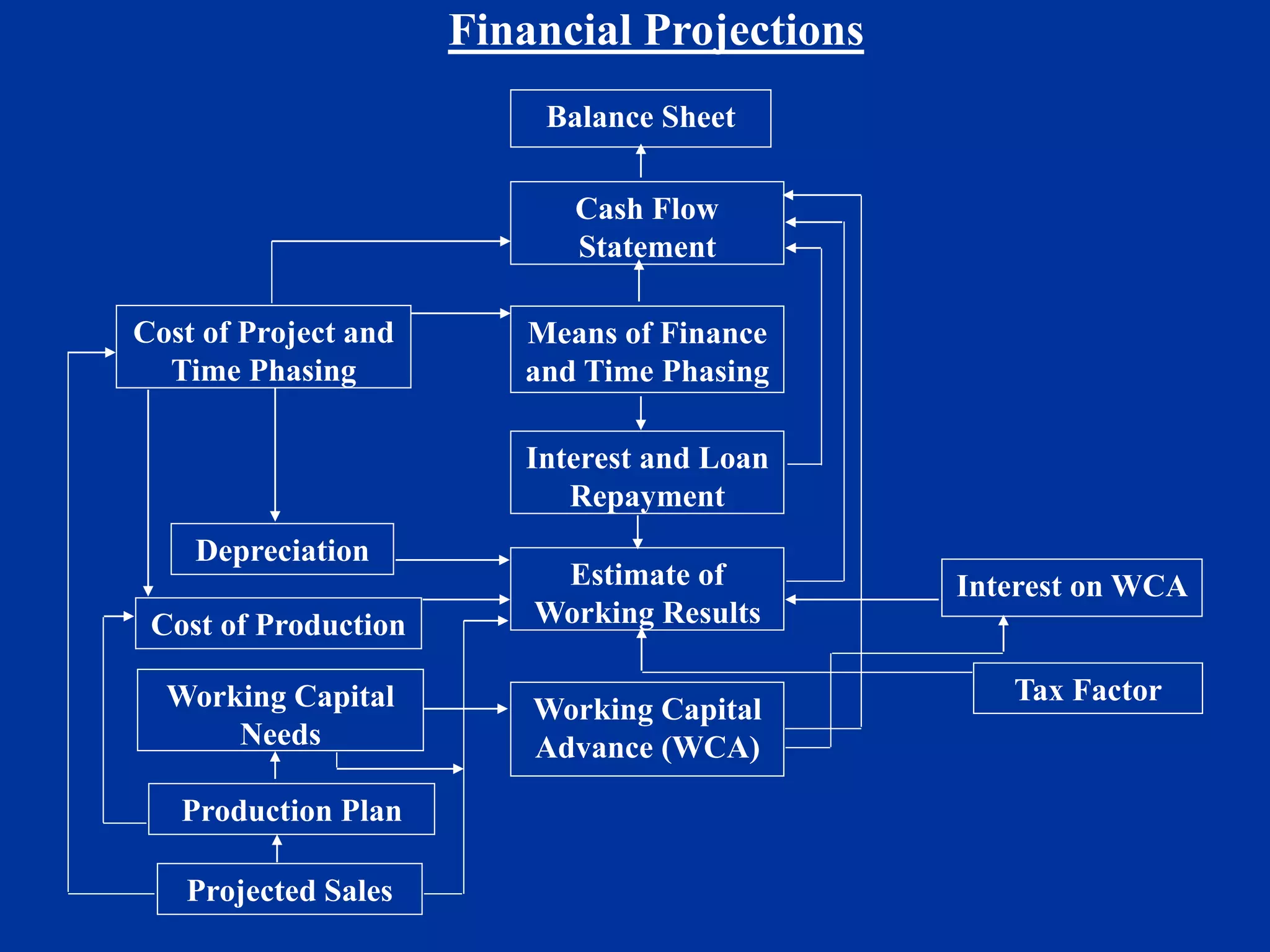

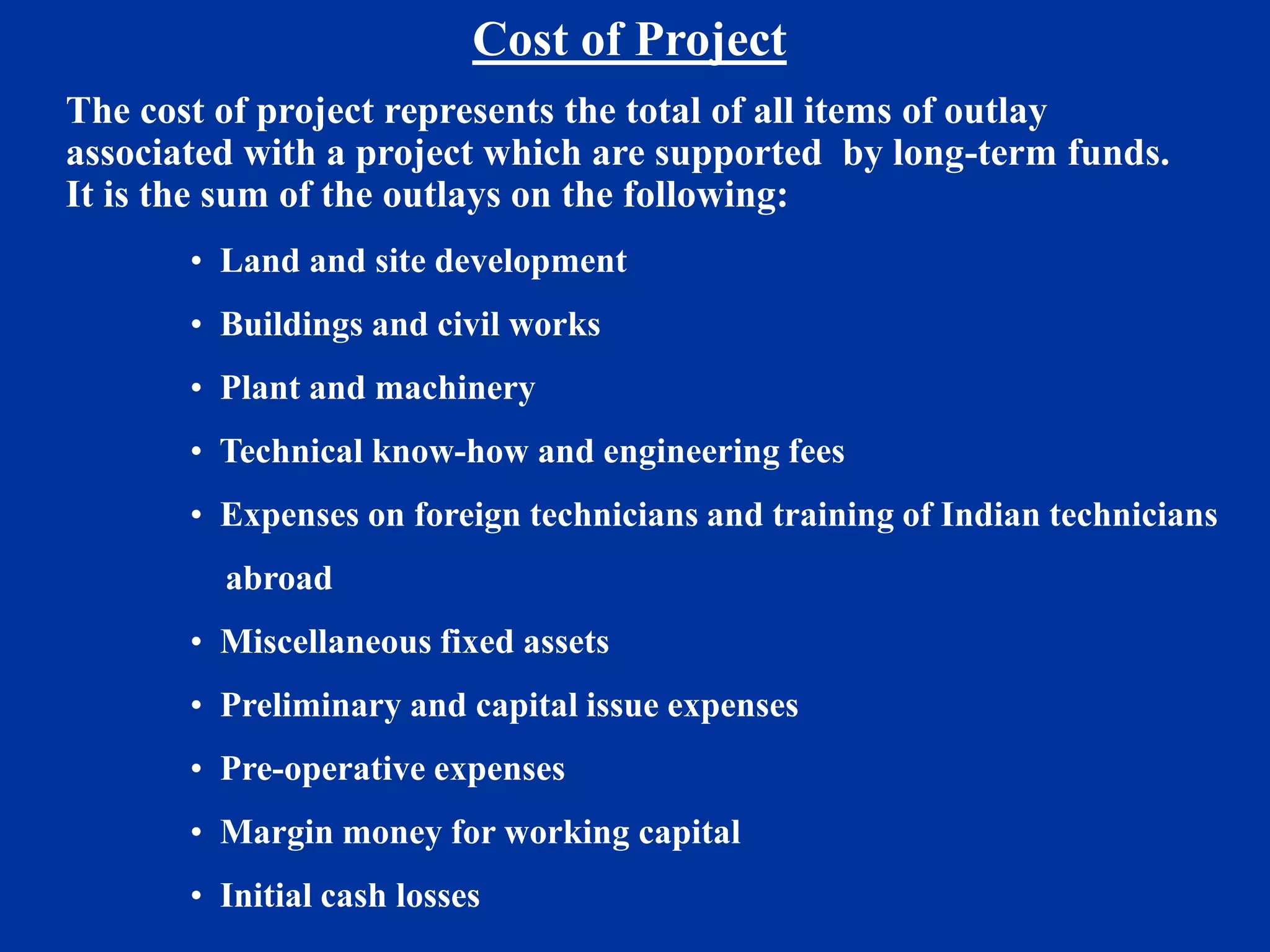

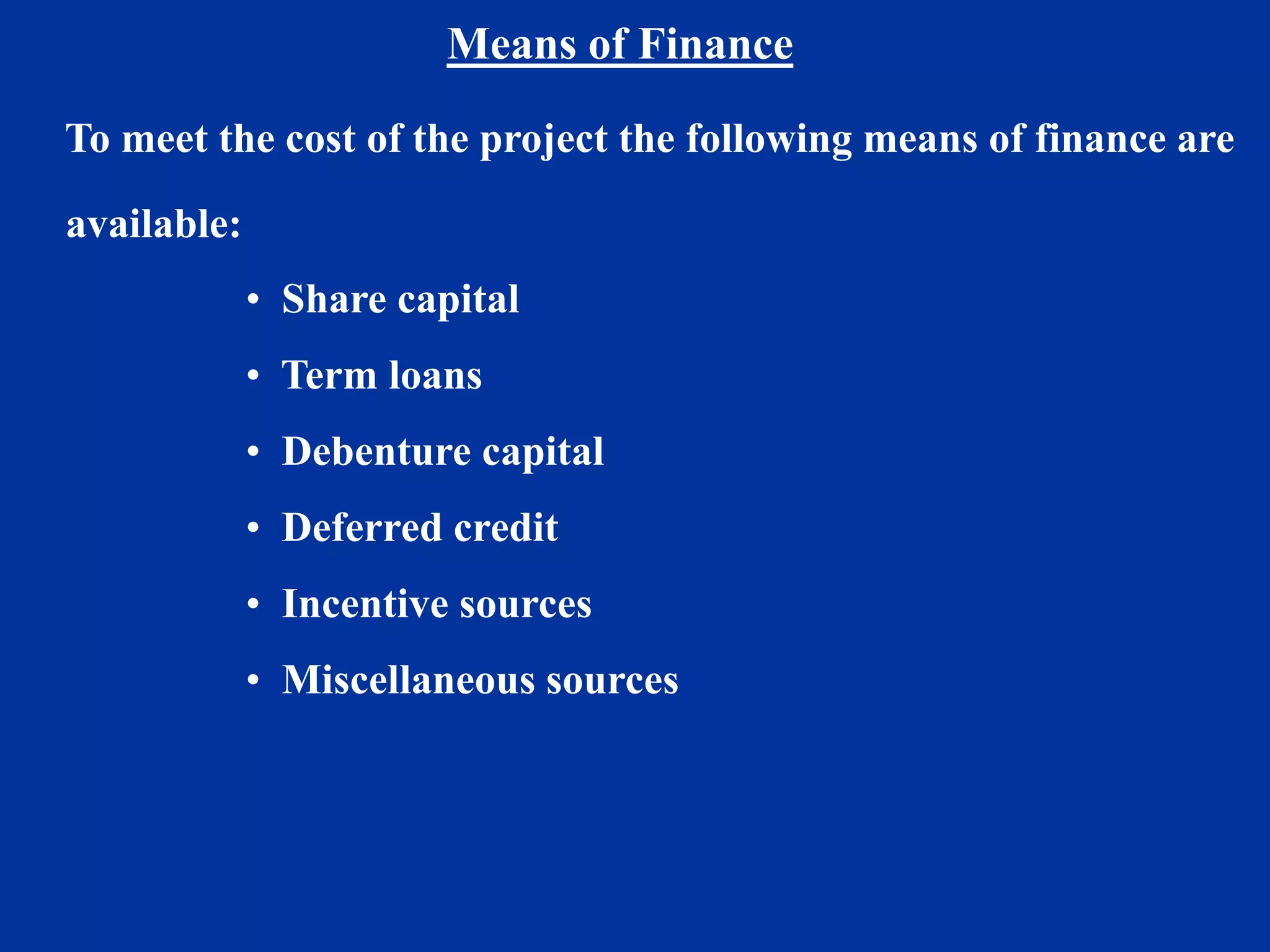

