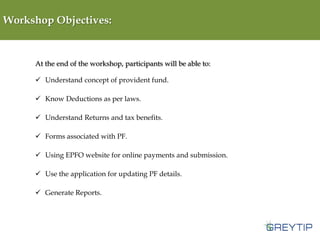

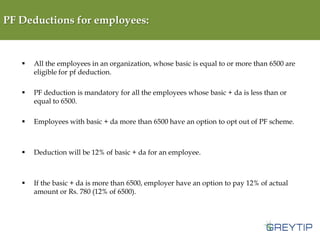

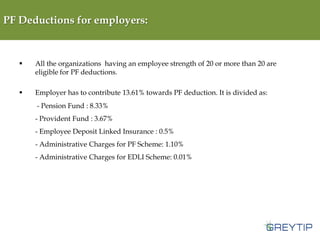

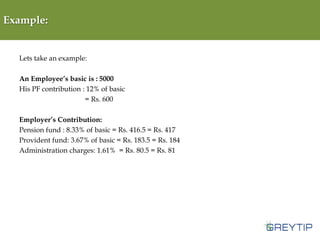

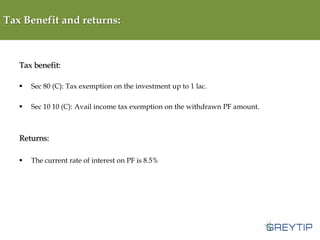

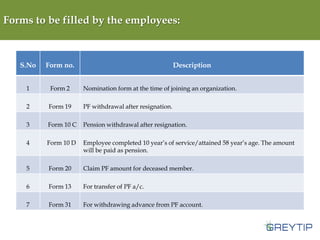

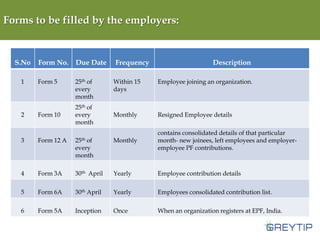

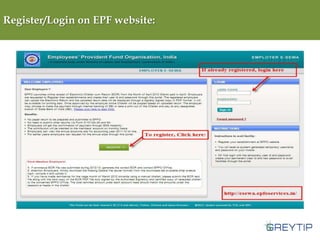

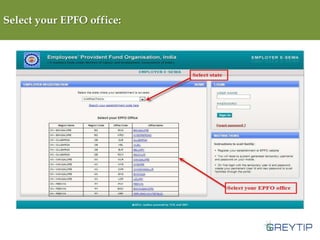

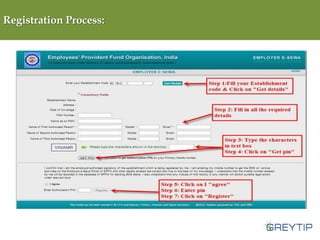

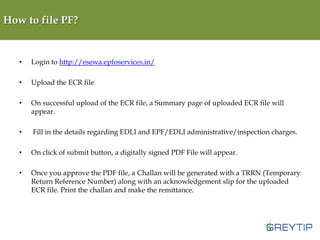

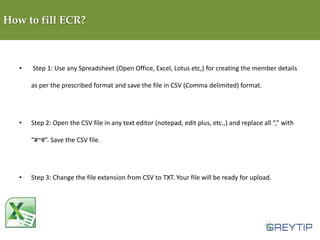

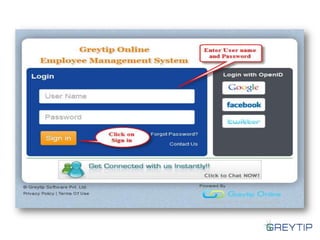

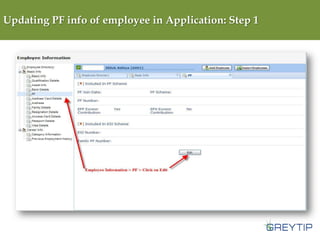

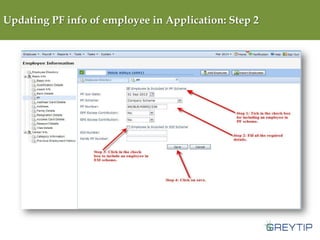

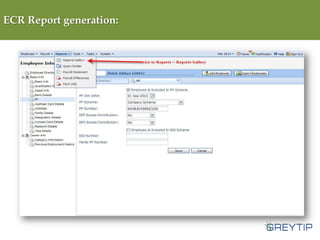

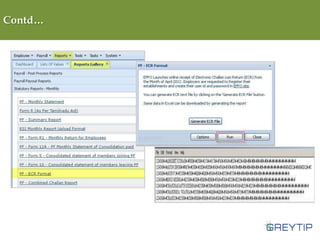

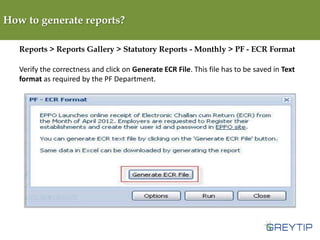

This document provides information on provident fund deductions and procedures for employers and employees in India. It outlines the workshop objectives of understanding PF concepts, deductions, forms, and tax benefits. It then details PF contribution rates for employers and employees, including an example calculation. It describes the process for registering and filing PF contributions online, generating ECR reports, and updating employee PF details in the application.