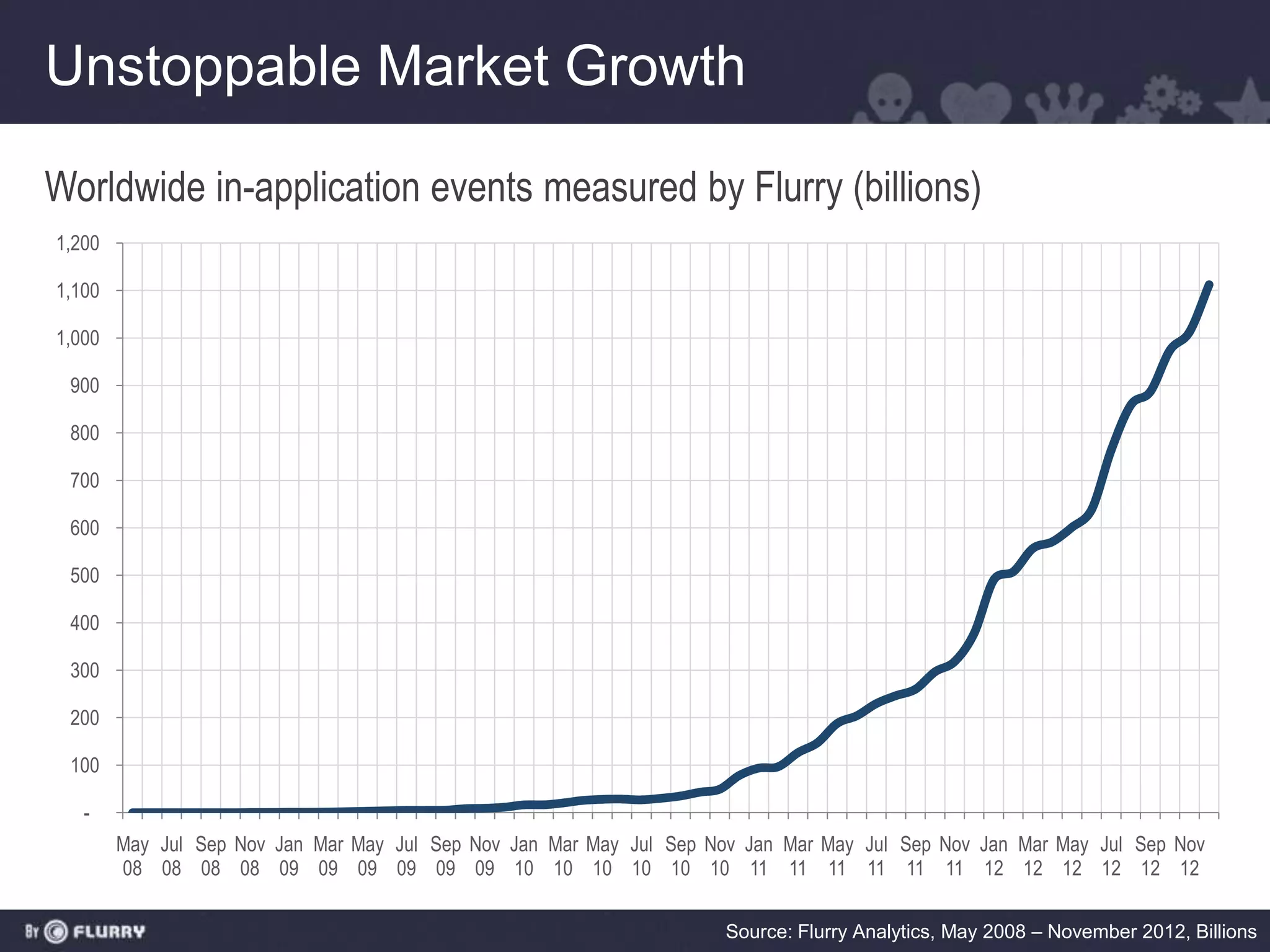

The document summarizes mobile app usage trends from 2008-2012 based on data from Flurry Analytics. Key points include:

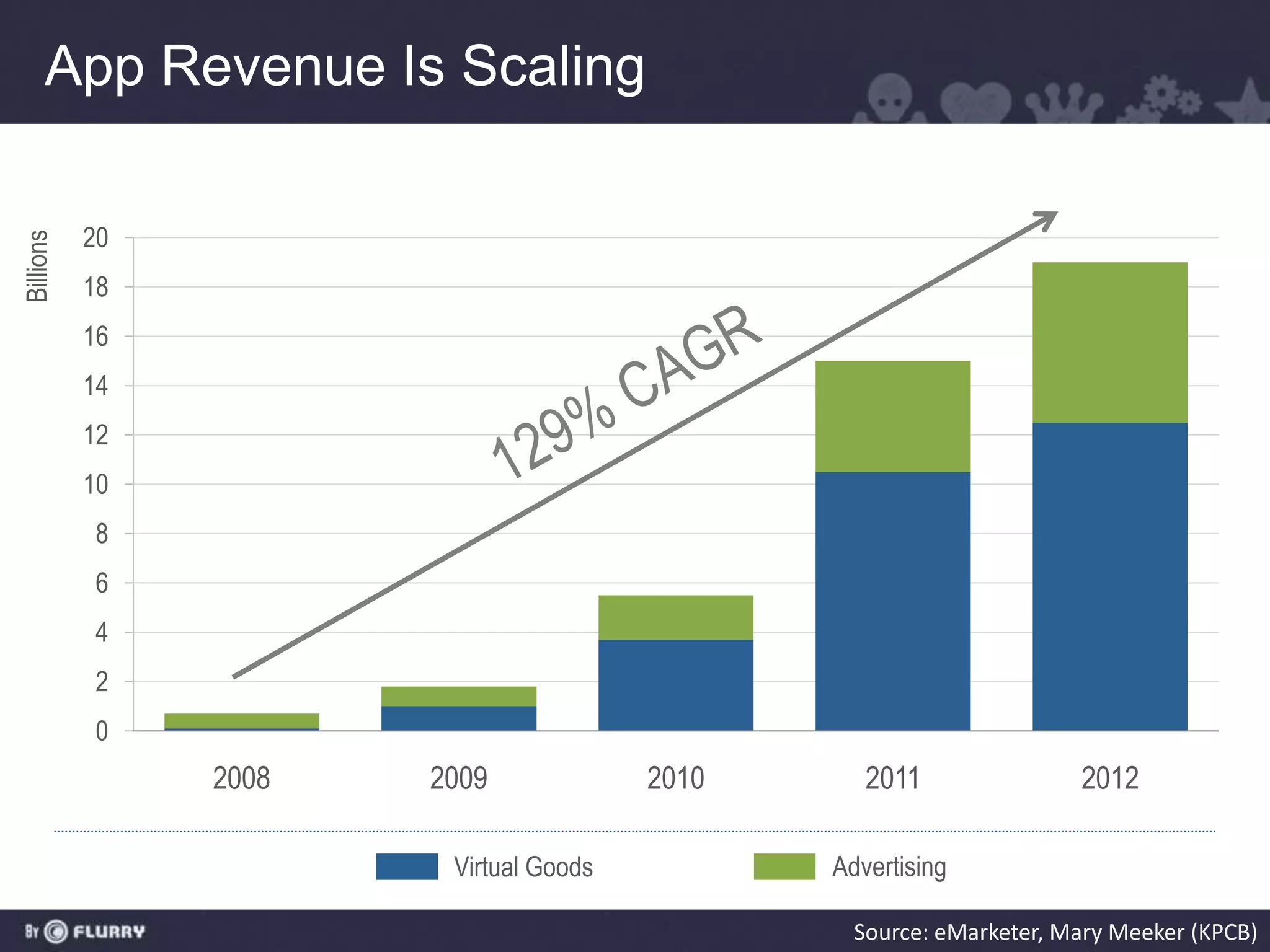

- Worldwide in-app events have grown exponentially from 100 billion in 2008 to over 1 trillion in 2012.

