The document discusses several key concepts related to banking and financial transactions:

- It defines banking as accepting deposits and lending money to earn a profit. Terms refer to the specific details of agreements.

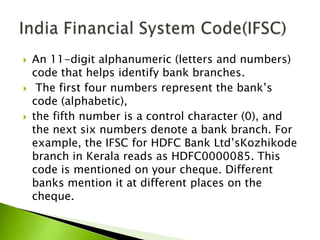

- It then explains several Indian banking terms - MICR and IFSC codes which help identify banks and branches, RTGS and NEFT for instant and 2-day fund transfers, CVV for credit card security, and more.

- Electronic banking topics covered include EFT, EDI, ECS for bulk payments, and mobile/internet banking. Key infrastructure like INFINET and SFMS that enable financial transactions are also summarized.