unit-4govt-200422174519 (1)-19-38.pptx

The document discusses different types of government budget expenditures and deficits. It defines revenue expenditure as spending that does not create assets or reduce liabilities, such as pensions and salaries, while capital expenditure does create assets or reduce liabilities, like purchasing shares. It also defines plan expenditure as spending allocated to central plans and non-plan expenditure as unplanned spending like disaster relief. The document then explains the differences between revenue and capital deficits, fiscal deficits which include all expenditures and receipts except borrowings, and primary deficits which calculate deficits excluding interest payments on previous debts. It outlines the implications of each type of deficit and measures governments can take to reduce them.

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Similar to unit-4govt-200422174519 (1)-19-38.pptx

Similar to unit-4govt-200422174519 (1)-19-38.pptx (20)

More from SudhanshuPandey969519

More from SudhanshuPandey969519 (9)

Recently uploaded

Recently uploaded (20)

unit-4govt-200422174519 (1)-19-38.pptx

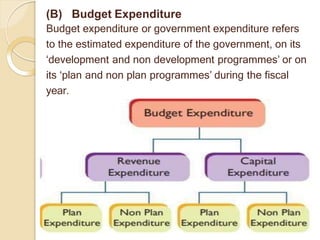

- 1. (B) Budget Expenditure Budget expenditure or government expenditure refers to the estimated expenditure of the government, on its ‘development and non development programmes’ or on its ‘plan and non plan programmes’ during the fiscal year.

- 2. (a) Revenue and Capital Expenditure (i) Revenue Expenditure ● This expenditure: • does not create assets of the government, • does not cause a reduction in liabilities of the govt. For example, old age pensions, salaries and scholarship etc. (ii) Capital Expenditure ● This expenditure: • either create assets of the government or, • causes a reduction in liabilities of the govt. For example, purchase of shares of MNC’s, repayment of loans etc.

- 3. (b) Plan Expenditure and Non-plan Expenditure (i) Plan Expenditure ● It is incurred during the year in accordance with the central plan of the country. ● It is incurred on financing the objectives of central plans of different sectors of the economy. For example, planned expenditure on health, education law and order etc. (ii) Non- Plan Expenditure ● It Non- plan refers to all such government expenditures which are non-planned. ● It is incurred on financing those projects which are not planned in the central plan. For example, expenditure as a relief to the earthquake victims etc.

- 4. (c) Development Expenditure and Non- development Expenditure (i) Development Expenditure ● It is incurred on economic and social development of the country. ● It relates to growth and development projects of the country. For example, expenditure on development of agriculture, industries, health, education etc. (ii) Non- development Expenditure ● It is incurred on general services of the government which do not usually promote economic development. ● It relates to non-developmental activities of the government. For example, expenditure on administration, defence, justice etc.

- 5. Difference b/w Revenue Expenditure and Capital Expenditure Basis Revenue Expenditure Capital Expenditure 1. Creation of Assets 2. Reduction in Liabilities 3. Effect on assets & It does not create any corresponding asset. It does not cause any reduction in the liabilities. Assets and liabilities are not liabilities of affected. Govt. It creates corresponding asset. It causes a reduction in the liabilities. Assets and liabilities are not affected.

- 7. Budget Deficit Budgetary deficit is defined as the excess of total estimated expenditure over total estimated revenue. When the government expenditure exceeds its revenue it incurs a budgetary deficit. Budget Deficit = BE (RE +CE) ─ BR (RR + CR)

- 8. Types of Budgetary Deficit

- 9. I. Revenue Deficit (RD) ● This deficit occurs in revenue budget of the govt. Revenue deficit is concerned with the revenue expenditure and revenue receipts of the government. Revenue deficit = RE - RR ● In other words, government’s revenue is insufficient to meet the expenditure on normal functioning of government departments and provisions for various services.

- 10. Implications of Revenue Deficit (i)It indicates the inability of the govt. to meet the expenditure on routine functioning of the economy. (ii) Includes current income & expenditure of the government. (iii) It implies dis-savings on government account. (iv) Govt. has to finance it from capital receipts. Measures to reduce Revenue Deficit • Govt. should reduce its wasteful expenditure. • By curtailing non-plan expenditure. • Increase in existing tax rate and impose new taxes. • Tax evasion should be controlled.

- 11. (II) Fiscal Deficit (FD) ● Fiscal deficit refers to the excess of total expenditure over total receipts (excluding borrowings) during a given fiscal year. Fiscal Deficit = TE - TR (Excluding Borrowings)

- 12. Implications of Fiscal Deficit (a)Debt Trap – Fiscal deficit increases the future liability of the Govt. in the form of payment of interest & repayment of loans. This may increase the revenue deficit. Therefore, the Govt. is required to borrow more to pay interest & repay old loans. It is known as debt trap. (b)Causes Inflation – Govt. generally borrows from RBI. RBI prints more currency to meet the fiscal deficit. It increases the circulation of money supply in the economy & causes inflation. It is also known as deficit financing. (c) Increase in Foreign Dependence (d) Financial Burden for Future Generations

- 13. Measures to finance Fiscal Deficit (a) Borrowings (b) Deficit financing Measures to reduce Revenue Deficit • Govt. should reduce its wasteful expenditure. • By curtailing non-plan expenditure. • Increase in existing tax rate and impose new taxes. • Tax evasion should be controlled.

- 14. (iii) Primary Deficit (PD) ● Primary deficit refers to the difference between fiscal deficit of the current year and interest payments on the previous borrowings. Primary Deficit = FD - Interest Payments ● To calculate the amount of borrowings on account of current expenditure exceeding revenue, we need to calculate the amount of the primary deficit. It is done by subtracting interest from fiscal deficit.

- 15. Implications of Primary Deficit (i)It indicates how much govt. borrowings are required to meet its existing expenses other than interest payments on public debt. (ii)A zero primary deficit means that the govt. has to resort to borrowings only to meet its interest payments on public debt. Measures to Reduce Primary Deficit (a) Efforts should be made to reduce fiscal deficit. (b)To reduce fiscal deficit, interest payments should be reduced through repayment of loans as early as possible.

- 16. An Extra Mile I. Types of Budget

- 17. (A) Balanced Budget – A govt. Budget is said to be balanced budget in which government estimated receipts are equal to government estimated expenditure. This budget has a neutral effect on the level of economic activity.

- 18. (B) Unbalanced Budget - An unbalanced budget is that budget in which receipts and expenditure of the government are not equal. It may be: (i) Surplus Budget - Surplus budget is a budget in which the govt. Estimated receipts are greater than govt. estimated expenditure. Here the govt. soaks money supply.

- 19. (ii) Deficit Budget - Deficit budget is the budget in which estimated govt. expenditure are greater than govt. receipts. Here the govt. injects more money supply.

- 20. Presented by – Ritvik Tolumbia