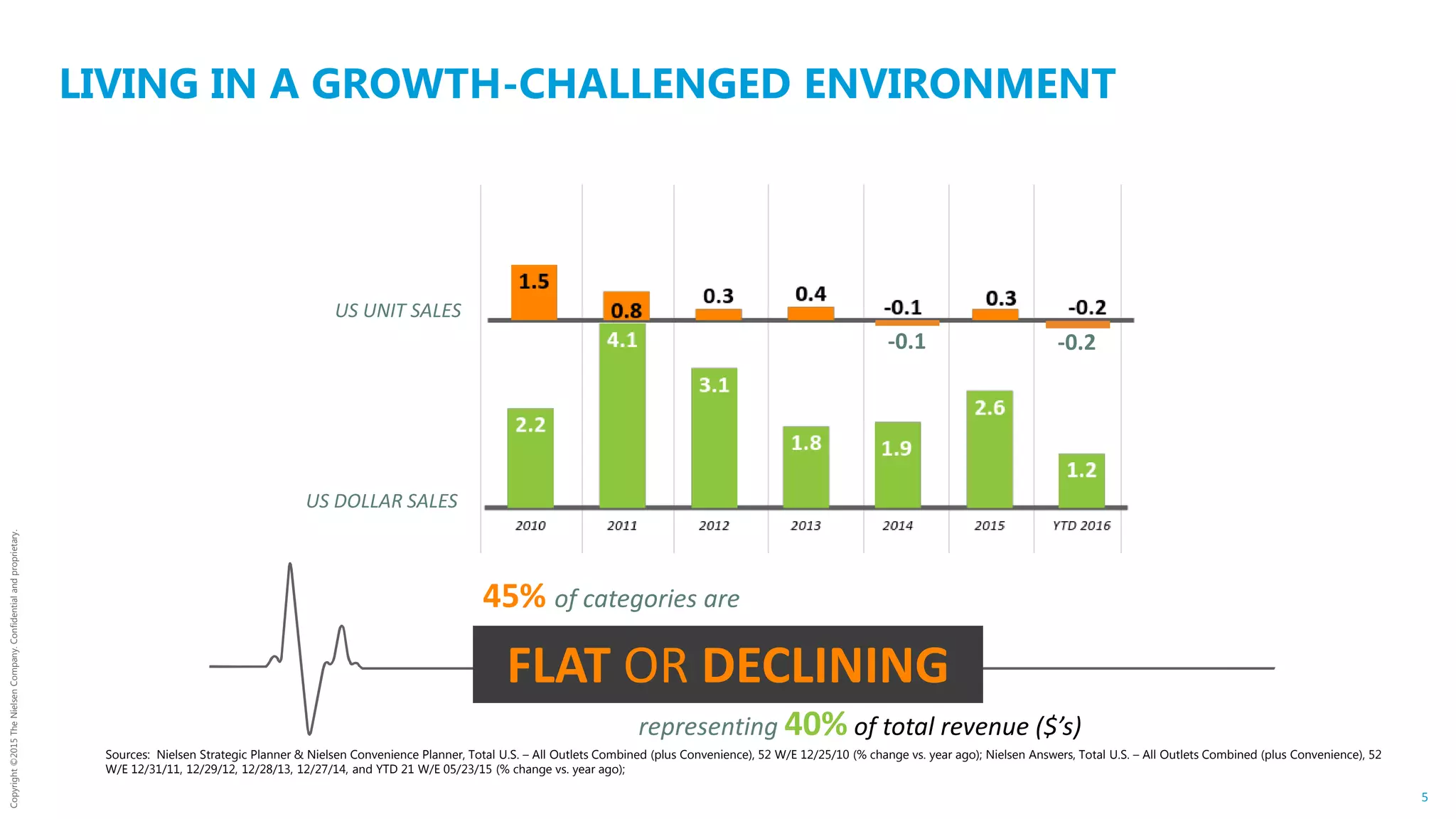

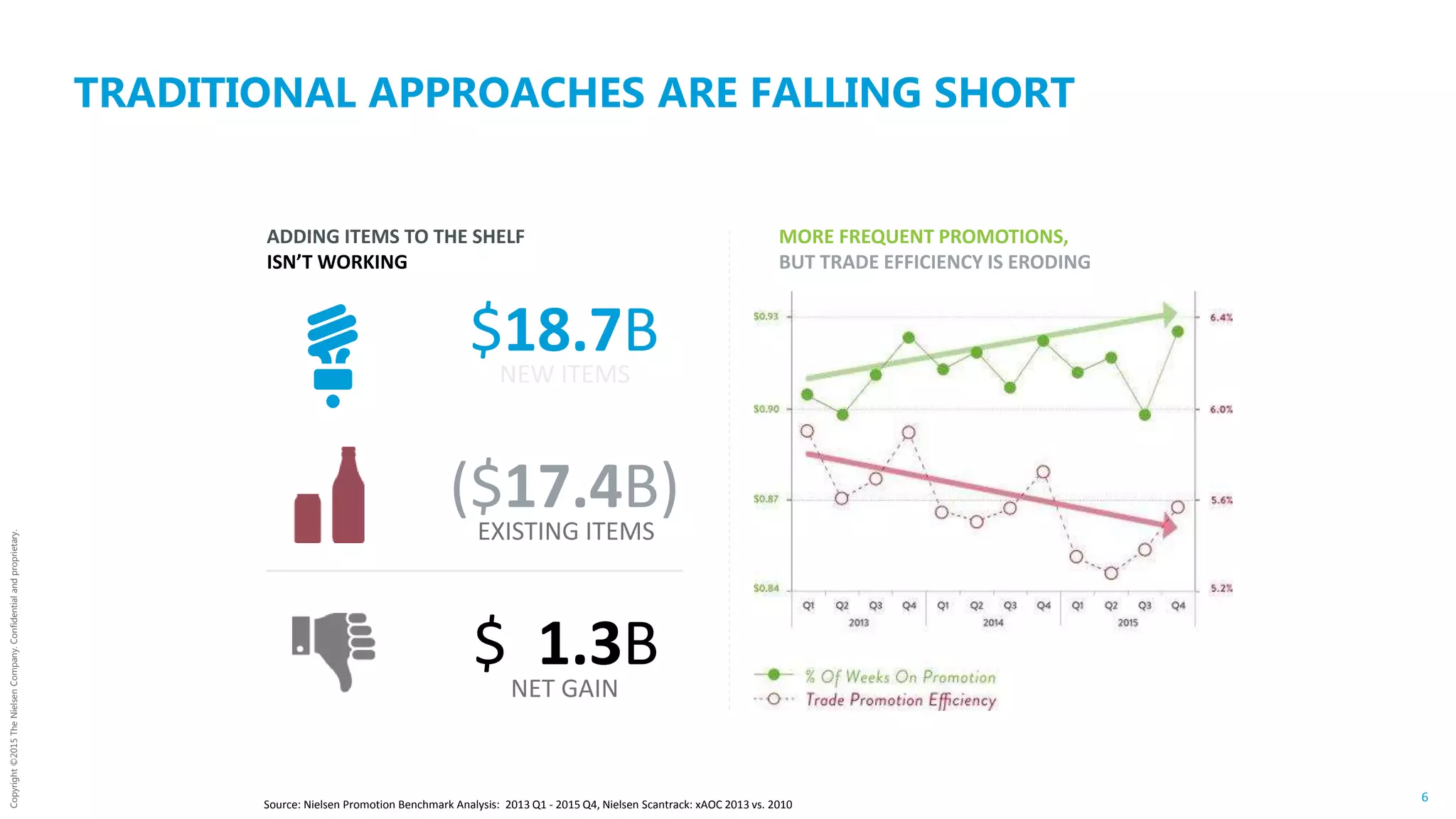

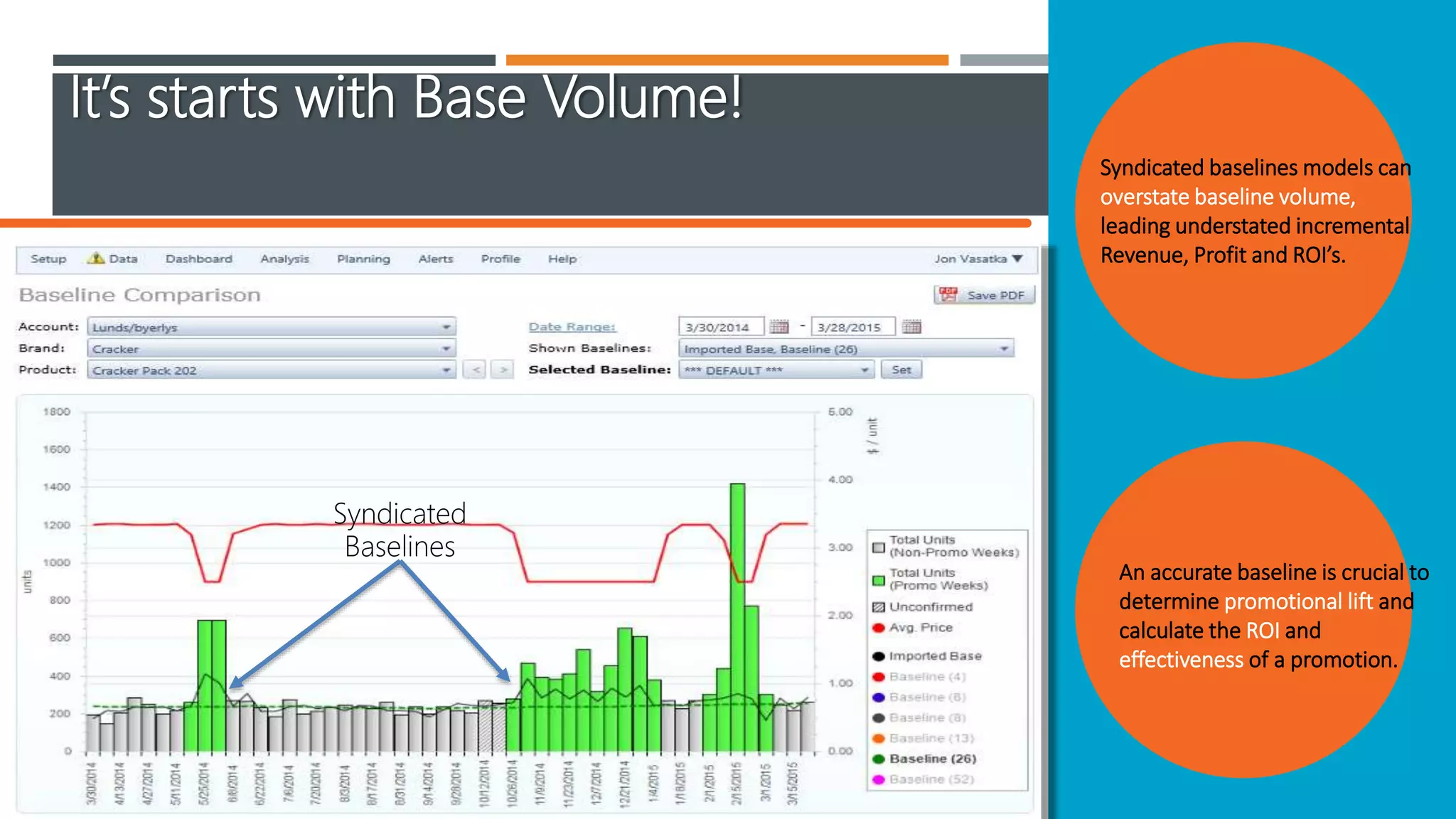

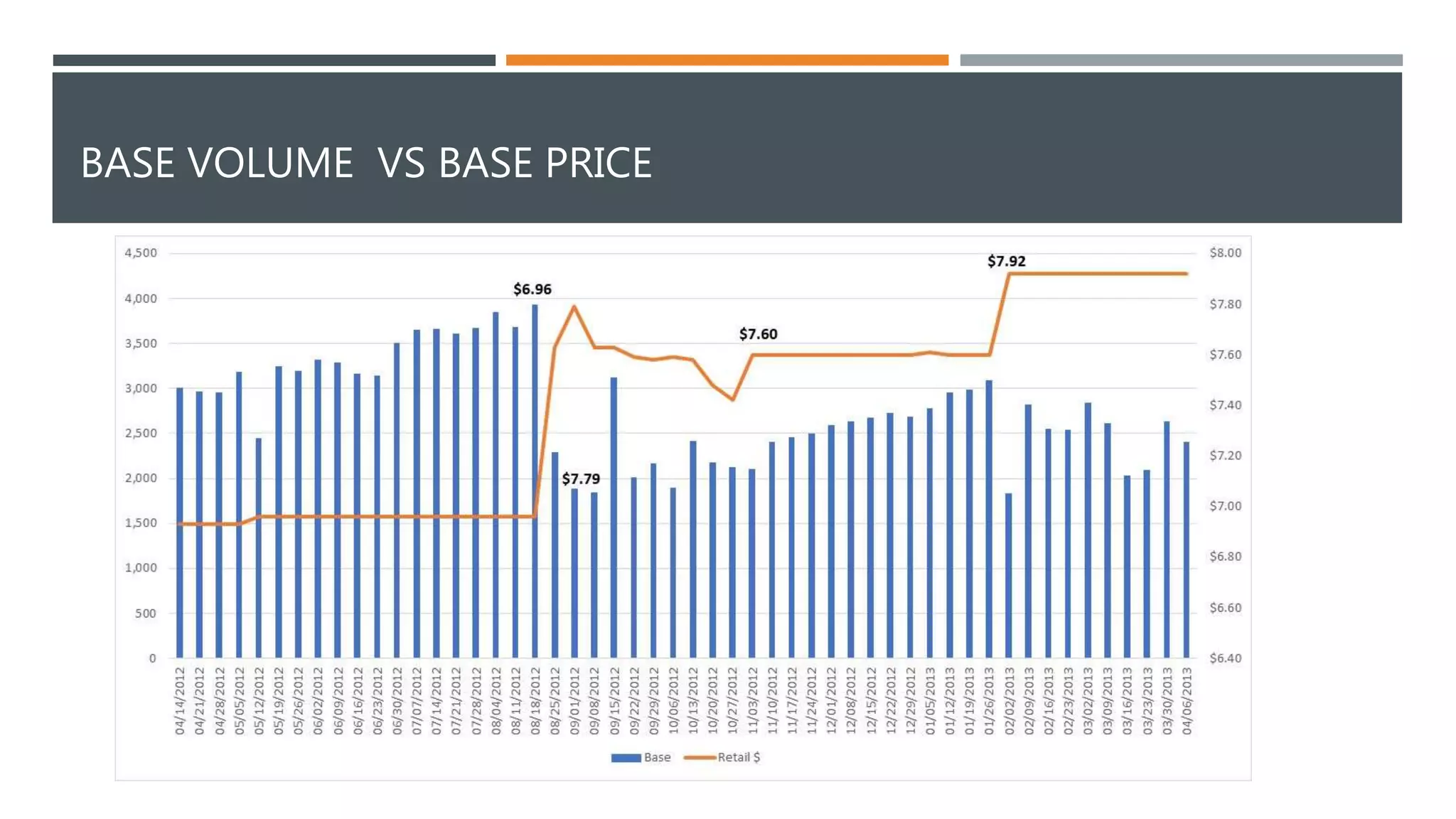

