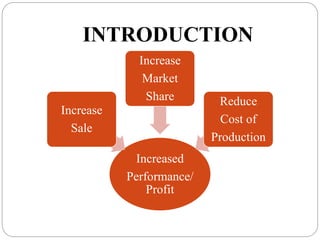

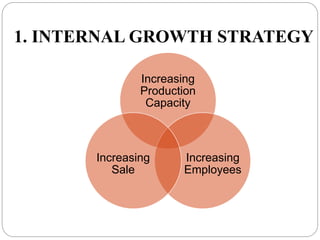

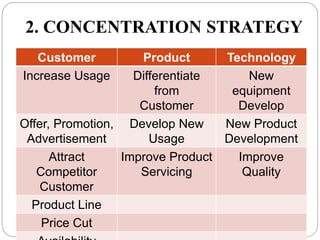

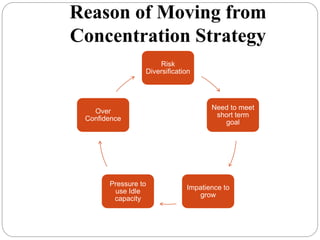

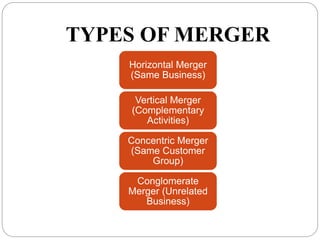

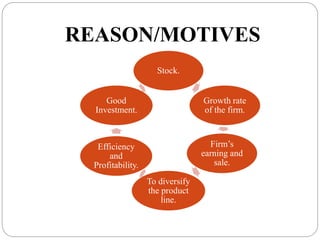

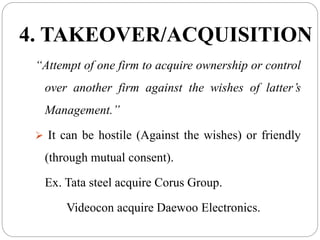

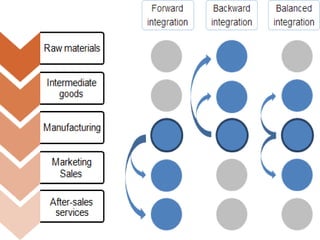

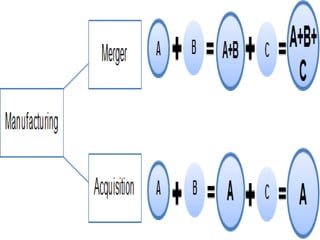

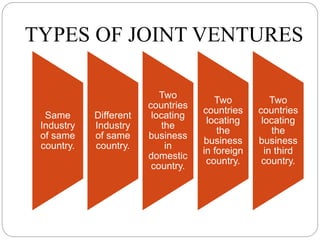

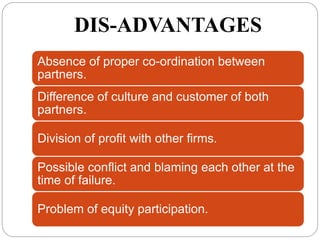

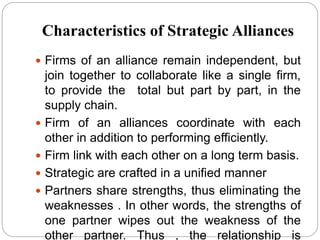

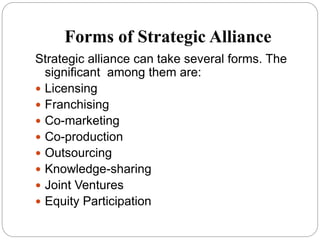

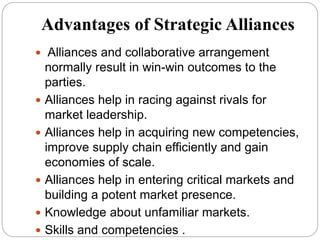

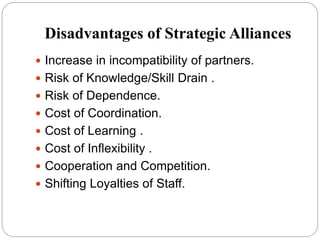

The document discusses various strategies for strategy formulation, including stability strategies, growth strategies, and strategic alliances. It provides details on different types of stability strategies such as maintenance of status quo. Growth strategies discussed include internal growth, concentration, mergers and acquisitions, horizontal and vertical integration, and joint ventures. Strategic alliances are defined as teaming with other companies to help perform business activities across the supply chain. The objectives, characteristics, and forms of strategic alliances are also summarized.