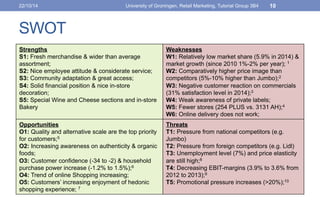

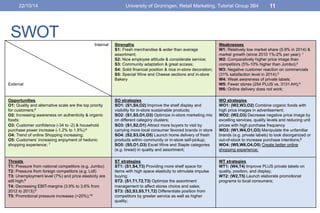

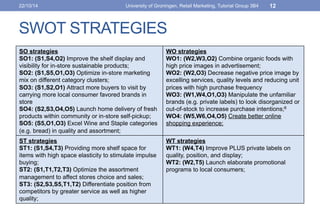

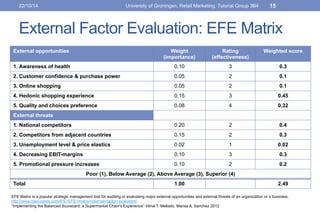

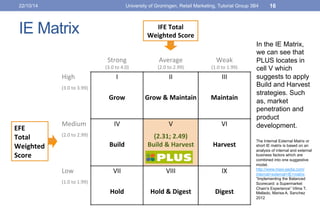

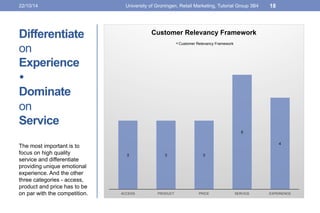

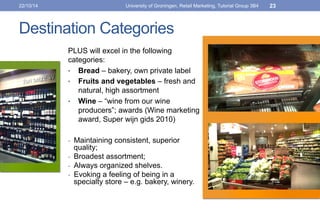

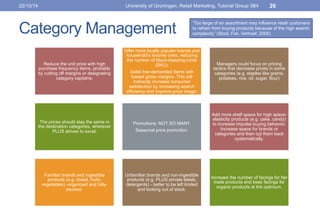

The document analyzes the retail supermarket chain Plus in the Netherlands, identifying key challenges such as low market share, high perceived prices, and competition from discounters. It presents a SWOT analysis highlighting strengths like fresh merchandise and weaknesses like low awareness of private labels, alongside strategic recommendations for improvement. The document concludes with the use of various strategic management tools, including the IE matrix, to suggest growth and market penetration strategies for Plus.