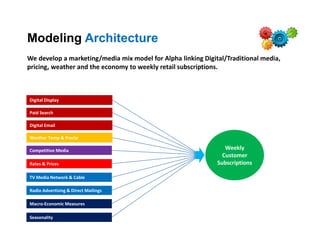

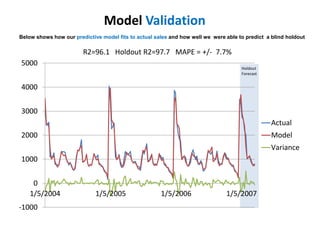

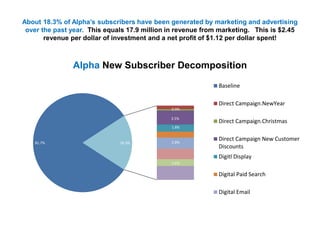

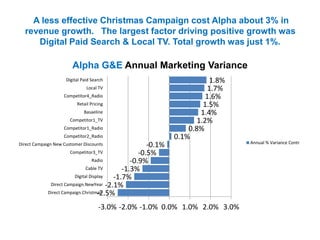

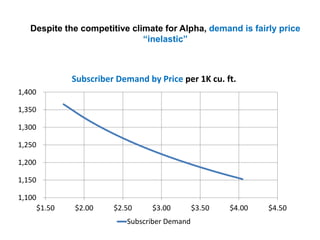

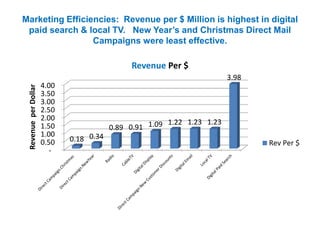

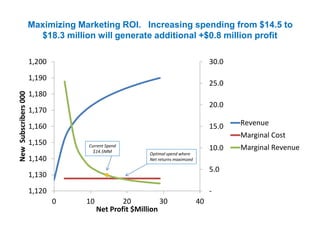

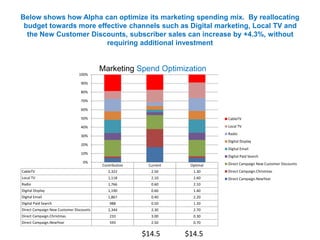

This case study examines how Alpha Gas & Electric improved its marketing effectiveness using data analytics and marketing/media mix modeling. By reallocating budget towards more effective marketing channels, such as digital paid search and local TV, the company increased its subscriber growth by 4.3% without extra investment. The project revealed that 18.3% of new subscribers came from marketing efforts, yielding significant revenue and profit gains.