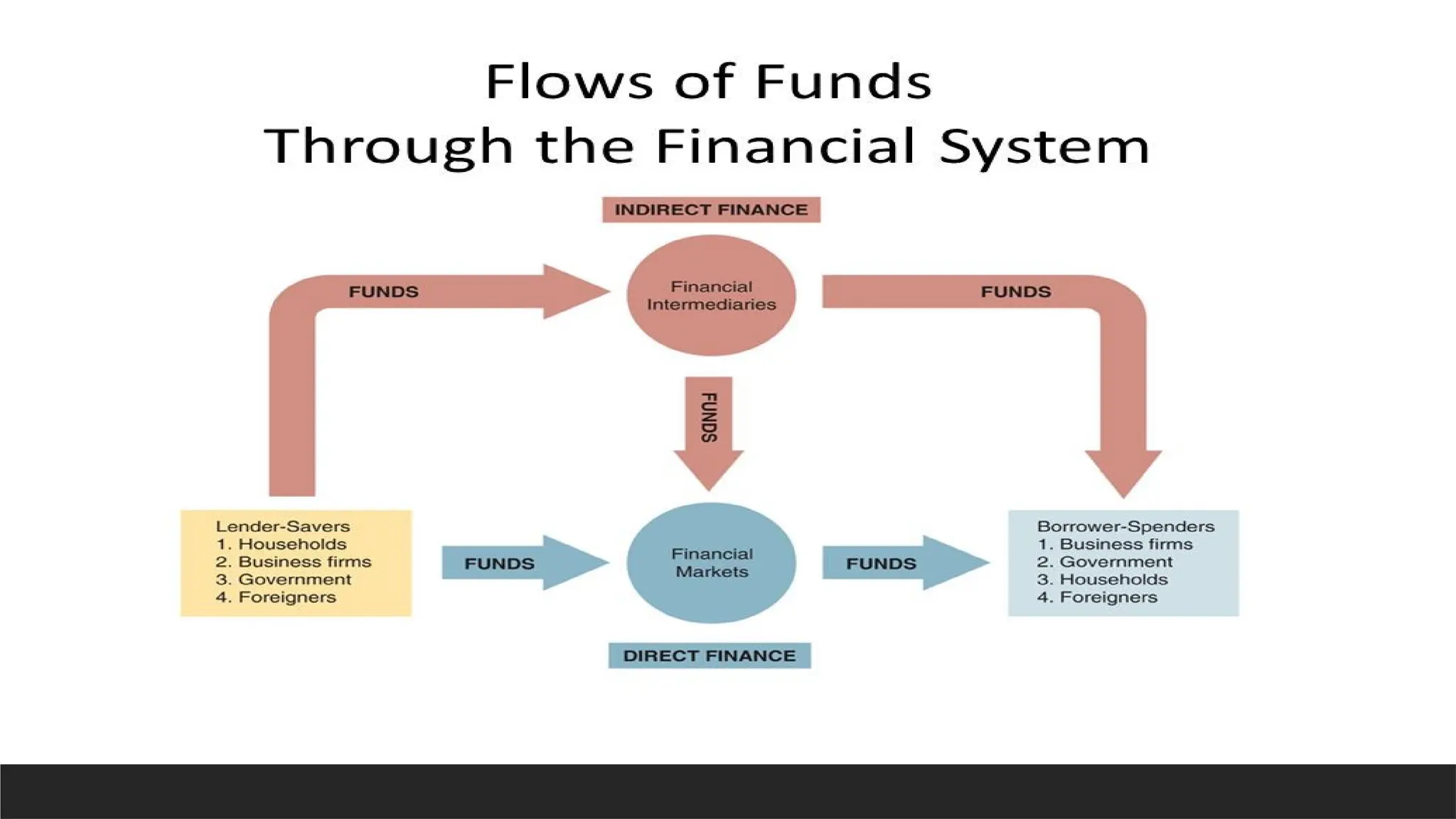

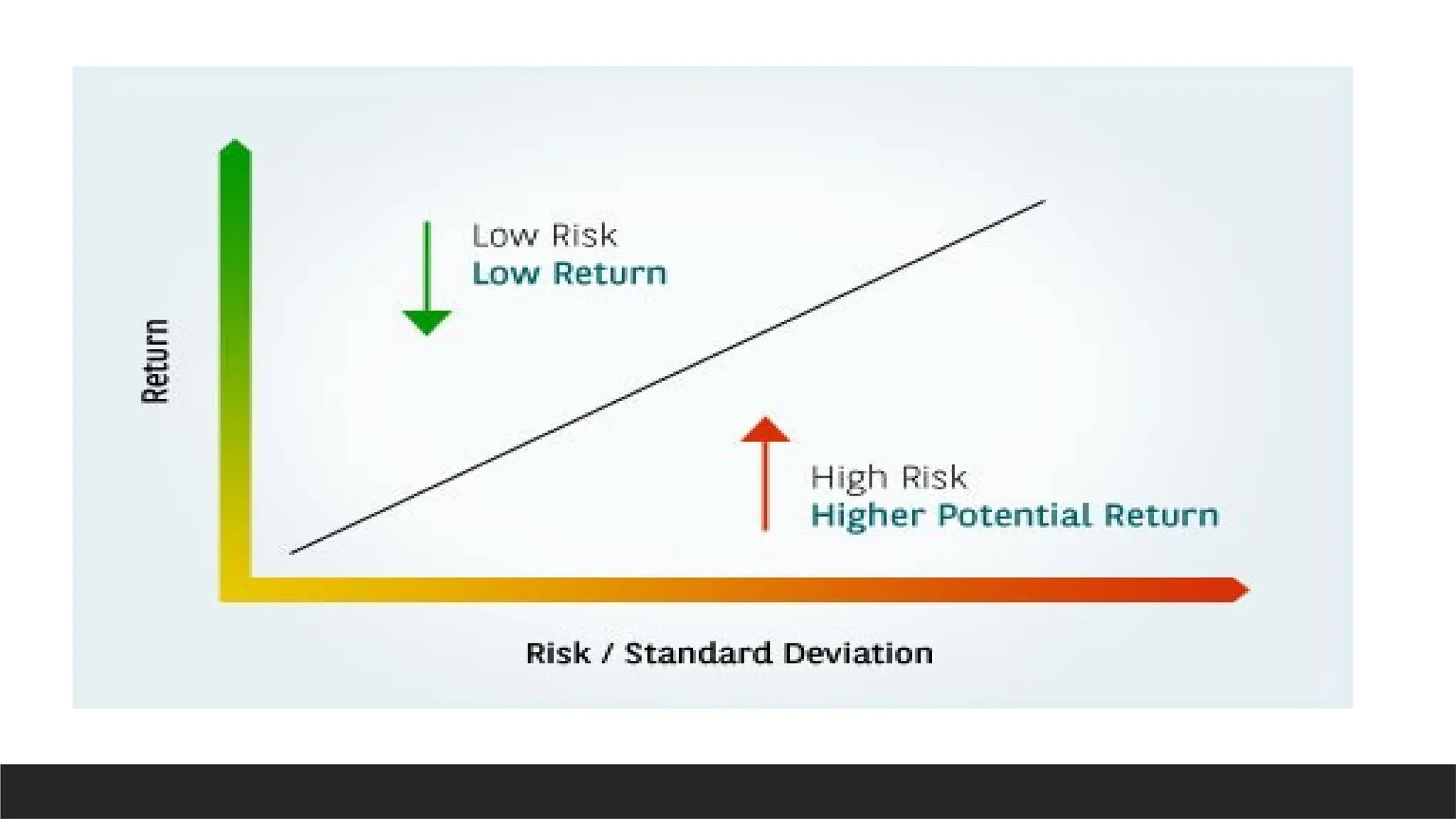

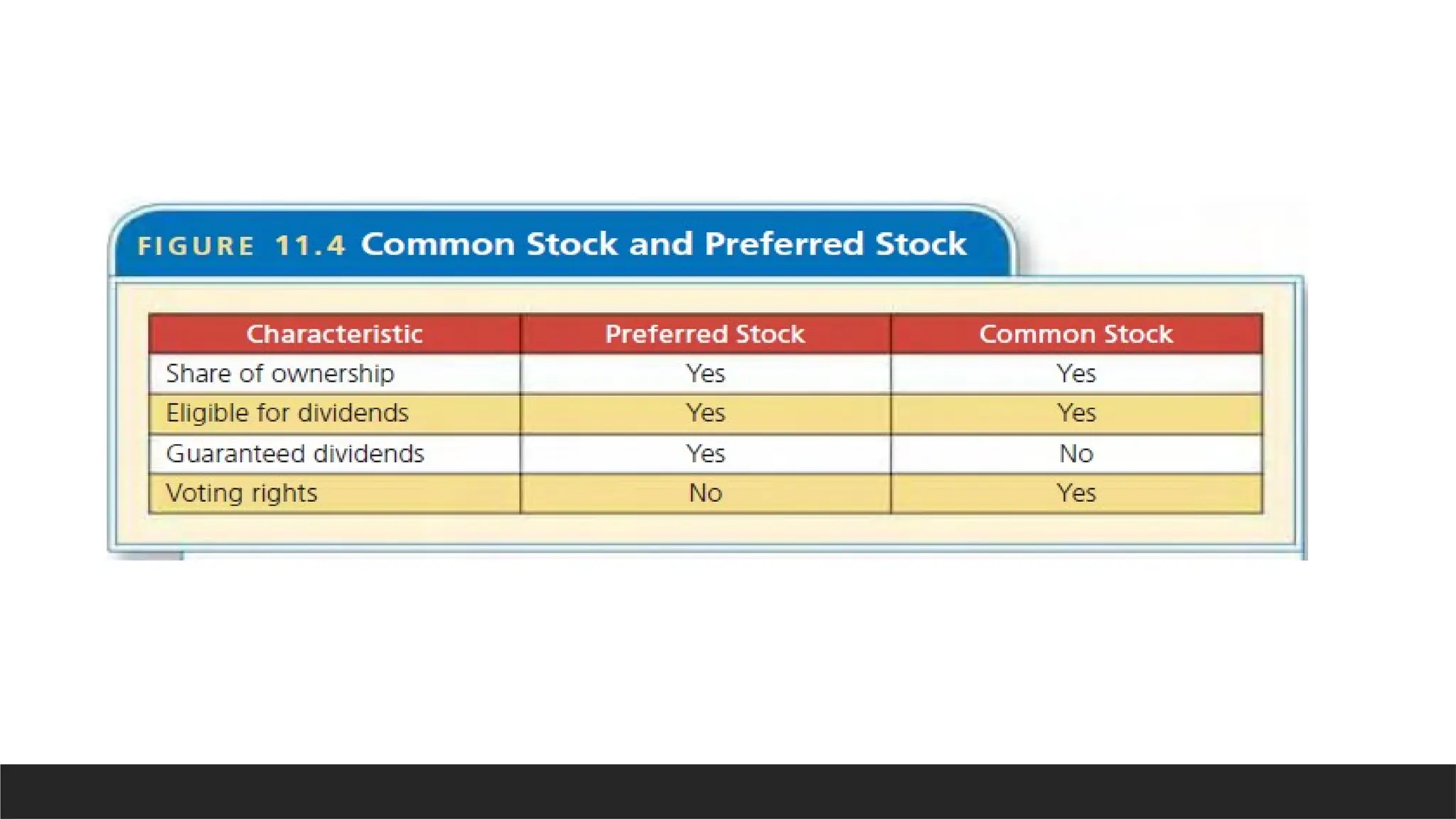

