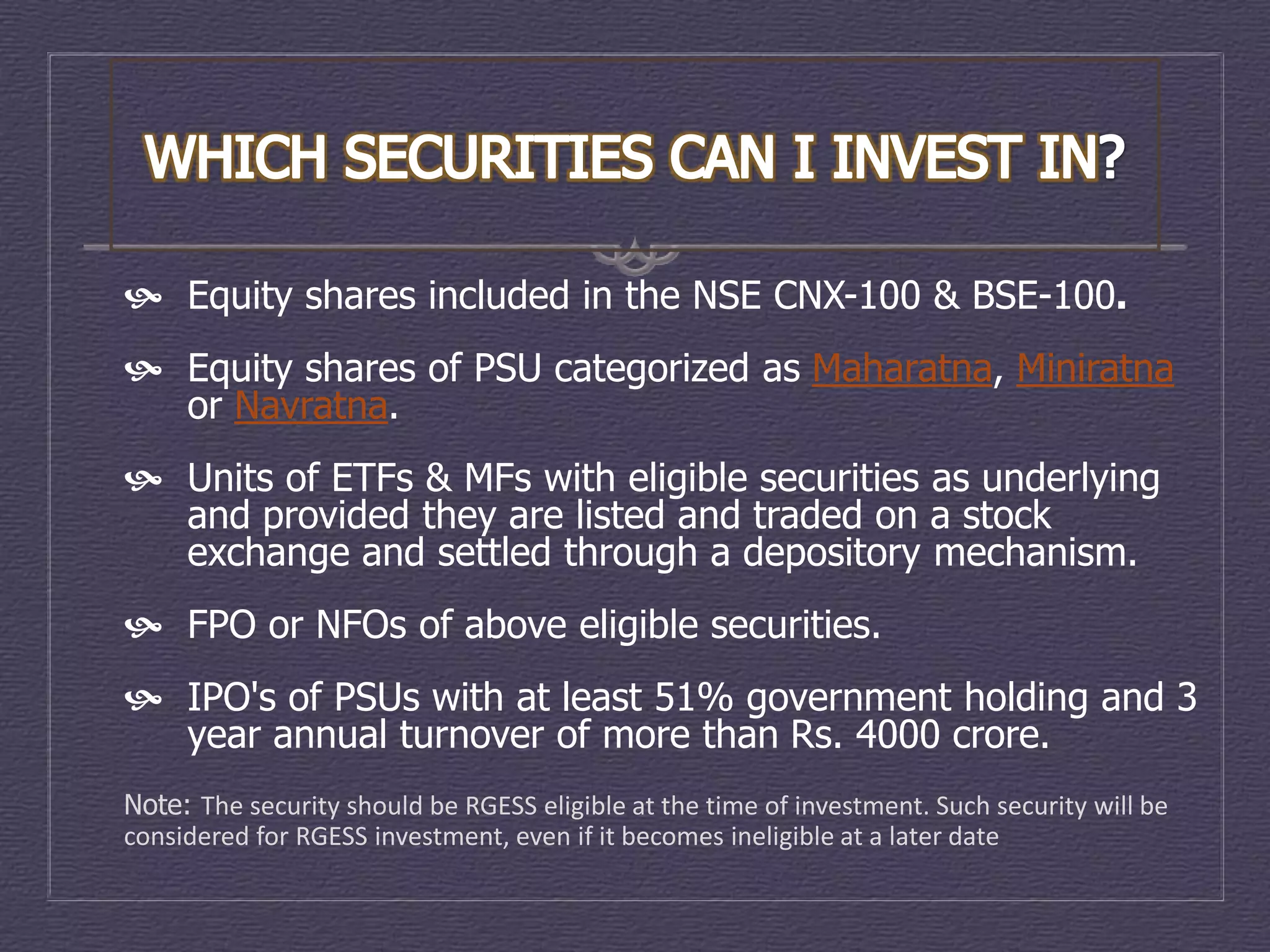

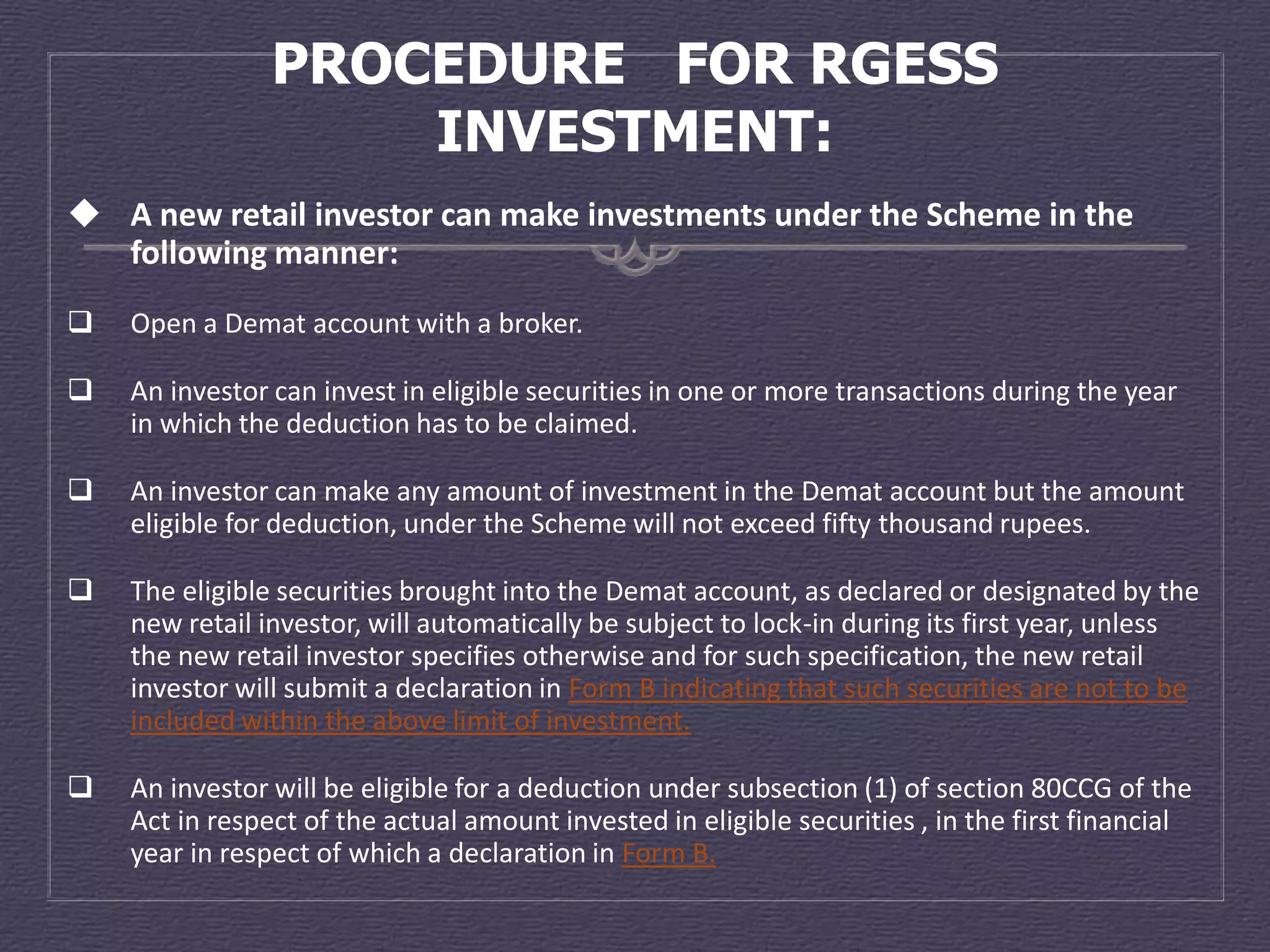

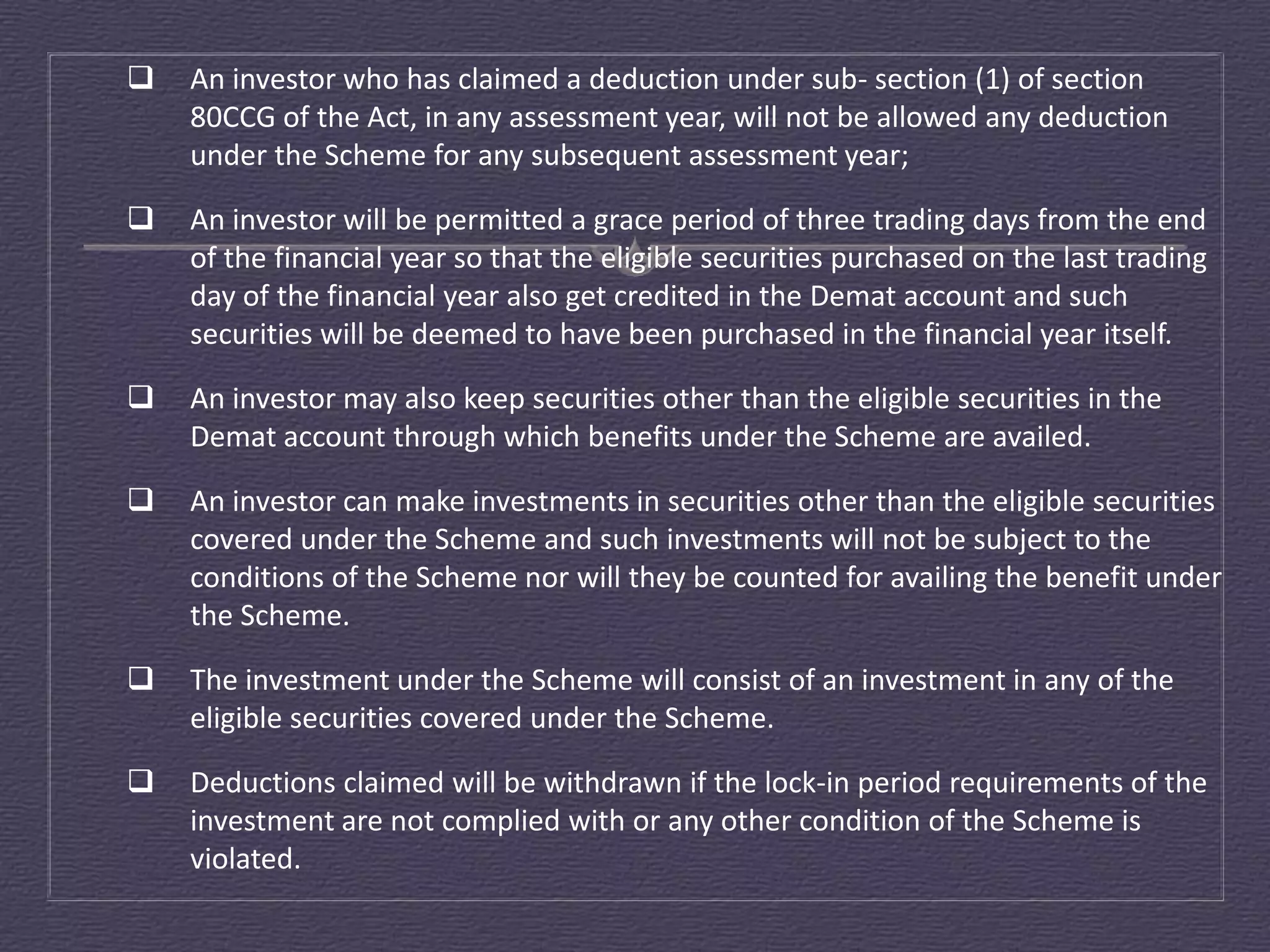

