The document is a project report titled 'The Study of Stock Market' submitted by Shweta Sudhakaran Acharya as part of the T.Y.B.M.S program at the University of Mumbai. It outlines the objectives of understanding the stock market, its functioning, and the regulatory framework in India, while detailing the roles of stock exchanges and trading mechanisms. The report includes comprehensive research, interviews, and a historical perspective of stock markets, aiming to equip new investors with essential knowledge for investment decisions.

![THE STUDY OF STOCK EXCHANGE

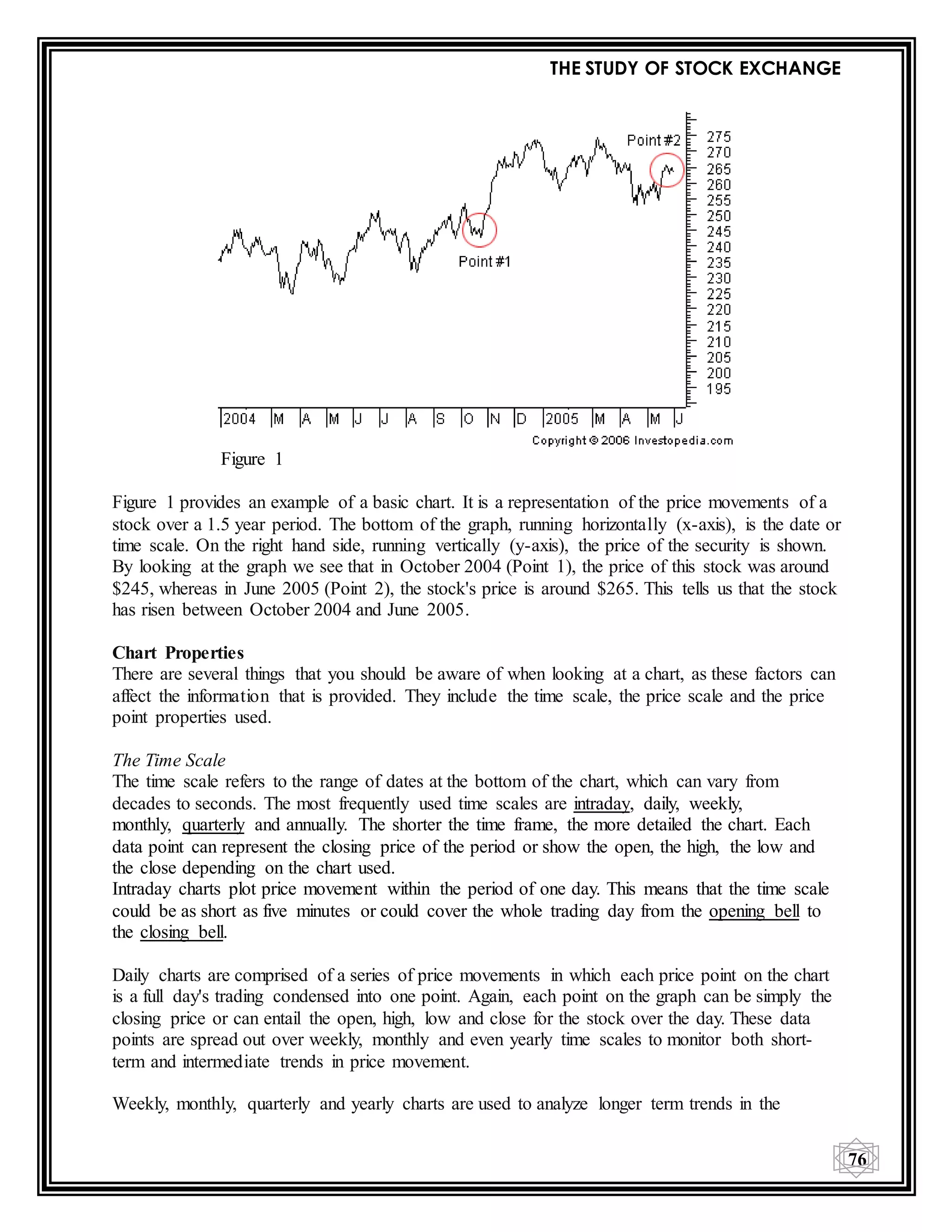

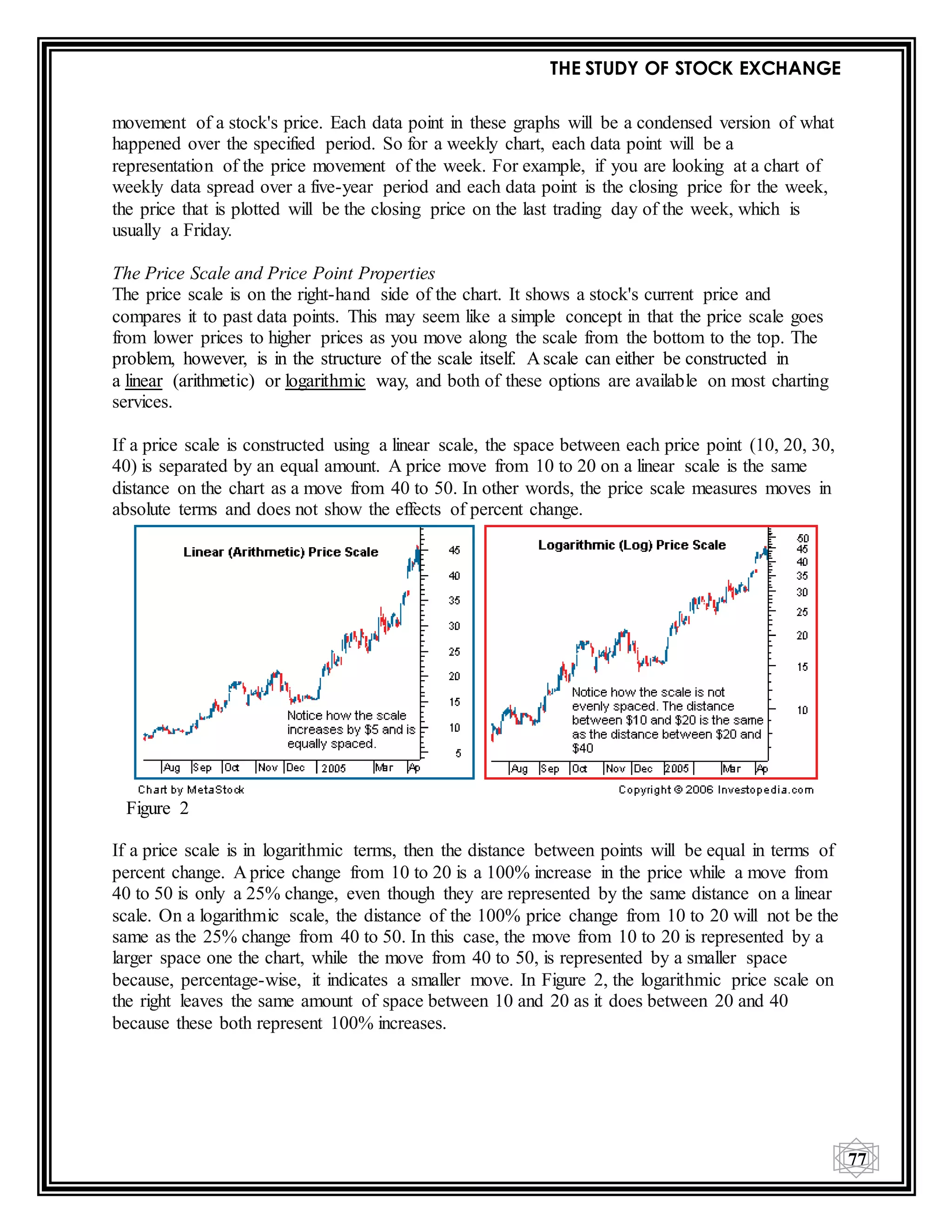

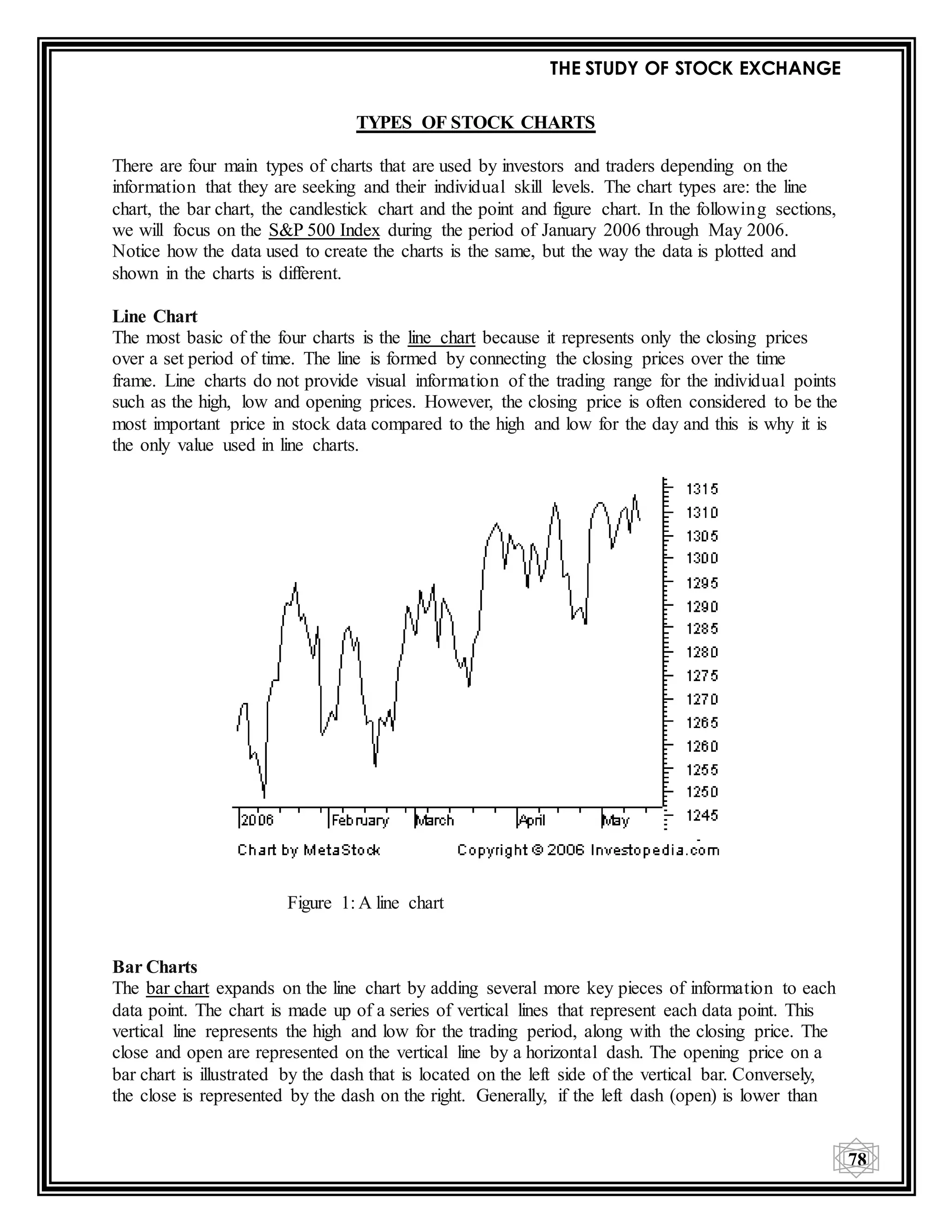

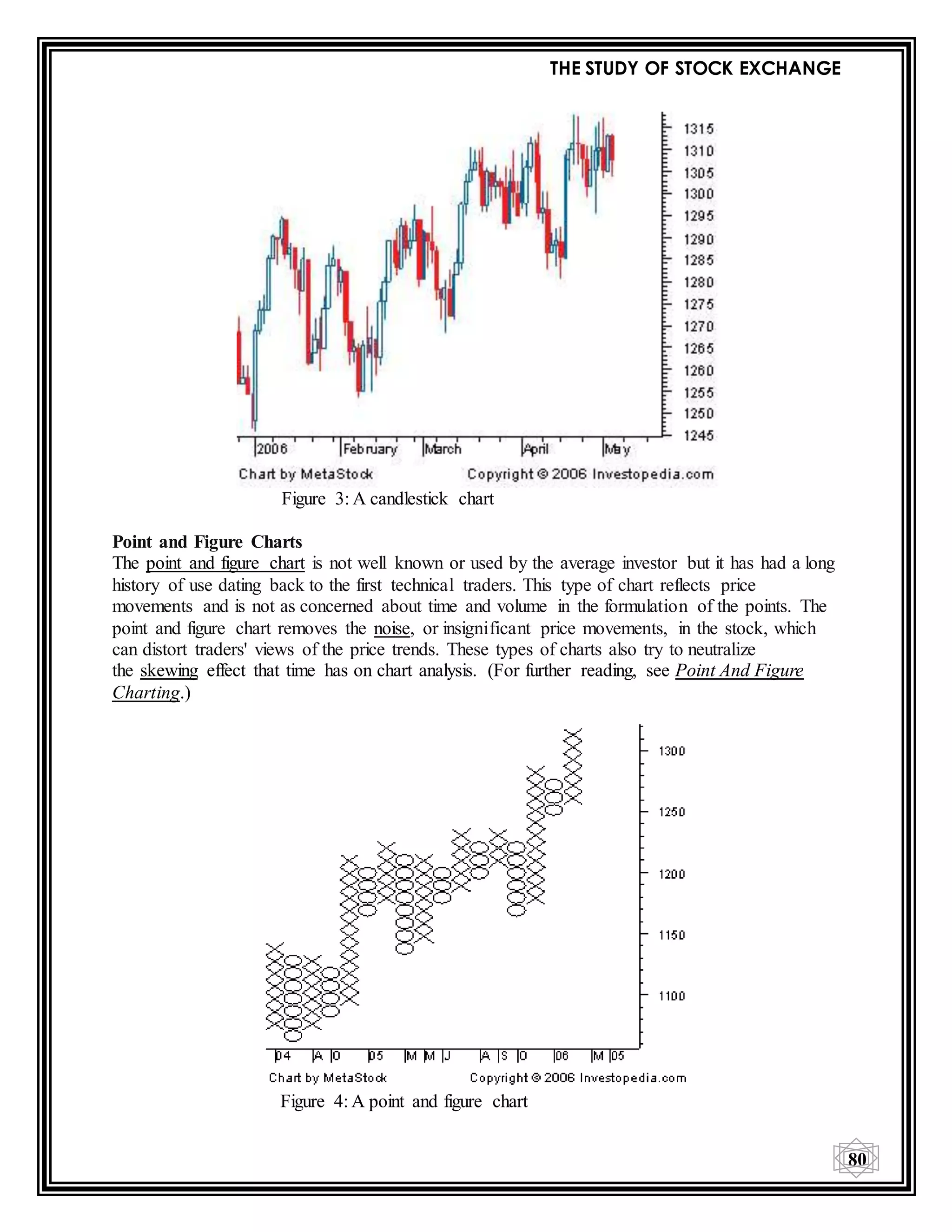

36

Now, I will mention in short on the main stock exchanges of India, i.e. NSE

(National Stock Exchange), BSE (Bombay Stock Exchange) and OTCEI (Over The Counter

Exchange Of India). Though OTCEI plays a part of the key role, NSE and BSE are the most

important Stock Exchanges in India, which dominates and influences the Indian economy.

