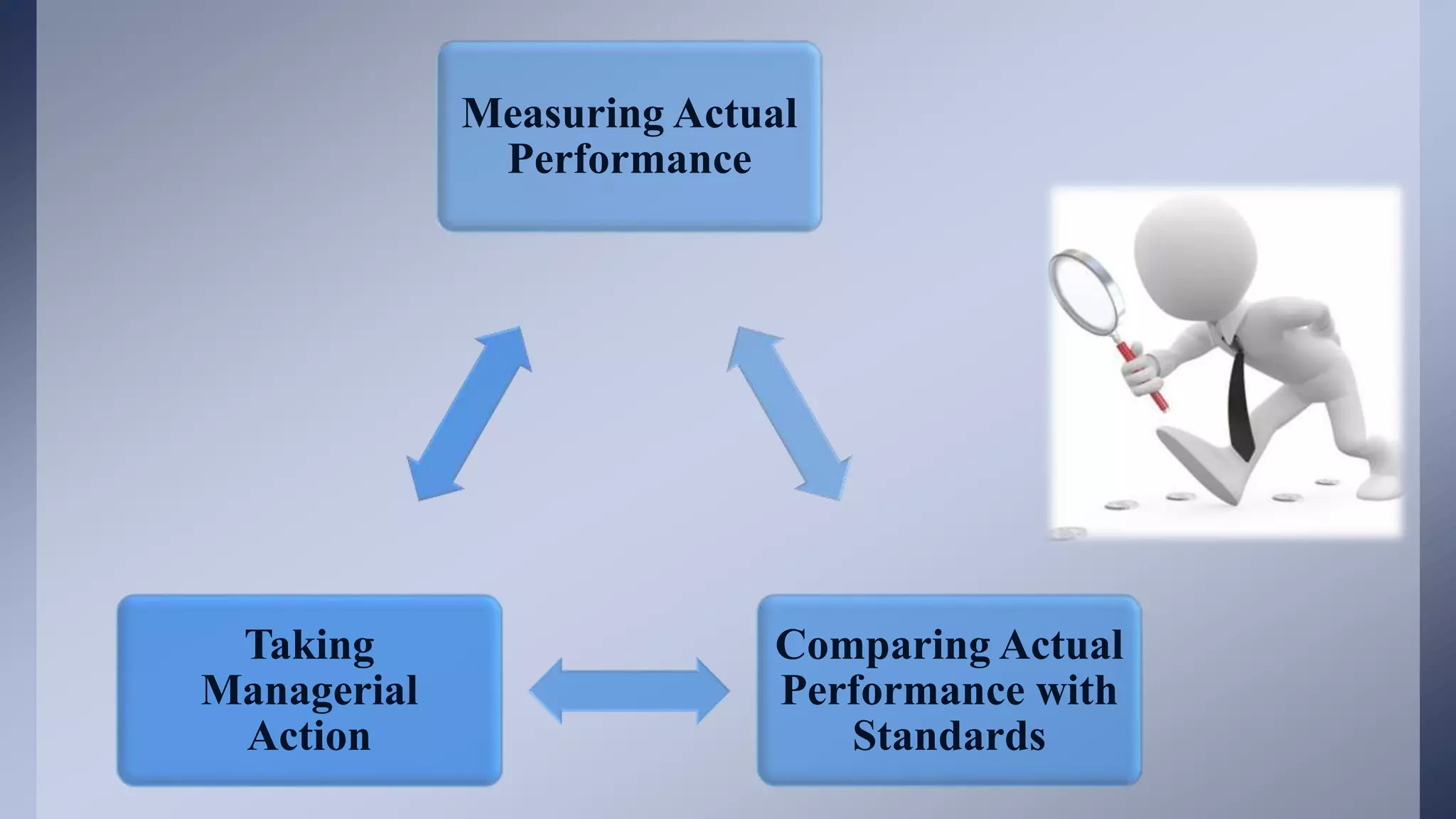

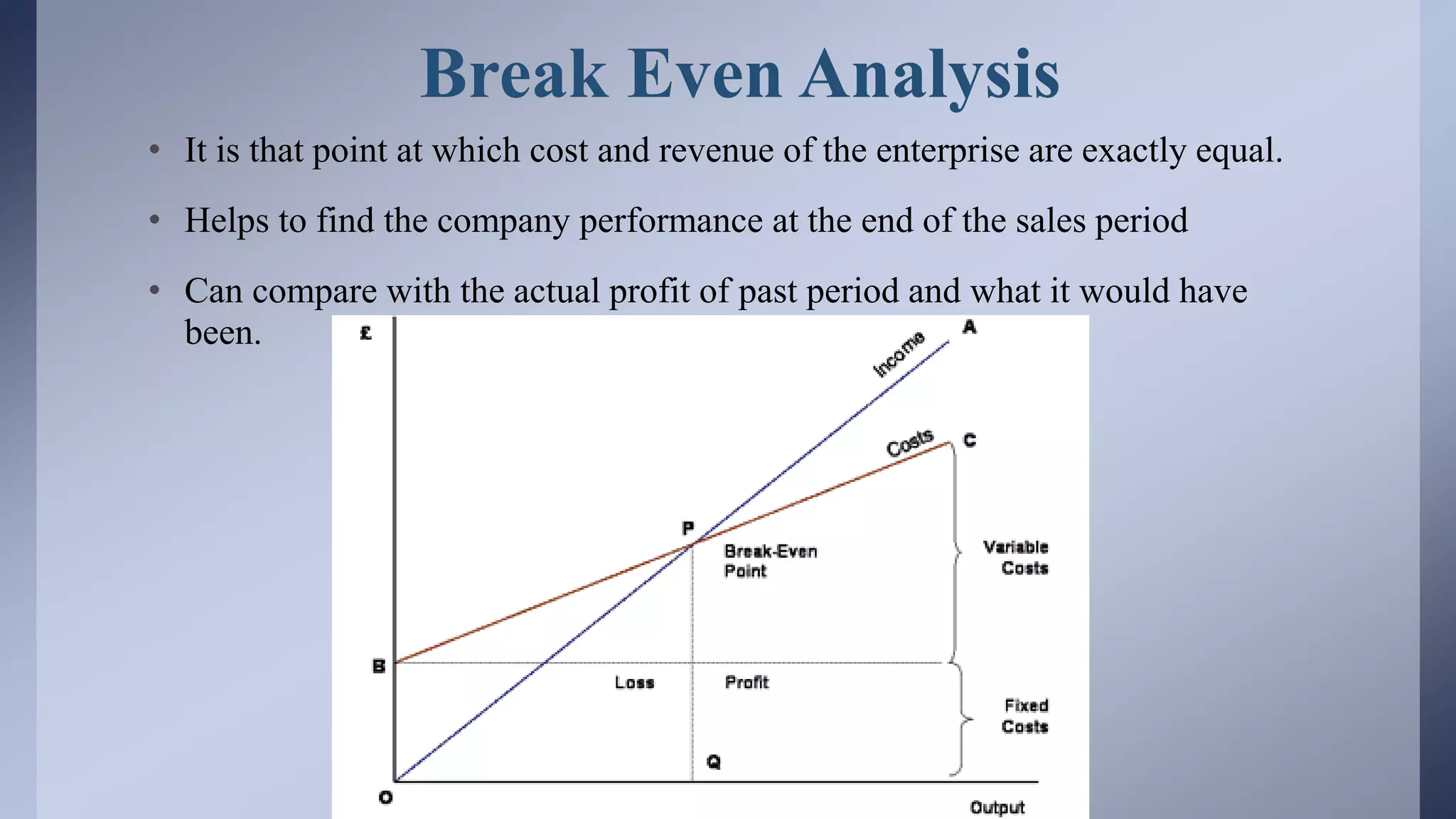

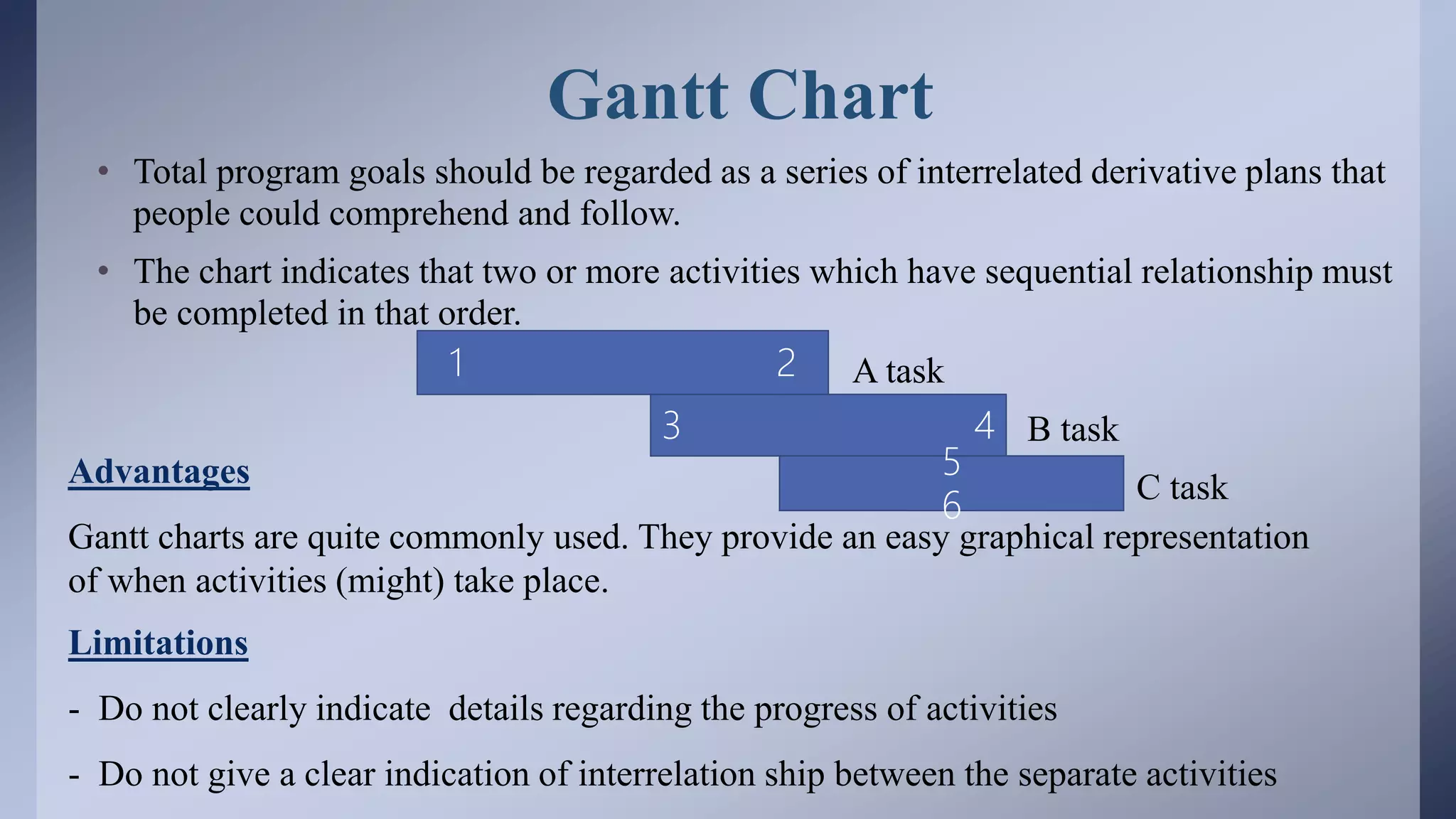

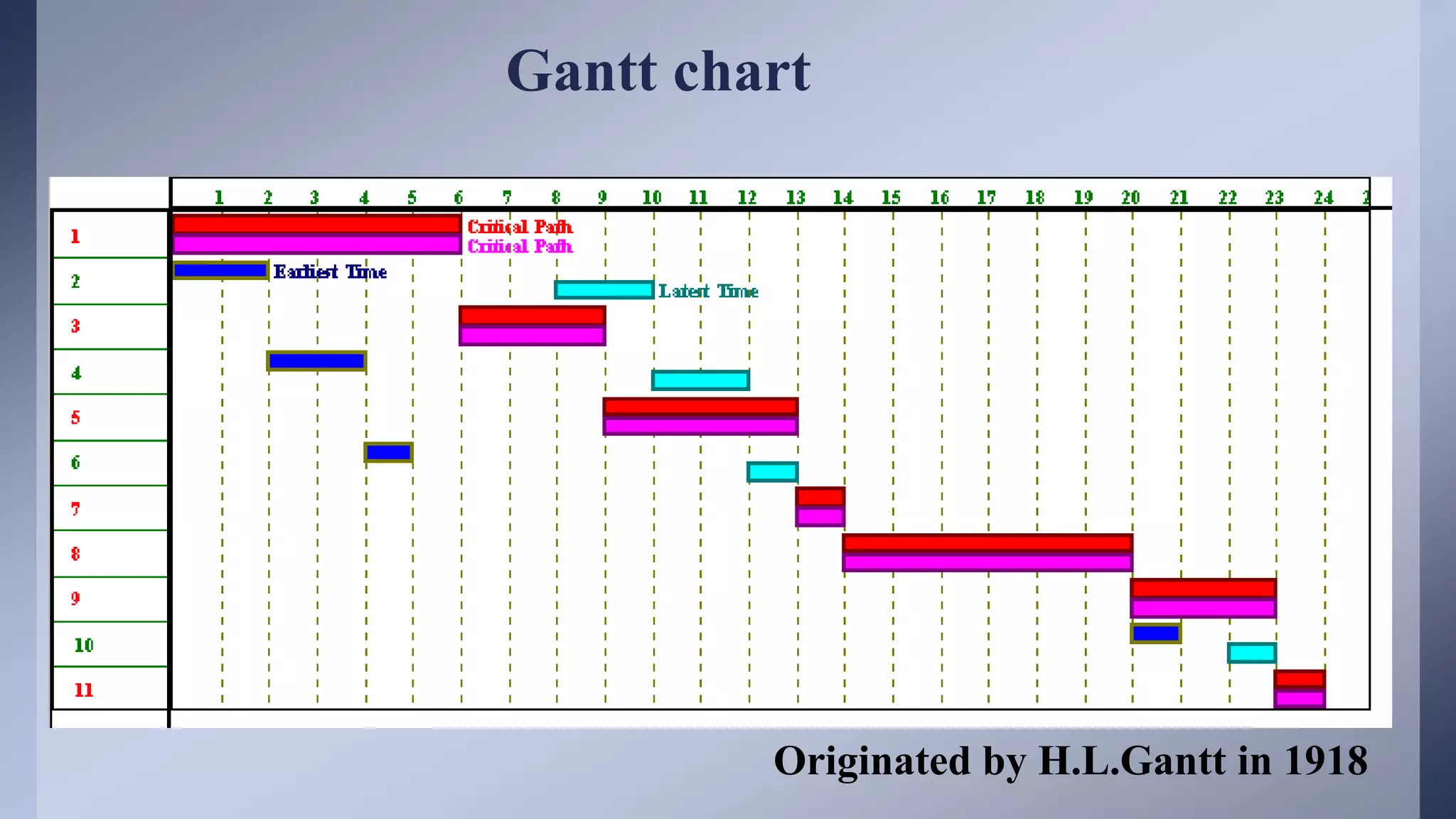

This document discusses various operational and financial control techniques used by managers. It begins by defining control as measuring and correcting performance to ensure objectives are met. It then separates control techniques into financial and operational categories. Some key financial techniques discussed include budgeting, cost accounting, ratio analysis, break-even analysis, and internal/external auditing. Operational techniques addressed include personal observation, Gantt charts, responsibility accounting, and management audits. The document provides details on how each technique works and its purpose in helping managers monitor and improve organizational performance.