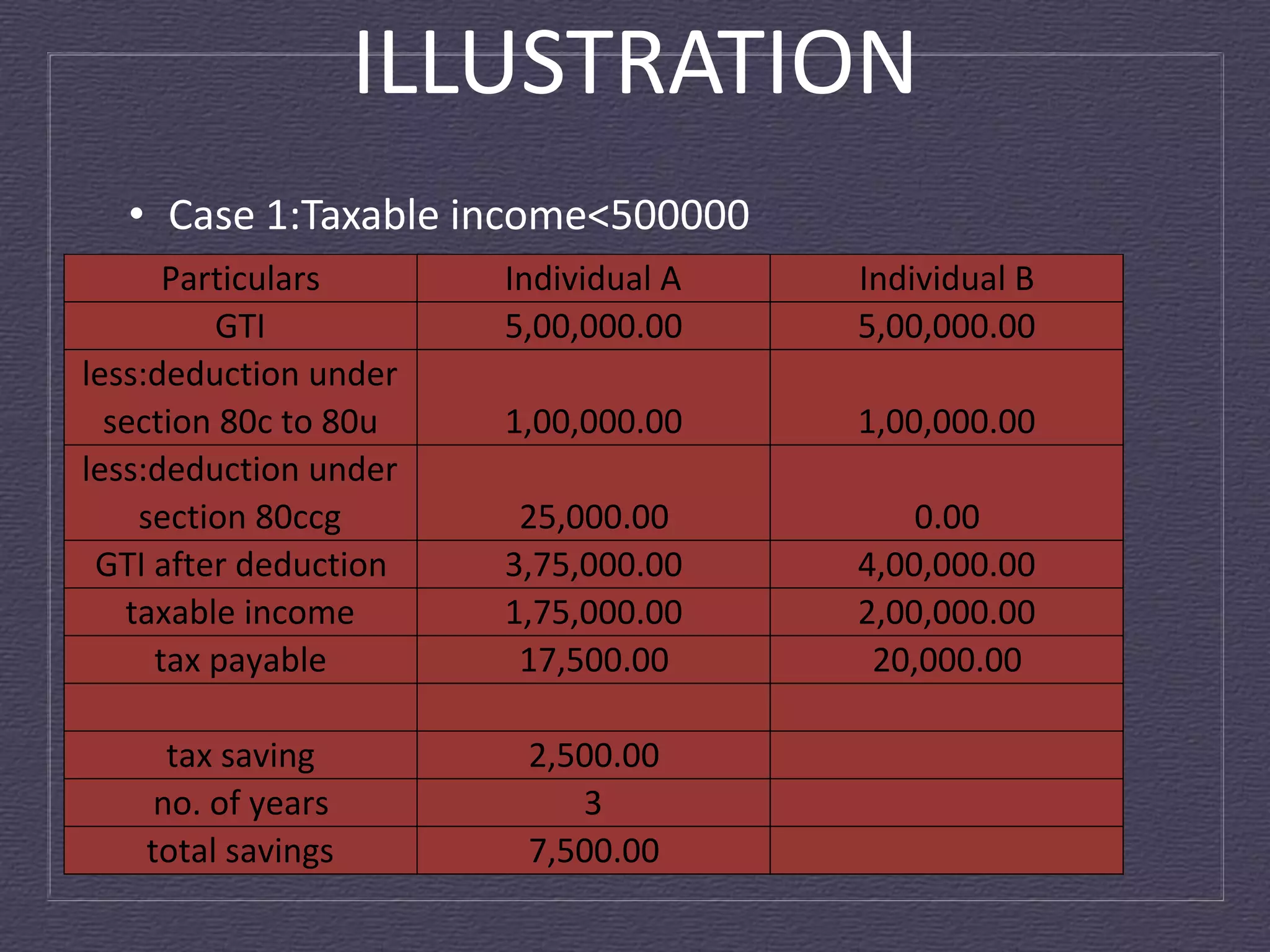

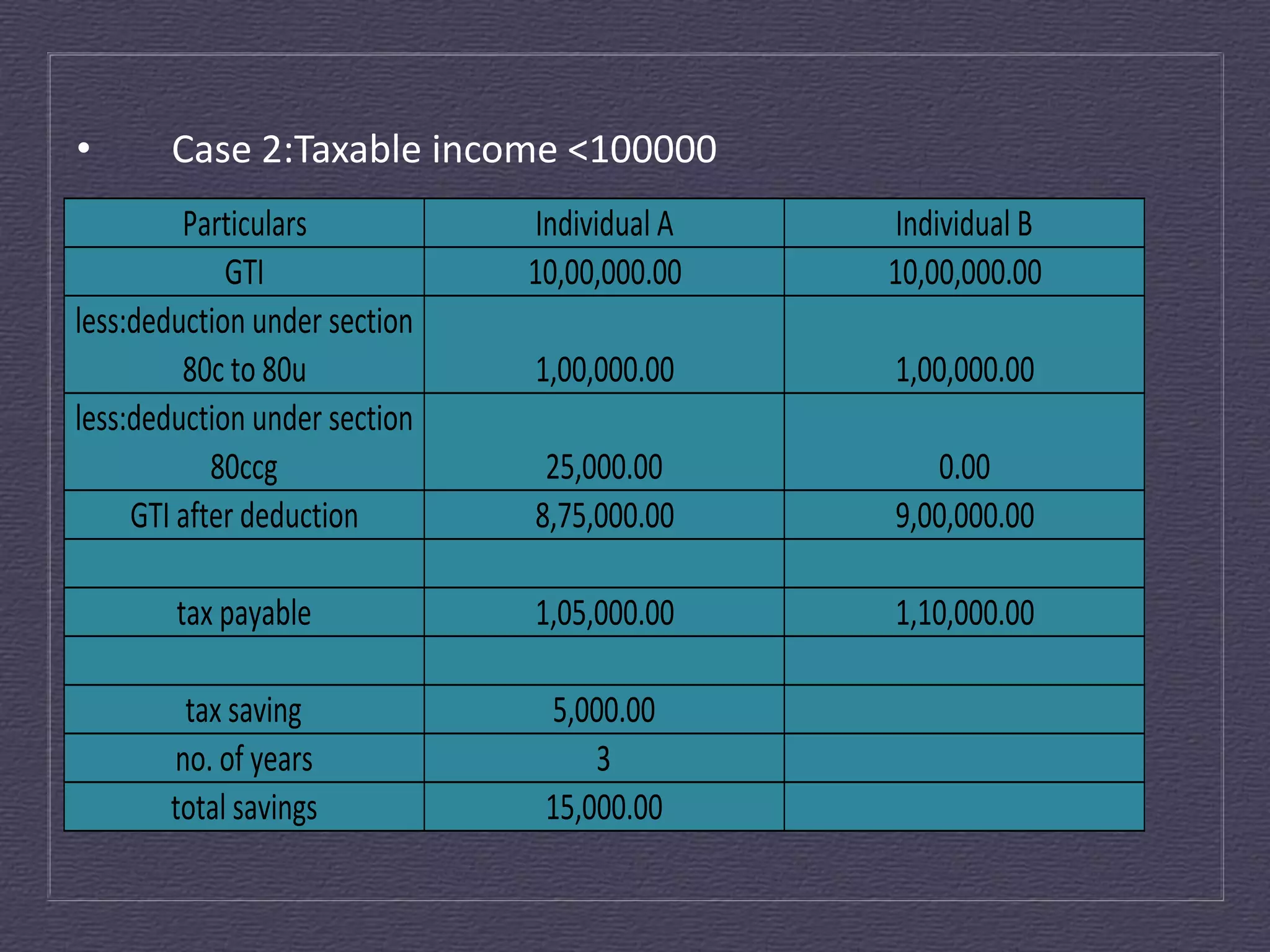

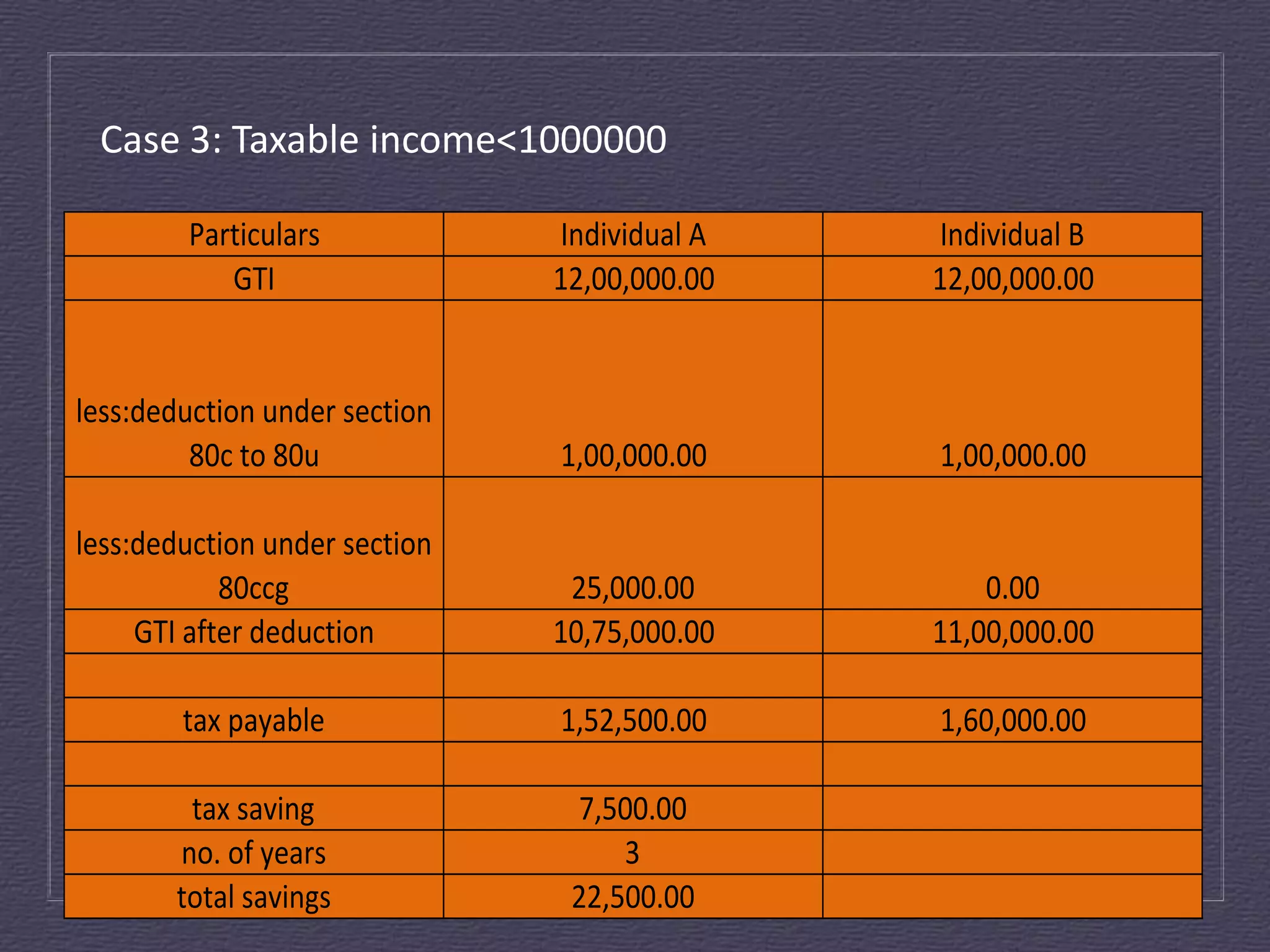

