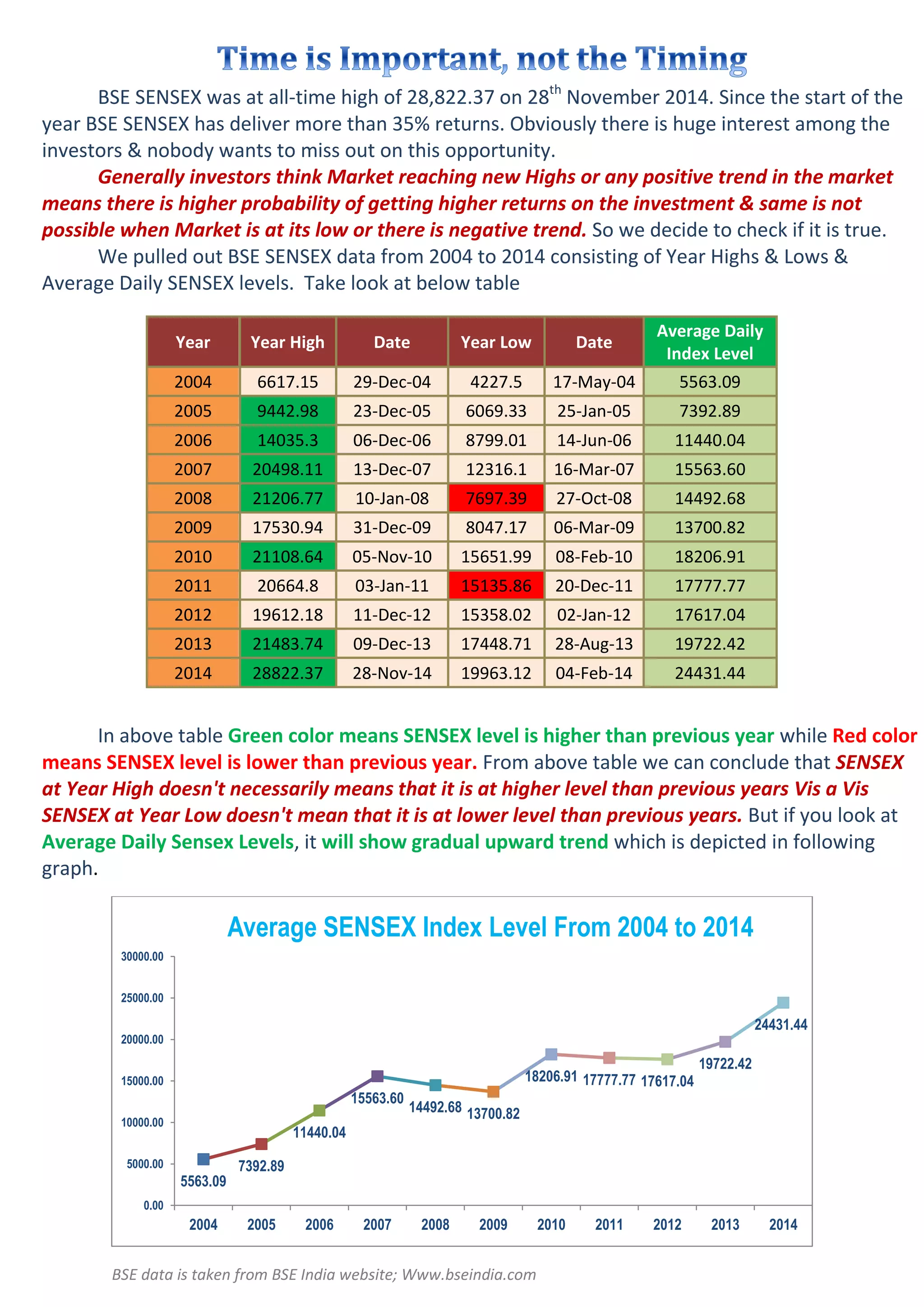

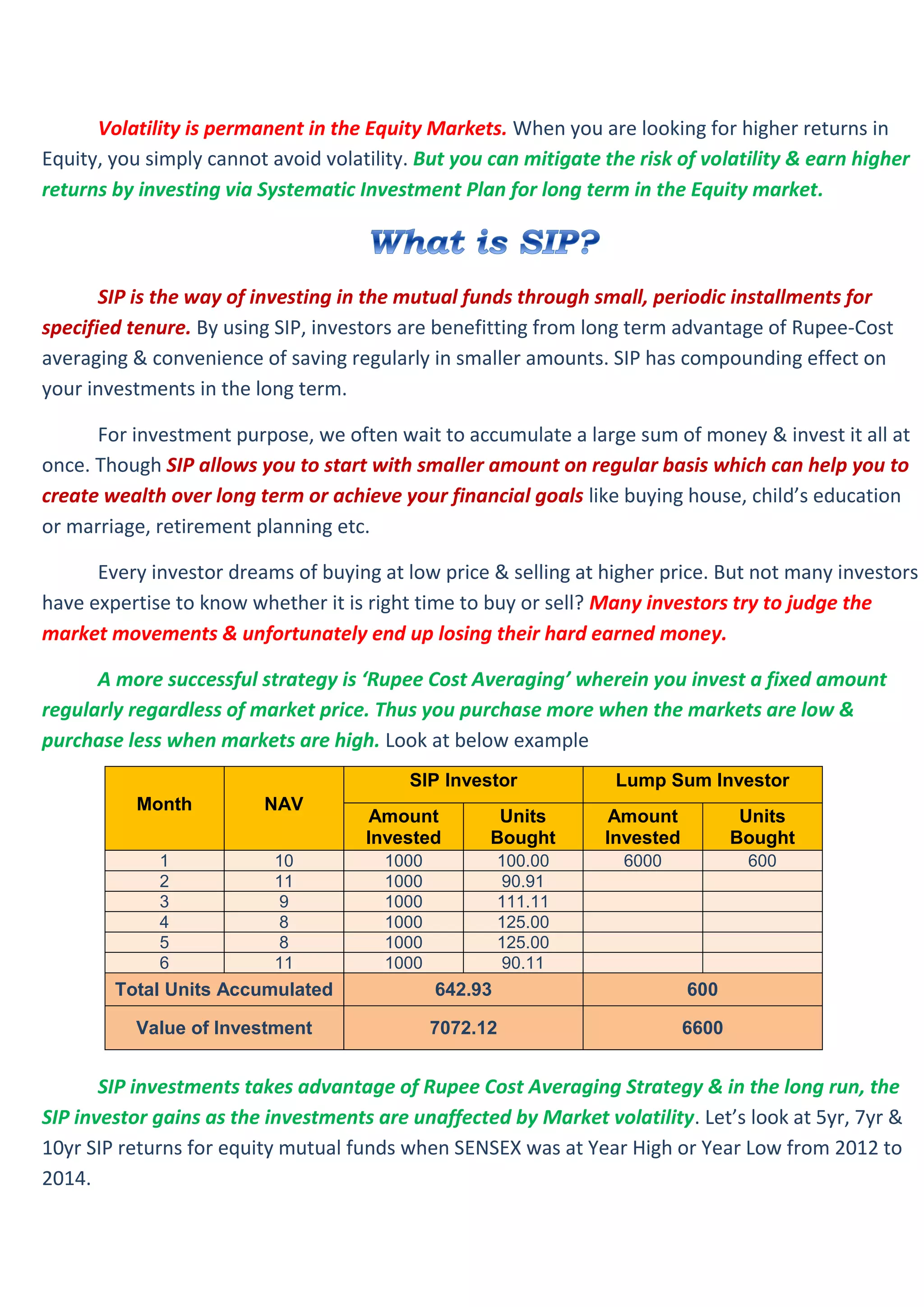

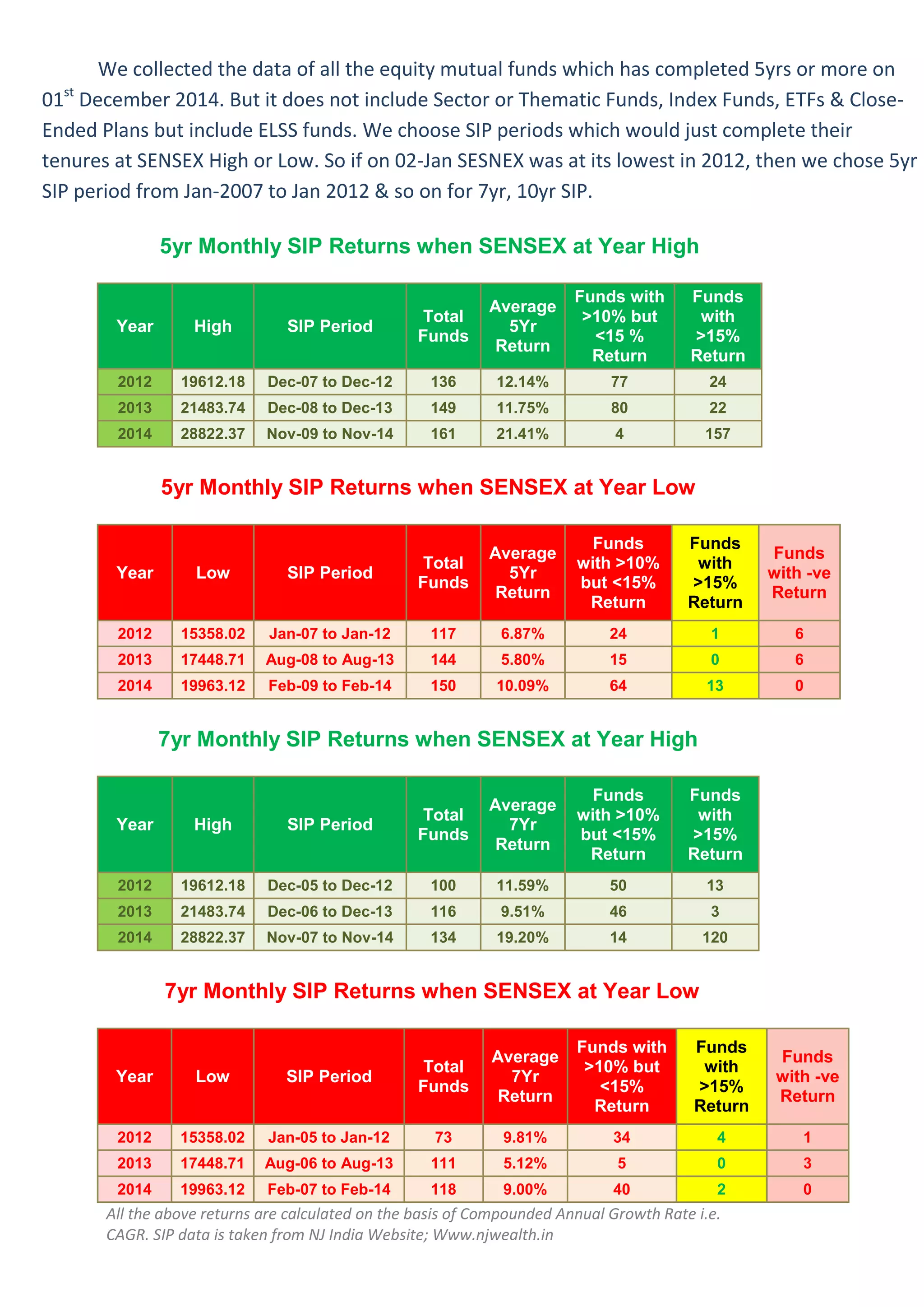

