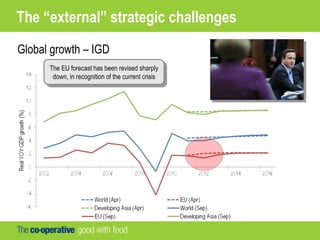

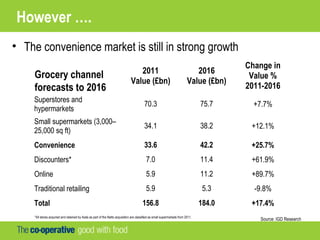

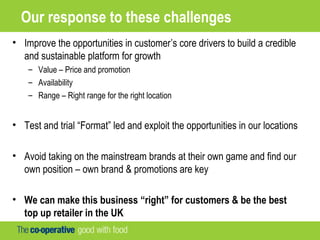

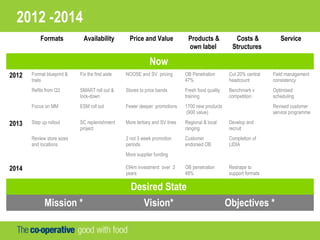

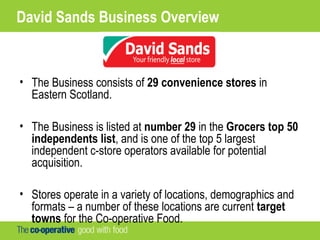

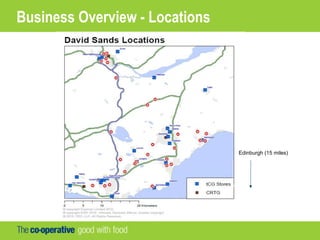

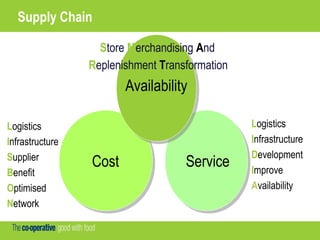

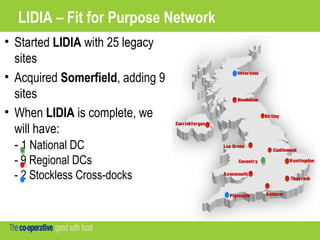

The Co-operative Group has a large food retail business facing strategic challenges from competitors. Their plan is to improve value, availability, and range through a format-led approach. They will focus on fixing basics, truly understanding customers, rolling out chosen formats across stores, and marketing their differentiated proposition. This will be supported by significant price investment, supply chain optimization, and £94M in store investments over 3 years.