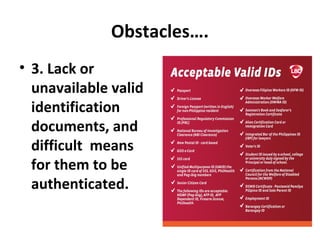

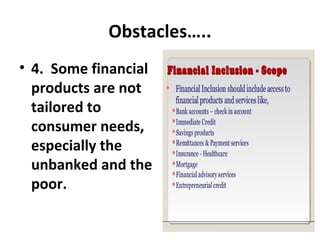

This document discusses financial inclusion, which refers to effective access to a wide range of affordable financial services for all individuals. These services include savings, credit, insurance, and payments. The importance of financial inclusion is that it improves lives, supports business growth, and contributes to economic stability. However, obstacles like hard-to-reach populations and lack of financial literacy impede greater inclusion. Cooperatives can help promote inclusion through various programs like microfinance, insurance, financial literacy training, and serving as payment centers. Being an active cooperative member is key to achieving financial inclusion.