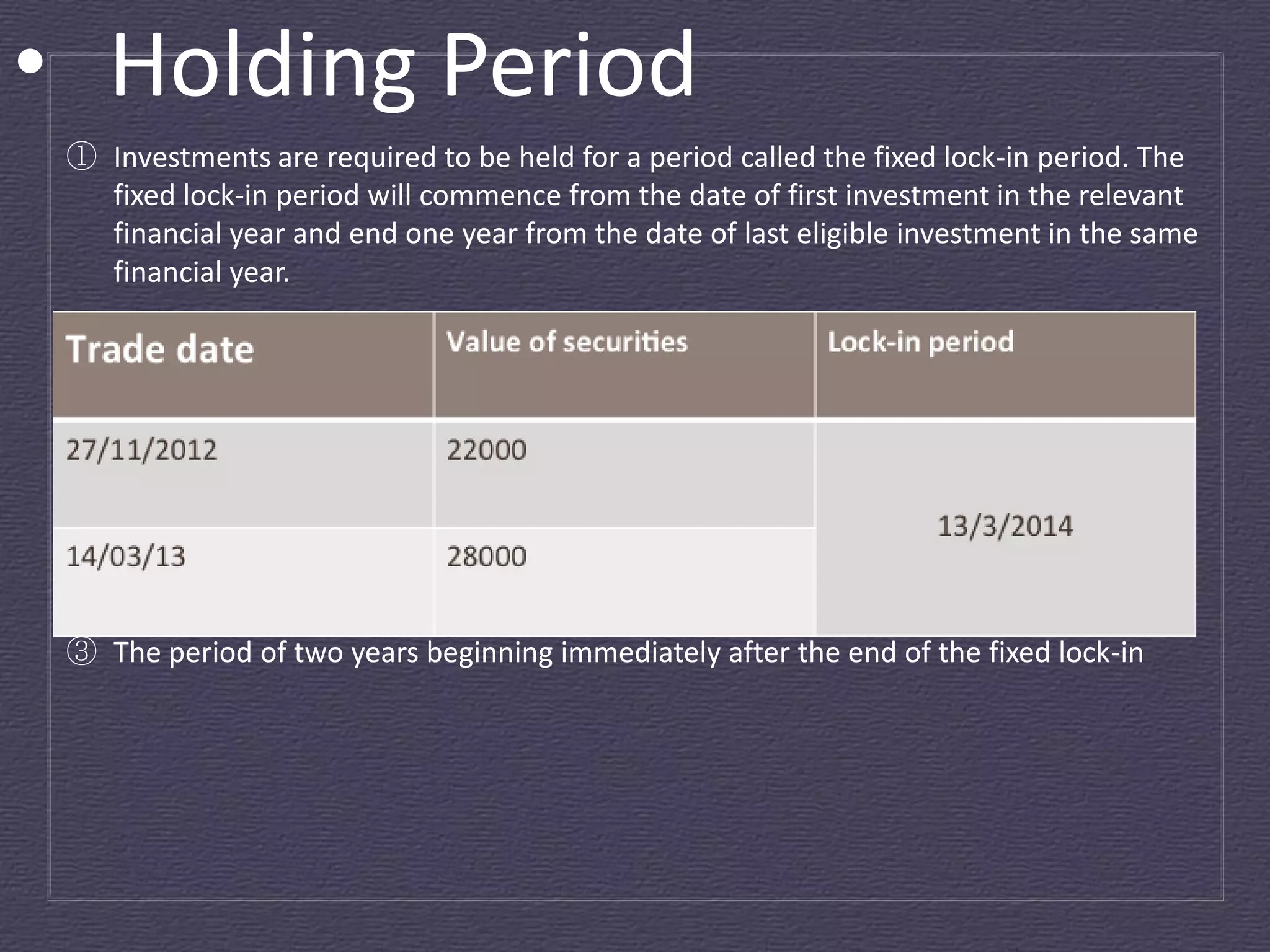

The document discusses the Rajiv Gandhi Equity Savings Scheme (RGESS), which aims to encourage first-time investors to invest in capital markets. Under RGESS, new retail investors with annual income under Rs. 12 lakhs can claim a tax deduction of up to 50% of the amount invested in eligible securities up to Rs. 50,000. Eligible securities include stocks in the CNX 100 and BSE 100 indices and PSU stocks. Investments must be held for 3 years to receive the tax benefits, with a one year initial lock-in period. The maximum potential tax savings are relatively small at around Rs. 7,500 over 3 years. Overall, RGESS provides limited incentives for first-time