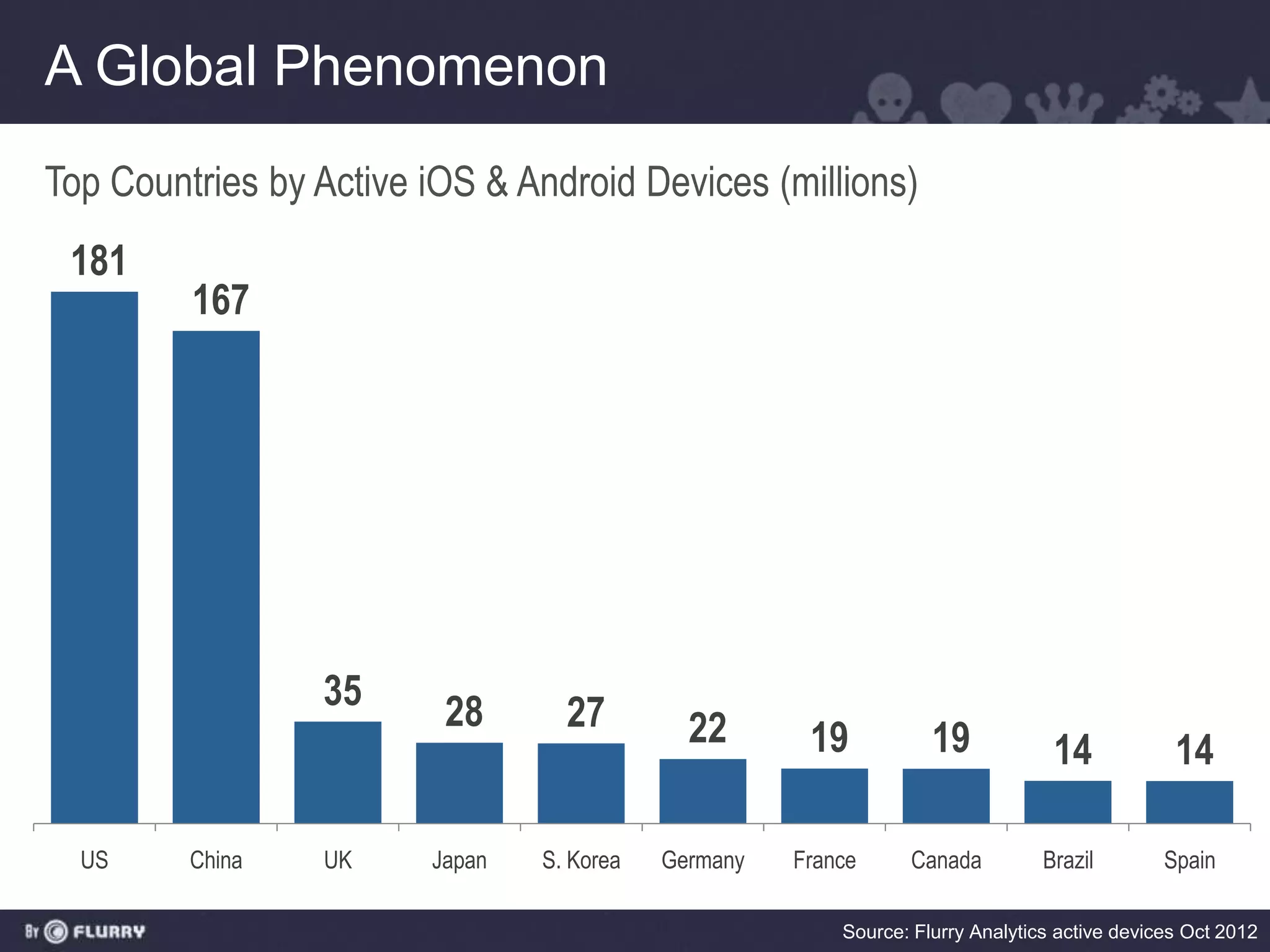

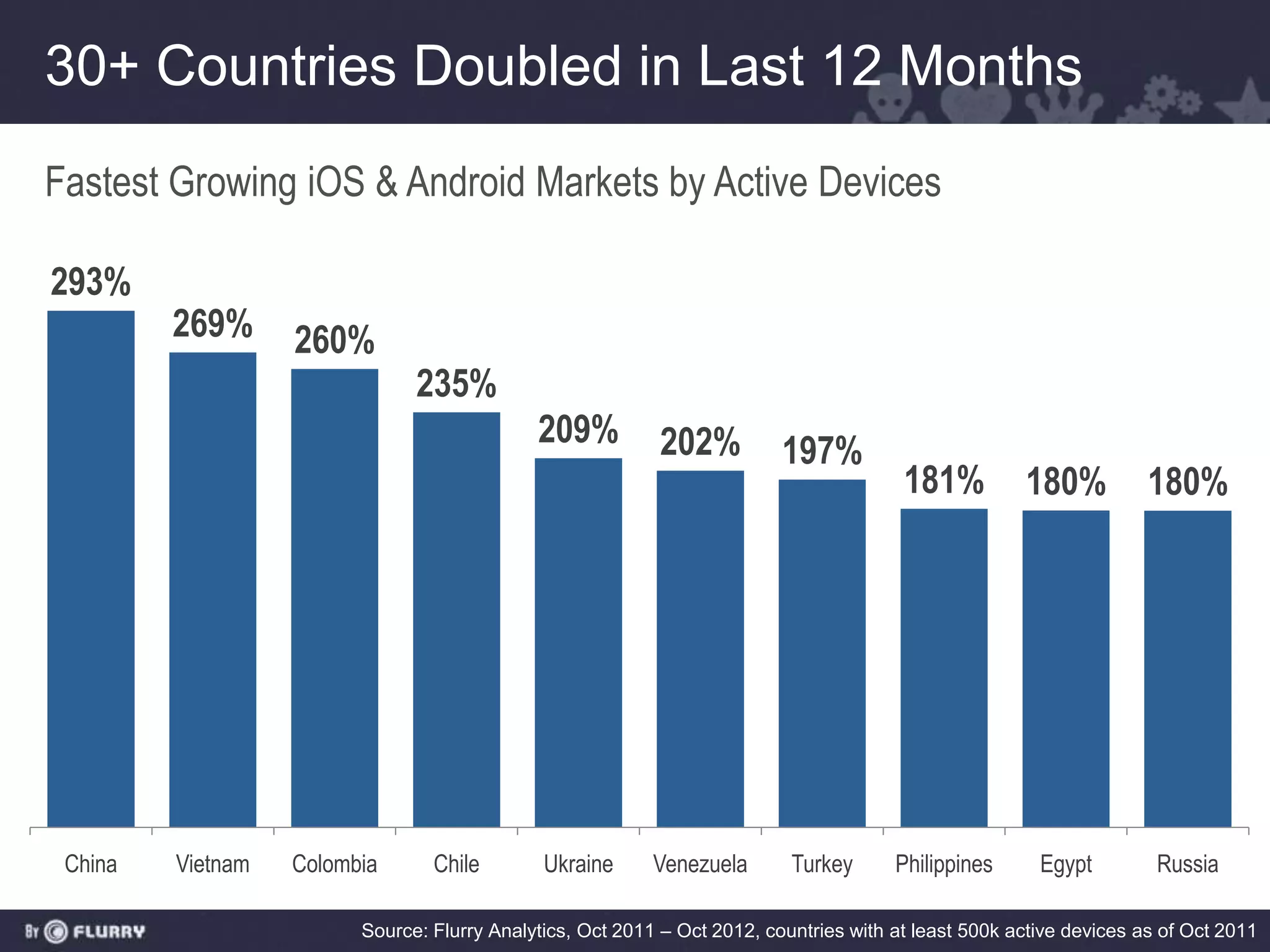

- The US, China, UK, Japan, and South Korea have the most active iOS and Android devices. Emerging markets like China and Vietnam have seen the fastest growth over the last year.