NATIONAL STOCK EXCHANGE (NSE)

The National Stock Exchange (NSE) is India's leading stock exchange covering various cities

and towns across the country. NSE was set up by leading institutions to provide a modern, fully

automated screen-based trading system with national reach. The Exchange has brought about

unparalleled transparency, speed & efficiency, safety and market integrity. It has set up facilities

that serve as a model for the securities industry in terms of systems, practices and procedures.

NSE has played a catalytic role in reforming the Indian securities market in terms of

microstructure, market practices and trading volumes. The market today uses state-of-art

information technology to provide an efficient and transparent trading, clearing and settlement

mechanism, and has witnessed several innovations in products & services viz. demutualisation of

stock exchange governance, screen based trading, compression of settlement cycles,

dematerialisation and electronic transfer of securities, securities lending and borrowing,

professionalisation of trading members, fine-tuned risk management systems, emergence of

clearing corporations to assume counterparty risks, market of debt and derivative instruments

and intensive use of information technology. The National Stock Exchange of India

Ltd. (NSE) located in the financial capital of India, Mumbai. National Stock Exchange (NSE)

was established in the mid 1990s as a demutualised electronic exchange. NSE provides a

modern, fully automated screen-based trading system, with over two lakh trading terminals,

through which investors in every nook and corner of Indiacan trade.

NSE has a market capitalisation of more than US$1.5 trillion and Number of securities (equities

segment) available for trading are 3,091 as on June 2014.[2]Though a number of other exchanges

exist, NSE and the Bombay Stock Exchange are the two most significant stock exchanges in

India, and between them are responsible for the vast majority of share transactions. NSE's

flagship index, the S&P CNX NIFTY, is used extensively by investors in India and around the

world to take exposure to the Indian equities market.

NSE was started by a clutch of leading Indian financial institutions at the behest of the

Government of India to bring transparency to the Indian market, and has a diversified

shareholding comprising domestic and global investors. The domestic investors includes Life

Insurance Corporation of India, GIC, State Bank of India and Infrastructure Development

Finance Company (IDFC) Ltd, while the foreign investors include MS Strategic (Mauritius)

Limited, Citigroup Strategic Holdings Mauritius Limited, Tiger Global Five Holdings and

Norwest Venture Partners X FII-Mauritius. It offers trading, clearing and settlement services in

equity, debt and equity derivatives. It is India's largest exchange, globally in cash market trades,

in currency trading and index options. As on June 2013, NSE has 1673 VSAT terminals and 2720

leaselines, spread over more than 2000 cities across India.](https://image.slidesharecdn.com/finalblackbook-150202033757-conversion-gate02/75/THE-STUDY-OF-STOCK-MARKET-36-2048.jpg)

![THE STUDY OF STOCK EXCHANGE

39

2000, the BSE used this index to open its derivatives market, trading SENSEX futures contracts.

The development of SENSEX options along with equity derivatives followed in 2001 and 2002,

expanding the BSE's trading platform. Established in 1875, BSE Ltd. (formerly known as

Bombay Stock Exchange Ltd. and established as "The Native Share and Stock Brokers'

Association") is one of Asia’s fastest stock exchanges, with a speed of 200 microseconds and

one of India’s leading exchange groups. BSE is a corporatized and demutualised entity, with a

broad shareholder-base that includes two leading global exchanges, Deutsche Bourse and

Singapore Exchange, as strategic partners. BSE provides an efficient and transparent market for

trading in equity, debt instruments, derivatives, and mutual funds. It also has a platform for

trading in equities of small-and-medium enterprises (SME). Over the past 139 years, BSE has

facilitated the growth of the Indian corporate sector by providing an efficient capital-raising

platform.

More than 5000 companies are listed on BSE, making it the world's top exchange in terms of

listed members. The companies listed on BSE Ltd. command a total market capitalization of

USD 1.51 Trillion as of May 2014.[1]It is also one of the world’s leading exchanges (3rd largest

in March 2014) for Index options trading (Source: World Federation of Exchanges).

BSE also provides a host of other services to capital market participants, including risk

management, clearing, settlement, market data services, and education. It has a global reach with

customers around the world and a nation-wide presence. BSE systems and processes are

designed to safeguard market integrity, drive the growth of the Indian capital market, and

stimulate innovation and competition across all market segments. BSE is the first exchange in

