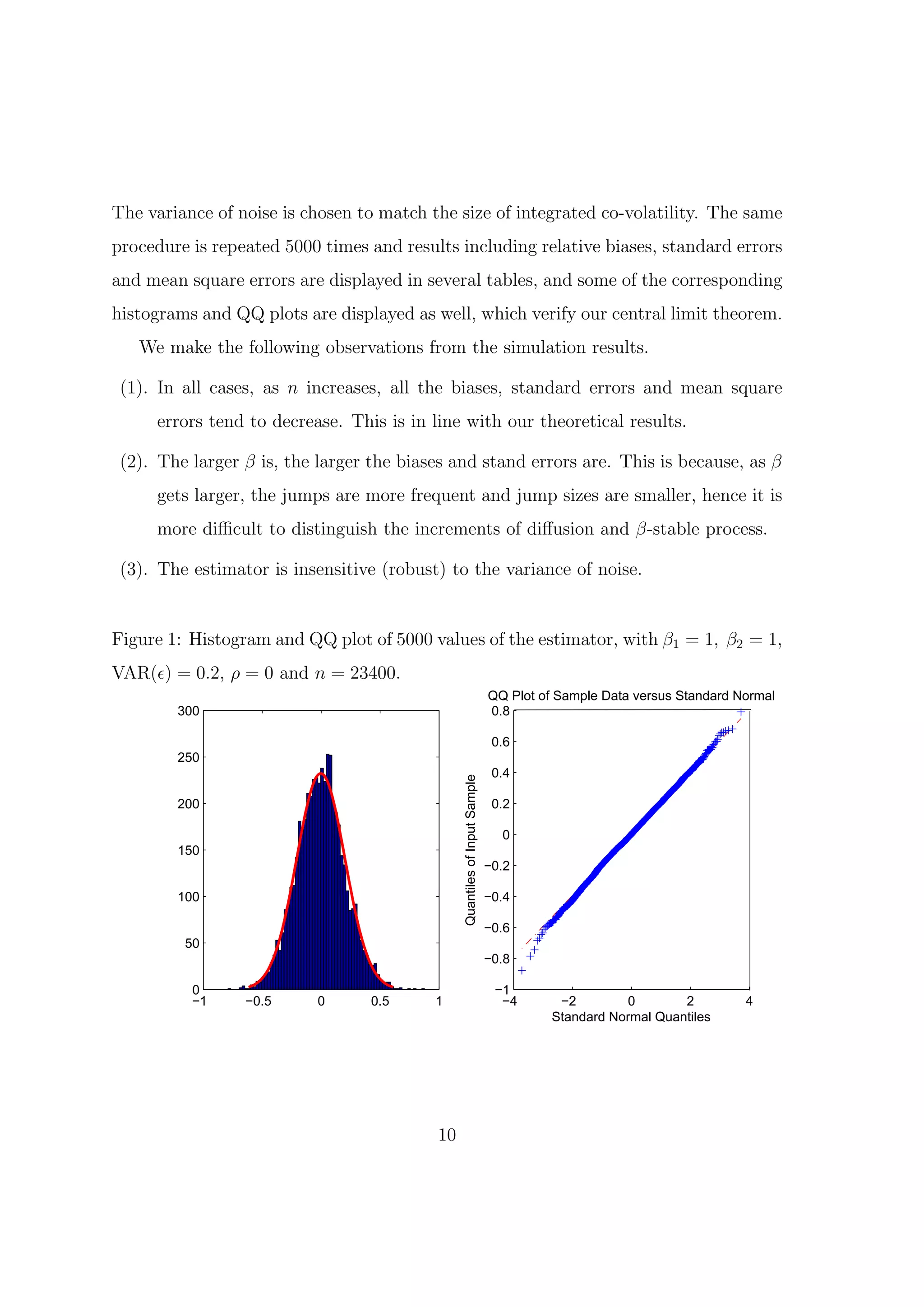

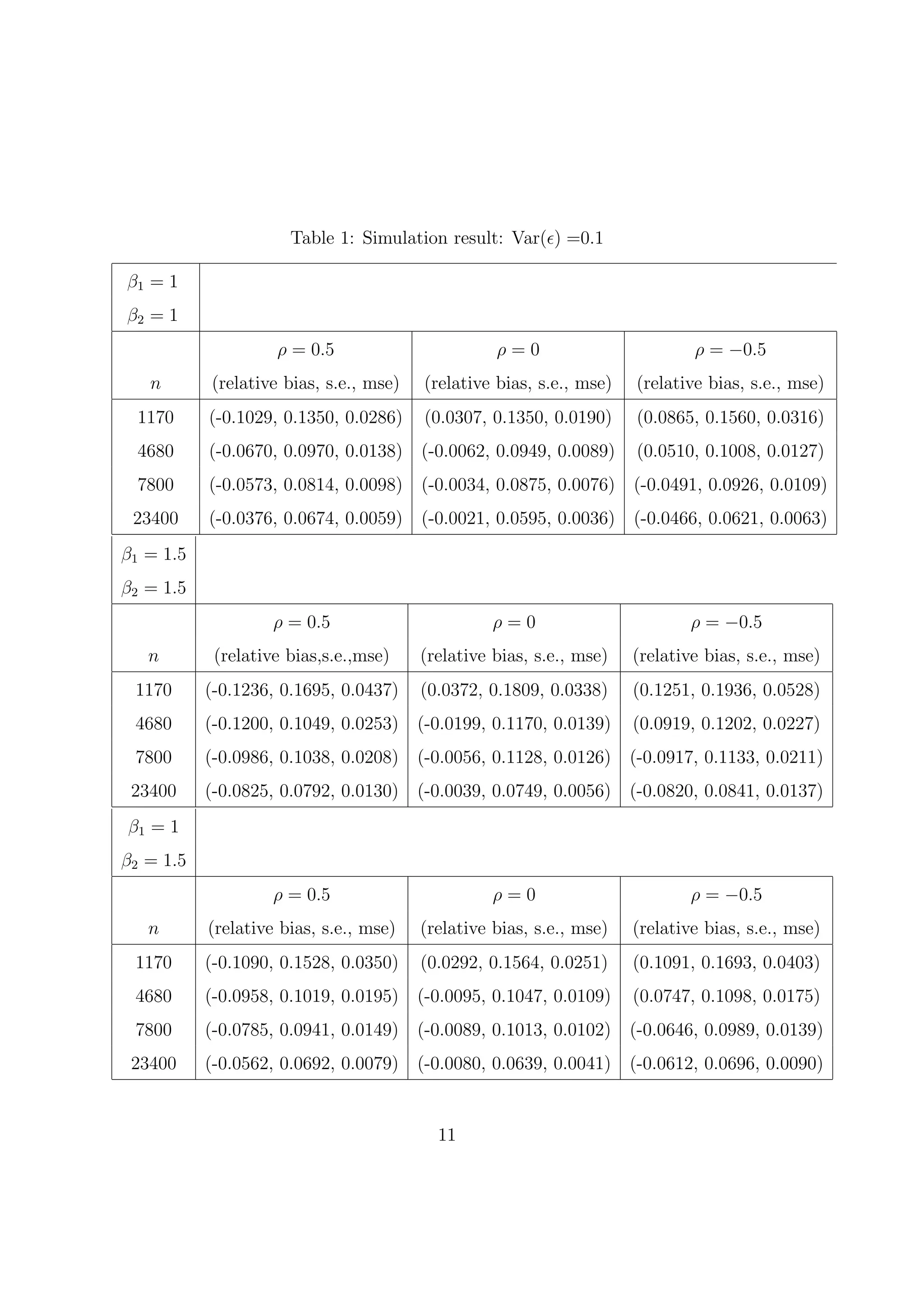