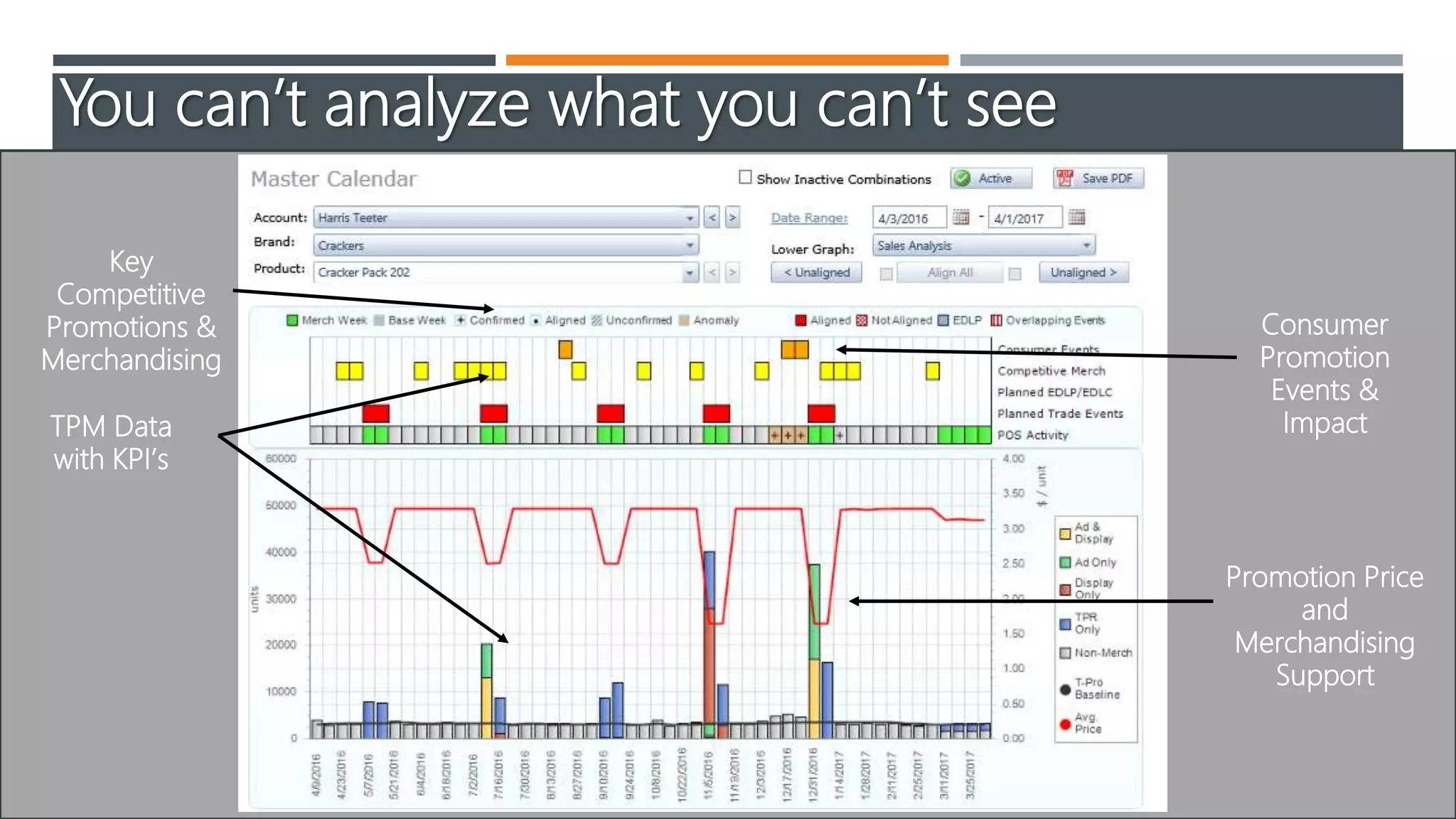

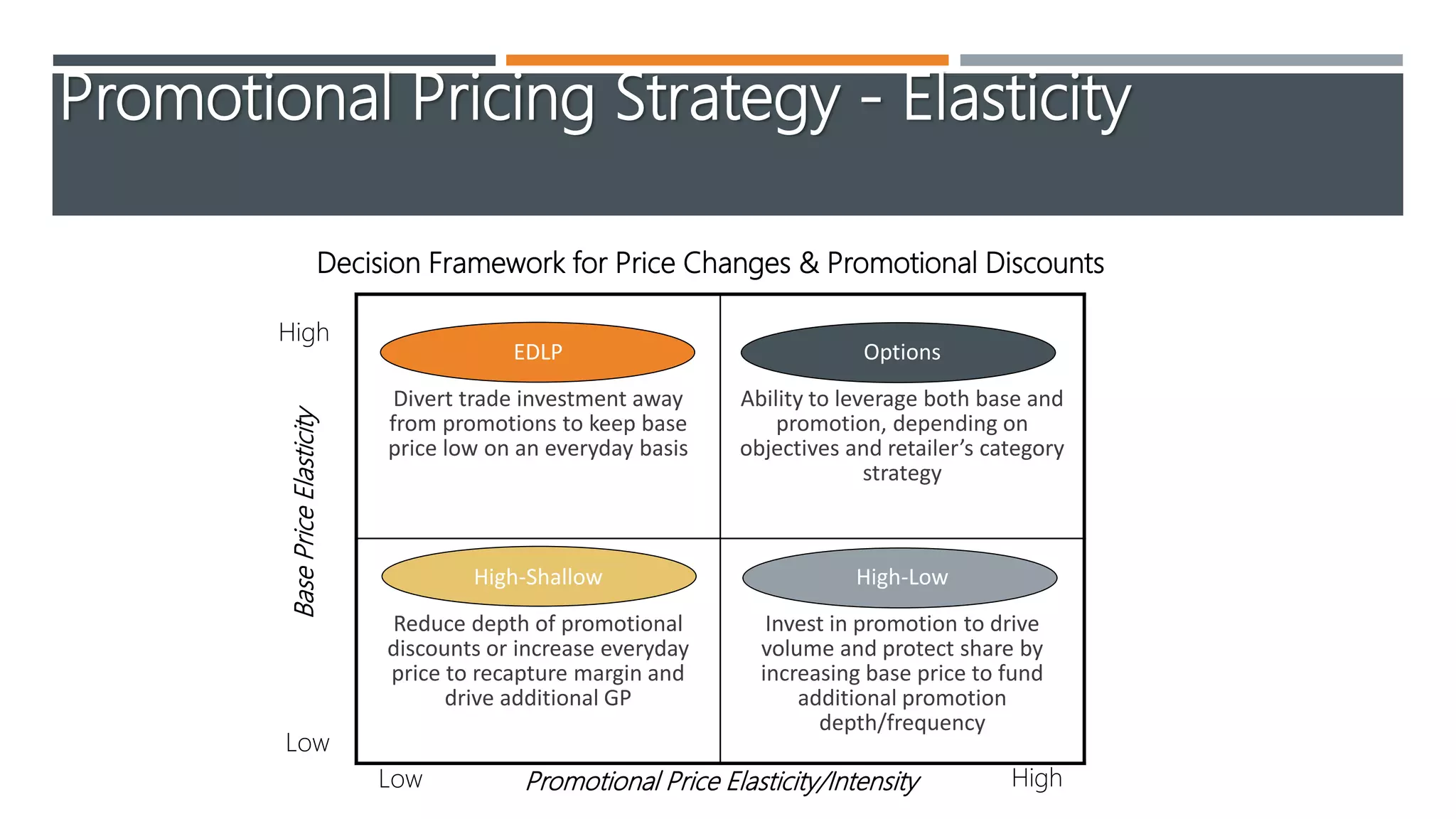

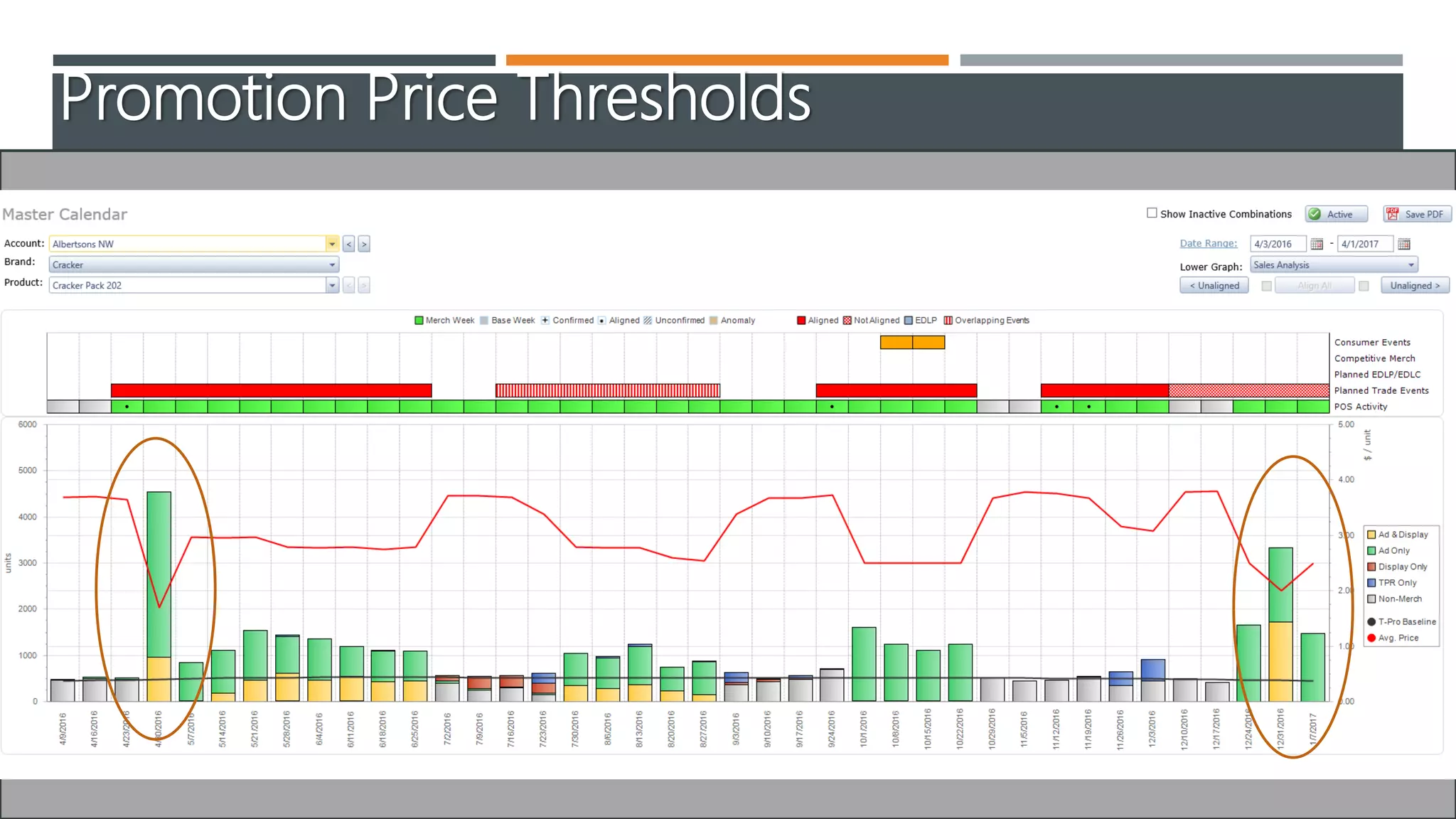

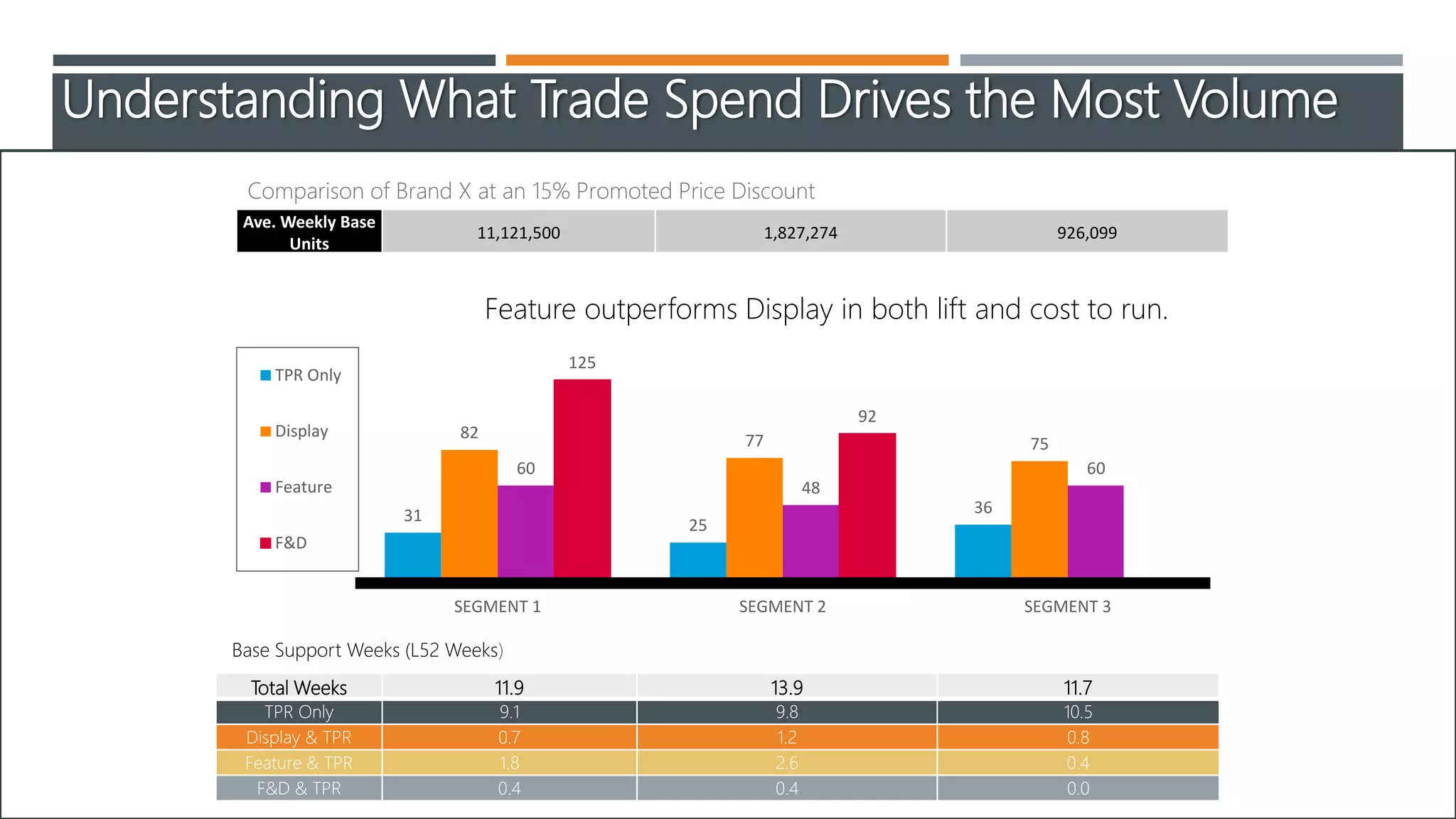

