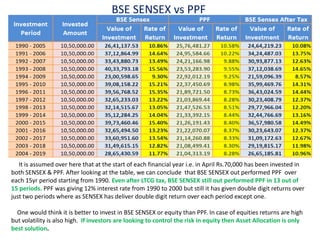

The document discusses tax planning strategies for the financial year 2019-20, focusing on investments under Section 80C to save taxes. It compares investment options such as PPF and ELSS mutual funds, highlighting their returns, risk factors, and tax implications. It emphasizes the importance of asset allocation based on individual risk tolerance and time horizon to achieve financial goals while providing downside protection against market volatility.