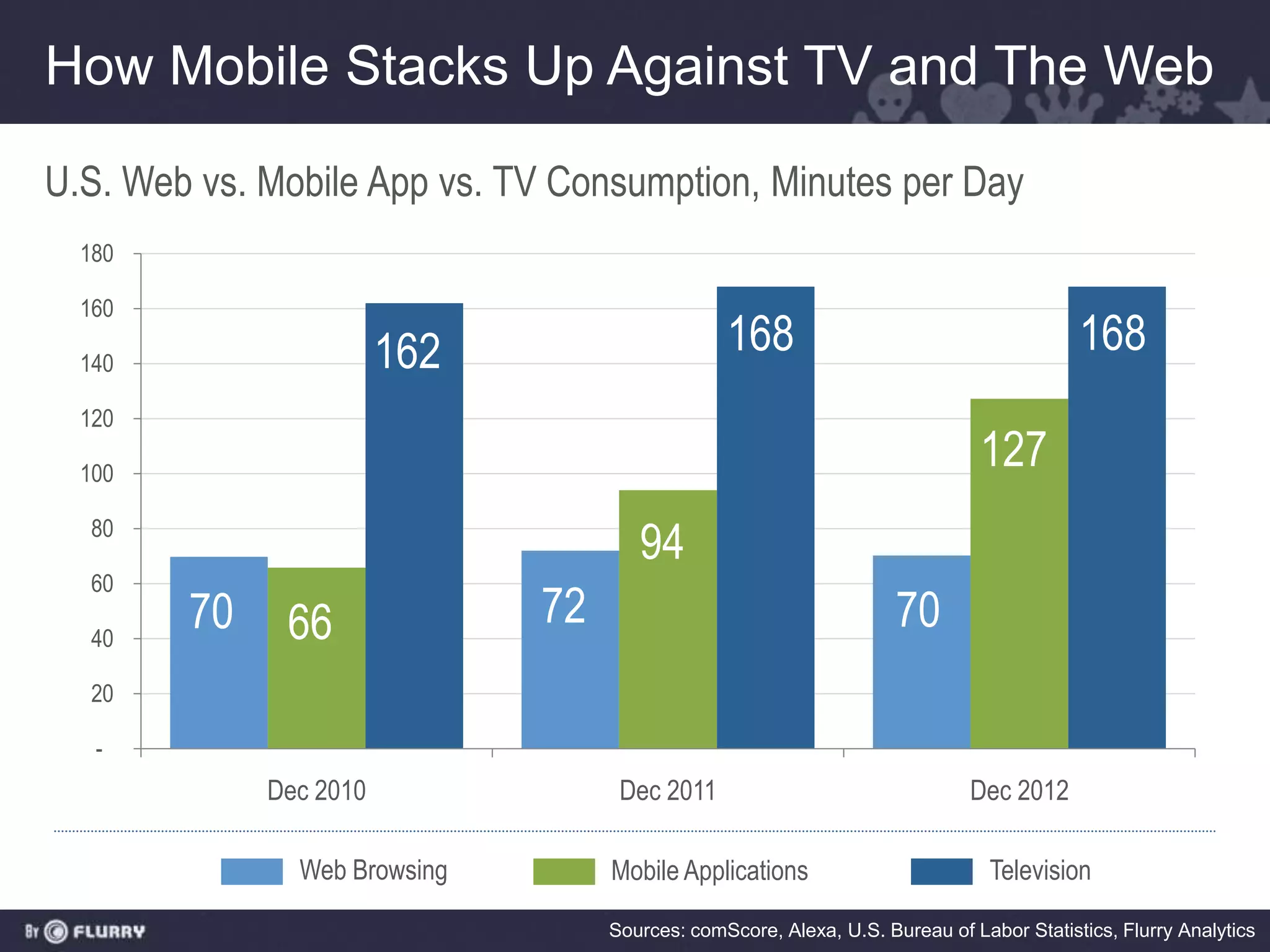

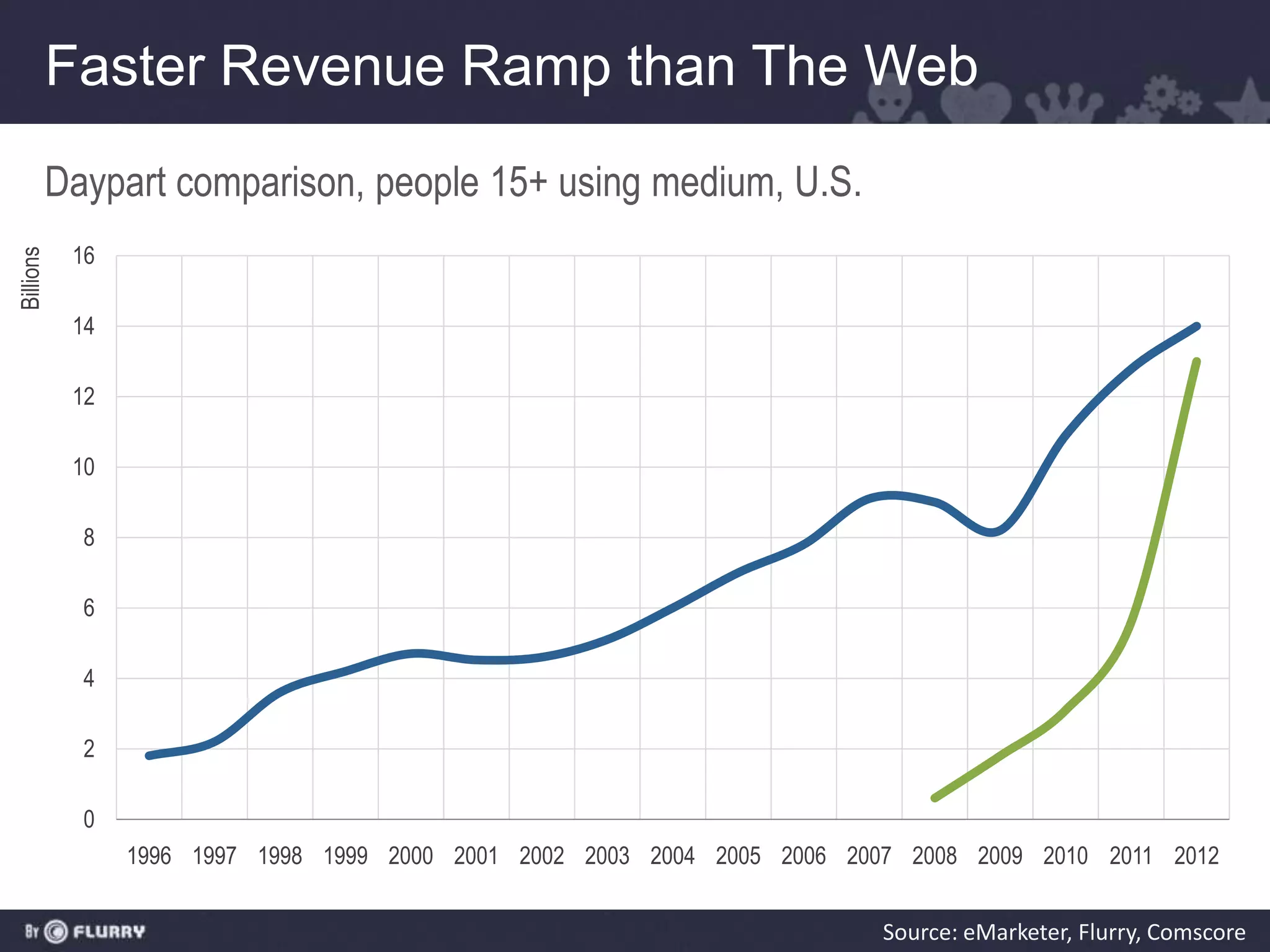

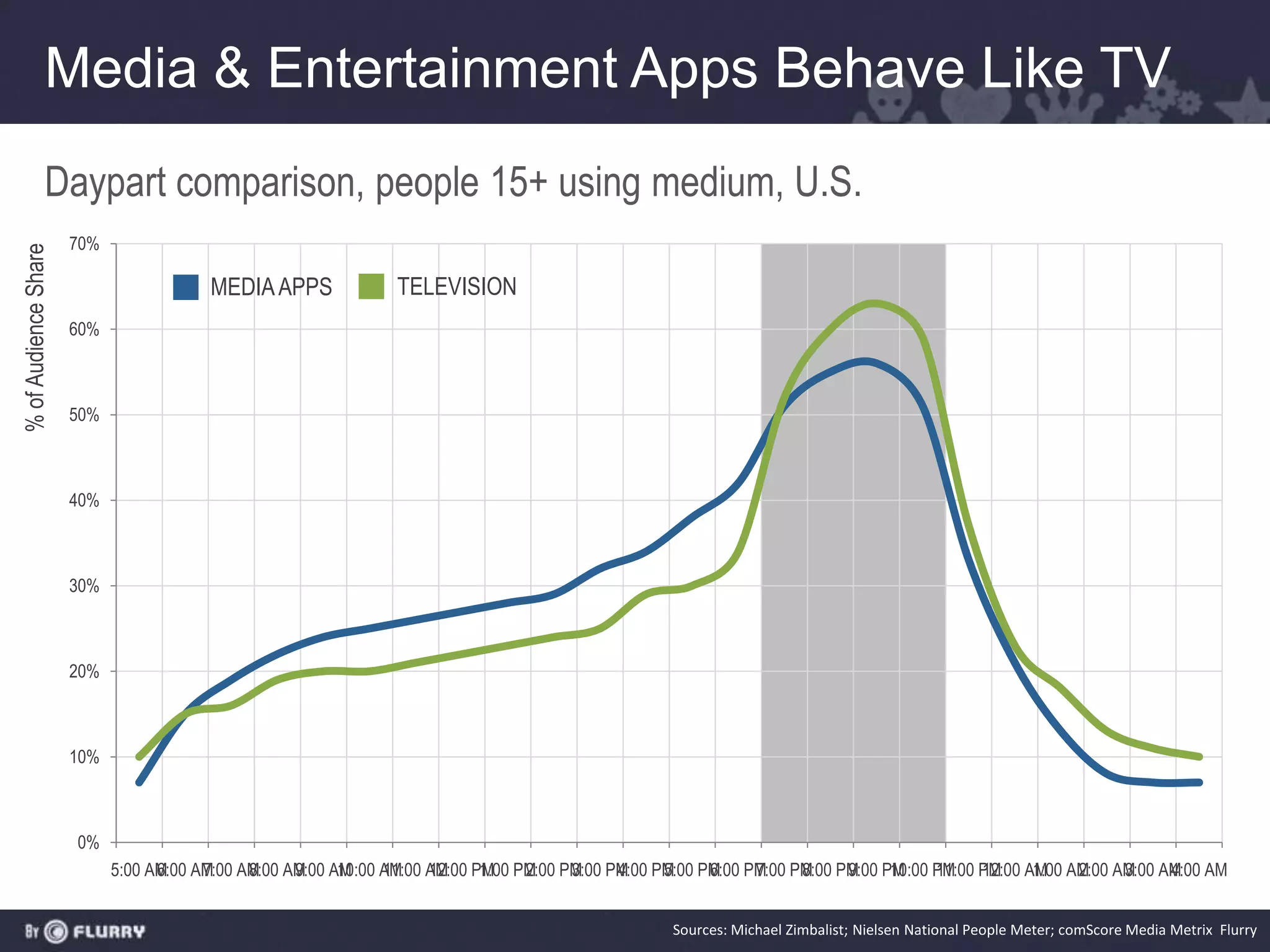

- Time spent on mobile apps now exceeds time spent on the web and is approaching TV viewing levels in the US.

