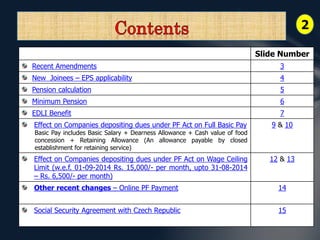

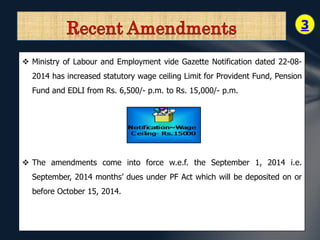

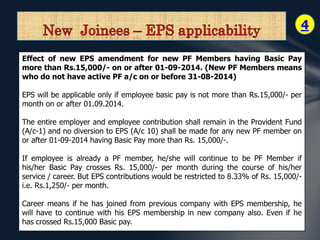

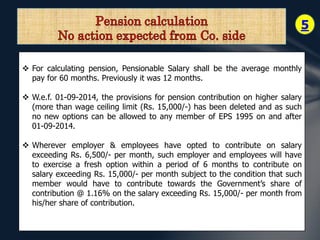

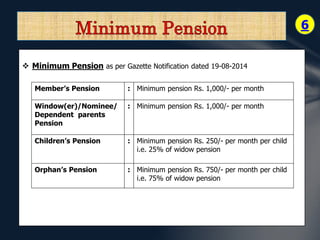

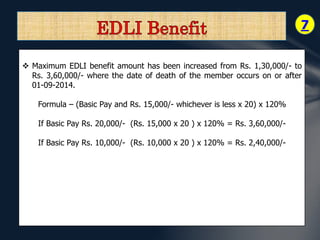

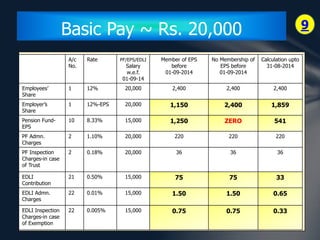

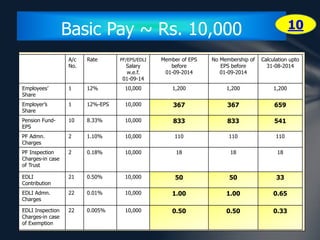

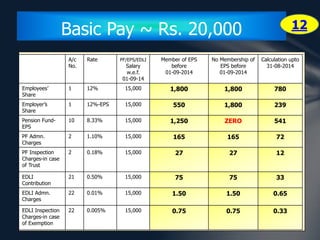

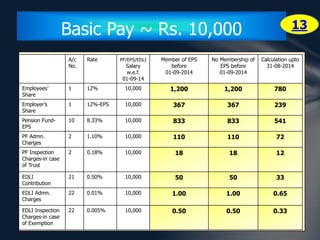

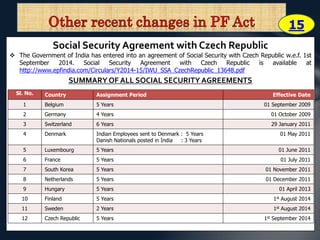

The document summarizes recent amendments made in relation to Provident Fund contributions in India effective September 1, 2014. Key changes include increasing the wage ceiling limit from Rs. 6,500 to Rs. 15,000 per month, calculating pension based on average monthly pay over 60 months instead of 12 months, and increasing the maximum EDLI benefit from Rs. 1,30,000 to Rs. 3,60,000. The amendments affect contribution rates and calculations for employees earning above the new wage ceiling limit. Online PF payment and a new social security agreement with the Czech Republic are also mentioned.