Embed presentation

Downloaded 28 times

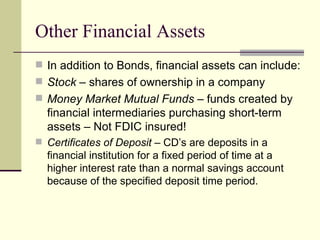

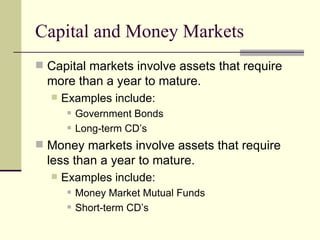

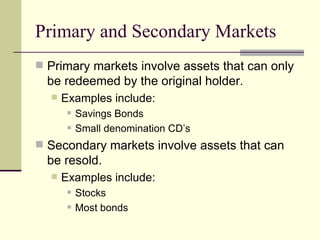

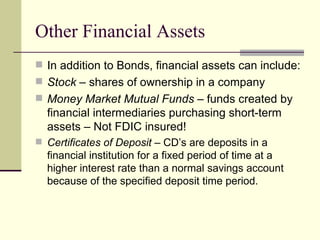

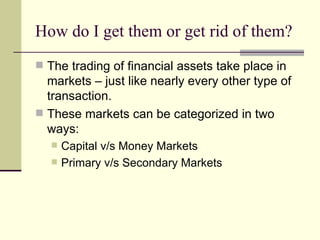

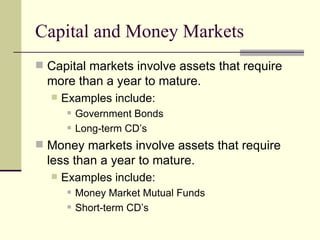

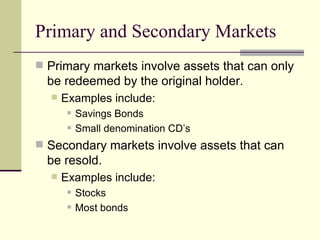

Other financial assets include stocks, money market mutual funds, and certificates of deposit. Stocks represent ownership in a company, money market mutual funds invest in short-term assets but are not FDIC insured, and certificates of deposit are bank deposits for a fixed time period at a higher interest rate. Financial assets are traded on capital markets, which involve assets that mature in over a year, or money markets, which involve assets that mature in under a year. They can also be traded on primary markets, where only the original holder can redeem the asset, or secondary markets, where the asset can be resold.