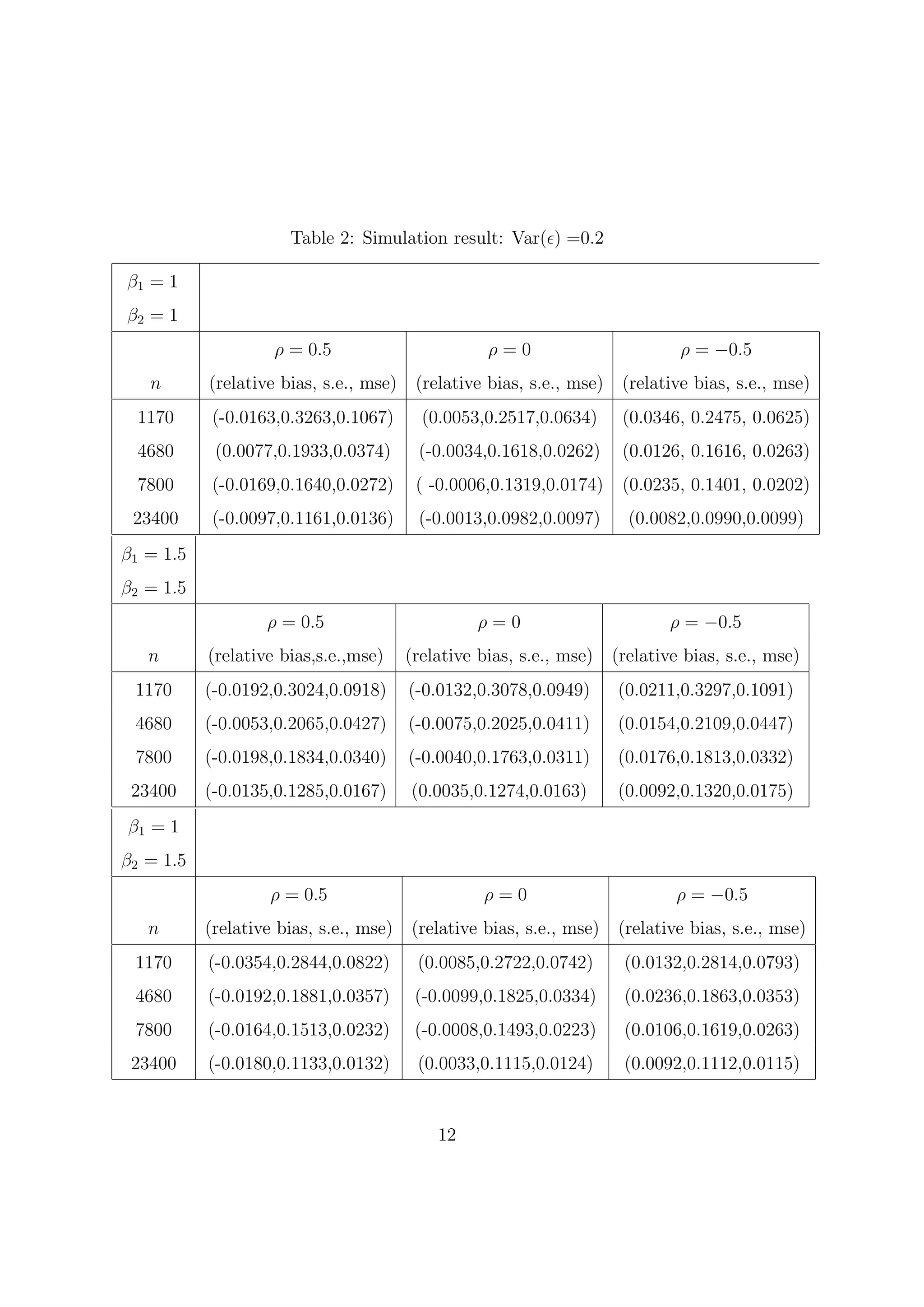

This document proposes a method to estimate the integrated co-volatility of two asset prices using high-frequency data that contains both microstructure noise and jumps.

