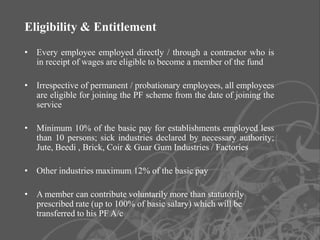

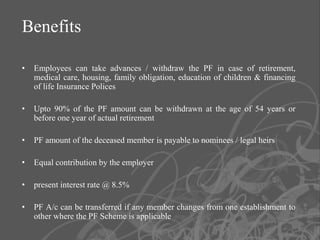

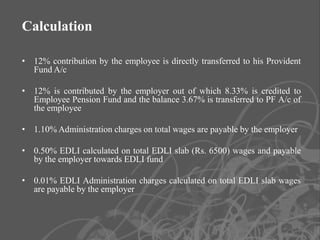

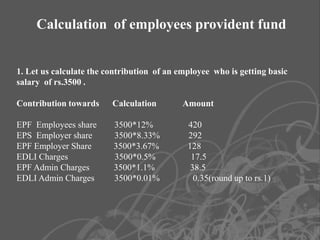

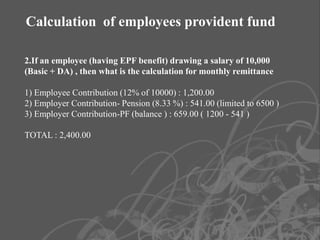

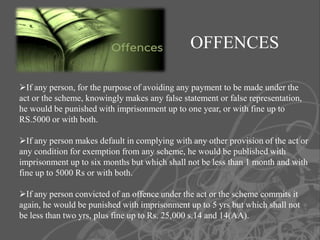

The Employee's Provident Fund Act of 1952 mandates compulsory contributions from both employees and employers to establish a retirement fund for employees in India, providing financial security upon retirement or in case of early death. The Act is applicable to factories and certain establishments with 20 or more employees and outlines eligibility, contribution rates, benefits, and withdrawal conditions. It includes provisions for pensions, insurance, and penalties for non-compliance, ensuring the future welfare of employees and their families.