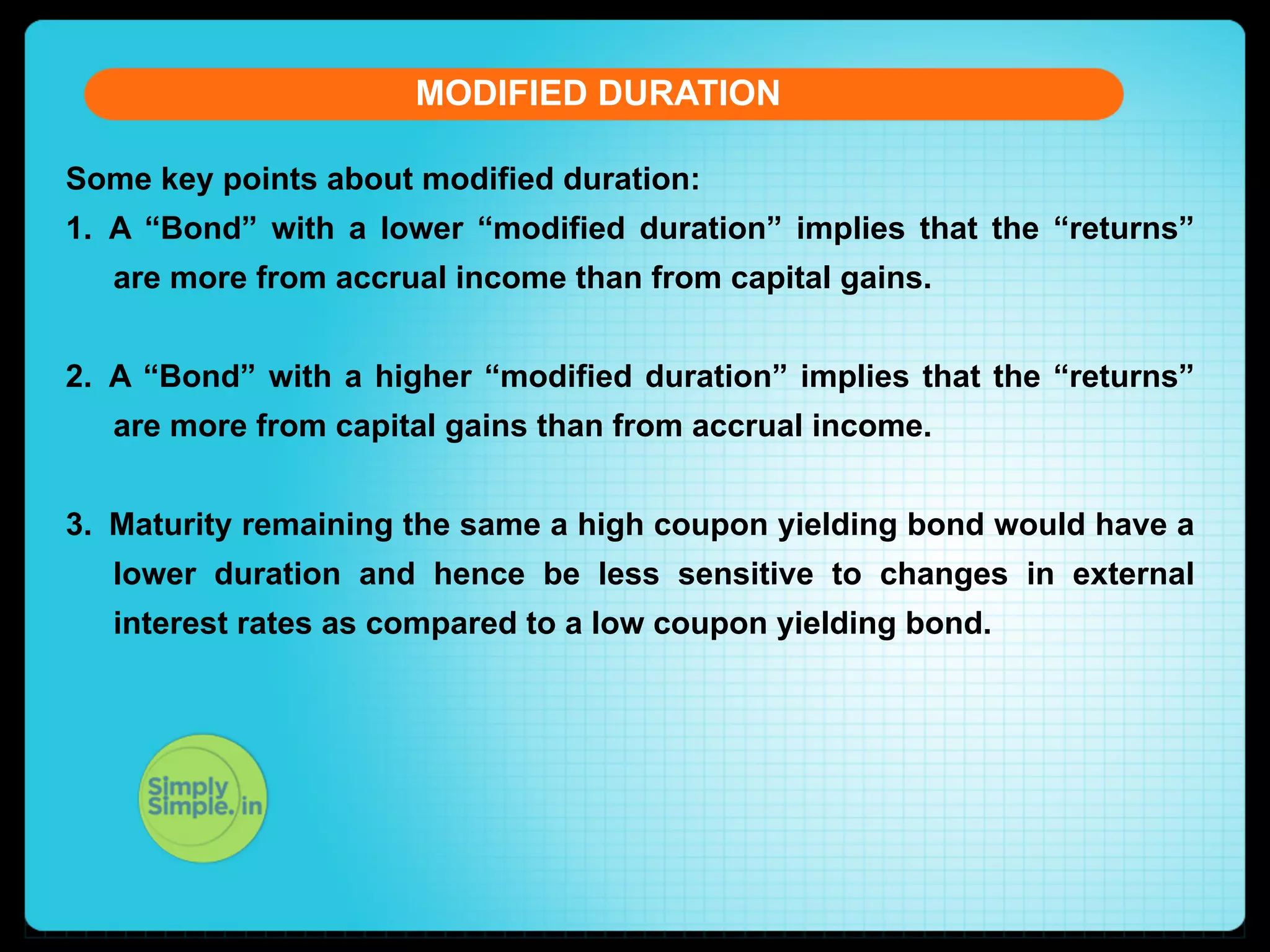

The document explains modified duration in the context of debt products, comparing it to stock inventory of winter clothes, where external factors affect pricing. A lower modified duration indicates less sensitivity to interest rate changes, while a higher modified duration signifies greater price fluctuation risk. The document also provides formulas for calculating bond price changes based on modified duration and yield variation.

![MODIFIED DURATION

CURRENT ACCOUNT DEFICIT

Let us see the formula of the Current Account Balance (CAB)

CAB = X - M + NI + NCT

X = Exports of goods and services

M = Imports of goods and services

NI = Net income abroad

[Salaries paid or received,

credit / debit of income from

FII by definition

Modified Duration& FDI etc. ] expresses

NCT = Net current transfers sensitivity of Remittancesbond to a

the [Workers' the price of a

change in interest rate.(unilateral),

Donations, Aids &

The change in interest rate can be linked

Grants,

Official, Assistance and

with the season change as explained in the

Pensions

etc]

previous example.](https://image.slidesharecdn.com/modifiedduration-140210055648-phpapp01/75/Modified-Duration-6-2048.jpg)

![MODIFIED DURATION

CURRENT ACCOUNT DEFICIT

Let us see the formula of the Current Account Balance (CAB)

CAB = X - M + NI + NCT

X = Exports of goods and services

M = Imports of goods and services

NI = Net income abroad

[Salaries paid or received,

credit / debit of income from

FII & FDI etc. ]

NCT = Net current transfersHope you have understood

[Workers' Remittances

(unilateral),

Donations, Aids &

Official, Assistance and

etc]

the concept of Grants,

Modified Duration.

Pensions](https://image.slidesharecdn.com/modifiedduration-140210055648-phpapp01/75/Modified-Duration-13-2048.jpg)