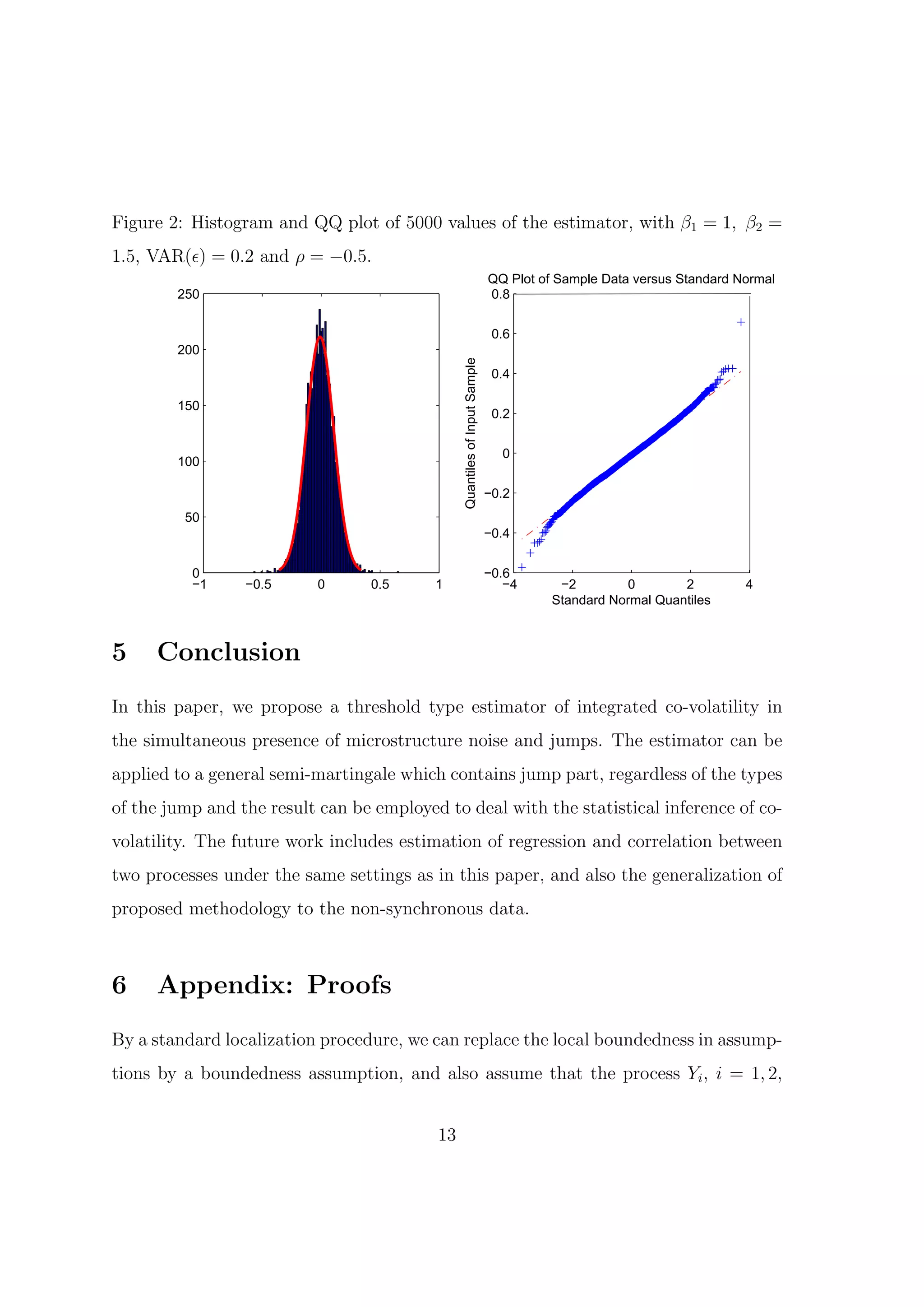

It considers two cases - when the jump processes of the two assets are independent, and when they are dependent. For the independent case, it proposes an estimator that is robust to jumps. For the dependent case, it proposes a threshold estimator that combines pre-averaging to remove noise with a threshold method to reduce the effect of jumps. It proves the estimators are consistent and establishes their central limit theorems. Simulation results are also presented to illustrate the performance of the proposed methods.

![1 Introduction

Suppose that we have p-multiple underlying log price processes of assets, X1t , ..., Xpt .

Denote Zt = (Z1t , ..., Zpt )τ for any generic processes Zit ’s. Then a widely used model

for Xt is the following semi-martingale:

Xt = Xc + Xd ,

t t (1.1)

where Xc and Xd are, respectively, the continuous and discontinuous components,

t t

whose forms are given in (2.3)-(2.4) later. From Protter (1990) and Jacod and

Shiryaev (2003), it is known that the covariance matrix [X, X]T has the following

decomposition:

[X, X]T = [Xc , Xc ]T + [Xd , Xd ]T .

Given discrete high frequency observations, Xti at 0 = t0 < t1 < ... < tn = T ,

both for pricing and hedging purposes and for financial econometrics applications,

it is important to separate the contributions of the diffusion part and jump part of

X (see Andersen et. al (2001); Barndorff-Nielsen and Shephard (2002b); Mancini

(2009)). Define the realized covariance matrix (RCV ) as

∑

n

RCV =: [X, X]T = ∆n X(∆n X)τ

i i

i=1

where ∆n X

i = Xti − Xti−1 is a column vector and Aτ defines the transpose of matrix

A. It is well known (see, e.g., Protter (1990)) that [X, X]T →P [X, X]T . Therefore,

it suffices to focus on the estimation of the continuous part [Xc , Xc ]T , which is the

center of our attention in the present paper.

