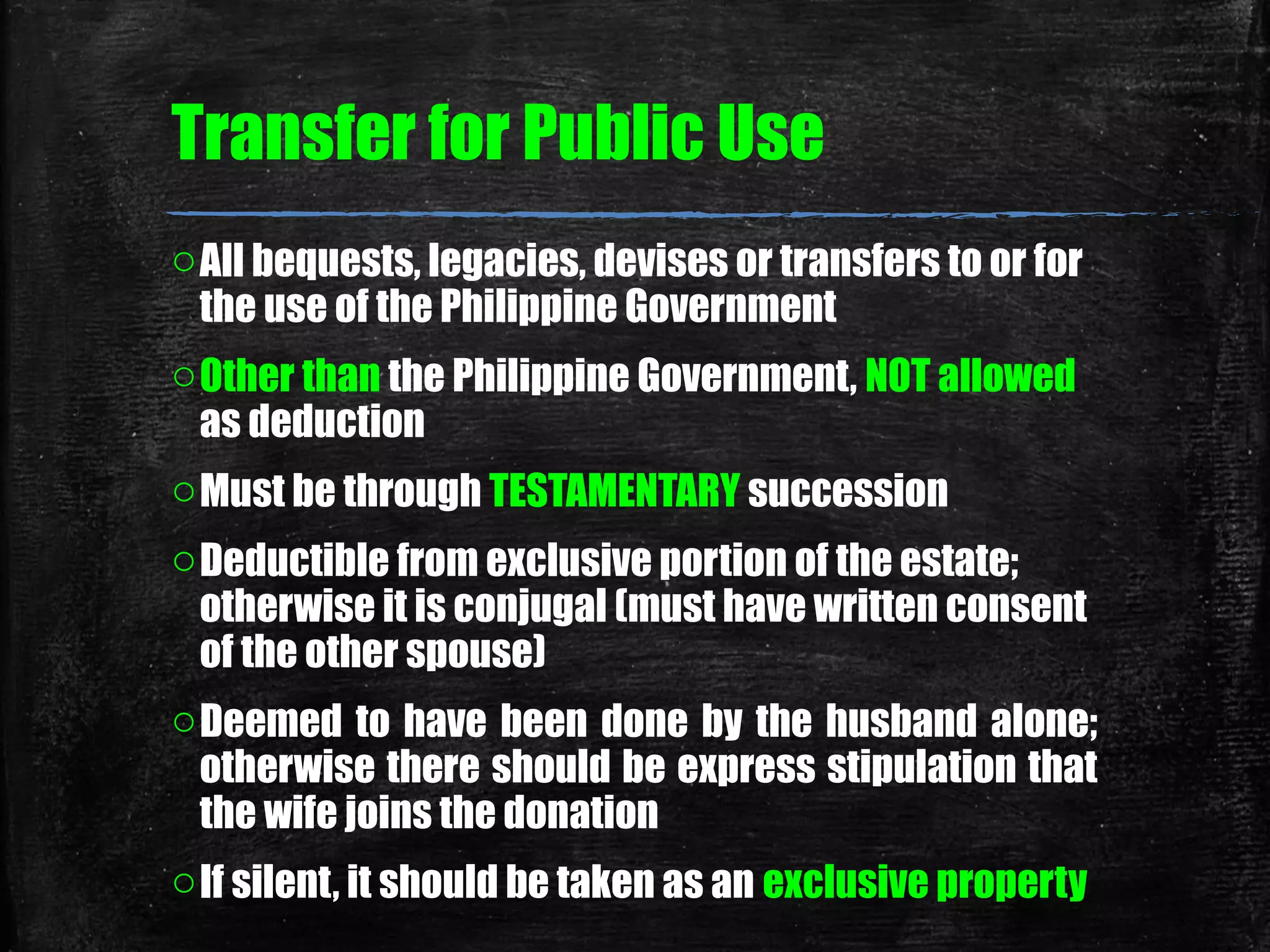

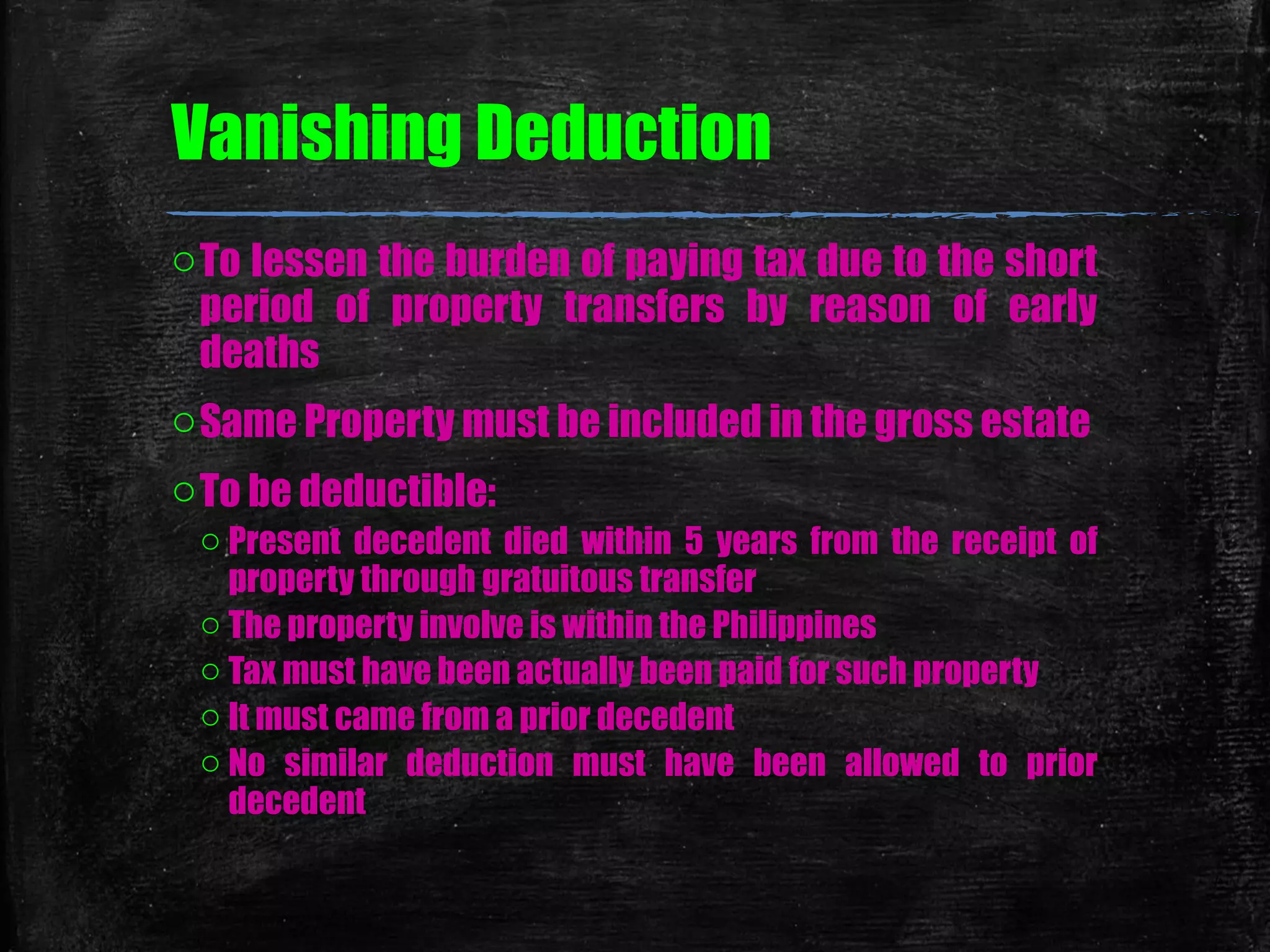

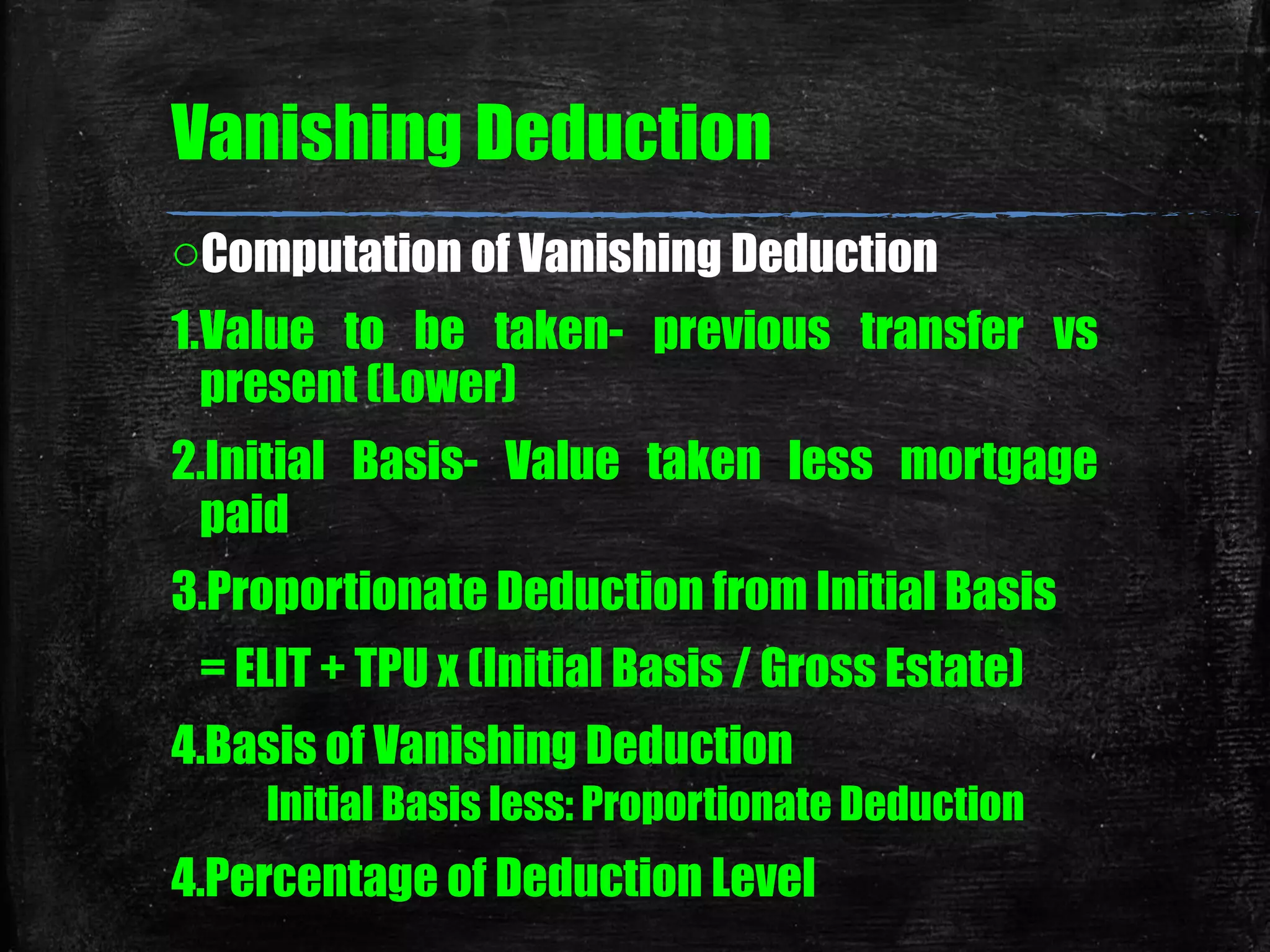