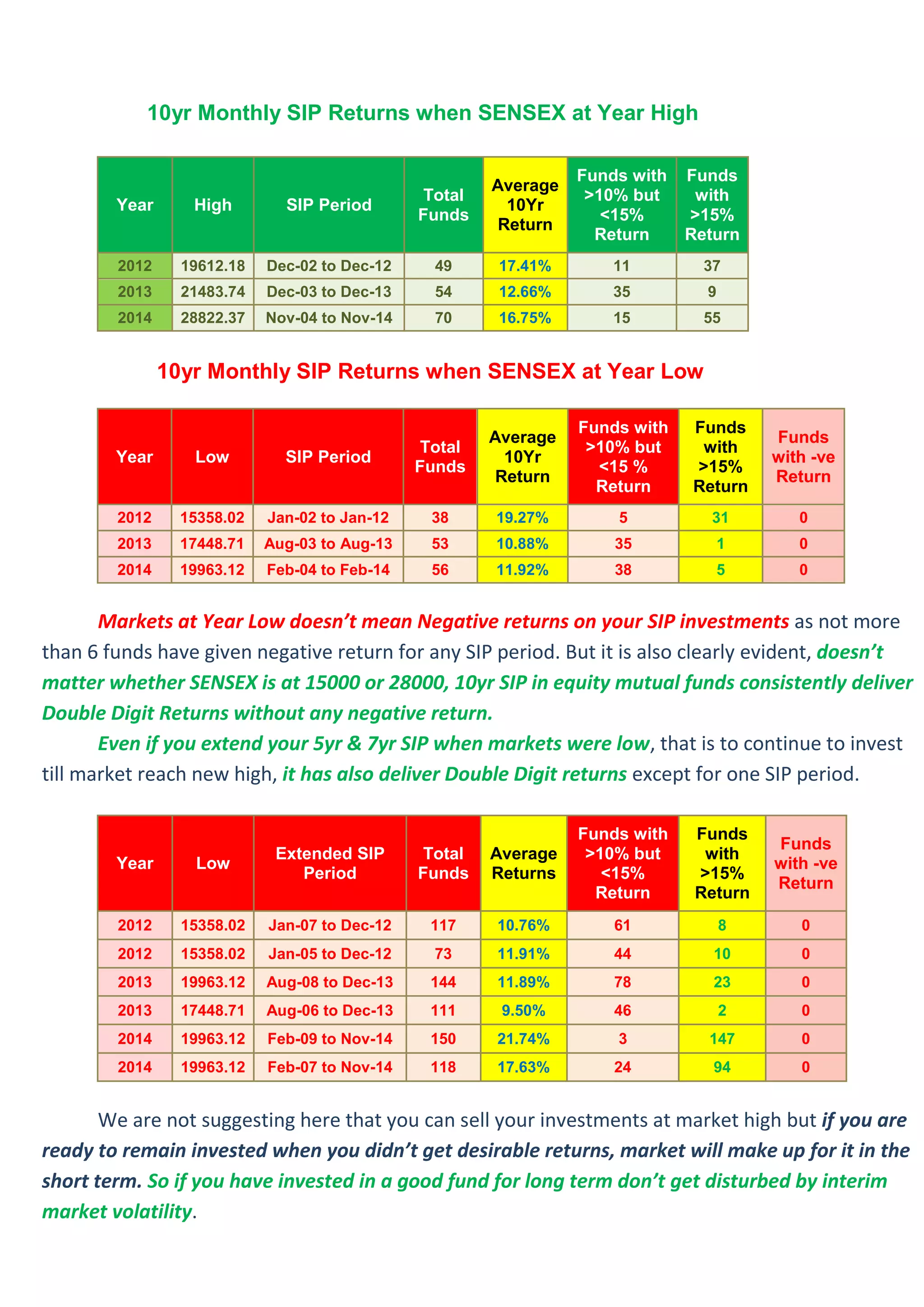

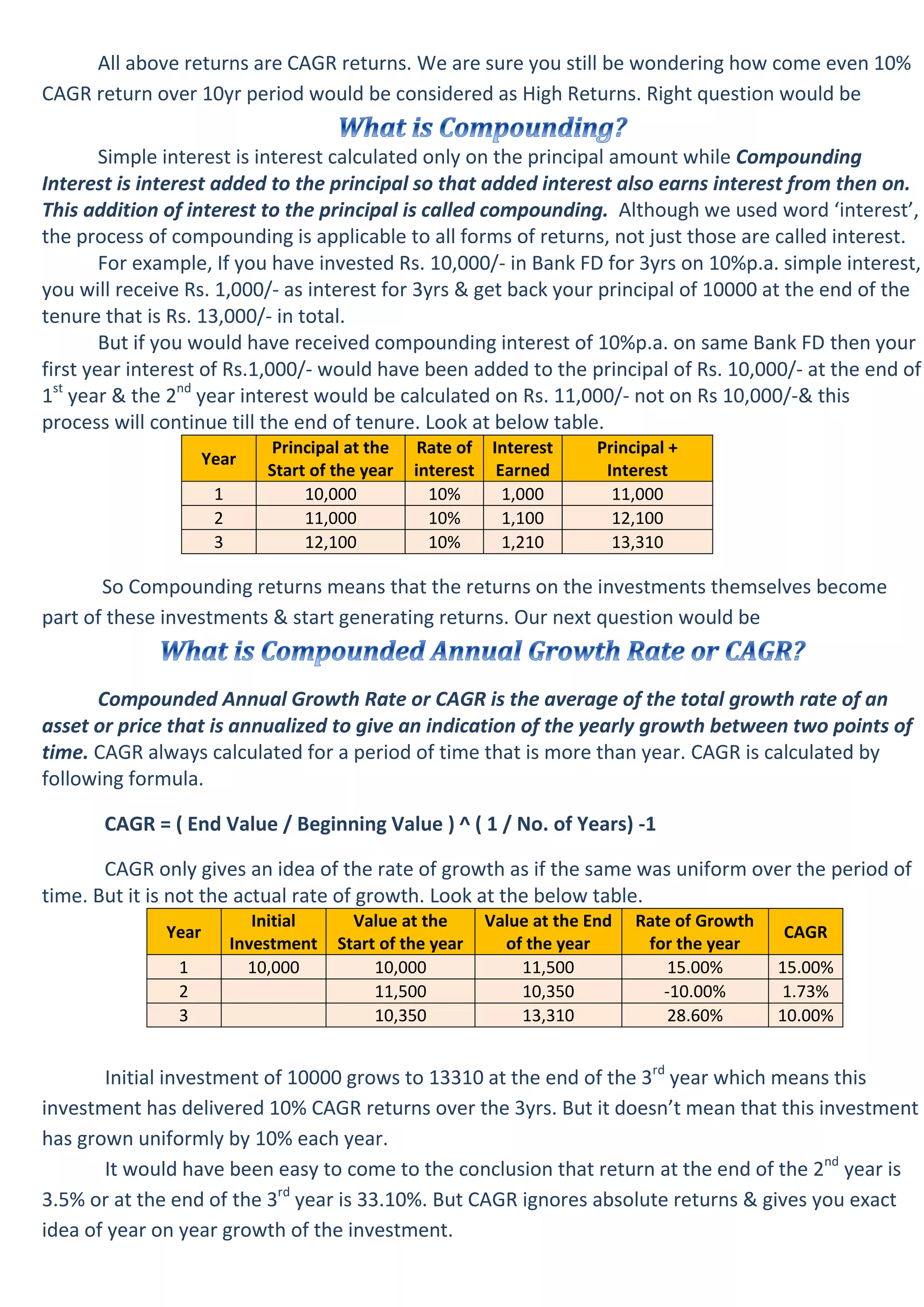

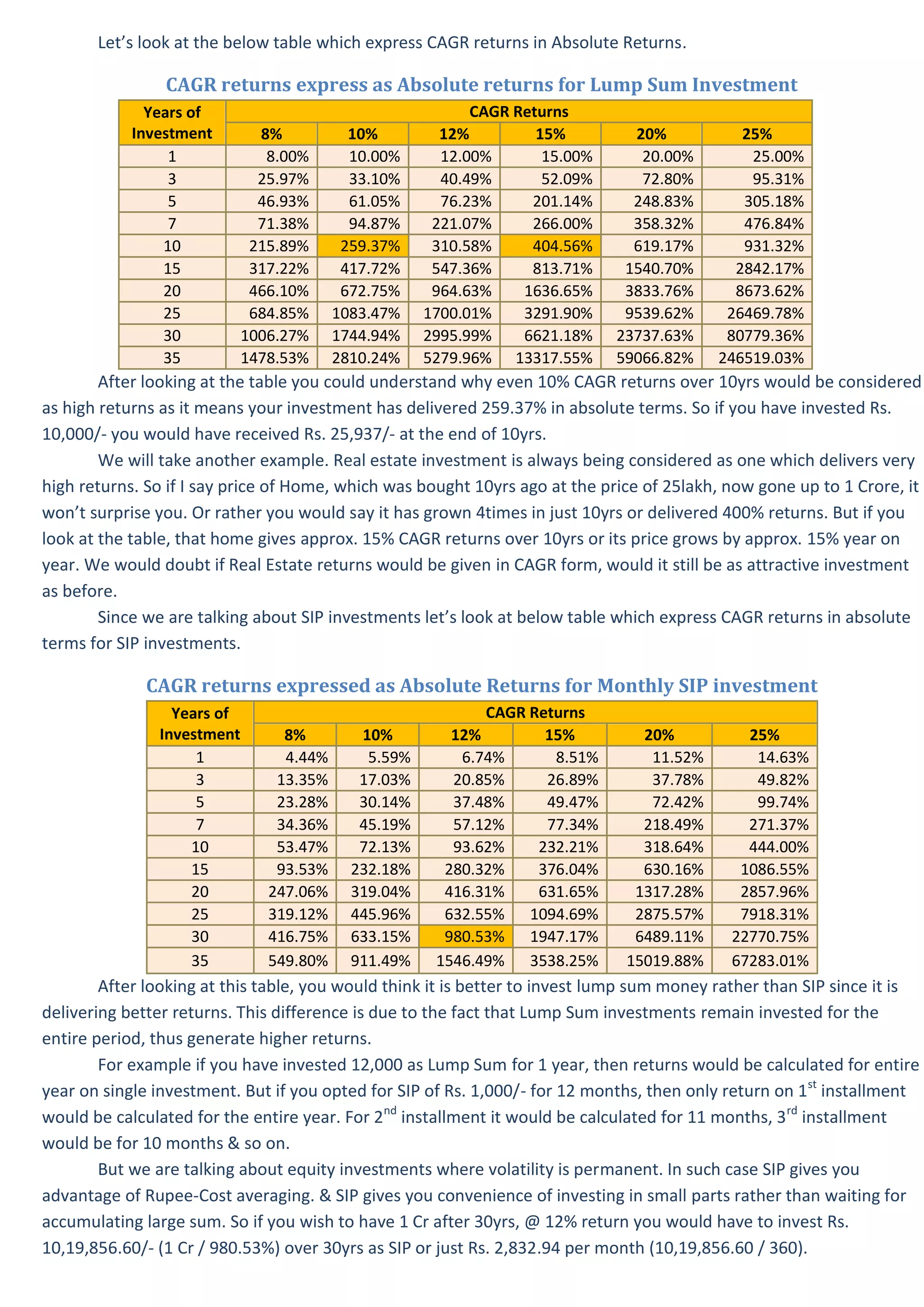

