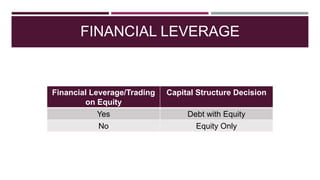

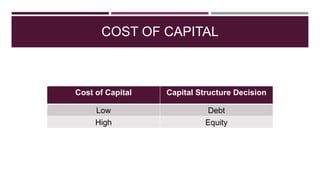

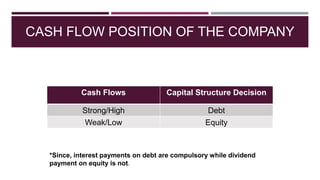

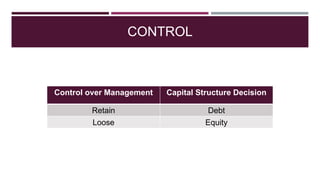

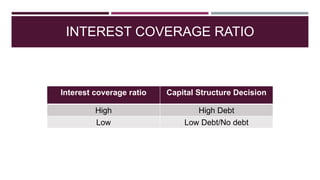

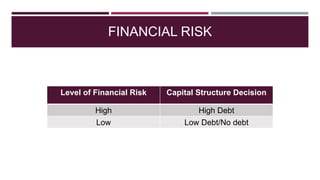

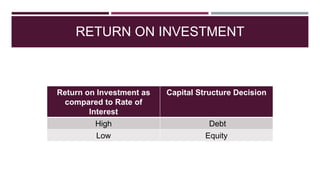

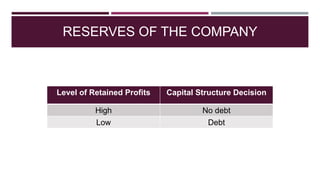

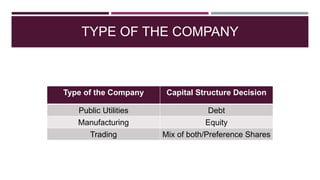

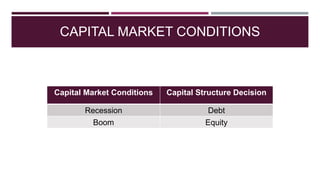

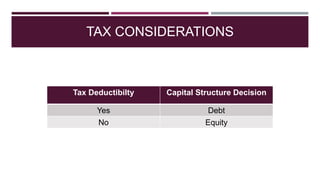

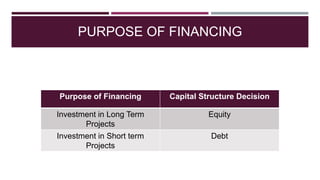

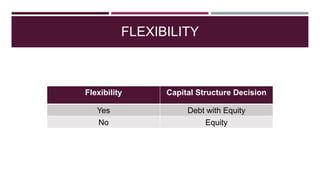

The document presents a presentation on factors affecting capital structure decisions. It discusses what capital structure and optimum capital structure refer to. It then lists and describes 10 factors that influence a company's capital structure decisions, including financial leverage, cost of capital, cash flow position, control, interest coverage ratio, financial risk, return on investment, reserves, type of company, and capital market conditions.