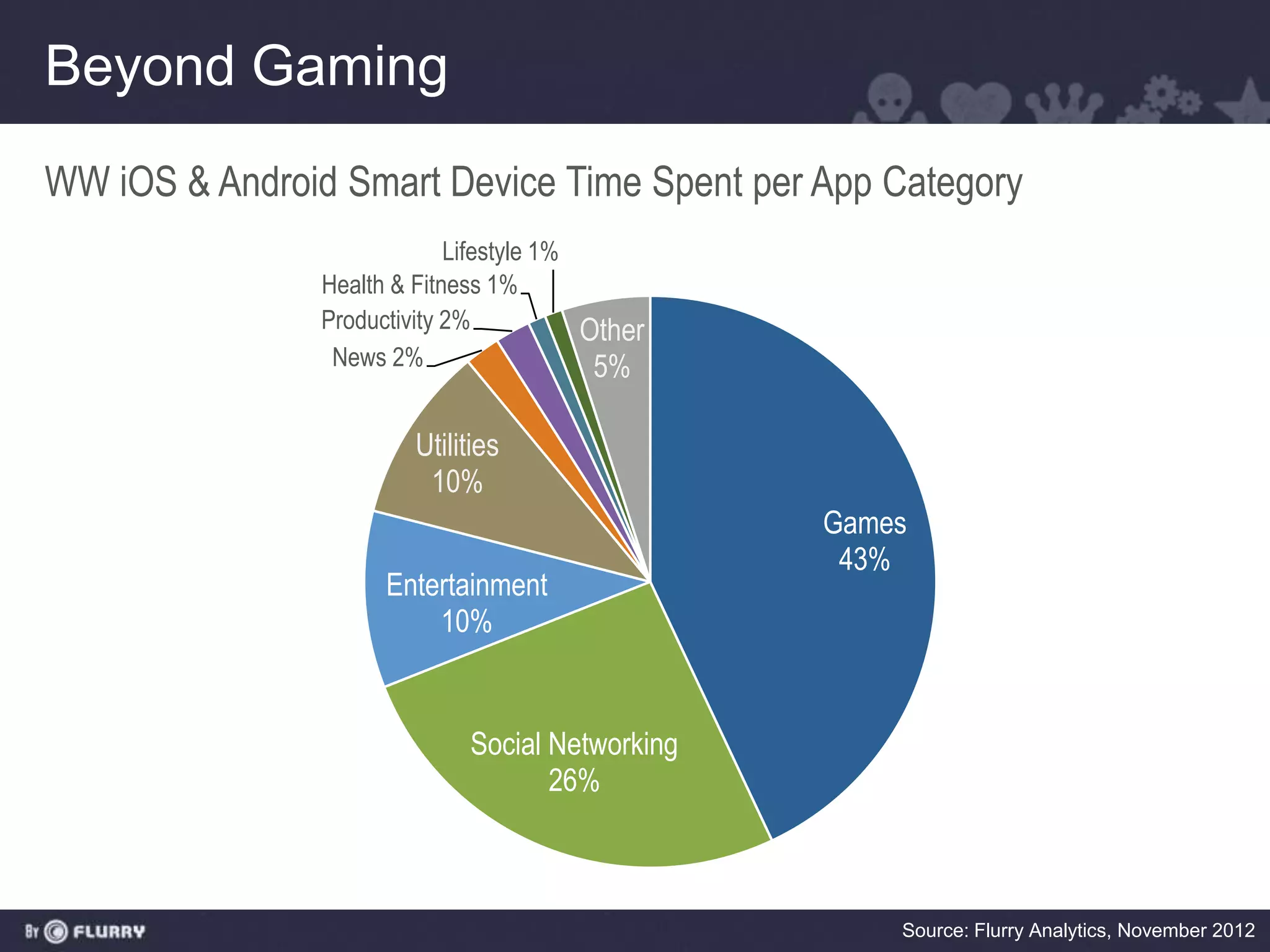

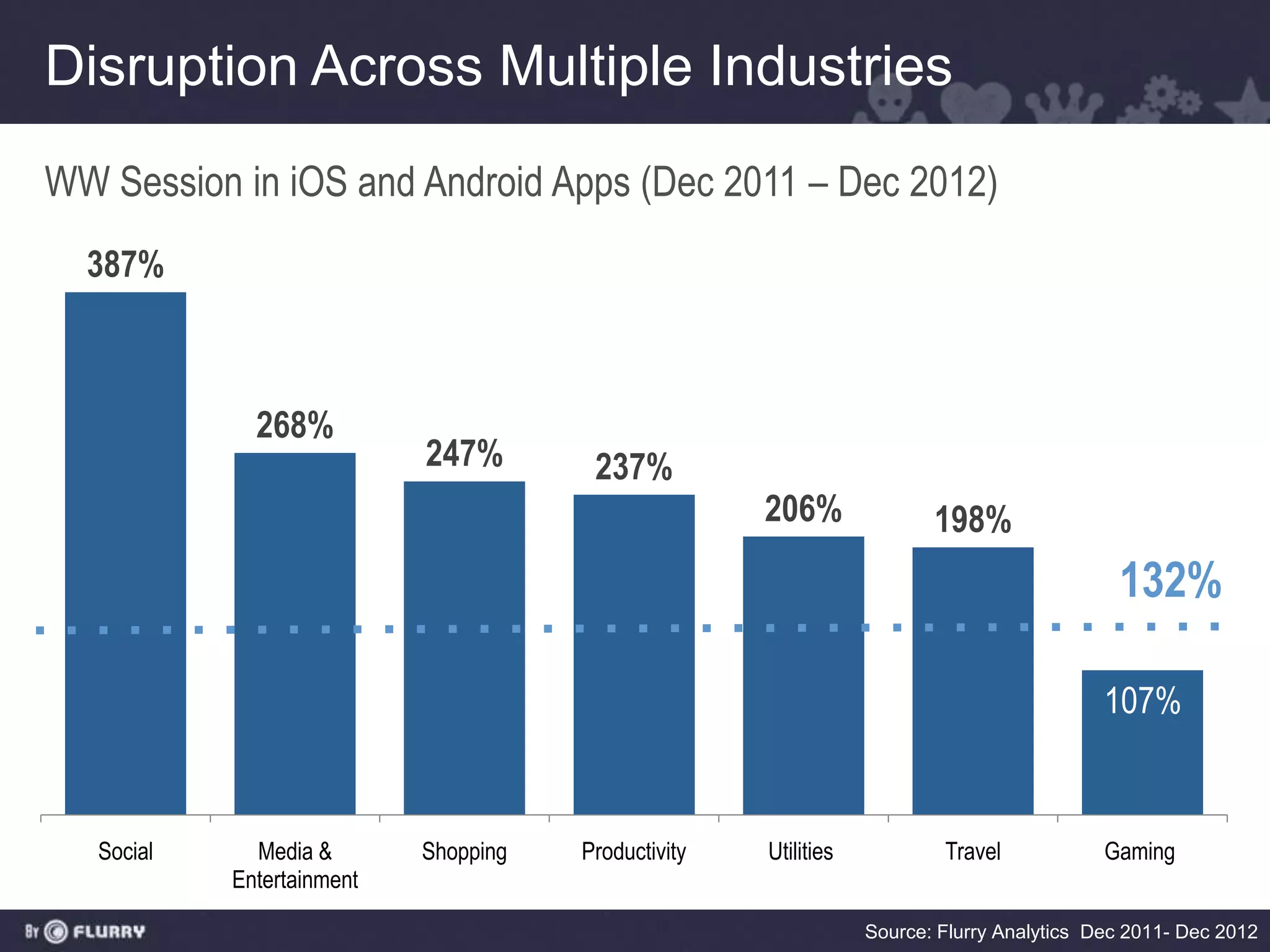

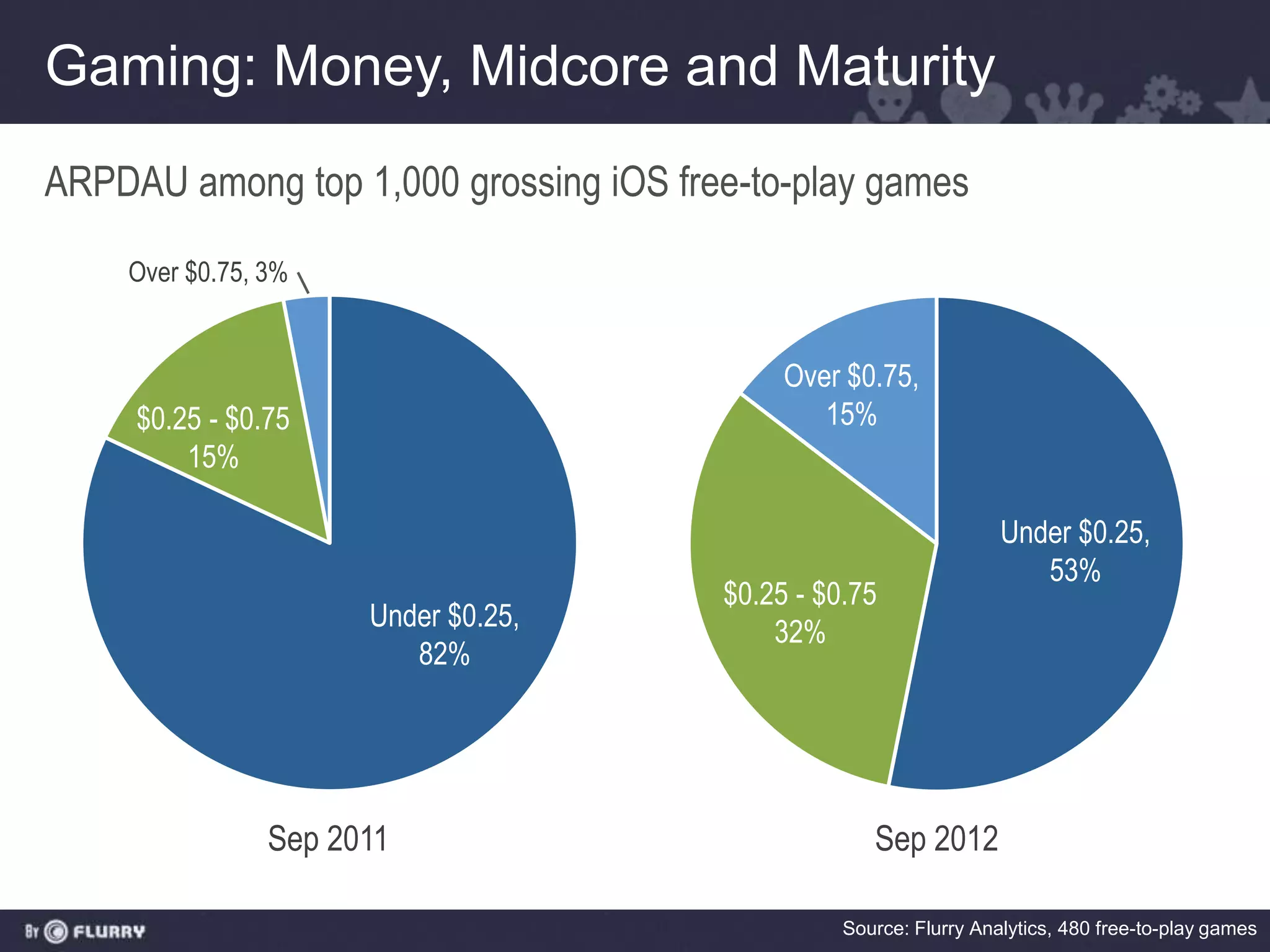

