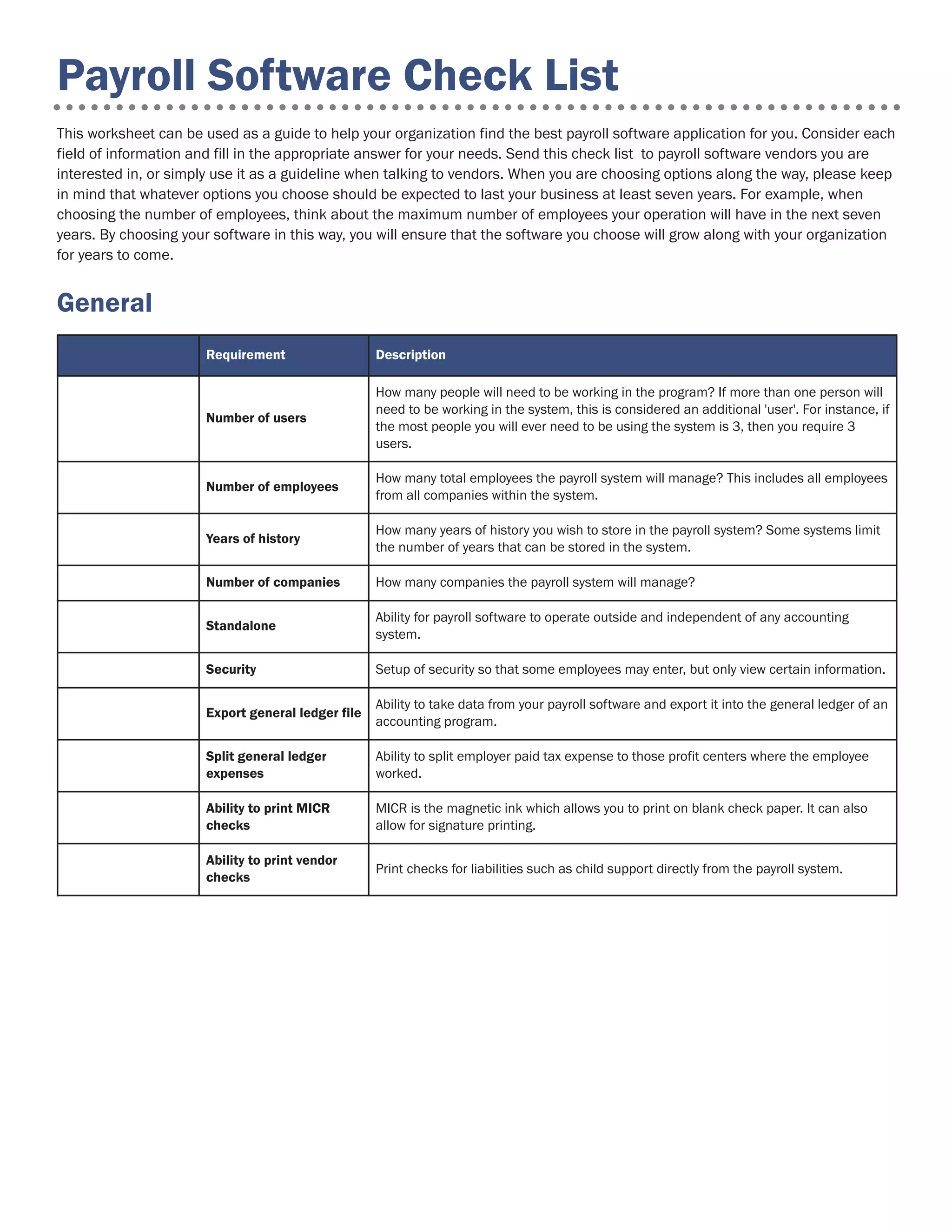

The document serves as a comprehensive checklist to assist organizations in selecting the best payroll software, highlighting essential features and requirements such as user count, data history, security, tax handling, and compliance. It emphasizes the importance of long-term planning for payroll needs to accommodate business growth over at least seven years. The checklist covers various functionalities including benefits management, time entry, reporting, and electronic tax processing.