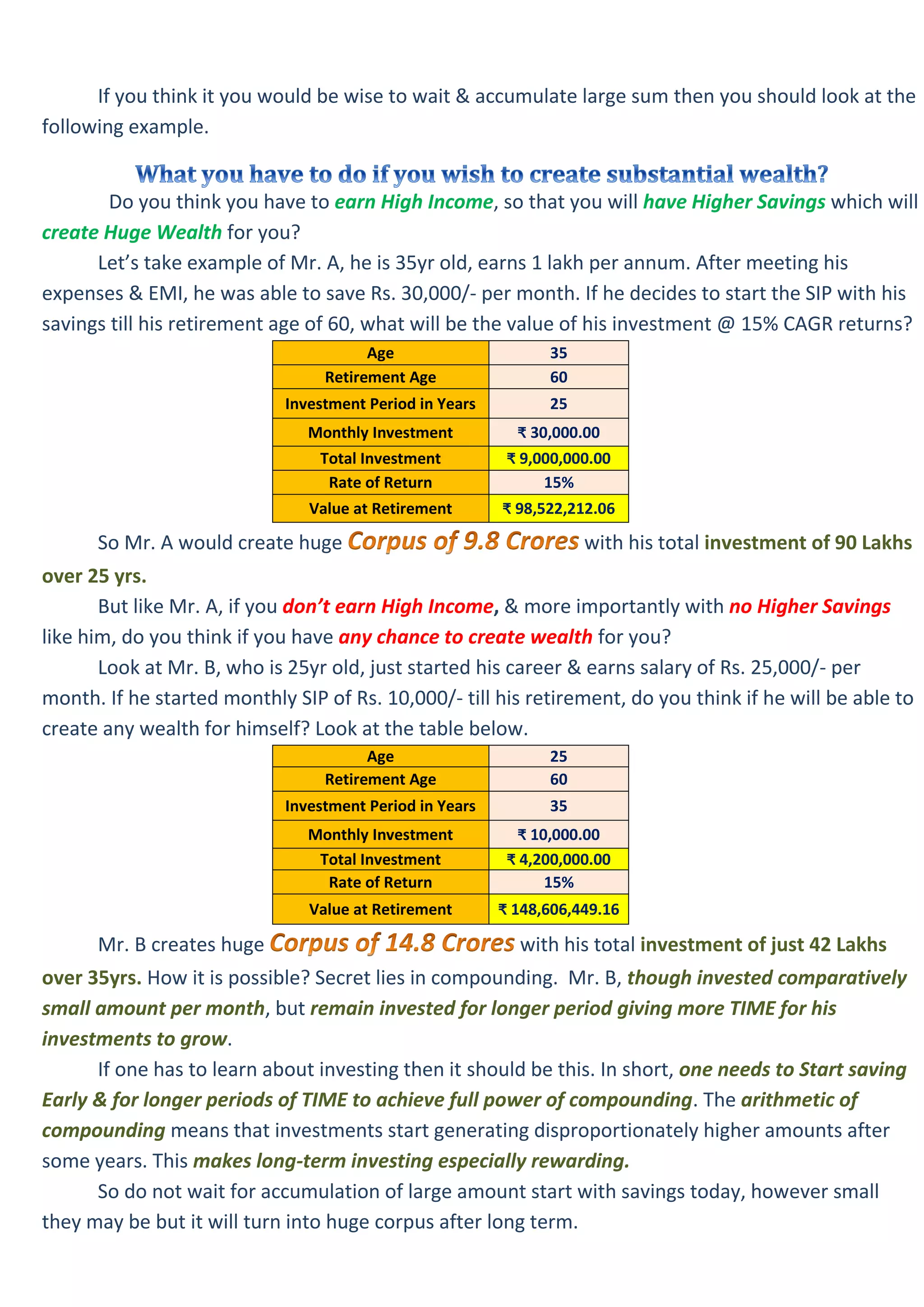

The document analyzes BSE Sensex data from 2004 to 2014 to assess the relationship between market highs and investor returns, highlighting that high market levels do not guarantee better returns compared to previous years. It emphasizes the benefits of systematic investment plans (SIPs) in managing volatility and promoting compounding returns, regardless of market conditions. The study concludes that SIP investments consistently yield positive returns over long periods, even when initiated during market lows.