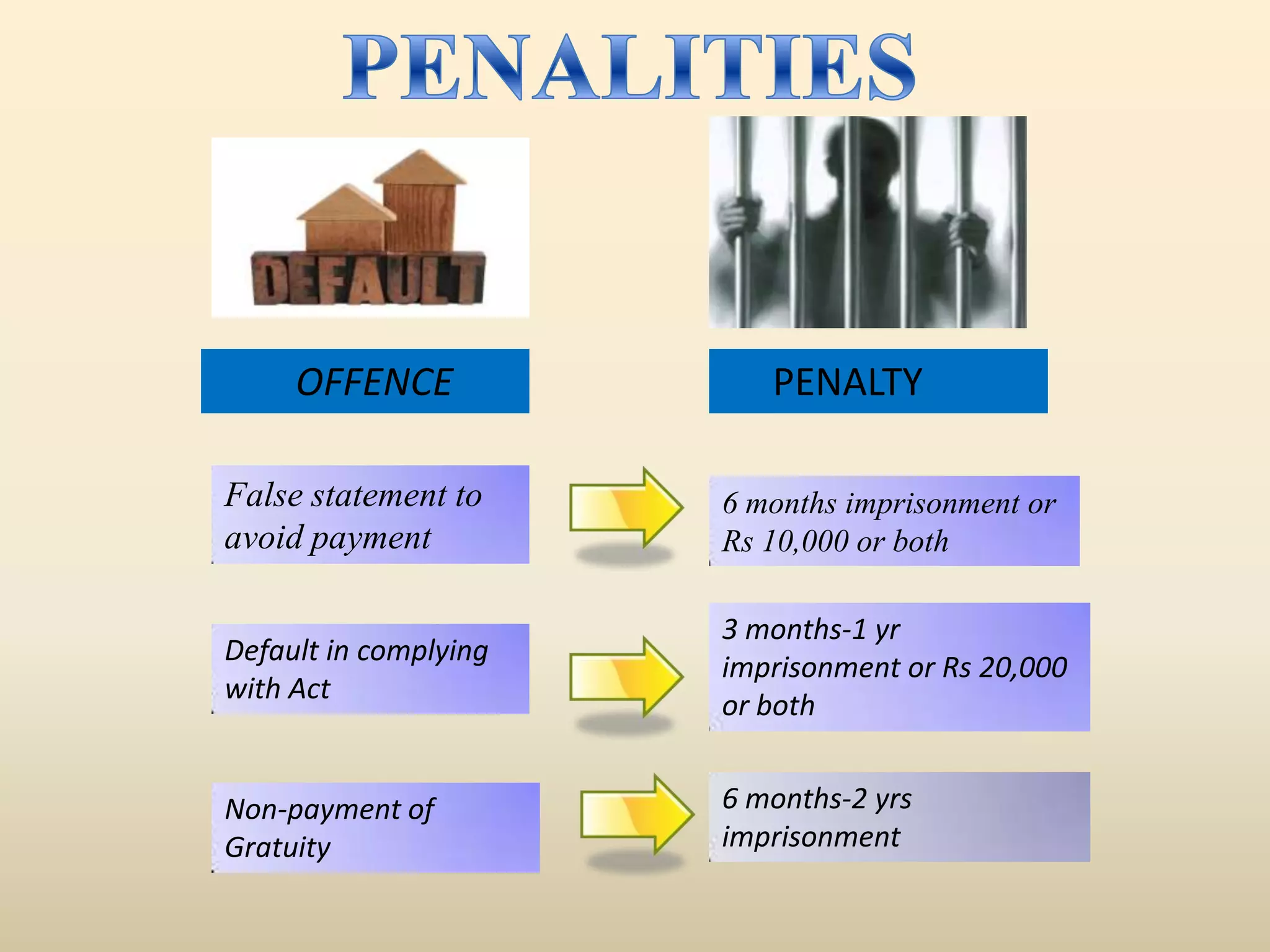

The document discusses the key aspects of gratuity as per the Payment of Gratuity Act, 1972. It provides definitions for gratuity, continuous service, and eligibility criteria. It states that gratuity is payable for continuous service of 5 years or more (or in case of death/disablement) and the maximum amount is Rs. 10 lakhs. The document outlines procedures for nomination, application for gratuity, penalties for non-compliance, and methods to calculate gratuity for different types of employees.