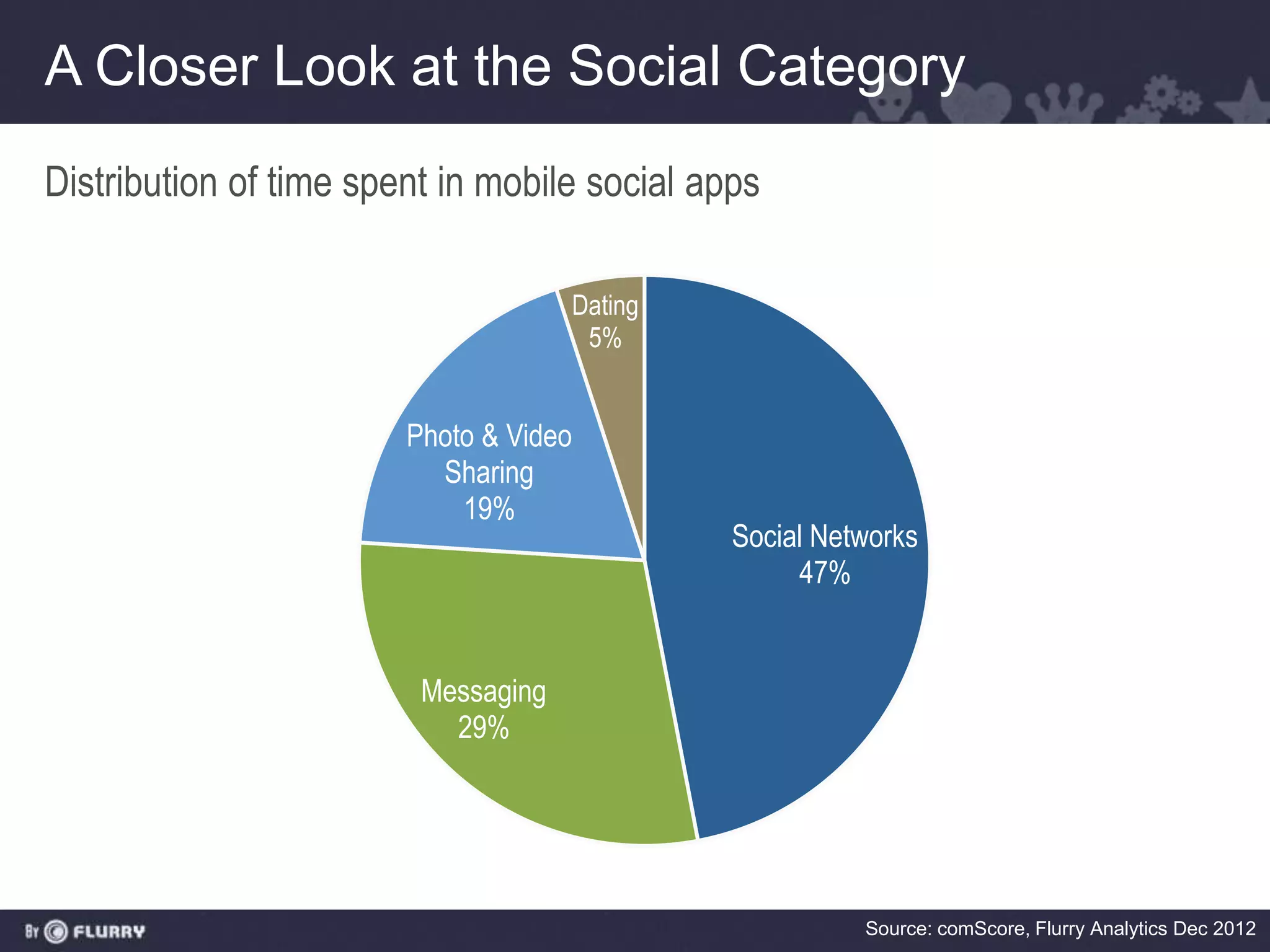

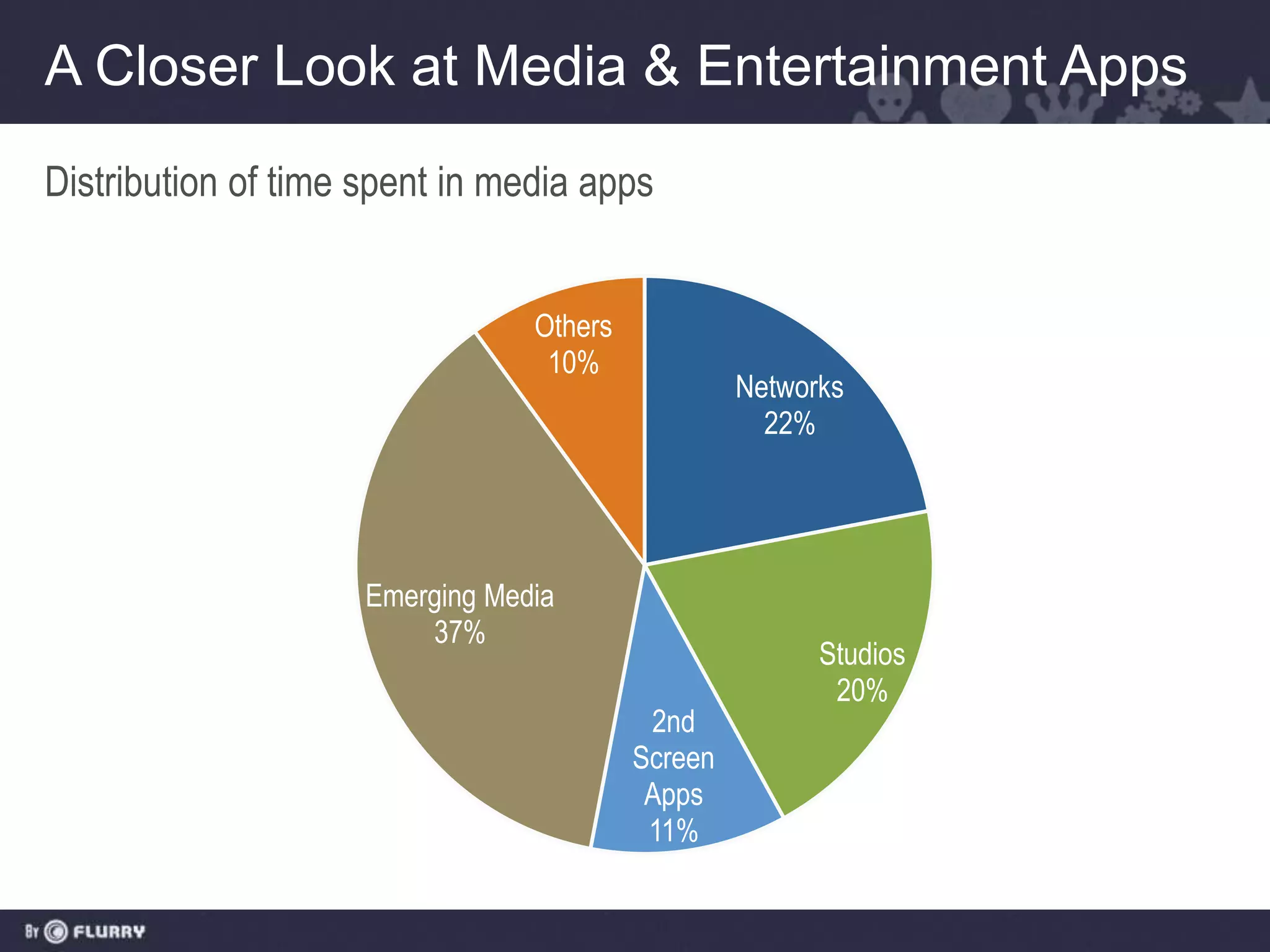

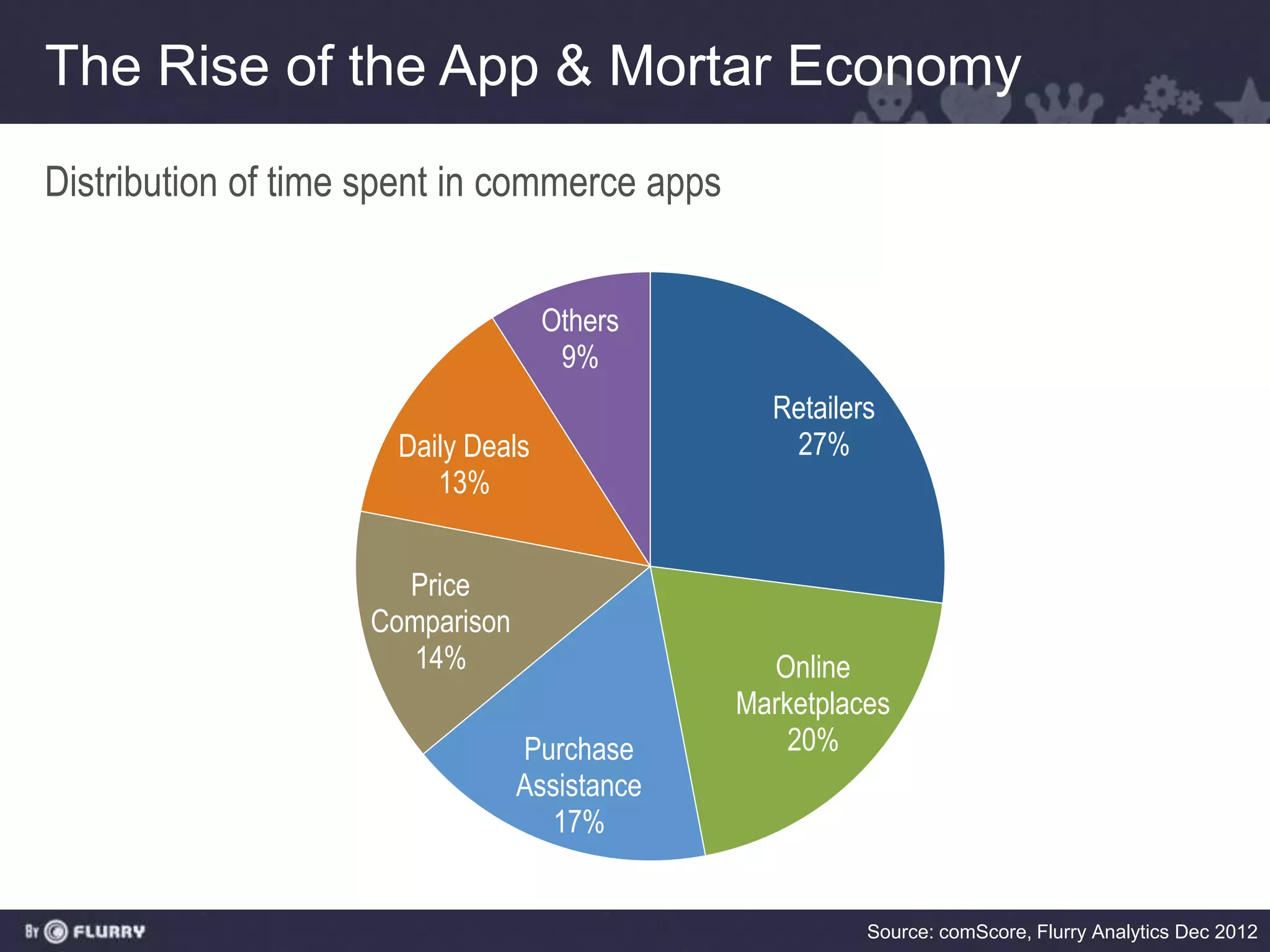