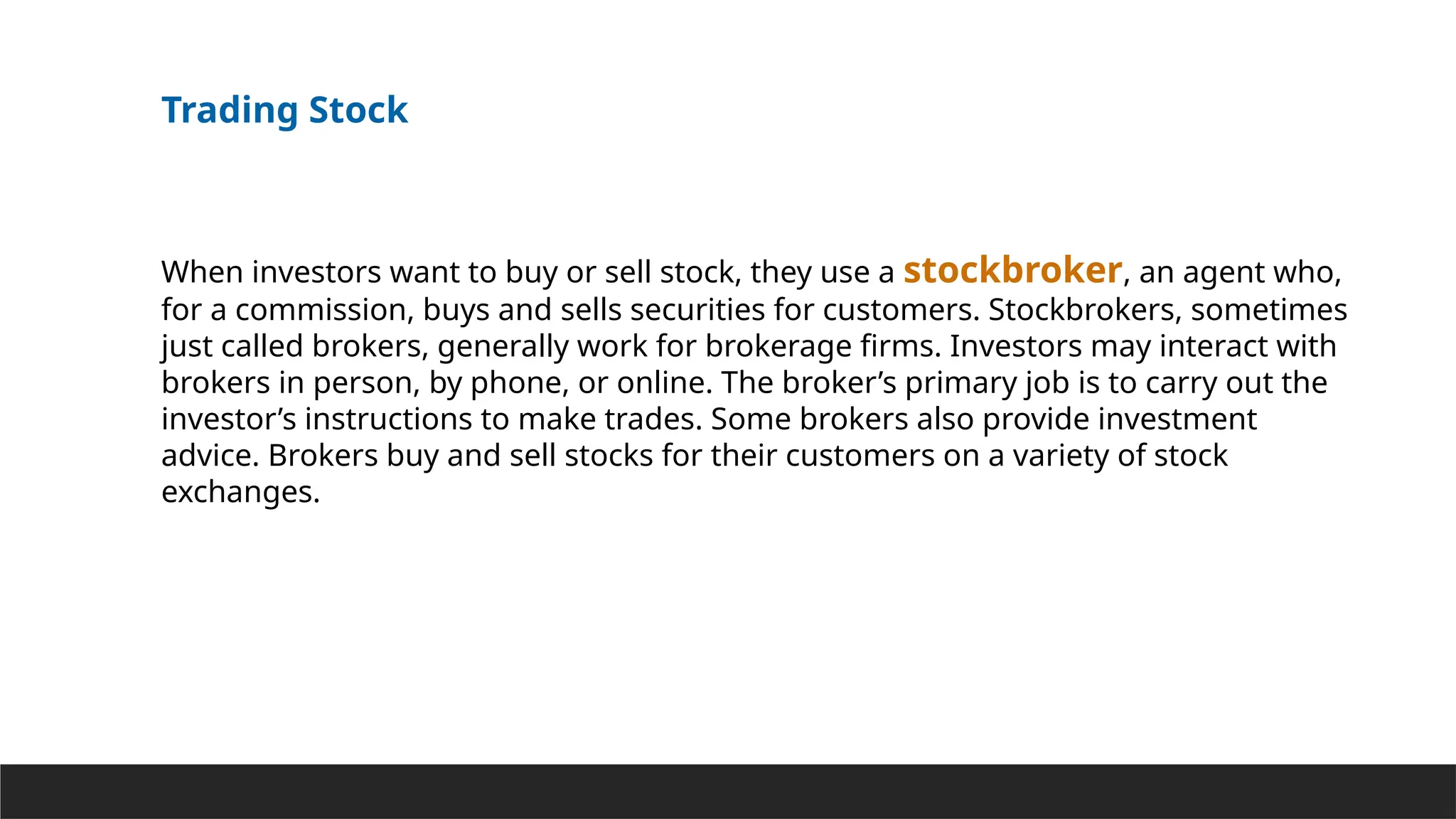

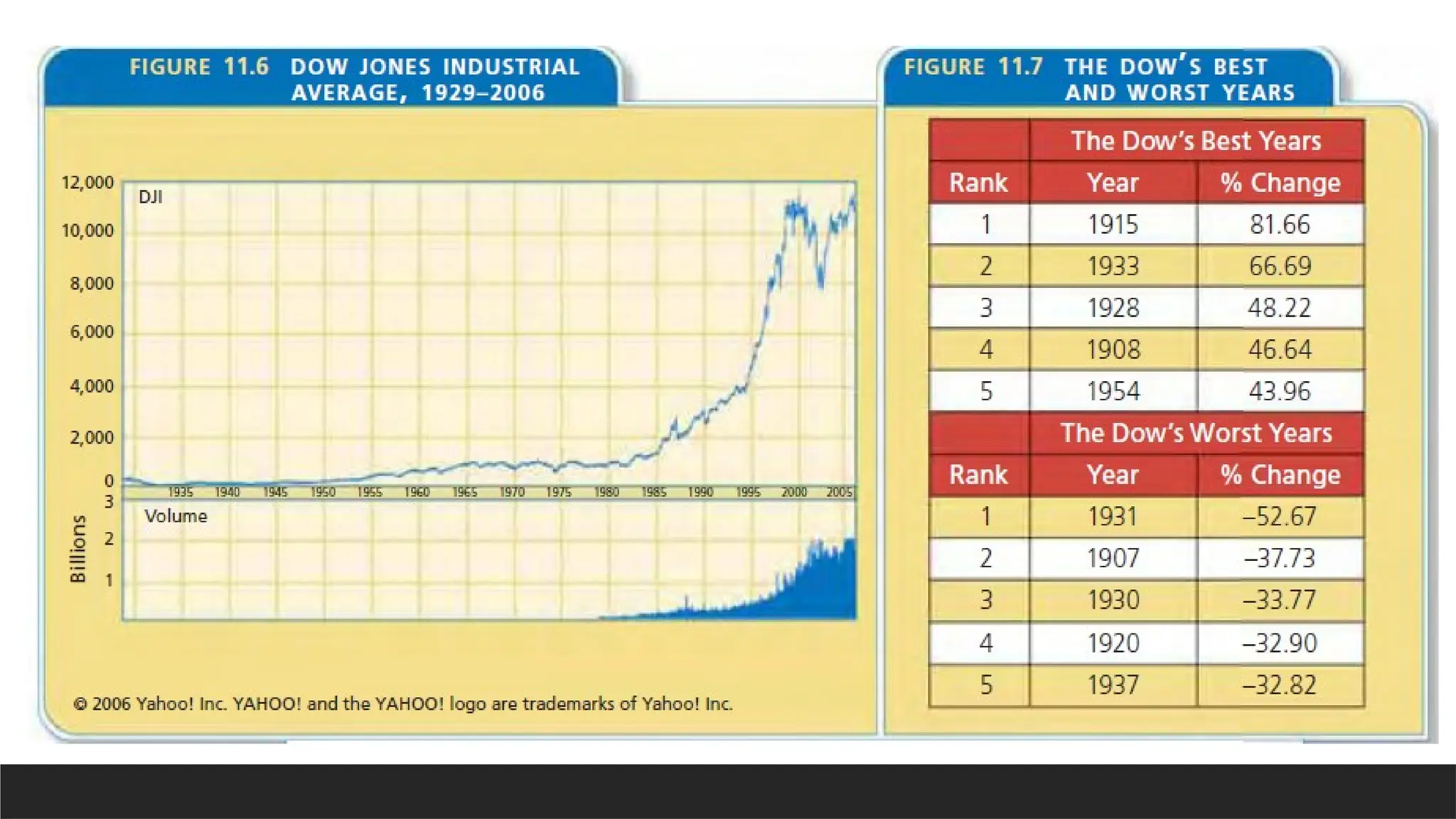

Chapter 11 covers financial markets, focusing on savings, investments, and how individuals and businesses can navigate these markets. It explains the distinctions between different types of financial assets, investment objectives, risks and returns, and the roles of financial intermediaries. The chapter also discusses stock trading, types of stocks, and how stock performance is measured through indices like the Dow Jones Industrial Average.