However, it is widely accepted that the observed prices are contaminated by mi-

crostructure noise due to bid-ask spreads and/or rounding errors etc. Hence, instead

of observing Xti = (X1ti , ..., Xpti ), we observe Yti = (Y1ti , ..., Ypti ), where

Yti = Xti + ϵti , i = 0, 1, ..., n, (1.2)

2](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-2-2048.jpg)

![where Xt are the latent semi-martingale price processes, the perturbation term ϵti =

(ϵ1ti , ..., ϵpti ) is the microstructure noise at time ti . Our objectives concern the in-

ference of [Xc , Xc ]T (and [Xd , Xd ]T ) for the latent price process X, based on the

contaminated observations Yti ’s.

The covariation matrix is of strong interest in financial applications, such as port-

folio risk and hedging of funds management; see, e.g., A¨

ıt-Sahalia, Fan, and Xiu

(2010), A¨

ıt-Sahalia, Mykland and Zhang (2011), Bai, Liu and Wong (2009), Zheng

and Li (2010) among others.

For p = 1, there has been a huge literature on the integrated volatility estimation.

In the absence of microstructure noise (ϵ = 0), we refer the reader to Andersen,

et al. (2001), Barndorff-Nielsen and Shephard (2002a, 2002b), Jacod and Protter

(1998), Mykland and Zhang (2006), Mancini (2009) among others. In the presence of

microstructure noise, the references include A¨

ıt-Sahalia, Mykland and Zhang (2005,

2011) and Bandi and Russell (2006), Zhang, Mykland, and A¨

ıt-Sahalia (2005) and

Zhang (2006), Fan and Wang (2007), Podolskij and Vetter (2009a, 2009b), Barndorff-

Nielsen et al. (2008), and Jacod, Podolskij and Vetter (2010), among others.

For p ≥ 2, there has been an increasing literature recently. For instance, Gobbi

and Mancini (2009, 2010) derived an asymptotically unbiased estimator of the con-

tinuous part of the covariation process as well as of the co-jumps, and considered

its asymptotic behavior as well. However, these works assume that there is no mi-

crostructure noise in the underlying price process Xt .

In this paper, we attempt to develop a procedure that gives a consistent estimator

of the integrated co-volatility in the simultaneous presence of microstructure noise

and jumps. The method combines the two approaches: the pre-averaging method and

threshold technique. The former is employed to reduce the effect of microstructure

noise while the latter is used to remove the jumps. The central limit theorem is also

developed. The study of the p × p covariation matrix has some distinct features,

3](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-3-2048.jpg)

![compared with that of variation in the one-dimensional case. As will be seen later,

its studies depend on the assumptions of how the jumps of components related to

each other, and yield different estimators under different assumptions.

The remainder of this paper is organized as follows. In Section 2, we give some

assumptions on the model. We introduce the asymptotic theorems and central limit

theorem in Section 3. Simulation study is put to Section 4. Section 5 features the

conclusions and all the technical proofs are postponed to the appendix.

2 Preliminaries

2.1 Model assumptions

Since there is no essential difference between the two cases: p = 2 and p > 2, so for

simplicity, we shall assume that p = 2 from now on. In this case, [Xc , Xc ]t involves

c c c c c c

three [X1 , X1 ]t , [X2 , X2 ]t , and [X1 , X2 ]t . The first two variation processes are well

c c

studied in the literature. Below, we will focus on the covariation process [X1 , X2 ]t .

c d

We now describe model (1.2) in details. Assume that Xrt = Xrt + Xrt , r = 1, 2,

defined on a stochastic basis (Ω, F, Ft , P ), are Itˆ semi-martingales of the form

o

∫ t ∫ t

c

Xrt = Xr0 + brt dt + σrt dWrt (2.3)

∫ t∫ 0 0

∫ t∫

d

Xrt = x(µr − νr )(ds, dx) + xµr (ds, dx), (2.4)

0 |x|≤1 0 |x|>1

where b and σ are locally bounded optional processes, µr is a jump measure compen-

sated by νr , and νr has the form dtFrt (dx), where Frt (dx) is a transition measure form

∫

Ω × R+ endowed with the predictable σ-field into R/0. If |x|≤1 |x|Frt (dx) < ∞, we

∫

say that Xr has finite variation. Let βr =: inf{s : |x|≤1 |x|s Frt (dx) < ∞}, which is

d

called jump activity index in the literature. Further Wr = (Wrt ) are standard Wiener

4](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-4-2048.jpg)

![processes such that d[W1 , W2 ]t = ρdt. The integrated covariation is defined as

∫ T

c c

[X1 , X2 ]T = ρσ1s σ2s ds. (2.5)

0

We will impose some condition on the microstructure noise. For more details, see

Jacod, Podolskij and Vetter (2010).

