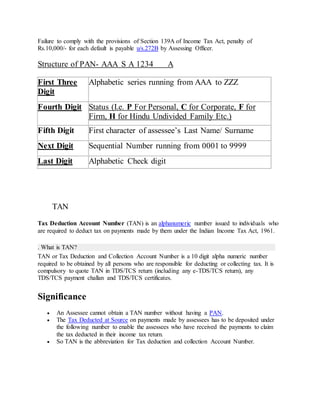

The document outlines the significance of the Permanent Account Number (PAN) and the Tax Deduction Account Number (TAN) as essential identifiers in the Indian tax system, required for various financial transactions and tax-related paperwork. PAN is a ten-digit alphanumeric code mandatory for activities such as opening bank accounts and property transactions, while TAN is needed for individuals or entities responsible for deducting tax at source. Both numbers are issued by the Income Tax Department and come with penalties for non-compliance.

![PAN

Permanent Account Number (PAN) is unique alphanumeric combination issued to all juristic

entities identifiable under the Indian Income Tax Act 1961. It is issued by the Indian Income Tax

Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also

serves as an important ID proof.

This number is almost mandatory for financial transactions such as opening a bank account,

receiving taxable salary or professional fees, sale or purchase of assets above specified limits etc

Permanent AccountNumber (PAN) is a ten-digit alphanumeric number, issued in

the form of a laminated card, by the Income Tax Department, to any “person”who

applies for it or to whom the department allots the number without an application.

PAN enables the department to link all transactions of the “person”with the

department.

PAN was introduced to facilitates linking of various documents, including payment

of taxes, assessment, returns of income/wealth/gift/FBT, specified transactions tax

demand, tax arrears etc. relating to an assessee, to facilitate easy retrieval of

information and to facilitate matching of information relating to investment, raising

of loans and other business activities of taxpayers collected through various

sources, bothinternal as well as external, for detecting and combating tax evasion

and widening of tax base.

PAN,thus, acts as an identifier for the “person”with the tax department.

WHY IS IT NECESSARY TO HAVE PAN?

It is mandatory to quote PAN on return of income, all correspondencewith any

income tax authority. From 1 January 2005 it has been mandatory to quote PAN on

challans for any payments due to Income Tax Department.

It is also compulsory to quote PAN in all documents pertaining to the following

financial transactions :-

(a) sale or purchase of any immovable property valued at five lakh rupees or more;

(b) sale or purchase of a motor vehicle or vehicle, [the sale or purchase of a motor

vehicle or vehicle does not include two wheeled vehicles, inclusive of any

detachable side-car having an extra wheel, attached to the motor vehicle;]

(c) a time deposit, exceeding fifty thousand rupees, with a banking company ;

(d) a deposit, exceeding fifty thousand rupees, in any account with PostOffice

Savings Bank;](https://image.slidesharecdn.com/pantan-160426054449/85/Pan-tan-1-320.jpg)

![Structure and validation[edit]

TAN structure is as follows: ANBA99999B: First four characters are letters, next 5

numerals, last character letter.

Each tax deductor is uniquely identified by his TAN.

If the TAN does not follow the above structure, then the TAN will be shown invalid.

The first three characters represent the city or state where the TAN was issued.

The fourth character of the TAN is the initial letter of the tax deduuctor:

Failure toapplyforTAN or not quotingthe same inthe specifieddocumentsattractsa penalty

of Rs.10,000/-.

Applying for TAN

TAN should applied through Form No 49B (prescribed under Income Tax Law). Such form can

be submitted online at NSDL website. OR can also be submitted at Tax Information Network

Facilitation Center (TIN-FC). These centers are established by NSDL (which is an appointed

intermediary by the Government) across India.

TAN Application should accompany a 'proof of identity' and a 'proof of address' (photocopies) of

the deductor. In case, the application is made online, these documents need to be sent over mail

(post/courier) to NSDL - TAN Application division.

Once NSDL receives the TAN application along with said documents (either through TIN FC /

Online), the details are verified and then sent to Income Tax Department. Once approved,

Income Tax Department will allocate a unique number, and indicate the applicant through NSDL

Application for allotment of TAN can either be made online at the NSDL-TIN website or

manually in Form 49B. The form is freely downloadable from NSDL-TIN website and also

available at TIN-FCs. Legible photocopies of the same in the prescribed format can also be used.

The application is to be submitted at TIN-FCs whose addresses are available at NSDL-TIN

website.

The applications are digitised by NSDL and forwarded to the Income-tax Department which

issues TAN. TAN is intimated to the applicant at the address mentioned in the application.

No documents are required to be submitted along with the application. In case of online

application, the signed acknowledgment which is generated after filling up the form is forwarded

to NSDL.](https://image.slidesharecdn.com/pantan-160426054449/85/Pan-tan-6-320.jpg)