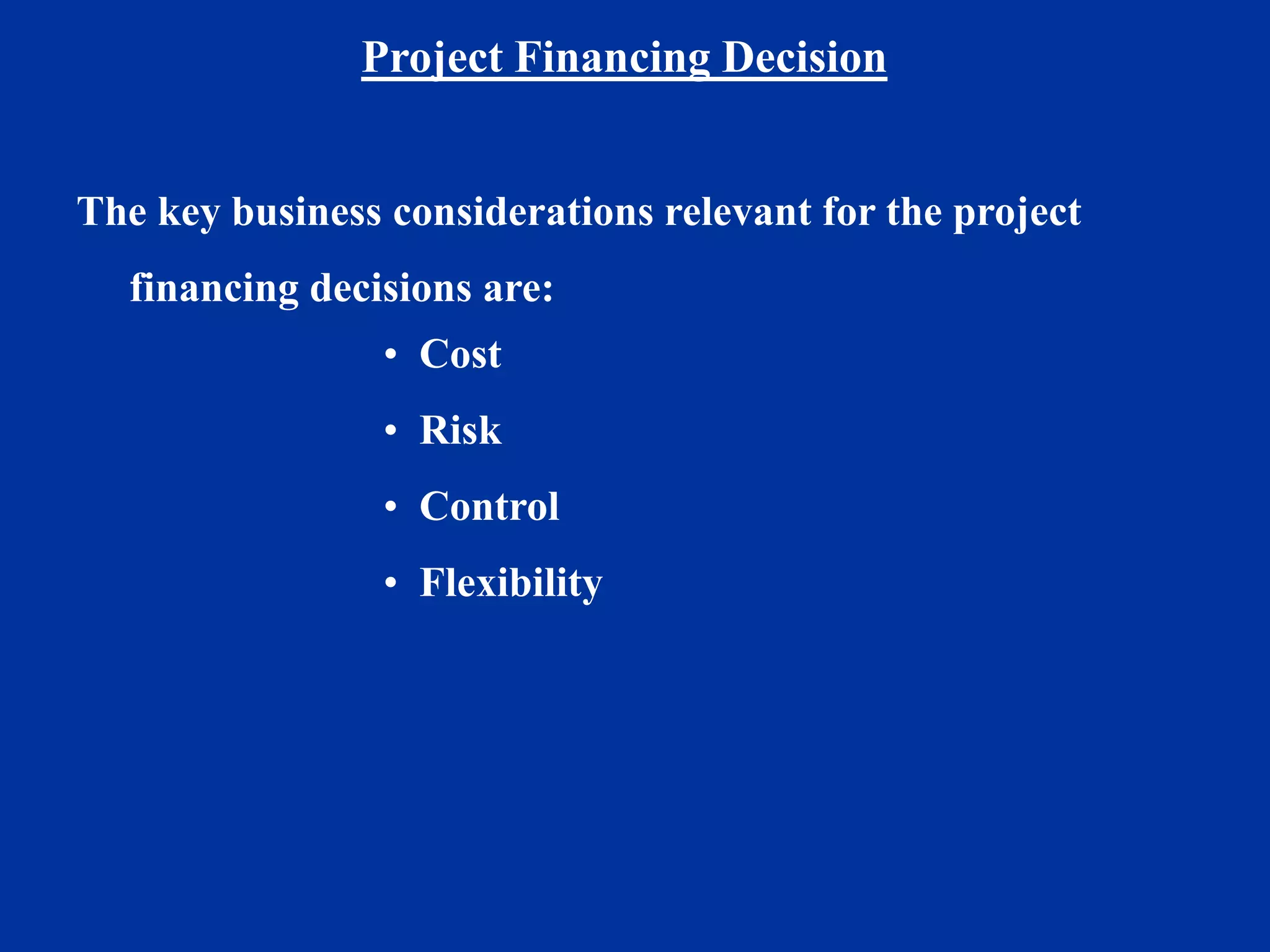

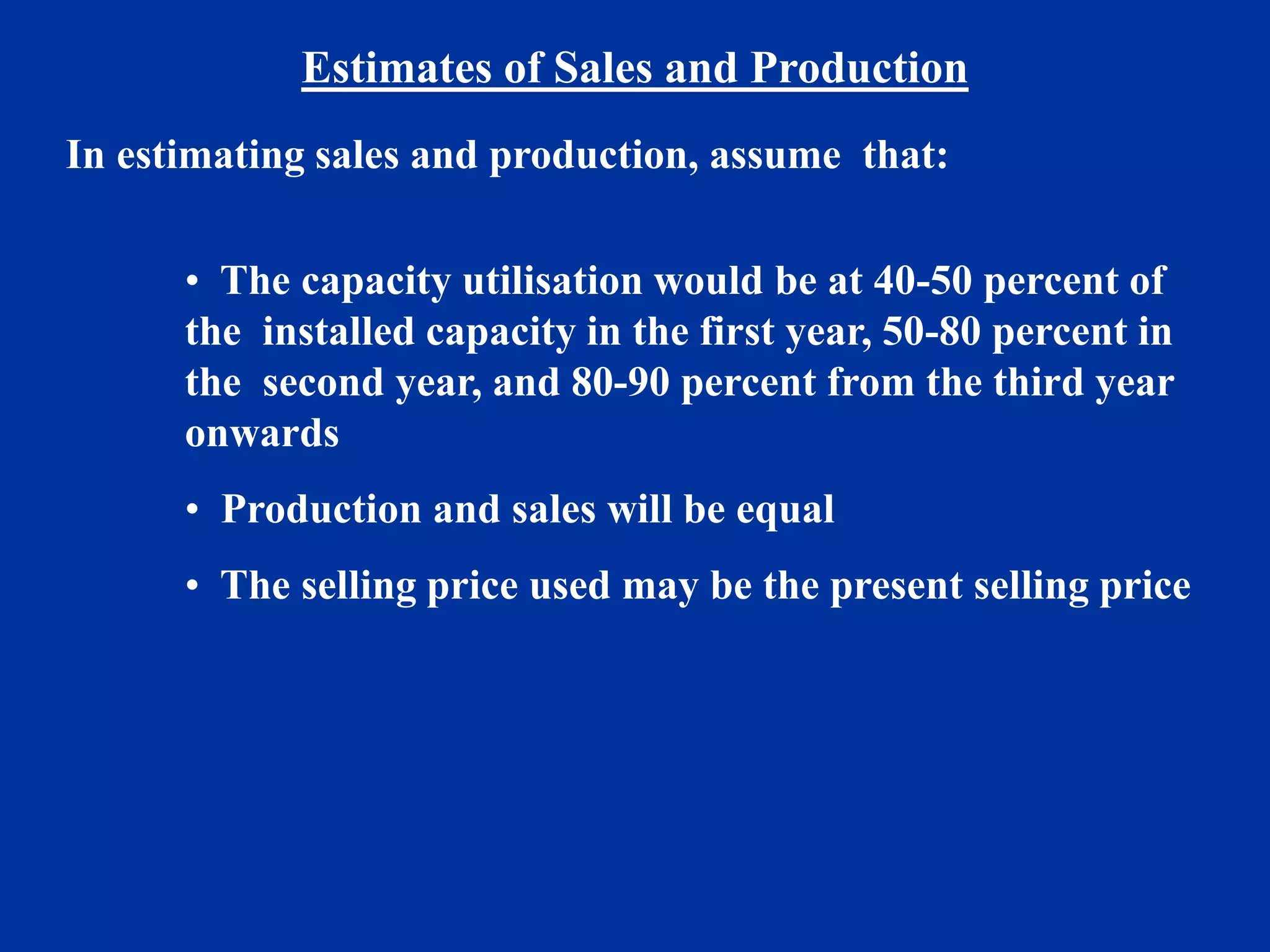

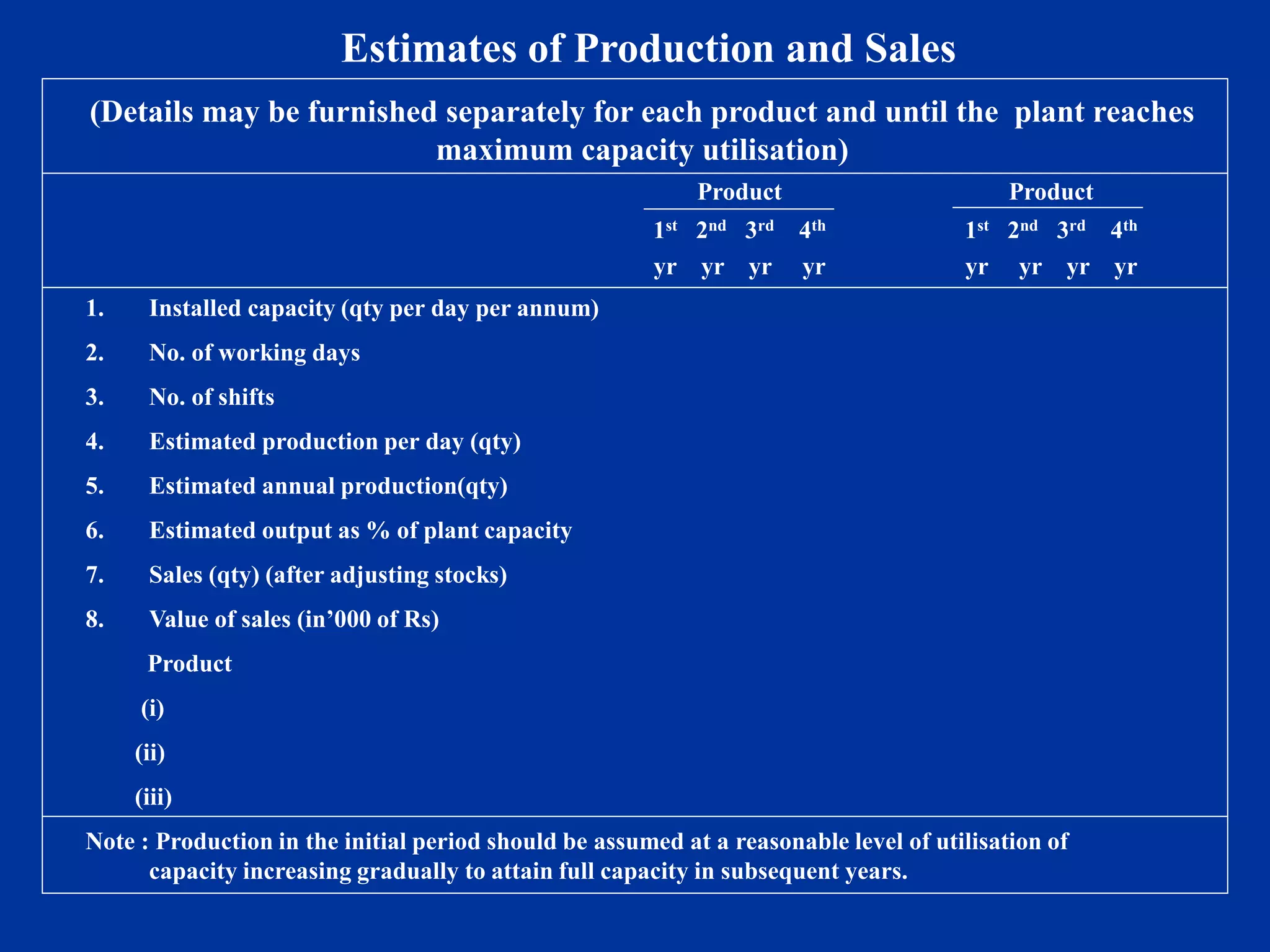

