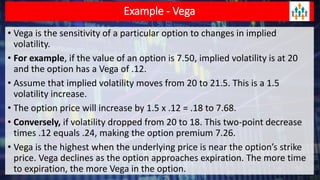

Vega measures an option's sensitivity to implied volatility, indicating how much the option's price will change with a one percentage point increase in volatility. All options have positive vega and gain value with rising volatility, with the highest vega occurring for at-the-money options, especially when there is more time to expiration. As options approach expiration, their vega decreases, and while volatility influences vega, at-the-money options maintain relatively stable vega across different volatility levels.