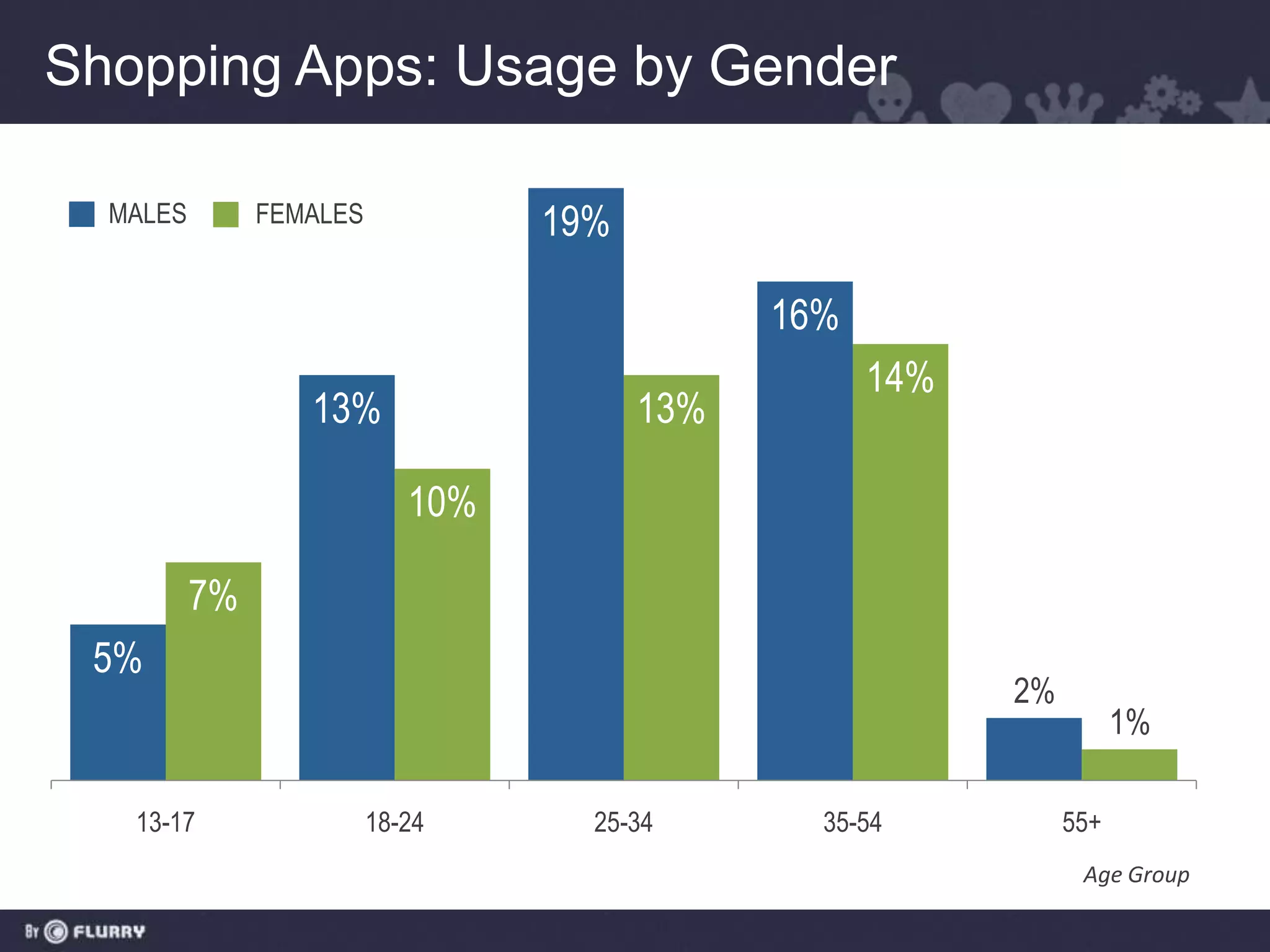

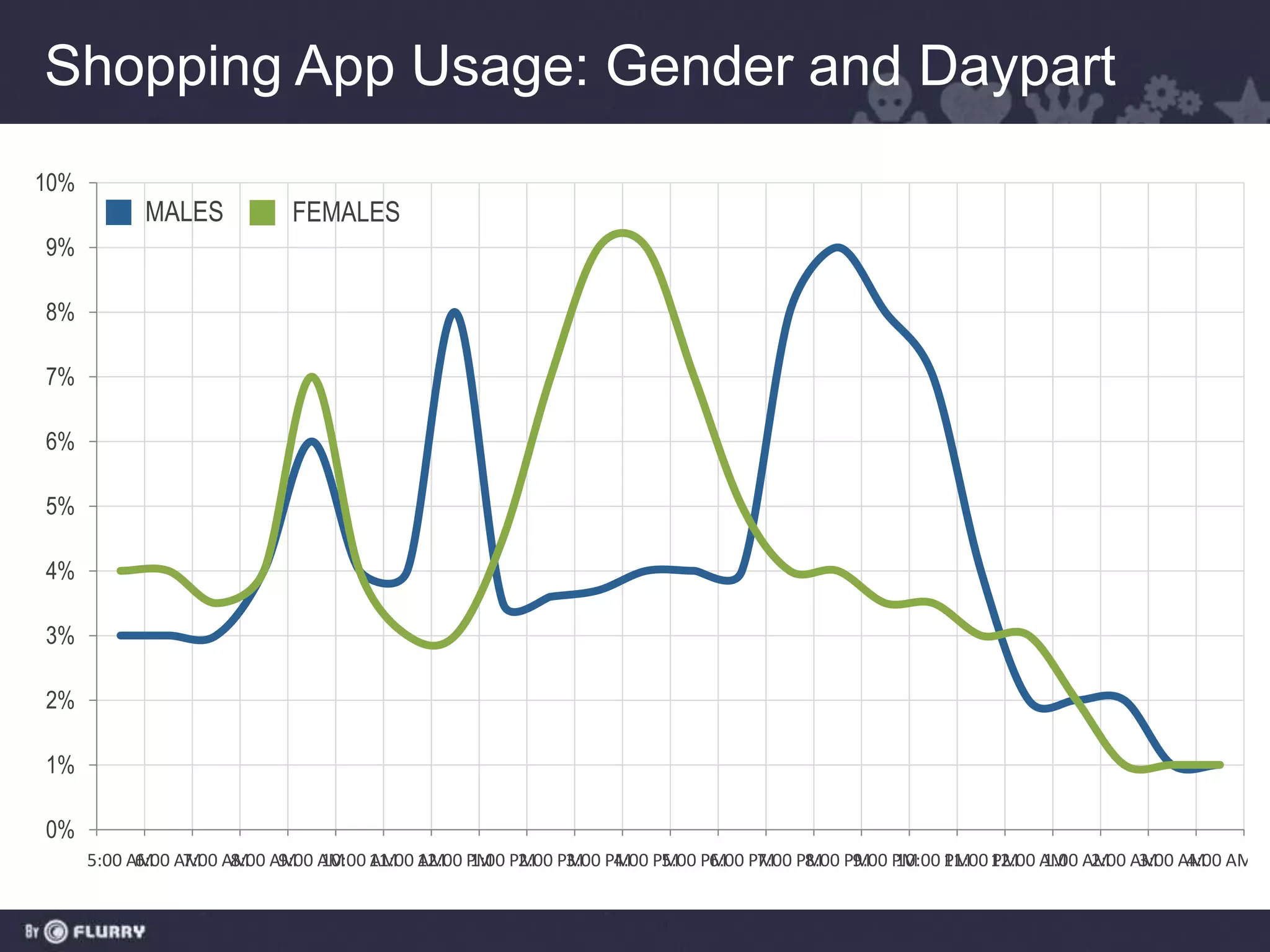

- Gaming dominates app usage but social, media, and shopping apps are growing rapidly. Disruption is occurring across many industries like retail, media, and travel