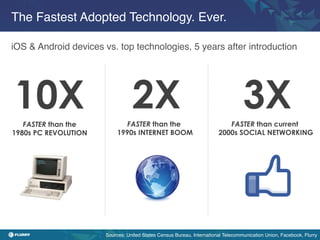

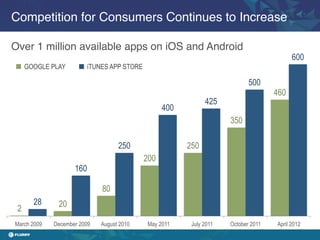

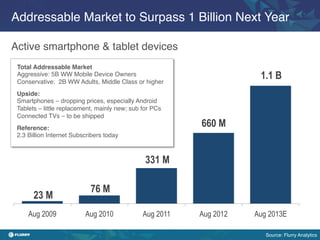

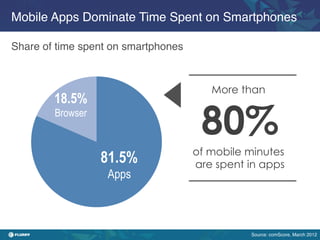

This document discusses the growth of the mobile games market and analyzes usage trends across smartphones, tablets, and platforms. Some key points:

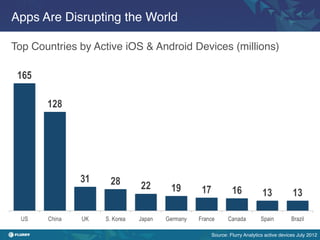

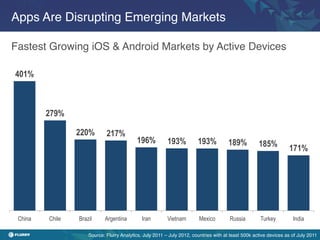

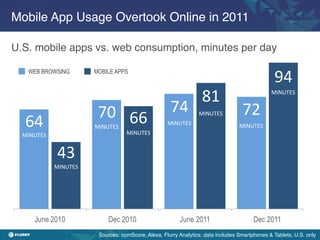

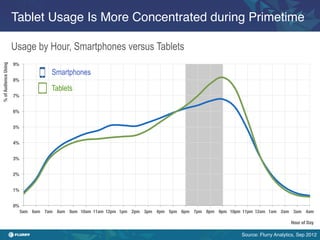

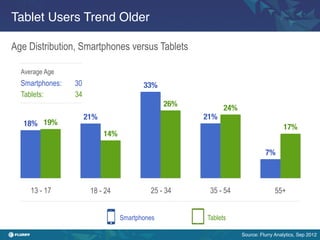

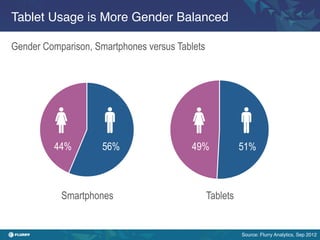

- The mobile games market is growing rapidly, surpassing 1 billion users next year, and apps are disrupting industries globally. Tablet usage is more concentrated during primetime and older users.

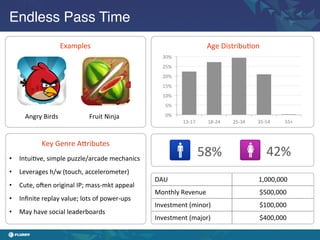

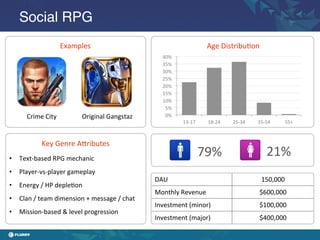

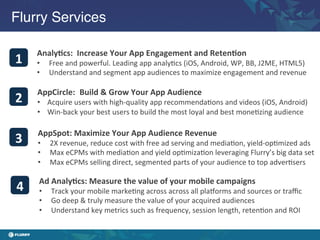

- The top successful game types are endless pass time, social RPGs, and "gamer's games" featuring high-end graphics. Flurry Services help developers increase engagement, acquire users, and maximize monetization.

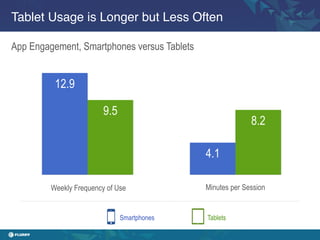

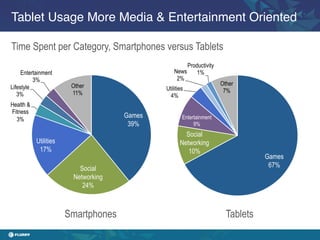

- Tablet usage is longer per session but less frequent than smartphones. Entertainment dominates tablet time spent versus a mix of categories on smartphones.