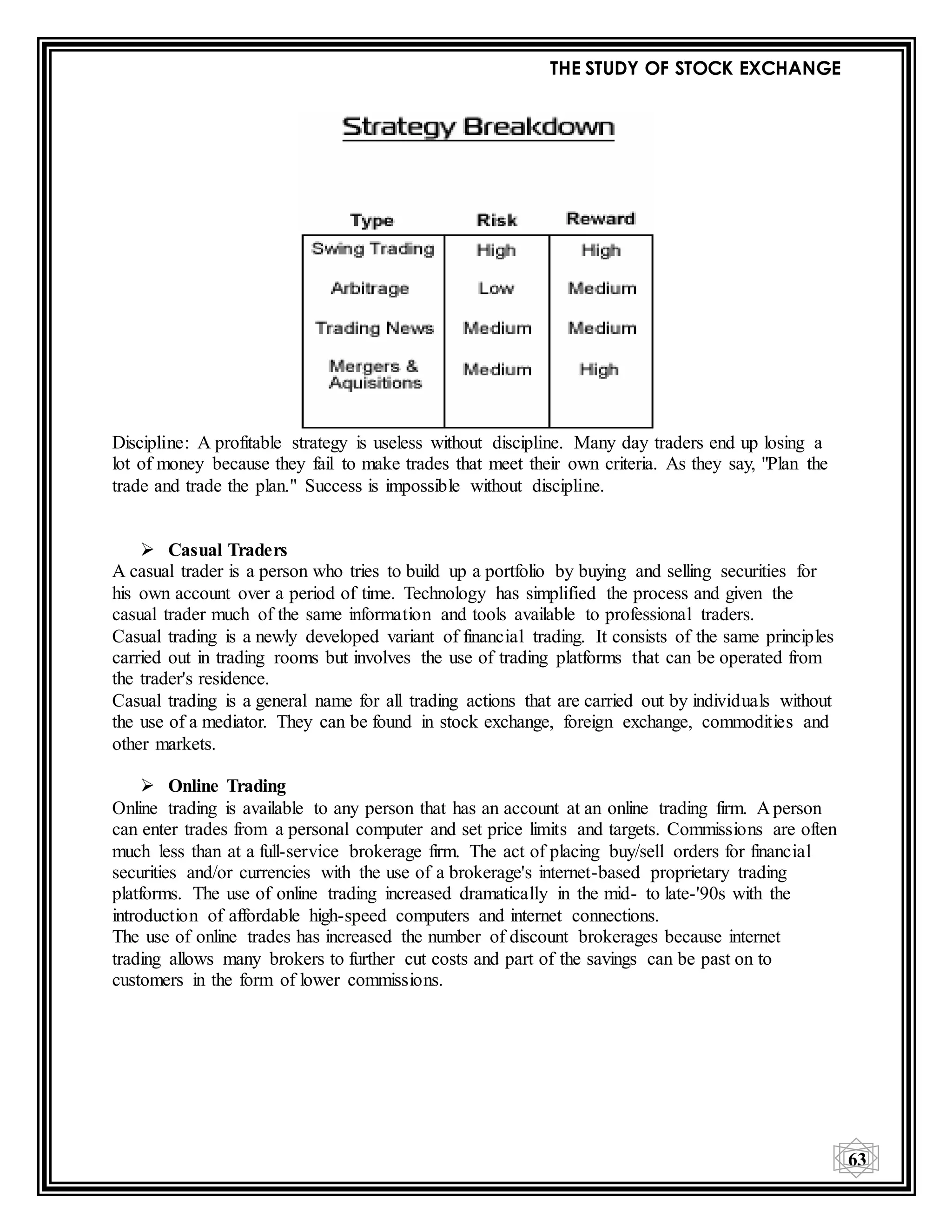

India and the second in the world to obtain an ISO 9001:2000 certification and the Information

Security Management System Standard BS 7799-2-2002 certification for its On-Line trading

System (BOLT). It operates one of the most respected capital market educational institutes in the

country (the BSE Institute Ltd.). BSE also provides depository services through its Central

Depository Services Ltd. (CDSL) arm.

BSE’s popular equity index - the S&P BSE SENSEX (Formerly SENSEX) - is India's most

widely tracked stock market benchmark index. It is traded internationally on the EUREX as well

as leading exchanges of the BRCS nations (Brazil, Russia, China and South Africa). On

Tuesday, 19 February 2013 BSE has entered into Strategic Partnership with S&P DOW JONES

INDICES and the SENSEX has been renamed as "S&P BSE SENSEX".](https://image.slidesharecdn.com/finalblackbook-150202033757-conversion-gate02/75/THE-STUDY-OF-STOCK-MARKET-39-2048.jpg)

![THE STUDY OF STOCK EXCHANGE

40

Advantages of trading at BSE

Historically an open outcry floor trading exchange, the Bombay Stock Exchange

switched to an electronic trading system developed by CMC Ltd in 1995. It took the

exchange only fifty days to make this transition. This automated, screen-based

trading platform called BSE On-line trading (BOLT) had a capacity of 8 million orders

per day. The BSE has also introduced the world's first centralized exchange-based

internet trading system, BSEWEBx.co.in to enable investors anywhere in the world to

trade on the BSE platform.

History and milestones:

Here is the latest history and milestone of NSE (2011-2014):

17 November 2011 Maharashtra and United Kingdom Environment Ministers launched

Concept Note for BSE Carbon Index

30 December 2011, picks up a stake in the proxy advisory firm, Institutional Investor

Advisory Services India Limited (IiAS)

7 January 2011 BSE Training Institute Ltd. with IGNOU launched India's first 2 year

full-time MBA programme specialising in Financial Market

15 January 2011 Co-location facility at BSE - tie up with Netmagic.com

22 February 2012 Launch of BSE-GREENEX to promote investments in Green India

13 March 2012 Launch of BSE - SME Exchange Platform

30 March 2012 BSE launched trading in BRICSMART indices derivatives

19 February 2013 - SENSEX becomes S&P SENSEX as BSE ties up with Standard and

Poor's to use the S&P brand for Sensex and other indices.[3]

28 November 2013 Launch of Currency Derivatives (BSE CDX)](https://image.slidesharecdn.com/finalblackbook-150202033757-conversion-gate02/75/THE-STUDY-OF-STOCK-MARKET-40-2048.jpg)

![THE STUDY OF STOCK EXCHANGE

54

WHAT IS TRADING OF STOCKS?

