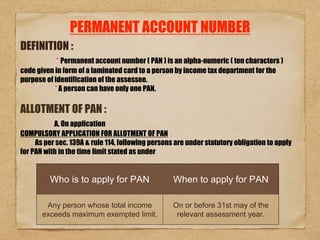

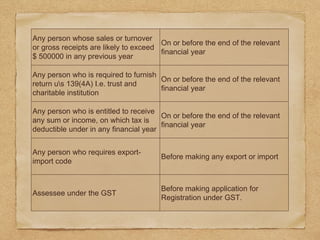

The document defines a Permanent Account Number (PAN) as a 10-character alphanumeric code issued by the income tax department to identify taxpayers. PAN is mandatory for certain individuals and entities, including those with income above a threshold, or involved in certain business transactions. It must be quoted on all tax-related documents and correspondence. Failure to apply for or quote PAN can result in penalties. PAN details are also required for transactions like opening bank accounts, purchasing vehicles, mutual funds or property to curb tax evasion.