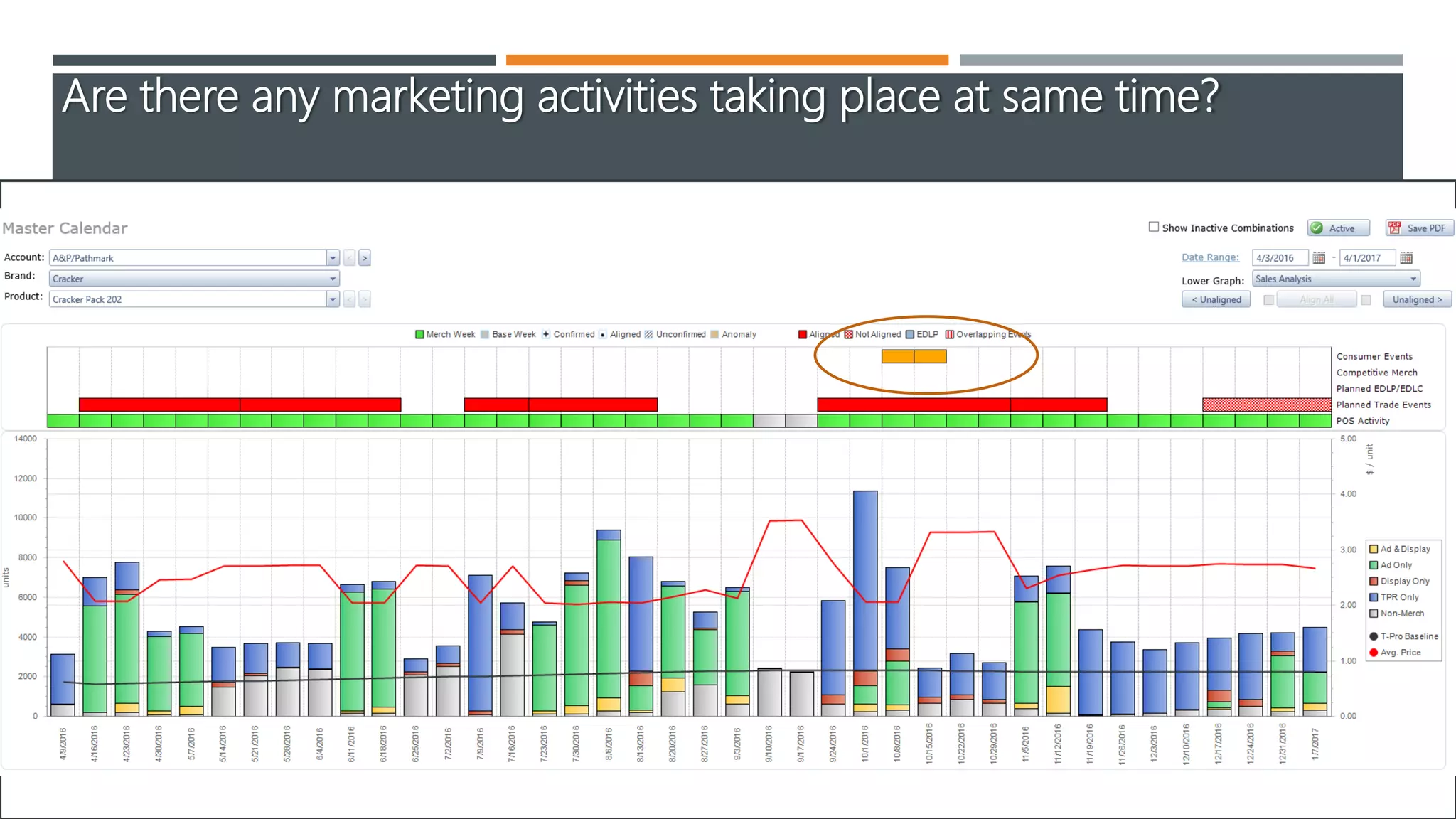

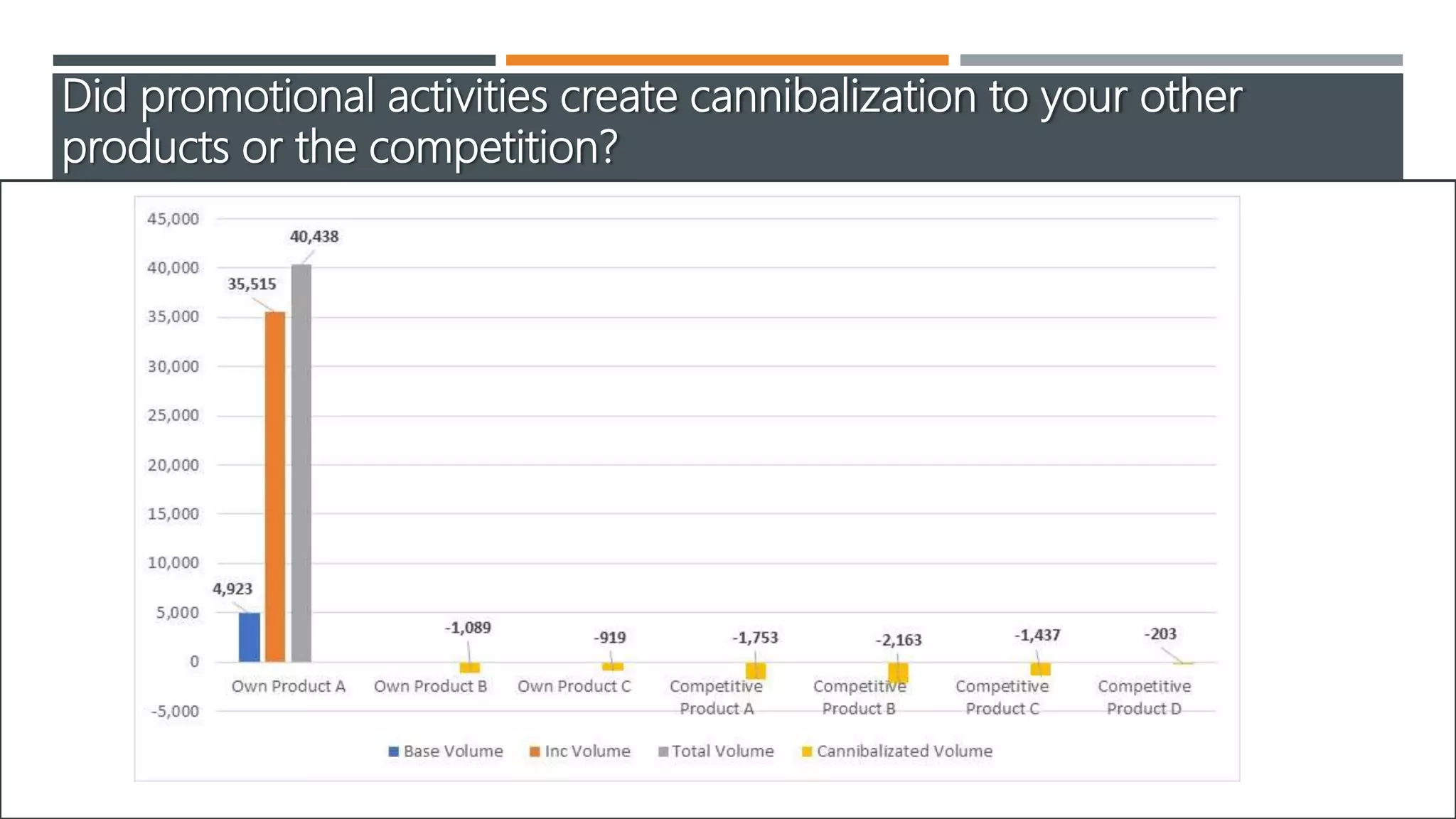

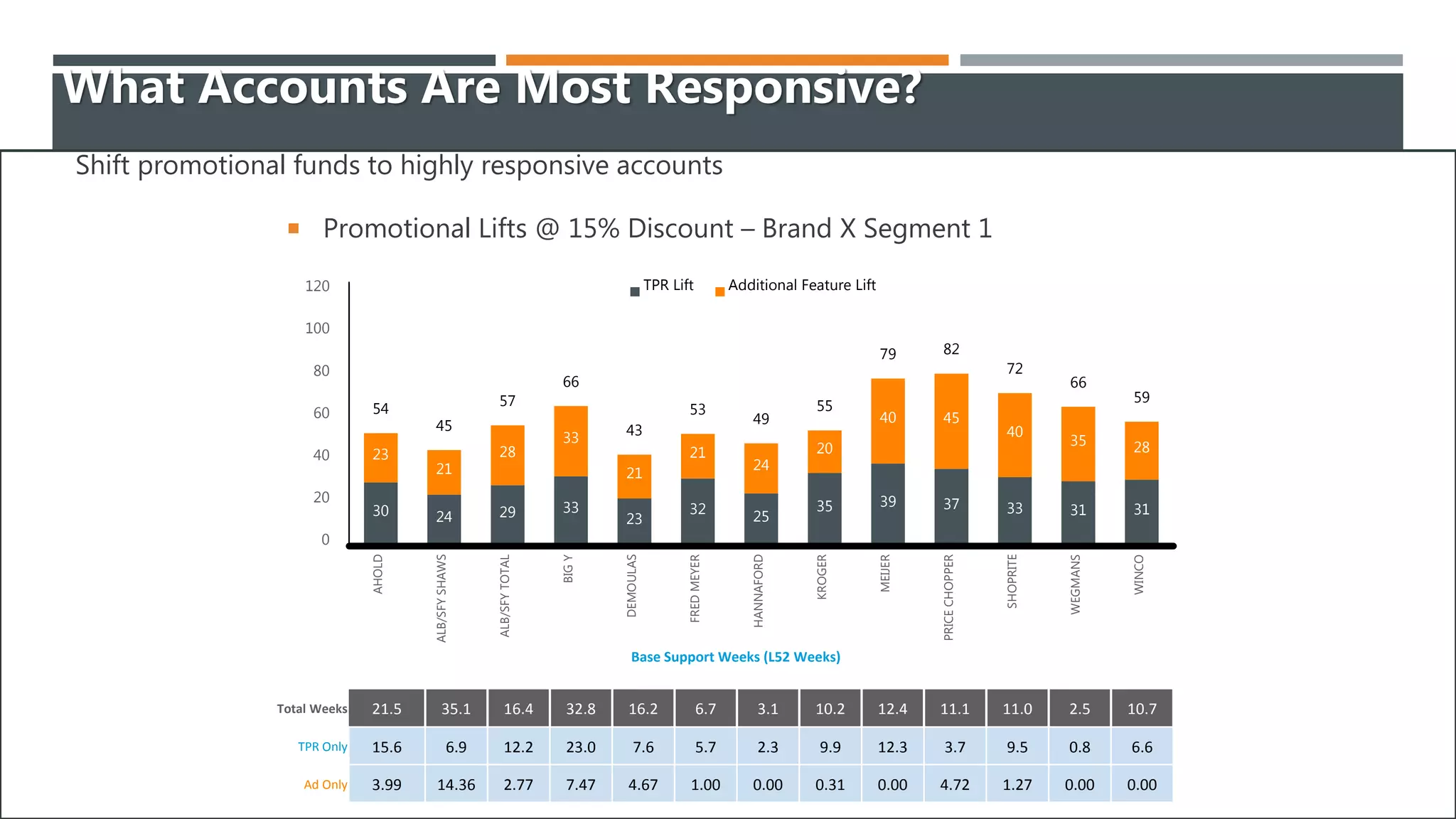

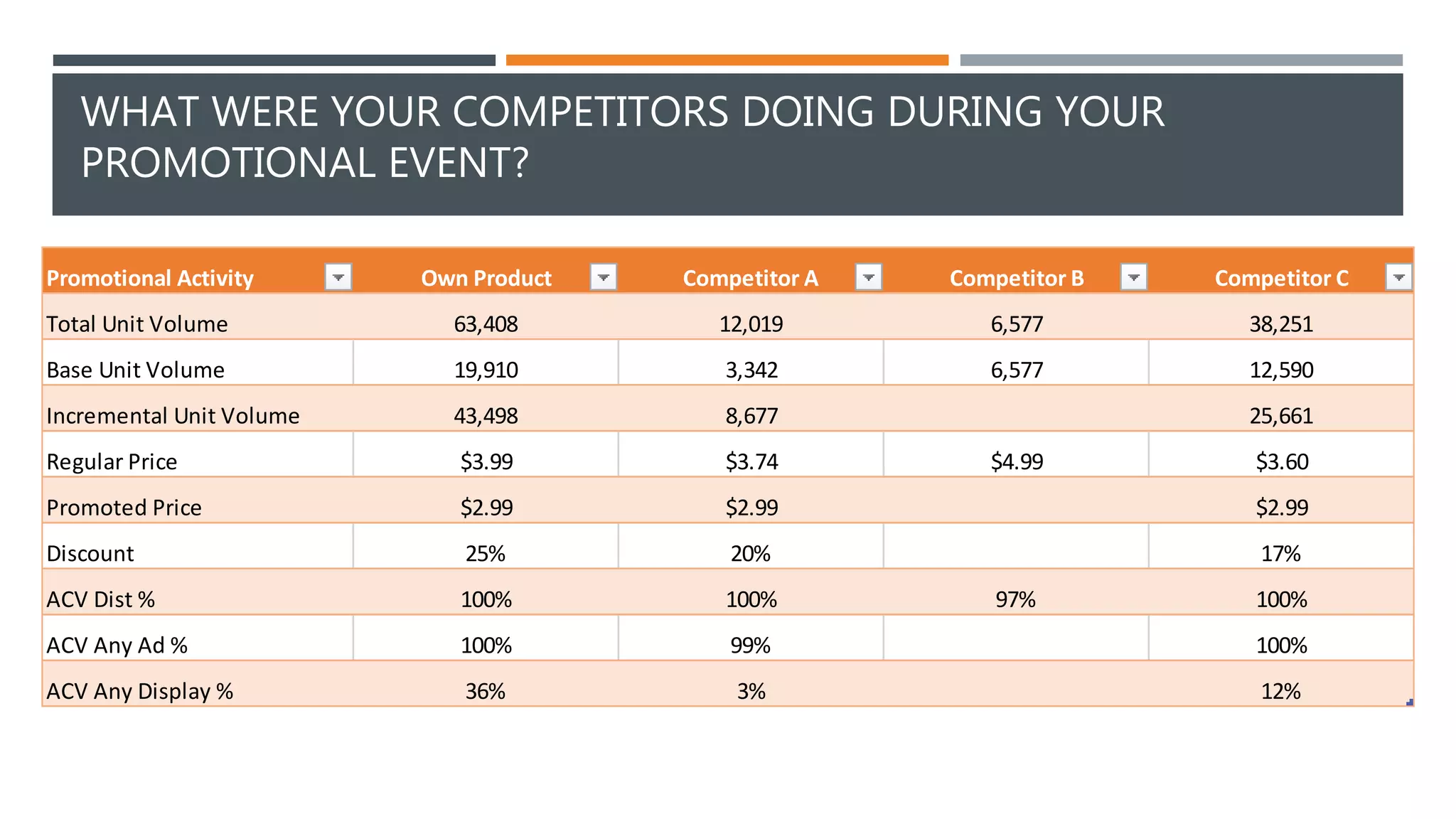

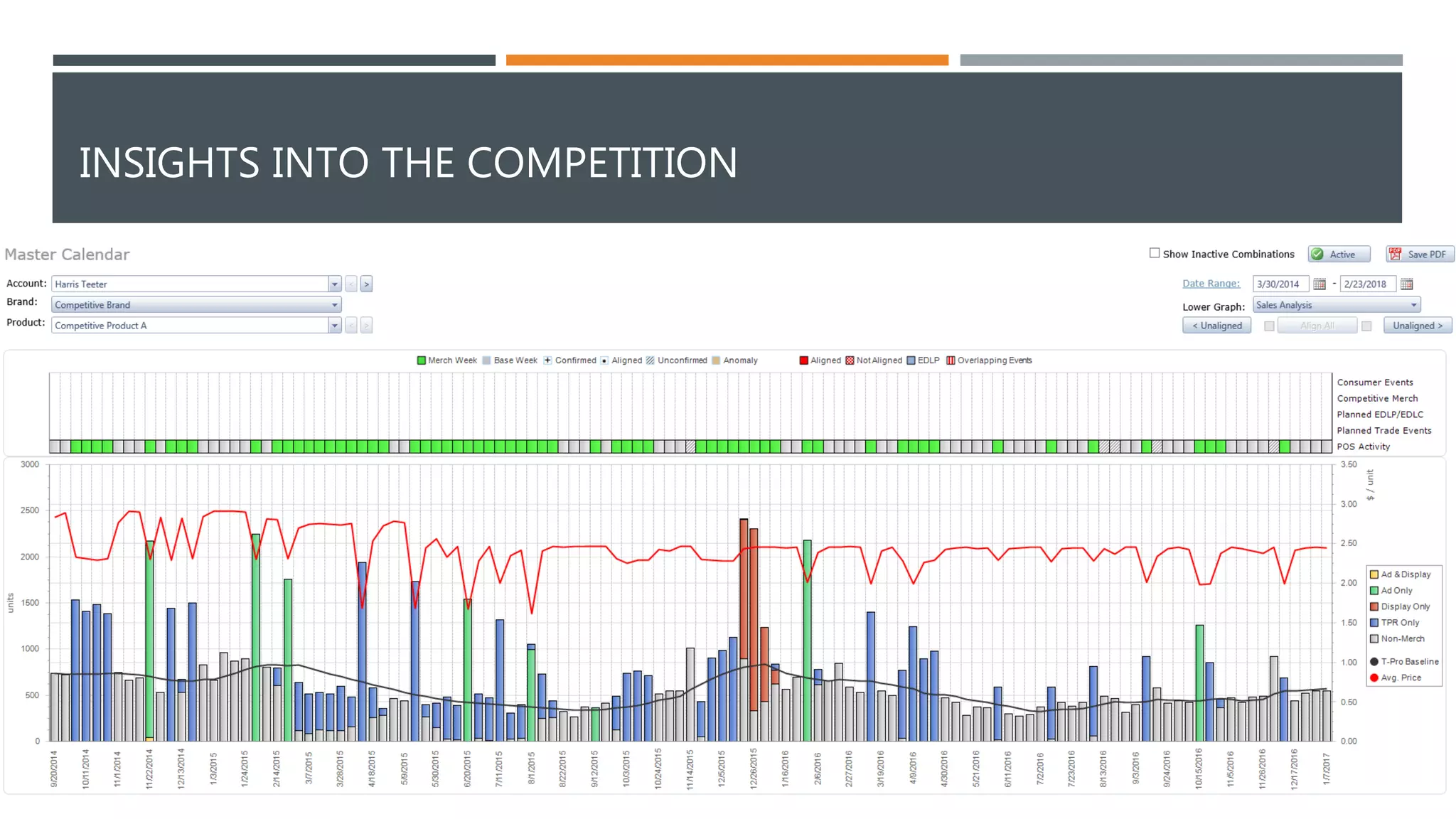