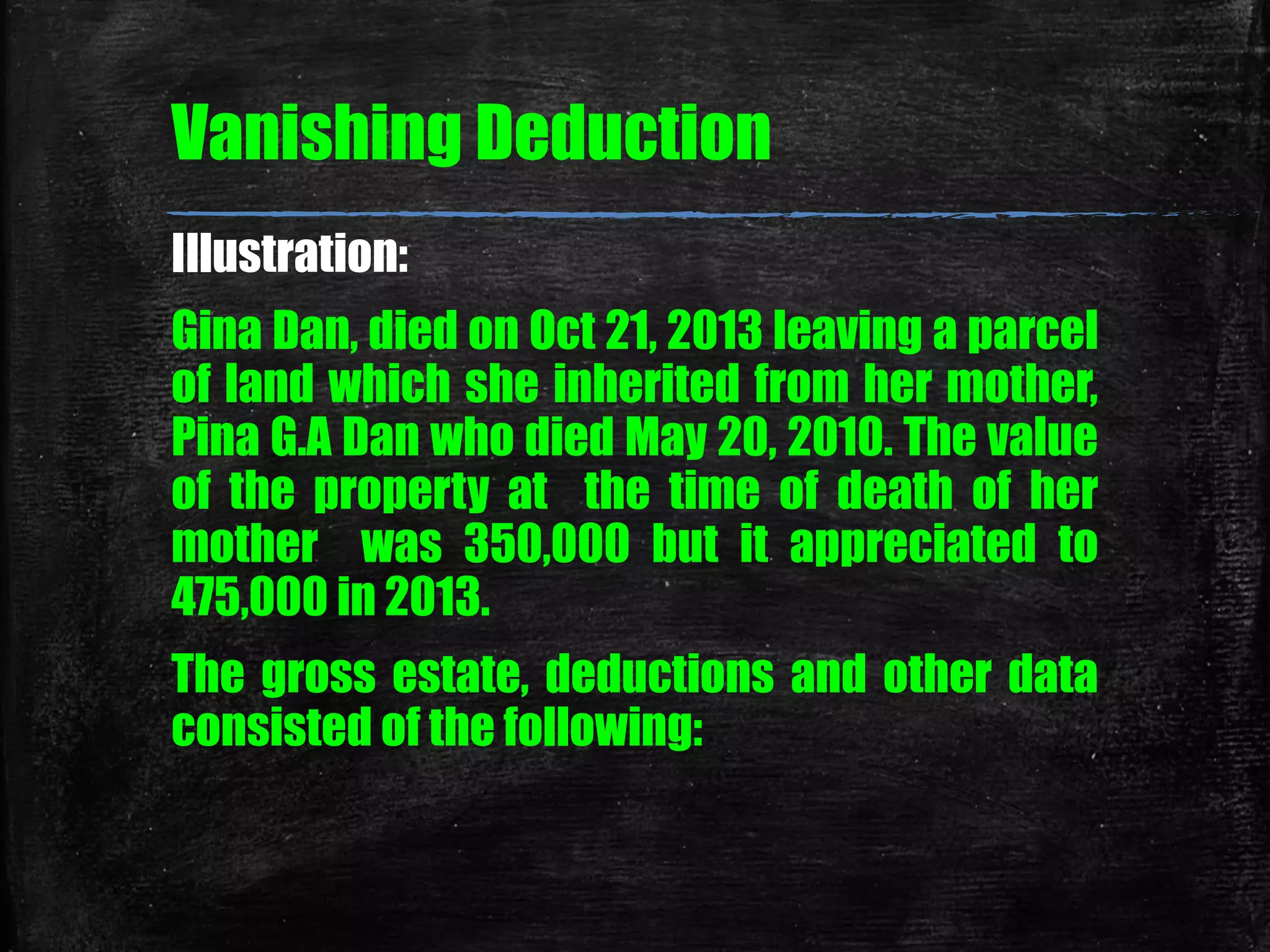

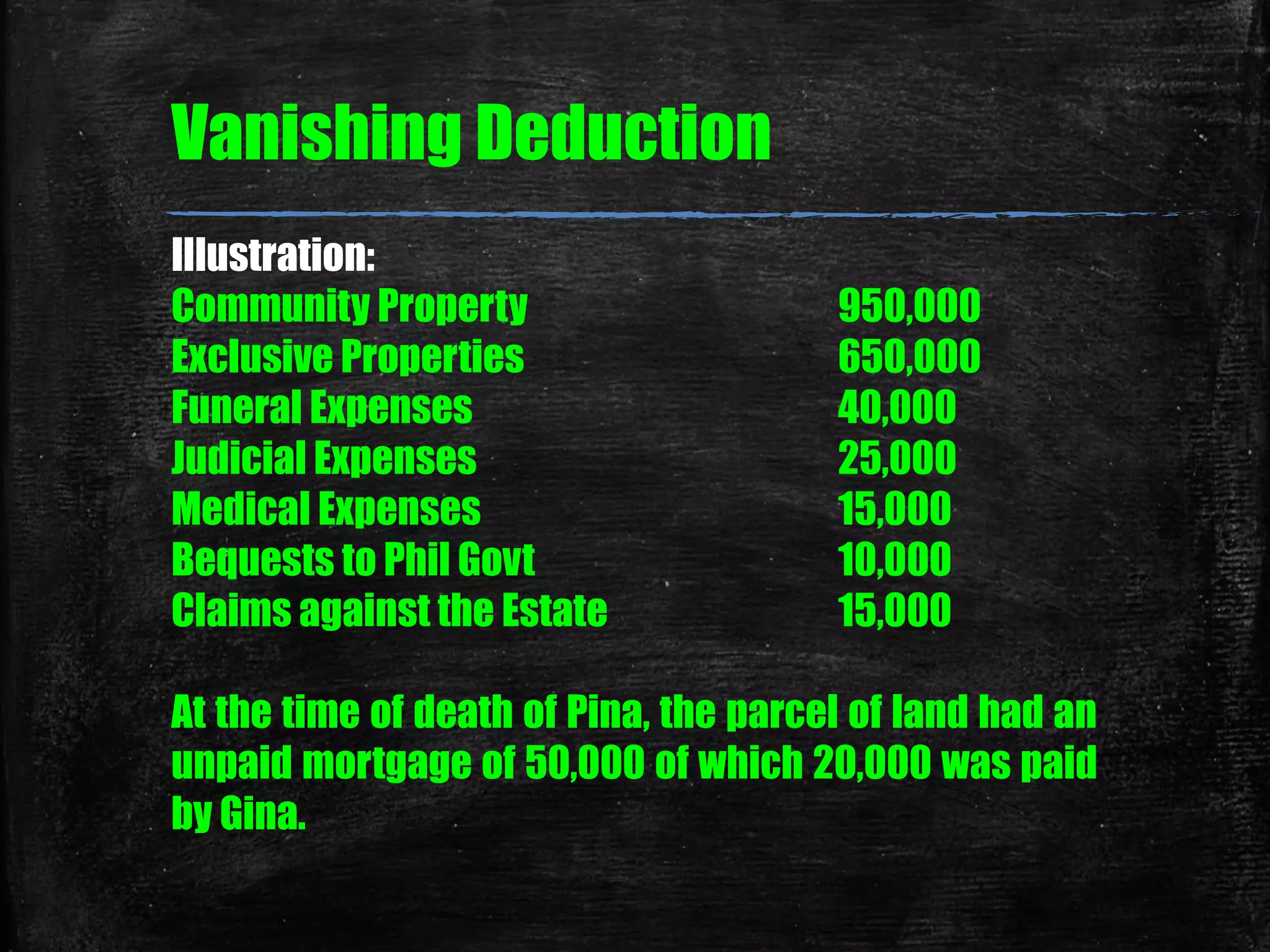

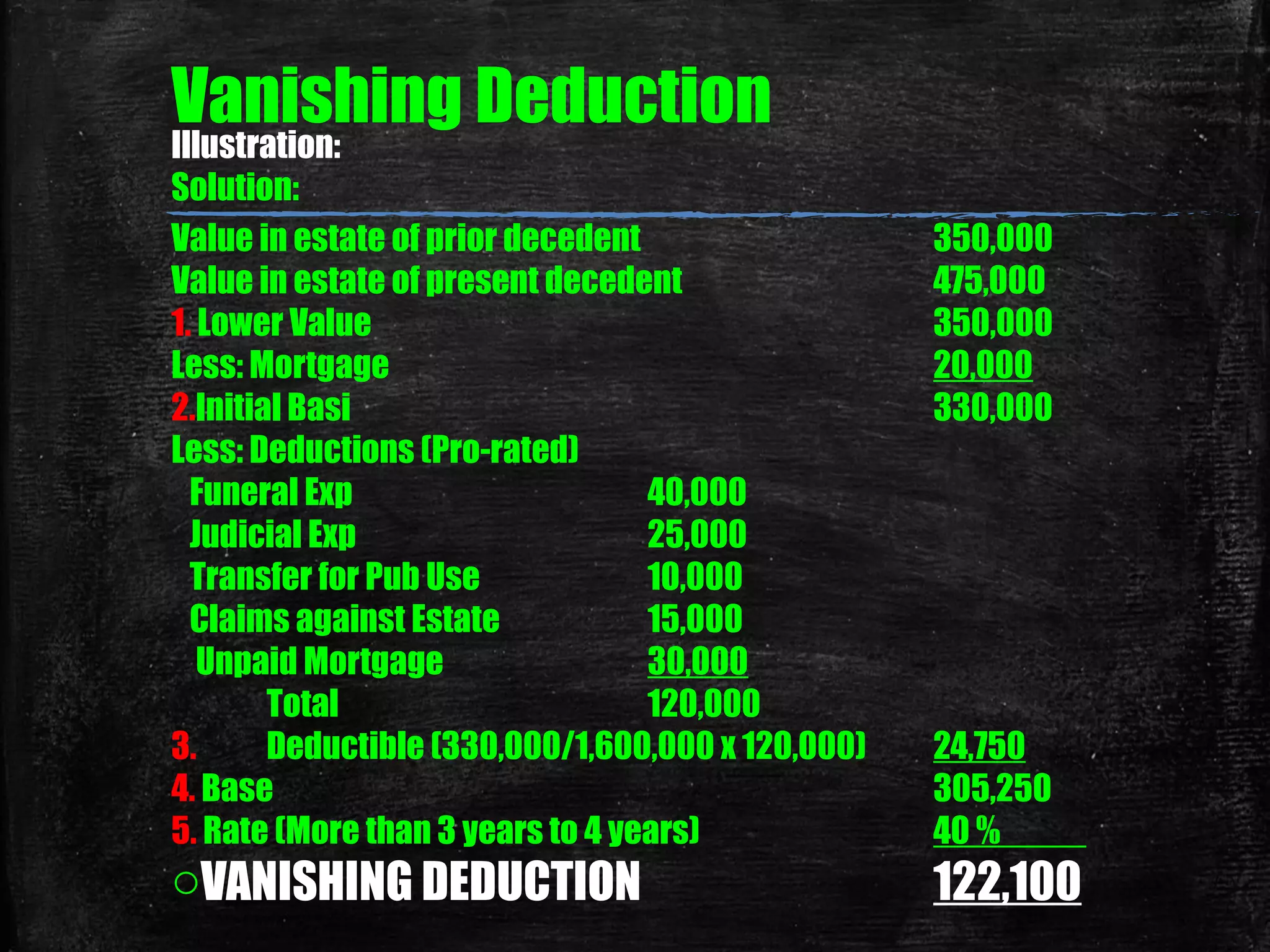

This document discusses various deductions that can be taken from a gross estate for tax purposes in the Philippines, including ordinary expenses, losses, indebtedness, taxes, transfers for public use, and amounts received by heirs. It provides details on vanishing deductions, which allow a deduction on property received within 5 years that was previously taxed. An example calculation is shown for a vanishing deduction involving property inherited by Gina Dan from her mother Pina Dan that increased in value over time.