Assumption 1 (Microstructure noise) The microstructure noise = (ϵ1 , ϵ2 ) are

ϵ

2

ω1 0

iid processes with E[ϵt ] = 0 and E[ϵt ϵ′t ] = ω, where ω = . We further

2

0 ω2

assume X ⊥ ϵ (here, ⊥ denotes stochastic independence).

2.2 Notations

• Let g be a continuous weight function on [0,1] with a piecewise Lipschitz deriva-

∫1

tive g ′ with g(0) = g(1) = 0 and 0 g 2 (s)ds > 0. Define

∫1

– g (2) =

¯ 0

g 2 (s)ds,

∫1 ∫1

– h(s) = s

g(u)g(u − s)du, Φ = 0

h2 (s)ds.

• For a generic process Z = {Zt , t ≥ 0}, the one-step increment is ∆n Z = Zti −

i

Zti−1 , and kn -step pre-averaged increment is defined as (kn is an integer)

∑

kn −1

∆n n Z

i,k = g(j/kn )∆n Z.

i+j

j=1

• Yt = Xc + ϵt , Yt = Xd = Xt − Yt . ∆n = T /n and ∆s X = Xs − Xs− .

c

t

d

t

c

• ∥x∥ represents the Euclidean distance.

5](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-5-2048.jpg)

![3 Main results

c c

We now consider the estimation of the integrated covariation [X1 , X2 ]T in (2.5). The

d d

estimators depend on how the jumps from the two processes, X1t and X2t , are related

to each other. We consider two separated cases below.

Case I: Two jump processes are independent

First we suppose that jump parts of two processes are independent. This is appro-

priate when the jumps are mainly due to effects of individual stocks but not the

systematic influence. In this case, we define an estimator as

∑

n−kn +1

V1n (Y) = (∆n n Y1 )(∆n n Y2 ).

i,k i,k (3.6)

i=0

√

Theorem 1 Assume that E∥ϵ∥4 < ∞. Fix θ > 0 and choose kn such that kn ∆n =

1/4

θ + O(∆n ). Then, under Assumption 1, we have

∫ T

1

∆ V1n (Y) →

1/2 P

ρσ1s σ2s ds.

θ¯(2) n

g 0

Remark 1 Although V1n (Y) contains jumps from both processes, their effects disap-

pear in the limit. It is not surprising because two independent purely discontinuous

processes never jump together almost surely. It is therefore easy to understand why the

estimator takes the same form as that by Podolskij and Vetter (2009a), who consider

a similar problem but without jumps.

Case II: Two jump processes are dependent

We now consider a more general case, which allows the two jump process to be

correlated. The two individual stocks may jump together since the common news

6](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-6-2048.jpg)

![such as the government announcements may affect all the individual stocks. In this

case, the estimator V1n (Y) in (3.6) will not work as all the common jumps will be

included in the limit. We need to get rid of the effect of the jumps from V1n (Y).

For ease of exposition, let us take kn = θ n1/2 from now on unless otherwise stated.

After the pre-averaging procedure, the smoothed increments from the diffusion part

1/4

and the smooth noise part, are both of size ∆n , while the smoothed increments from

1/4

the jump part may still be larger than ∆n . Following the idea of Mancini (2009) or

Jacod (2008), we can propose the following threshold estimator of [X c , X c ]T :

∑

n−kn +1

V2n (Y) = (∆n n Y1 )(∆n n Y2 )1{|∆n (1) 1{|∆n (2) (3.7)

i,kn Y1 |≤un } i,kn Y2 |≤un }

i,k i,k

i=0

(r)

where, un satisfy

un /∆ϖ1 → 0, u(r) /∆ϖ2 → ∞, for some 0 ≤ ϖ1 < ϖ2 < 1/4, r = 1, 2.