Most stocks are traded on exchanges, which are places where buyers and sellers meet and decide

on a price. Some exchanges are physical locations where transactions are carried out on a trading

floor. You've probably seen pictures of a trading floor, in which traders are wildly throwing their

arms up, waving, yelling, and signaling to each other. The other type of exchange is virtual,

composed of a network of computers where trades are made electronically.

The purpose of a stock market is to facilitate the exchange of securities between buyers and

sellers, reducing the risks of investing. Just imagine how difficult it would be to sell shares if you

had to call around the neighborhood trying to find a buyer. Really, a stock market is nothing

more than a super-sophisticated farmers' market linking buyers and sellers.

WHO IS A STOCKBROKER?

Definition of 'Stockbroker'

1. An agent that charges a fee or commission for executing buy and sell orders submitted by an

investor.

2. The firm that acts as an agent for a customer, charging the customer a commission for its

services.

A stockbroker is an individual / organization who are specially given license to participate in the

securities market on behalf of clients. The stockbroker has the role of an agent. When the

Stockbroker acts as agent for the buyers and sellers of securities, a commission is charged for

this service.

As an agent the stock broker is merely performing a service for the investor. This means that the

broker will buy for the buyer and sell for the seller, each time making sure that the best price is

obtained for the client.

An investor should regard the stockbroker as one who provides valuable service and information

to assist in making the correct investment decision. They are adequately qualified to provide

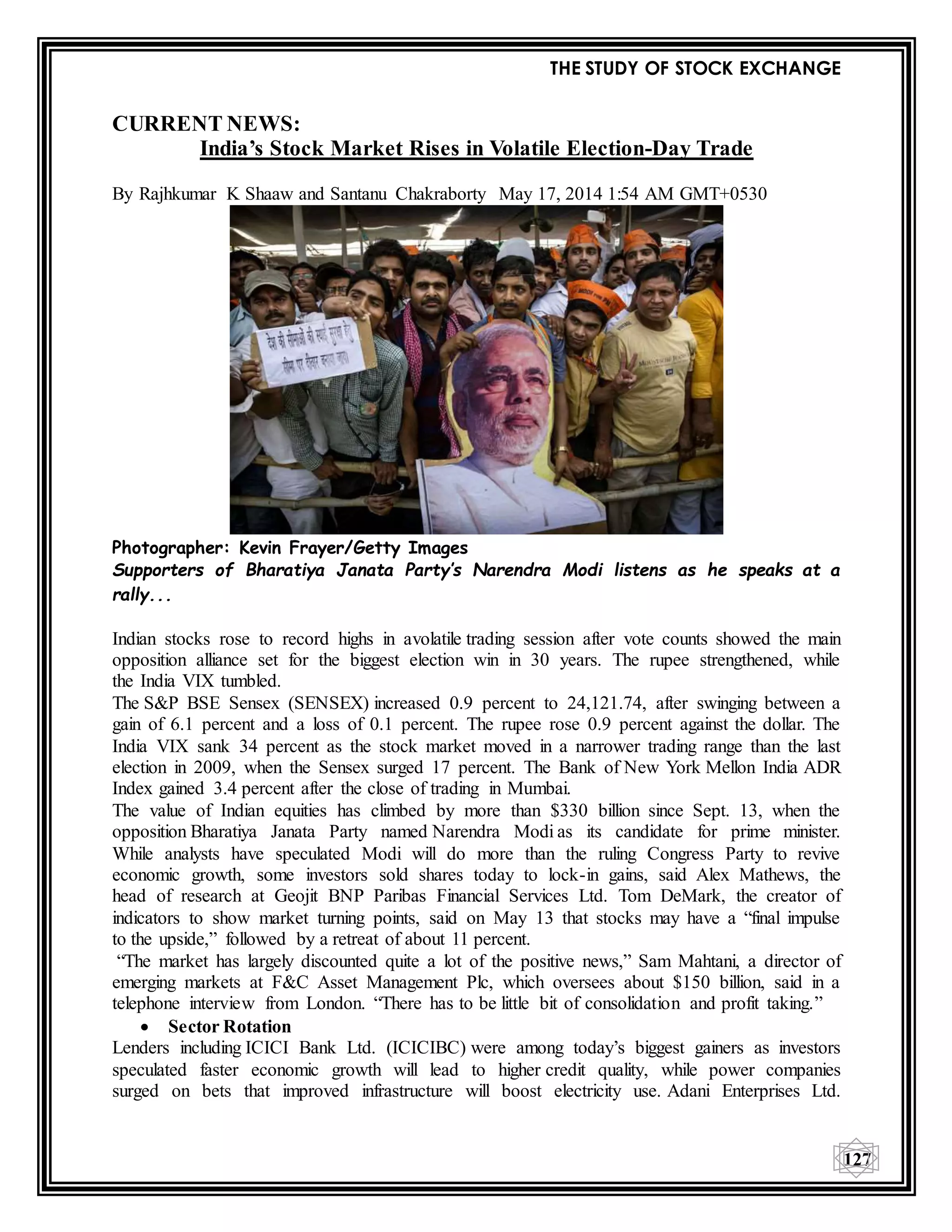

answers to a number of questions that the investor might need answers to and to assist in

participating in the regional market. Here are some questions which arise in the minds of the

investors before the take help of the brokers for investing their money in a particular company.