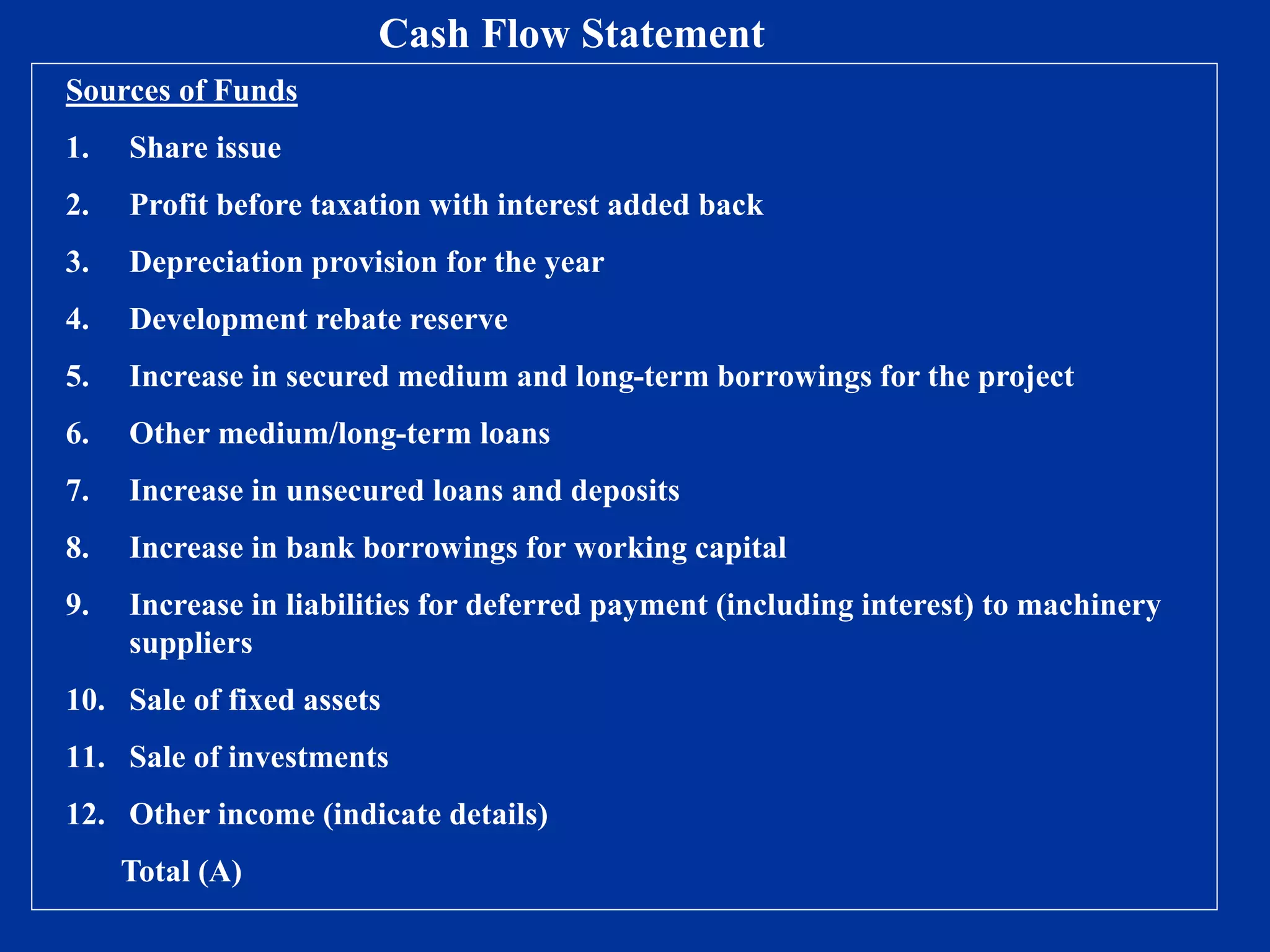

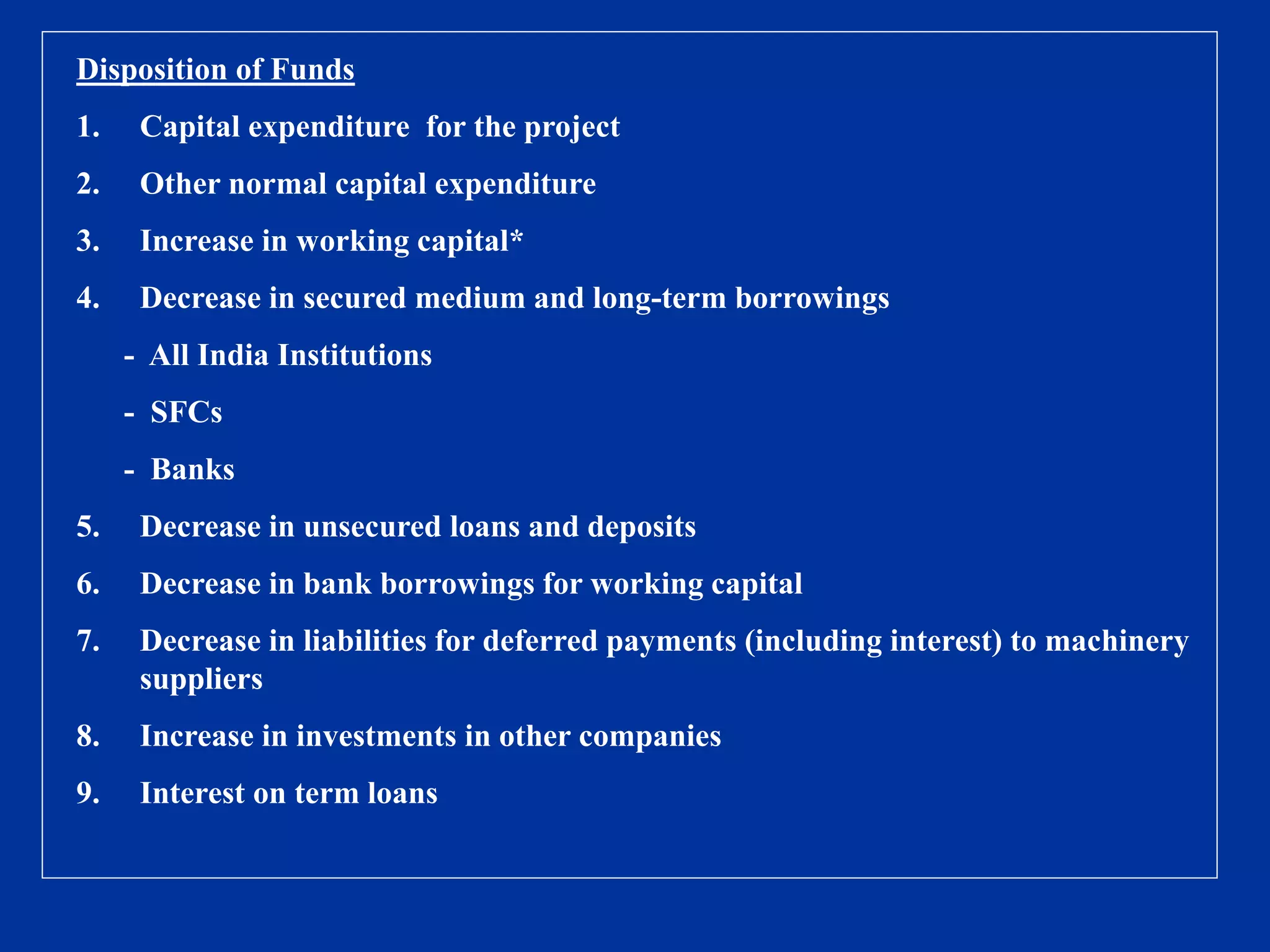

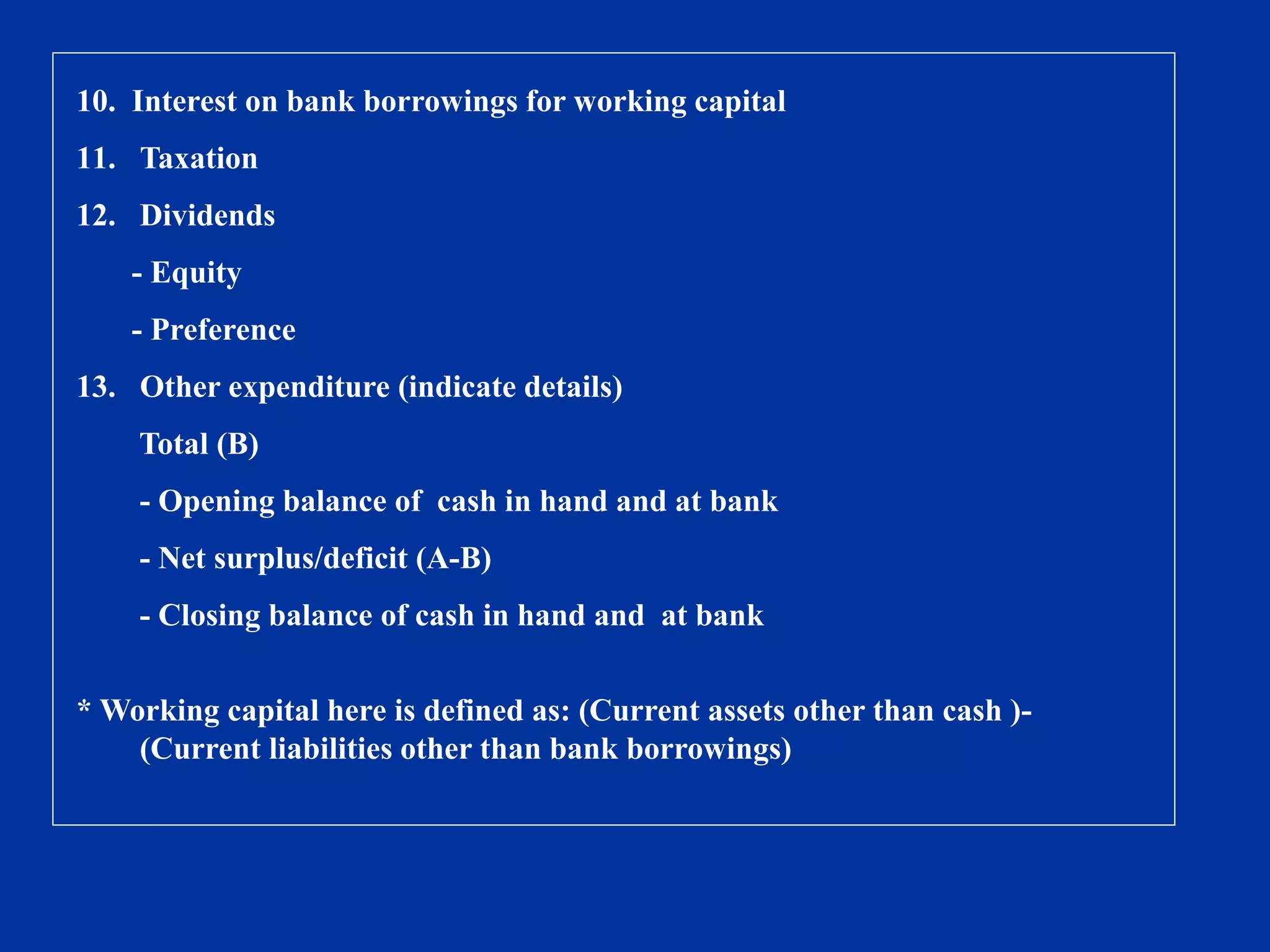

