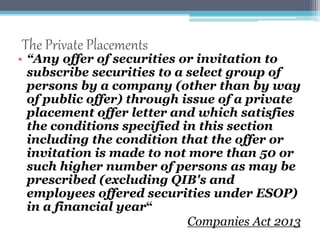

This document discusses various forms of long term debt financing for companies. It describes capital markets which facilitate the trade of securities like stocks and bonds. Private placements involve direct selling of bonds to a small number of qualified institutional investors like banks and insurance companies. Commercial papers are short term unsecured notes issued by large companies and financial institutions with maturities of up to nine months. Corporate bonds are longer term debt instruments issued by corporations to raise funds. Medium term notes have maturities between 5-10 years and combine aspects of commercial papers and corporate bonds.