(r)

n n n (3.8)

(r)

The threshold level un is chosen such that those (smoothed) increments larger than

(r)

un will be gradually excluded as n → ∞, and essentially only those increments due

to continuous part are included for the calculation of the integrated co-volatility since

we already smooth the data by pre-averaging. Hence we have the next theorem.

Theorem 2 Assume that E∥ϵ∥4 < ∞. Under Assumption 1, we have

∫ T

1

∆ V2n (Y) →

1/2 P

ρσ1s σ2s ds. (3.9)

θ¯(2) n

g 0

We now establish the central limit theorem. To do that, a structural assumption

on the volatility process σ is needed for technical reasons.

Assumption 2 The volatility process σ = {σt , t ≥ 0} satisfies the equation

∫ t ∫ t ∫ t

′ ′ ′ ′

σrt = σr0 + ars ds + σrs dWrs + νrs dBrs , (3.10)

0 0 0

where a′ , σ ′ and ν ′ are adapted c`dl`g processes, with a′ being predictable and locally

a a

bounded, and B ′ is a standard Brownian motion, independent of W , for r = 1, 2.

7](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-7-2048.jpg)

![The concept of stable convergence is needed in the next theorem. A sequence

of random variables Xn converges stably in law to X defined on the appropriate

extension of the original probability space, written as Xn →S X, if

lim P (Xn ≤ x, A) = P (X ≤ x, A), for any A ∈ F and any x ∈ R.

n→∞

If Xn →S X, then for any F−measurable random variable σ, we have the joint

weak convergence (Xn , σ) =⇒ (X, σ). So stable convergence is slightly stronger than

convergence in law.

Theorem 3 Let X1t and X2t be given in (2.3) and (2.4). Under Assumptions 1-2,

E∥ϵ∥8 < ∞, and X1 and X2 are of finite variation, we have

d d

( ∫ T ) √ ∫ T

1 √

−1/4 S 2 θΦ

∆n ∆n V2n (Y) −

1/2

ρσ1s σ2s ds → 1 + ρ2 σ1s σ2s dWs′ ,

θ¯(2)

g 0 g (2) 0

¯

where W ′ is a standard Brownian motion which may be defined on an extension of

the original space and independent of F.

To do inference for the integrated covariance, we need to estimate the asymptotic

∫T

conditional variance 0 (1 + ρ2 )(σ1s σ2s )2 ds. Inspired by Mancini (2009), we have

∑

n−kn +1

Γ2

n = ∆n [(△n n Y1 )(△n n Y2 )]2 1{|∆n

i,k i,k (1) 1{|∆n (2)

i,kn Y1 |≤un } i,kn Y2 |≤un }

i=0

∫ T ( ∫ T ∫ T )

→P 3θ2 g (2)2

¯ (1 + ρ2 )σ1s σ2s ds + g (2)g ′ (2) ω2

2 2

¯ ¯ 2 2 2

σ1s ds + ω1 2

σ2s ds

0 0 0

¯ 2

g ′ (2) 2 2

+ 2 ω1 ω2 T.

θ

∑n

2

Remark 2 Zhang, et al. (2005) showed ωr = 1

2n

n

i=1 (△i Yr )

2

→p ωr when X has

2

continuous path. Jing, Liu and Kong (2010) showed that this is still true when X

contains jumps. Thus, we obtain a consistent estimator for integrated volatility as

∫ T

1 ¯

g ′ (2) 2

Σr = △ U (Yr , g)t − 2

1/2 n

ω T → P 2

σrs ds,

θ¯(2) n

g θ g (2) r

¯ 0

8](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-8-2048.jpg)

![References

[1] A¨

ıt-Sahalia, Y., Fan, J., and Xiu, D. (2010). High frequency covariance esti-

mates with noisy and asynchronous aata. Journal of the American Statistical

Association. 2010, 105, 15041517.

[2] Ait-Sahalia, Y and Jacod, J. (2010). Is Brownian motion necessary to model high

frequency data? Annals of Stastistics. 38(5), 3093-3128.

[3] A¨ıt-Sahalia, Y., Mykland, P., Zhang, L. (2005). How often to sample a

continuous-time process in the presence of market microstructure noise. Review

of Financial Study 18, 351-416.

[4] A¨ıt-Sahalia, Y., Mykland, P. A., and Zhang, L. (2011). Ultra high frequency

volatility estimation with dependent microstructure noise, Journal of Economet-

rics, 160, 190-203.