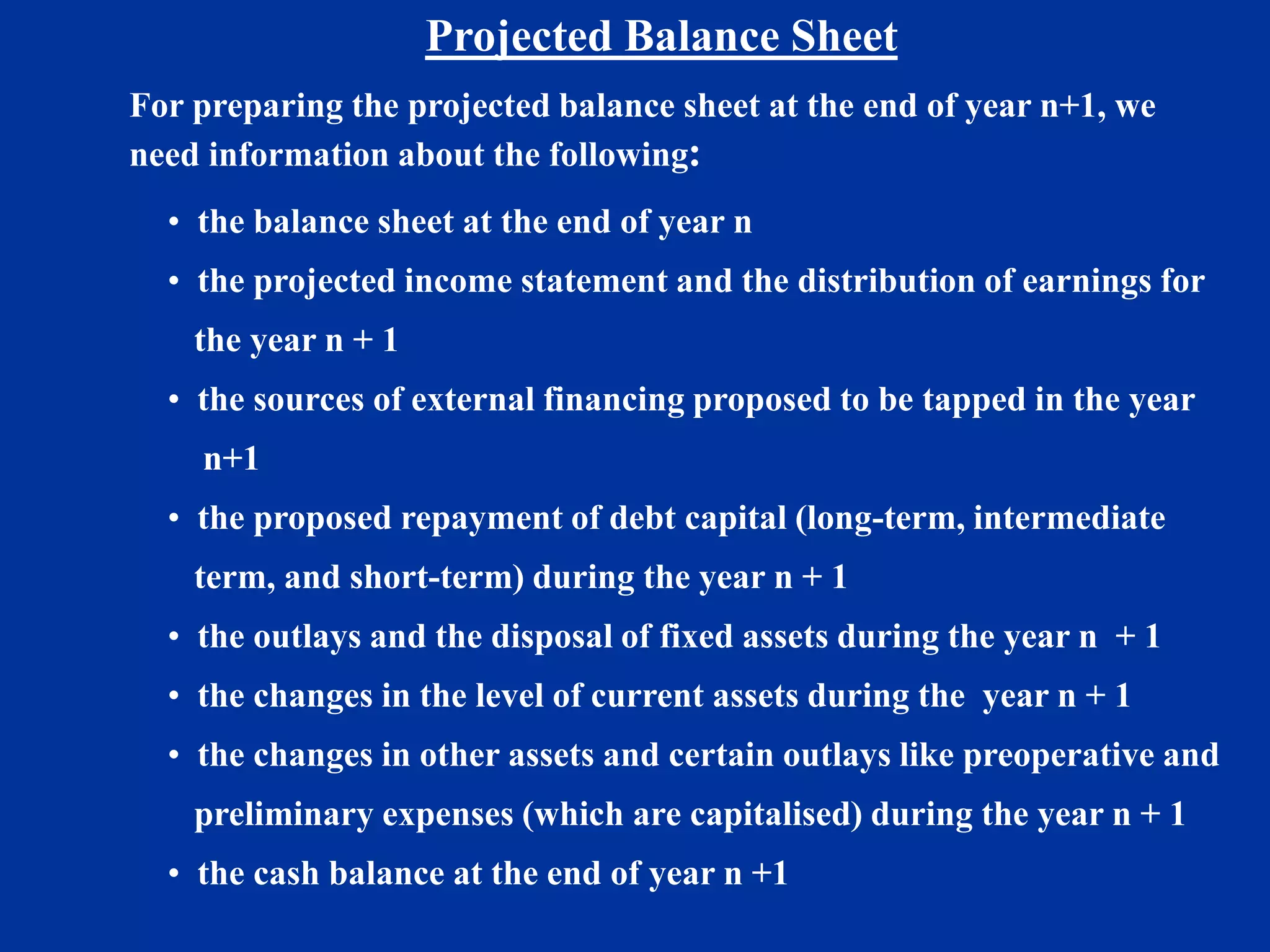

This document outlines the key financial projections and estimates required to evaluate a new project, including: cost of the project, means of financing, sales and production estimates, cost of production, working capital requirements and financing, profitability projections, cash flow statements, and projected balance sheets. Specifically, it details how to estimate sales and production levels over several years, calculate costs including material, labor and overhead, determine working capital needs, and develop multi-year profit/loss, cash flow and balance sheet projections.