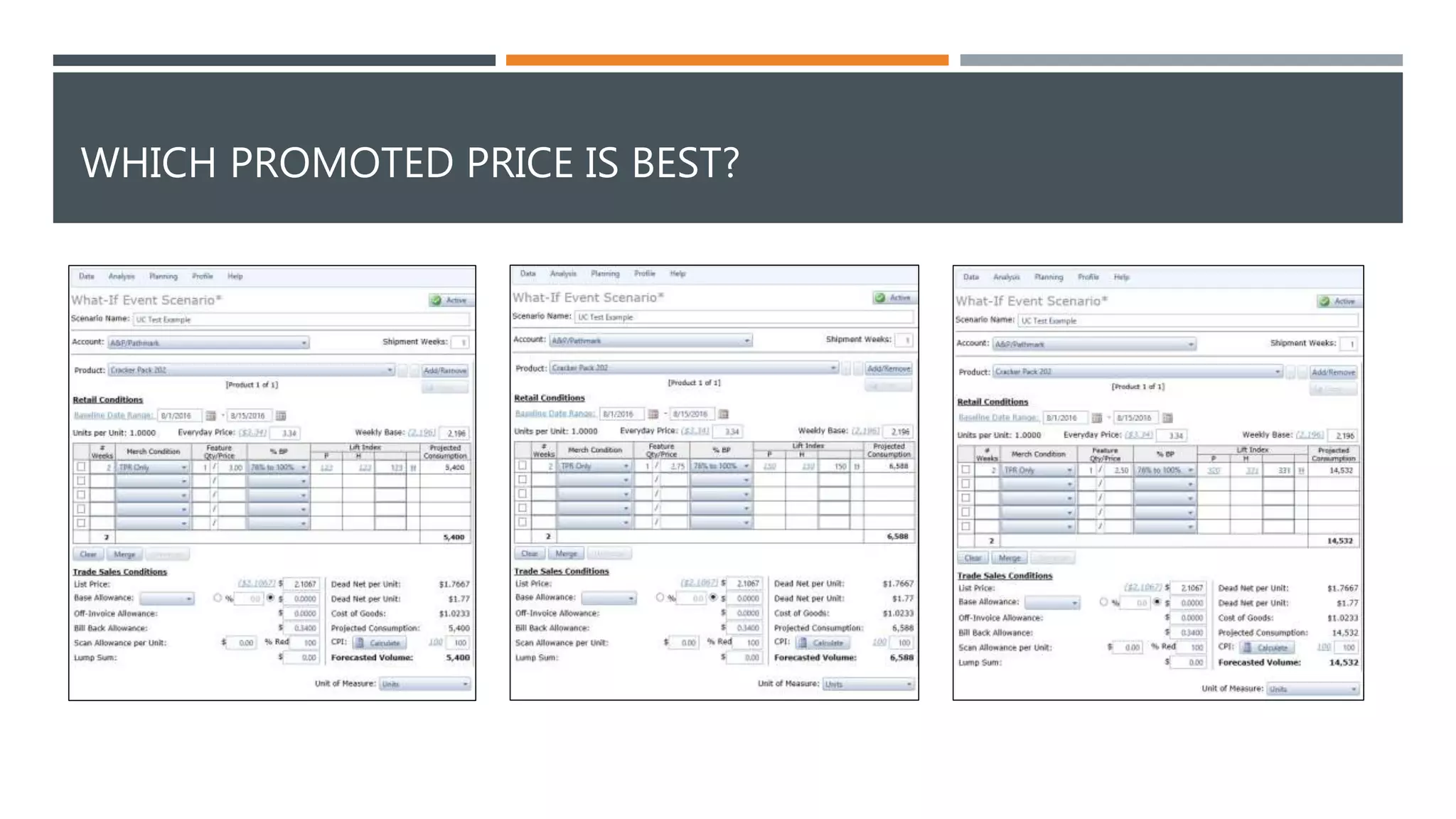

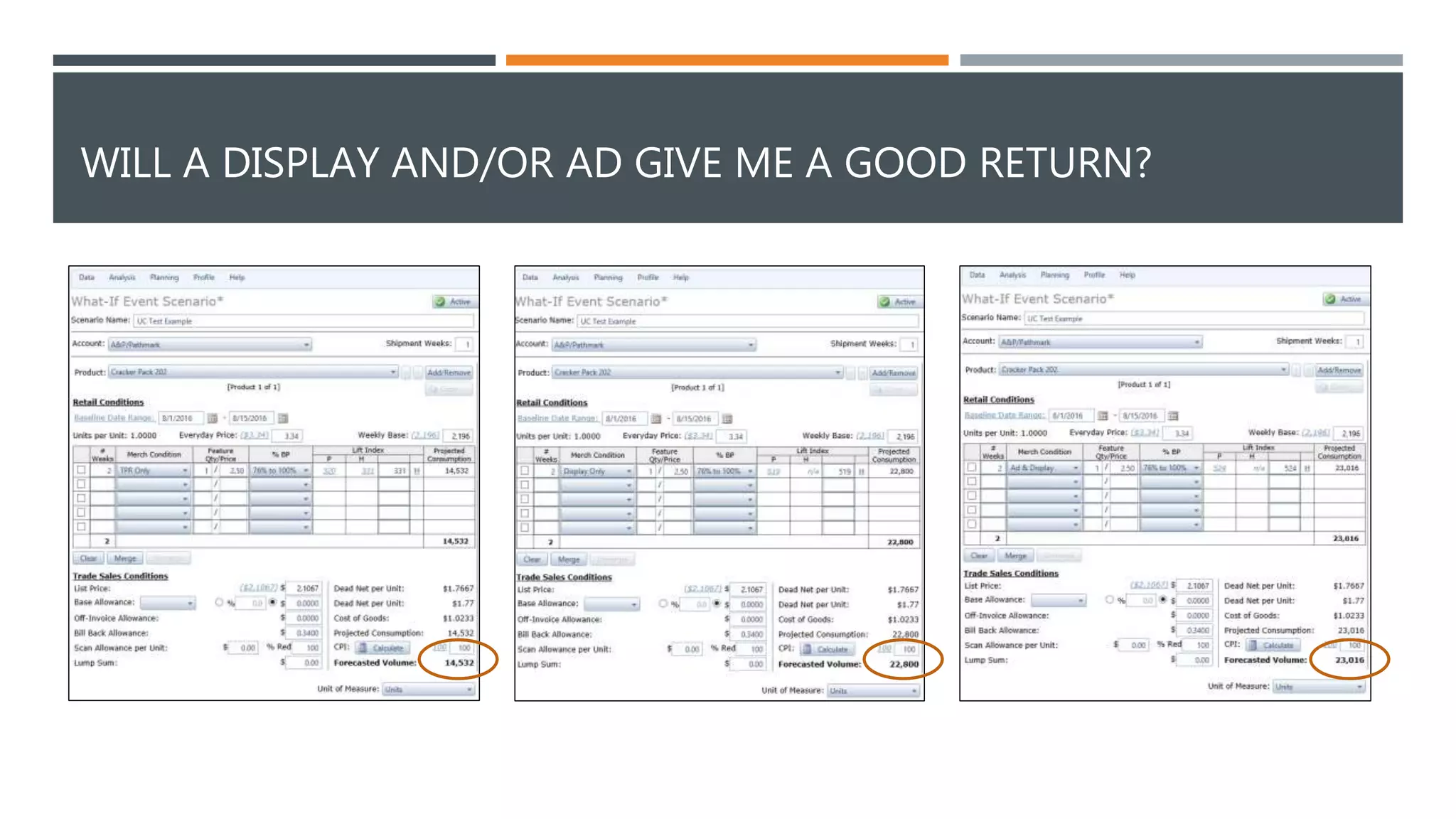

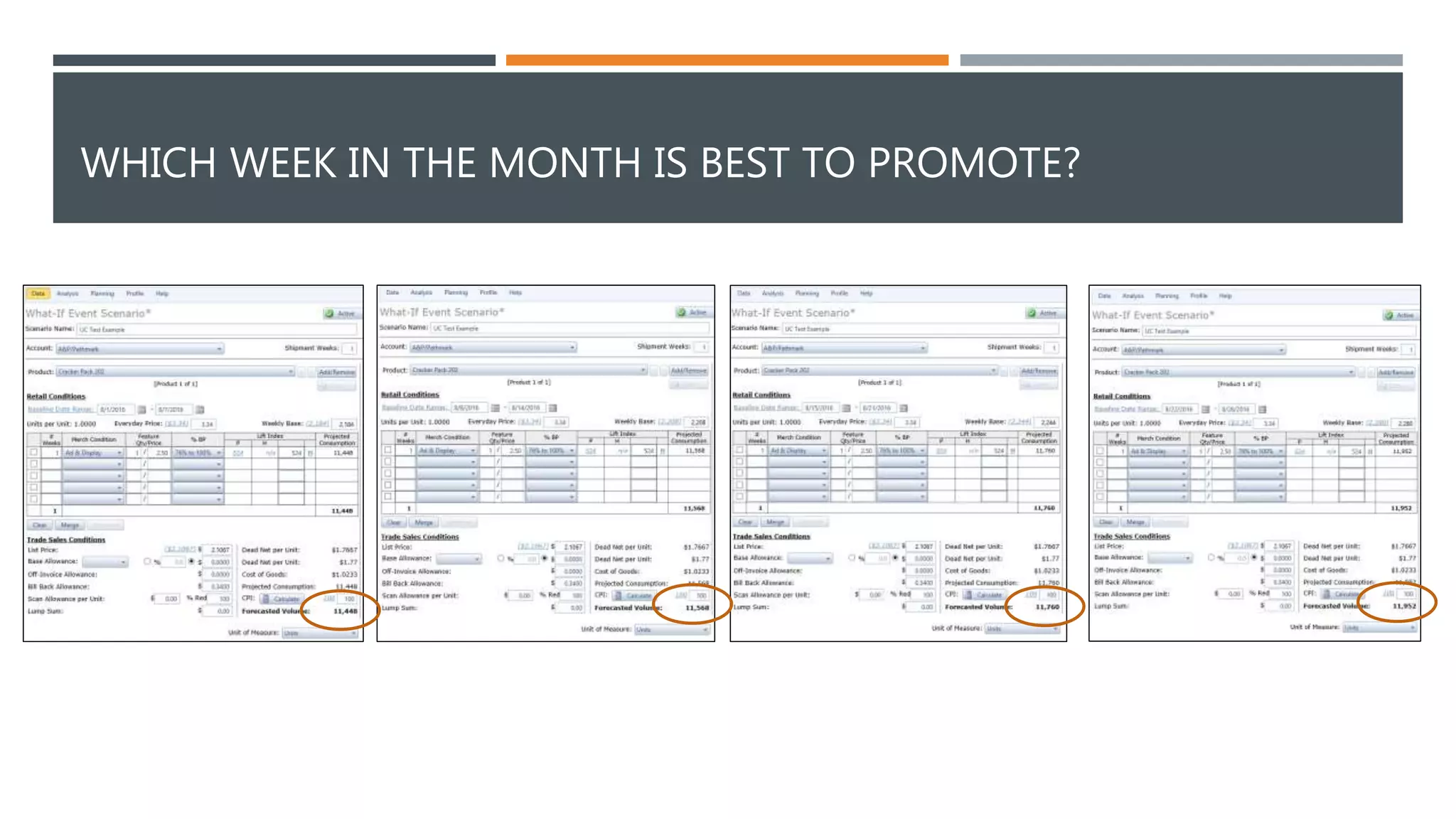

This document discusses strategies for optimizing trade promotion spending and analyzing promotion performance. It notes that over $200 billion is spent annually on trade promotions in the consumer packaged goods industry. Traditional approaches to promotions are becoming less effective as sales growth slows. The document recommends using post-promotion analysis to understand base volume, promotion pricing and execution, competitive activity, and which promotion types drive the most sales. It suggests this analysis can provide insights to optimize future promotion planning, such as identifying the most effective price points, spending, and timing of promotions. The overall goal is to maximize the ROI and effectiveness of trade spending.