[5] Andersen, T., Bollerslev, T., Diebold, F., Labys, P. (2001). The distribution of

realized exchange rate volatility. Journal of the American Statistical Association

96, 42-55.

[6] Bai, Z., Liu, H., and Wong, W. (2009). Enhancement of the applicabiity of

Markowitz’s portfolio optimization by utilizing random matrix theory. Math. Fi-

nance, 19, 639-667.

[7] Bandi, F.M. and Russell, J.R. (2006). Separating microstructure noise from

volatility. Journal of Financial Econometrics 1, 1-48.

[8] Barndorff-Nielsen, O.E. and Shephard, N. (2002a). Econometric analysis of re-

alized volatilty and its use in estimating stochastic volatility models. Journal of

the Royal Statistical Society, B 64, 253-280.

[9] Barndorff-Nielsen, O.E. and Shephard, N. (2002b). Estimating quadratic varia-

tion using realized variance. Journal of Applied Econometrics 17, 457-477.

[10] Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A. and Shephard, N. (2008). De-

signing realised kernels to measure the ex-post variation of equity prices in the

presence of noise. Econometrica, 76(6), 1481–1536.

[11] Cont, R. and Tankov, P. (2004). Financial modelling with jump processes. Chap-

man and Hall-CRC.

[12] Daniel, R. and Marc, Y. (2001). Continuous martingale and Brownian Motion.

Springer, New York.

[13] Gobbi, F., Mancini, C. (2009). Identifying the diffusion covariation and the co-

jumps given discrete observations. Econometric theory, Forthcoming.

18](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-18-2048.jpg)

![[14] Gobbi, F. and Mancini, C. (2010). Diffusion covariation and co-jumps in bi-

dimensional asset price processes with stochastic volatility and infinite activity

L´vy jumps. Arxiv, Jan, 2007.

e

[15] Jacod, J. (2008). Asymptotic properties of realized power variation and associated

functions of semi-martingale. Stochastic Processes and their Application 118,

517-559.

[16] Jacod, J., Protter, P. (1998). Asymptotic error distributions for the Euler method

for stochastic differential equations. Annals of Probability 26, 267-307.

[17] Jacod, J., Li, Y., Mykland, P.A., Podolskij, M. and Vetter, M.(2009). Microstruc-

ture noise in the continuous case: the pre-averaging approach. Stochastic Pro-

cesses and Their Applications 119, 2249-2276.

[18] Jacod, J., Podolskij, M. and Vetter, M. (2010). Limit theorems for moving aver-

ages of discretized processed plus noise. Annals of Statistics 38, 1478-1545.

[19] Jacod, J and Shiryayev, A. N. (2003). Limit Theorems for Stochastic Processes.

Springer, New York.

[20] Jing, B., Liu, Z., and Kong, X. (2010). Inference on integrated volatility with

jumps present in the latent price process under noisy observations. Working pa-

per.

[21] Karatzas. I. and Shreve, S. E. (1999). Brownian Motion and Stochastic Calculus.

Springer, New York.

[22] Mancini, C. (2009). Nonparametric threshold estimation for models with stochas-

tic diffusion coefficient and jumps. Scandinavian Journal of Statistics, 36(2),

270-296.

[23] Podolskij, M. and Vetter, M. (2009a). Estimation of volatility functionals in the

simultaneous presence of microstructure noise and jumps. Bernoulli 15, 634-658.

[24] Podolskij, M. and Vetter, M (2009b). Bi-power-type estimation in noisy diffusion

setting. Stochastic processes and their applications 119, 2803-2831.

[25] Protter, P. (1990). Stochastic integration and differential equations. Springer:

Berlin.

[26] Zhang, L. (2006). Efficient estimation of volatility using noisy observations.

Bernolli, 12(6) 1019-1043.

[27] Zhang, L., Mykland, P., A¨ ıt-Sahalia, Y. (2005). A tale of two time scales: Deter-

mining integrated volatility with noisy high-frequency data. Journal of the Amer-

ican Statistical Association 100, 1394-1411.

[28] Zheng, X. and Li, Y. (2010). On the estimation of integrated covariance matrices

of high dmensional diffusion processes. Manuscript.

19](https://image.slidesharecdn.com/onestimatingtheintegratedco-volatilityusing-130212084318-phpapp02/75/On-estimating-the-integrated-co-volatility-using-19-2048.jpg)