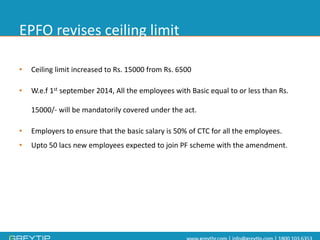

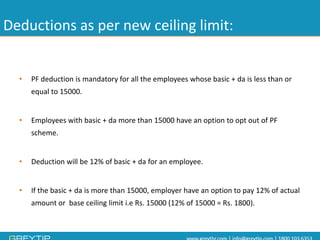

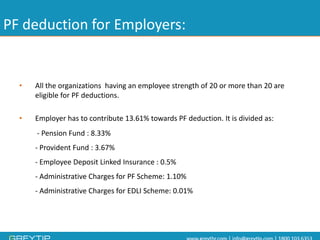

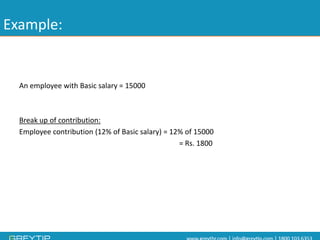

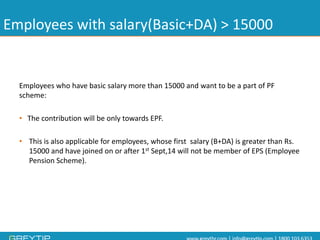

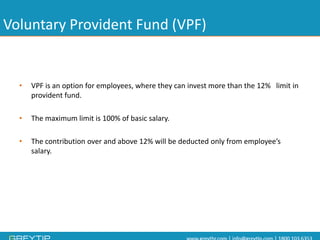

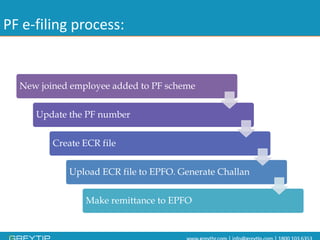

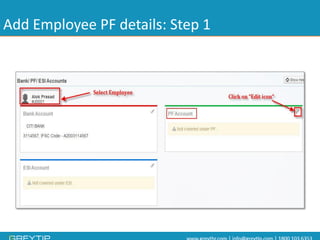

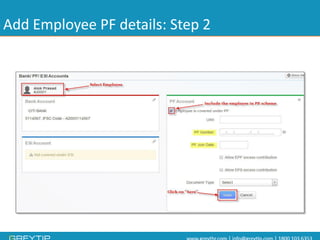

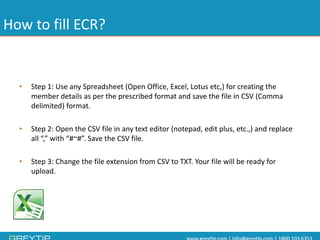

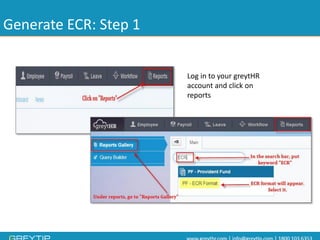

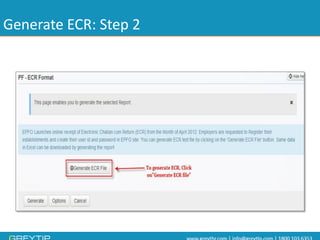

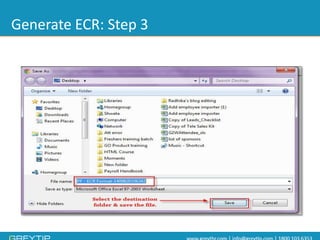

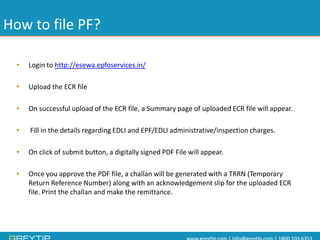

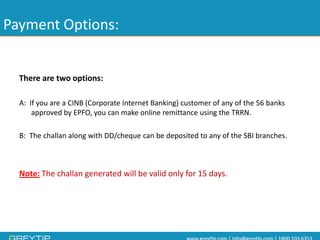

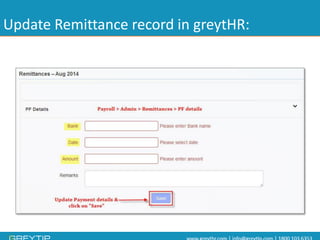

The document outlines the objectives of a workshop aimed at educating participants about the Provident Fund (PF) system, its benefits, deductions, and the new ceiling limit of Rs. 15,000 effective from September 1, 2014. It explains employer and employee contributions, voluntary options, tax benefits, and the process for e-filing PF details through greythr software. Additionally, it provides detailed steps for creating and submitting electronic contribution files and emphasizes the necessity of compliance for organizations with 20 or more employees.