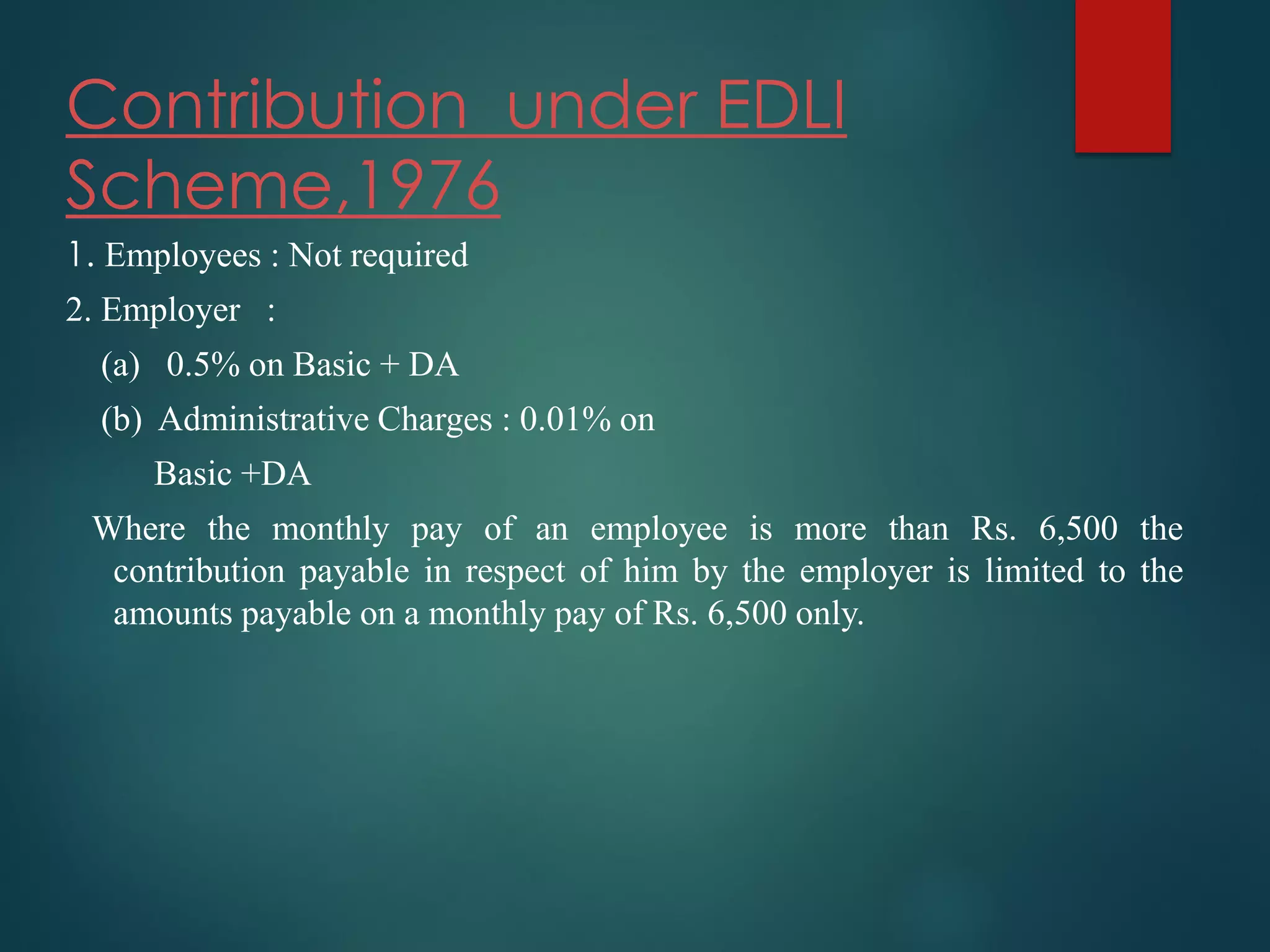

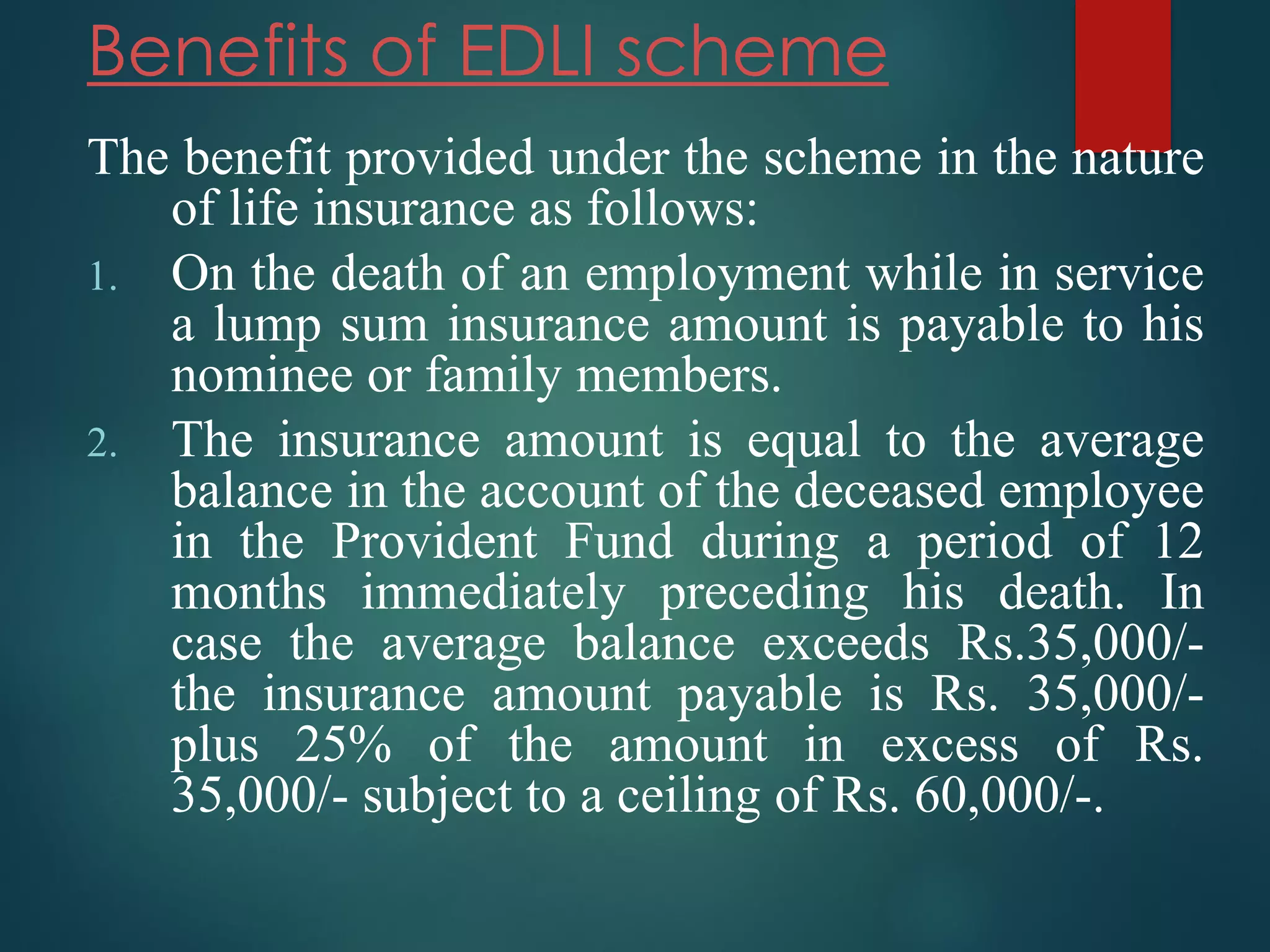

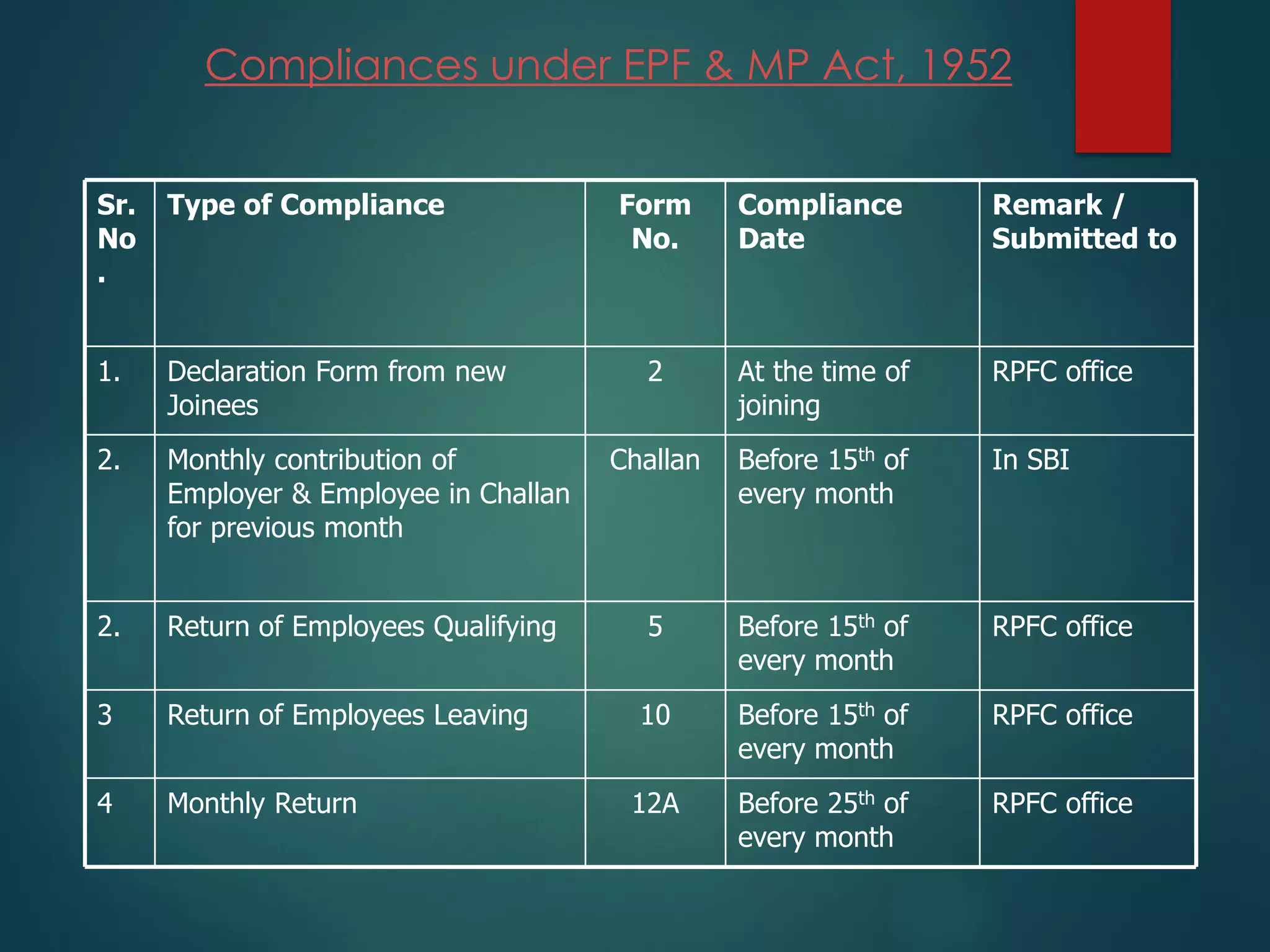

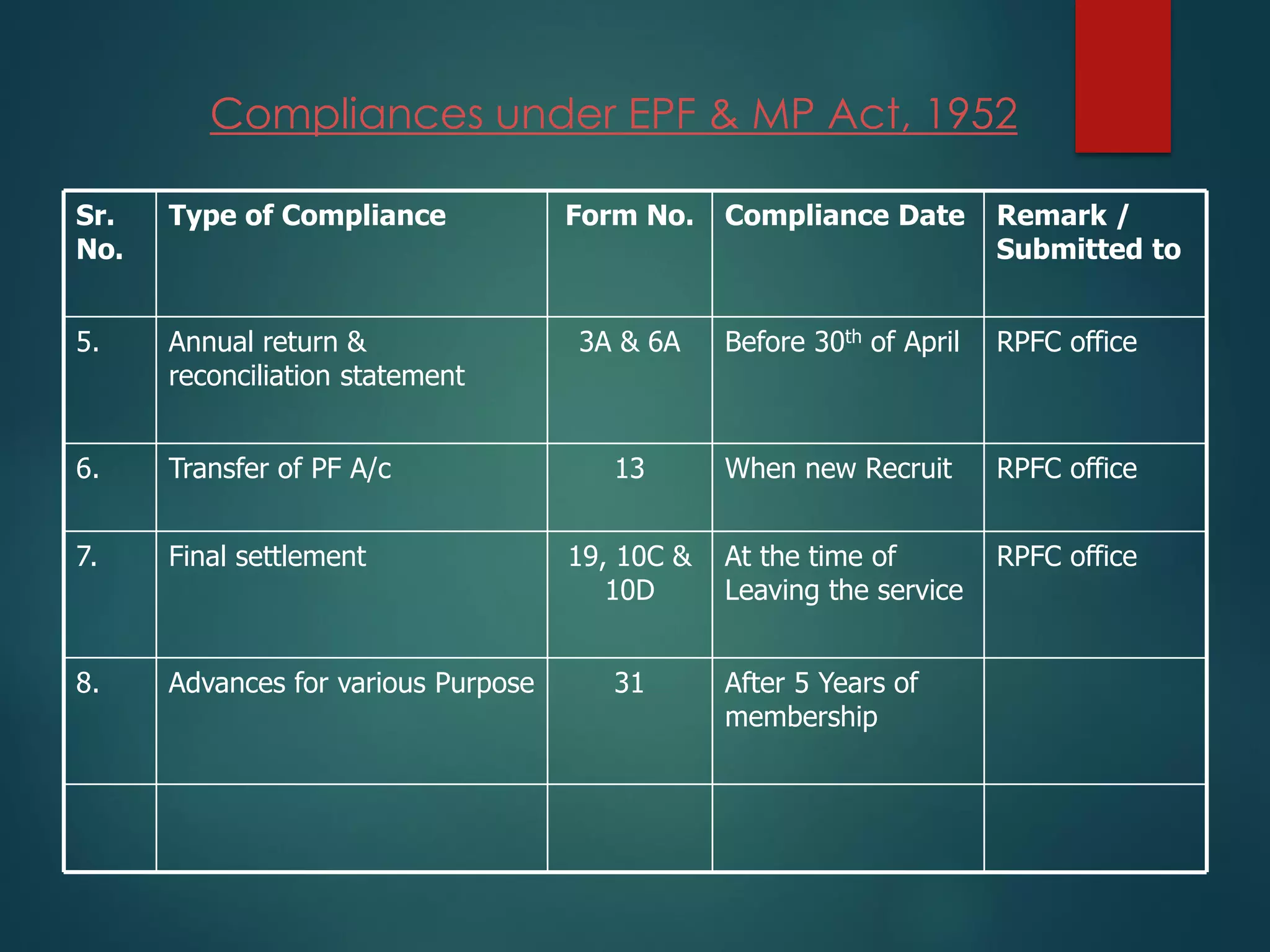

The document summarizes the key aspects of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952 in India. The Act aims to provide social security to industrial workers through retirement benefits like provident fund, pension, insurance, and benefits in contingencies like retrenchment or closure. It applies to establishments with 20 or more employees. The key schemes under the Act are the Employees' Provident Fund Scheme 1952, Employees' Pension Scheme 1995, and Employees' Deposit-Linked Insurance Scheme 1976. The schemes require monthly contributions from employers and employees, with benefits like pension, insurance payouts for family. Regular compliances like monthly returns and annual reconciliations are also required under the Act.