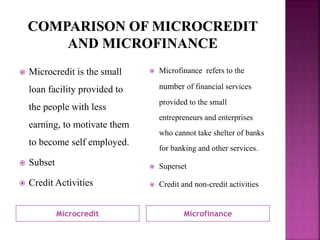

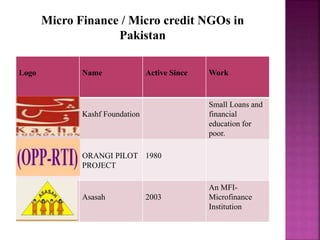

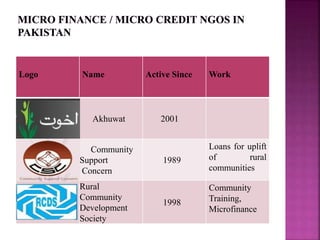

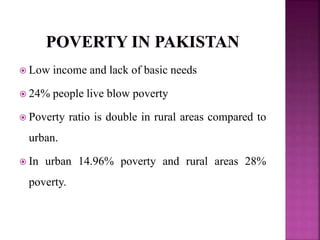

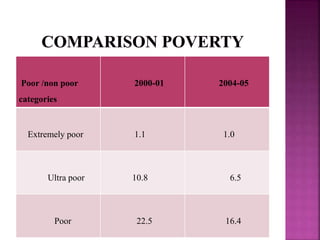

Microcredit provides small loans to low-income individuals to help them become self-employed entrepreneurs. The concept originated in the 18th century and was pioneered by organizations like the Grameen Bank founded by Muhammad Yunus in 1983. Yunus was awarded the Nobel Peace Prize for establishing microcredit as an effective anti-poverty strategy. In Pakistan, microcredit is offered through various microfinance institutions including NGOs, rural support programs, and commercial banks to support entrepreneurship among the 24% of Pakistanis living below the poverty line, which is double the urban rate.