Are they governed by any Rules and Regulations?

Of course, yes. Stock brokers are governed by SEBI Act, 1992, Securities Contracts (Regulation)

Act, 1956, Securities and Exchange Board of India [SEBI (Stock brokers and Sub brokers) Rules

and Regulations, 1992], Rules, Regulations and Bye laws of stock exchange of which he is a](https://image.slidesharecdn.com/finalblackbook-150202033757-conversion-gate02/75/THE-STUDY-OF-STOCK-MARKET-54-2048.jpg)

![THE STUDY OF STOCK EXCHANGE

93

INDIAN STOCK INDICES

There are two main indices of the Indian stock market:

NIFTY

SENSEX

NIFTY

NIFTY is a major stock index in India introduced by the National stock exchange.

NIFTY was coined for the two words ‘National’ and ‘FIFTY’. The word fifty is used because;

the index consists of 50 actively traded stocks from various sectors.

So the NIFTY index is a bit broader than the Sensex which is constructed using 30 actively

traded stocks in the BSE.

NIFTY is calculated using the same methodology adopted by the BSE in calculating the Sensex

– but with three differences.

They are:

The base year is taken as 1995

The base value is set to 1000

NIFTY is calculated on 50 stocks actively traded in the NSE

50 top stocks are selected from 24 sectors.

The CNX NIFTY, also called the NIFTY 50 or simply the NIFTY, is National Stock Exchange of

India's benchmark index for Indian equity market. NIFTY is owned and managed by India Index

Services and Products Ltd. (IISL), which is a wholly owned subsidiary of the NSE Strategic

Investment Corporation Limited. IISL is India's first specialized company focused upon the

index as a core product. IISL has a marketing and licensing agreement with Standard &

Poor's for co-branding equity indices. 'CNX' in its name stands for 'CRISIL NSE Index'.

CNX NIFTY has shaped up as a largest single financial product in India, with an ecosystem

comprising: exchange traded funds (onshore and offshore), exchange-traded futures and options

(at NSE in India and at SGX and CME abroad), other index funds and OTC derivatives (mostly

offshore).

The CNX NIFTY covers 22 sectors of the Indian economy and offers investment managers

exposure to the Indian market in one portfolio. During 2008-12, CNX NIFTY 50 Index share of

NSE market capitalisation fell from 65% to 29%[1] due to the rise of sectoral indices like CNX

Bank, CNX IT, CNX Mid Cap, etc. The CNX NIFTY 50 Index gives 29.70% weightage to

financial services, 0.73% weightage to industrial manufacturing and nil weightage to agricultural

sector.

The CNX NIFTY index is a free float market capitalisation weighted index. The index was

initially calculated on full market capitalisation methodology. From June 26, 2009, the

computation was changed to free float methodology. The base period for the CNX NIFTY index

is November 3, 1995, which marked the completion of one year of operations of National Stock

Exchital Market Segment. The base value of the index has been set at 1000, and a base capital of

Rs 2.06 trillion. The CNX NIFTY Index was developed by Ajay Shah and Susan Thomas. The

CNX NIFTY currently consists of the following 50 major Indian companies:

Kindly Note, post expiration of agreement between IISL and Standard and Poor’s Financial

Service LLC (S&P) on 31st Jan 2013, index is addressed as CNX NIFTY Index. (Formerly, S&P

CNX NIFTY Index)](https://image.slidesharecdn.com/finalblackbook-150202033757-conversion-gate02/75/THE-STUDY-OF-STOCK-MARKET-93-2048.jpg)

![THE STUDY OF STOCK EXCHANGE

113

Indexes:

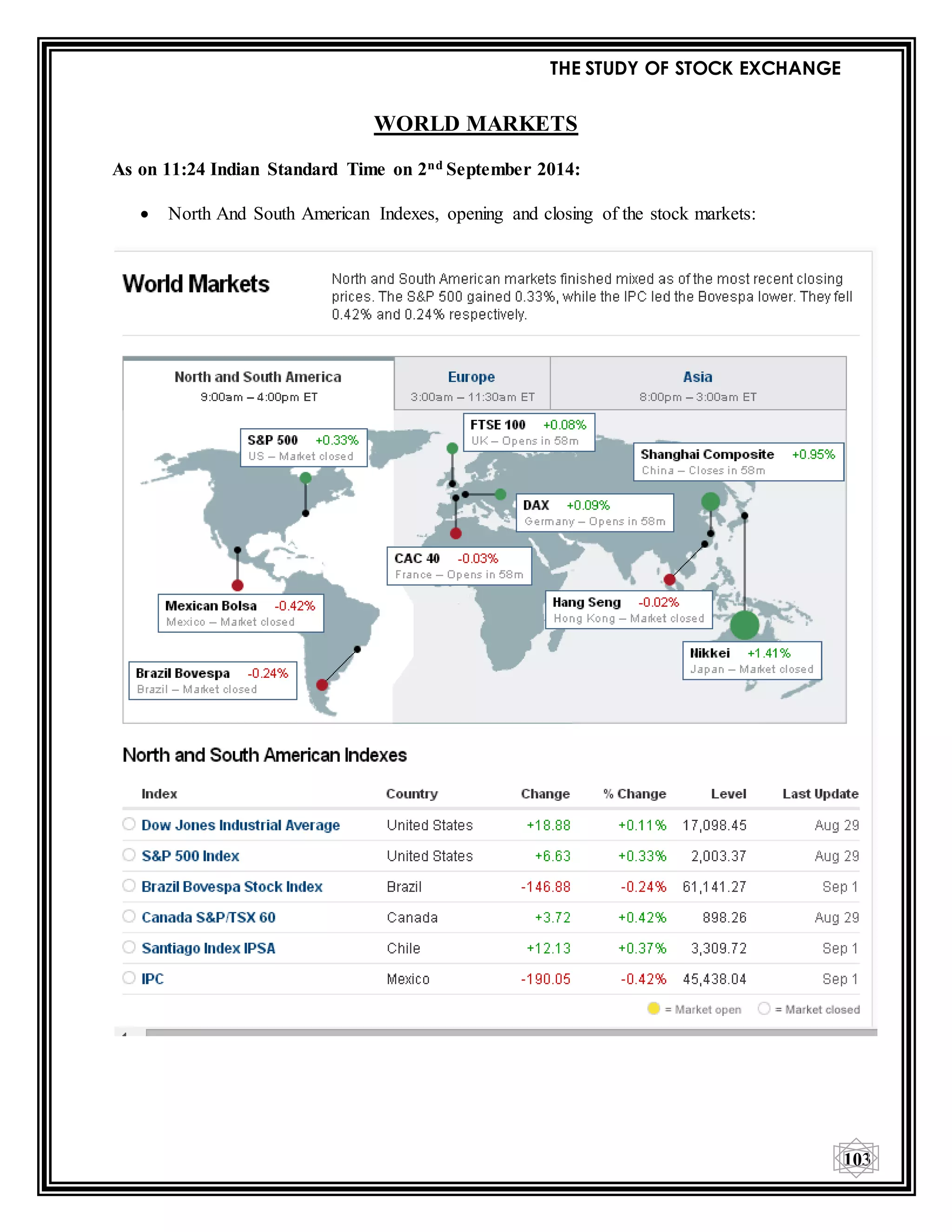

Dow Jones Industrial Average

The Dow Jones Industrial Average /also called theIndustrial Average, the Dow Jones, the Dow

Jones Industrial, the Dow 30, or simply the Dow, is a stock market index, and one of several

indices created by Wall Street Journal editor and Dow Jones & Companyco-founder Charles

Dow. The industrial average was first calculated on May 26, 1896. Currently owned by S&P

Dow Jones Indices, which is majority owned by McGraw-Hill Financial, it is the most notable of

the Dow Averages, of which the first (non-industrial) was first published on February 16, 1885.

The averages are named after Dow and one of his business associates, statistician Edward Jones.

It is an index that shows how 30 large publicly owned companies based in the United States have

traded during a standard trading session in the stock market.[3] It is the second oldest U.S.

market index after the Dow Jones Transportation Average, which was also created by Dow.

S&P 500

The S&P 500, or the Standard & Poor's 500, is a stock market indexbased on the market

capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

The S&P 500 index components and their weightings are determined by S&P Dow Jones

Indices. It differs from other U.S. stock market indices, such as the Dow Jones Industrial

Averageor the Nasdaq Composite index, because of its diverse constituency and weighting

methodology. It is one of the most commonly followed equity indices, and many consider it one

of the best representations of the U.S. stock market, and a bellwether for the U.S.

economy. The National Bureau of Economic Research has classified common stocks, as a

leading indicator of business cycles.

NYSE Composite

The NYSE Composite is a stock market index covering all common stock listed on the New

York Stock Exchange, includingAmerican depositary receipts, real estate investment

trusts, tracking stocks, and foreign listings. Over 2,000 stocks are covered in the index, of which

over 1,600 are from United States corporations and over 360 are foreign listings; however

foreign companies are very prevalent among the largest companies in the index: of the 100

companies in the index having the largest market capitalization (and thus the largest impact on

the index), more than half (55) are non-U.S. issues. This includes corporations in each of the ten

industries listed in the Industry Classification Benchmark. It uses free-float market

cap weighting.

Notable events:

The Wall Street Crash of 1929, also known as Black Tuesday or the Stock Market Crash

of 1929, began in late October 1929 and was the most devastatingstock market crash in

the history of the United States, when taking into consideration the full extent and

duration of its fallout. The crash signaled the beginning of the 10-year Great

Depression that affected all Western industrialized countries. The Black Thursday crash

of the Exchange on October 24, 1929, and the sell-off panic which started on Black

Tuesday, October 29, are often blamed for precipitating the Great Depression. In an effort

to try to restore investor confidence, the Exchange unveiled a fifteen-point program](https://image.slidesharecdn.com/finalblackbook-150202033757-conversion-gate02/75/THE-STUDY-OF-STOCK-MARKET-113-2048.jpg)