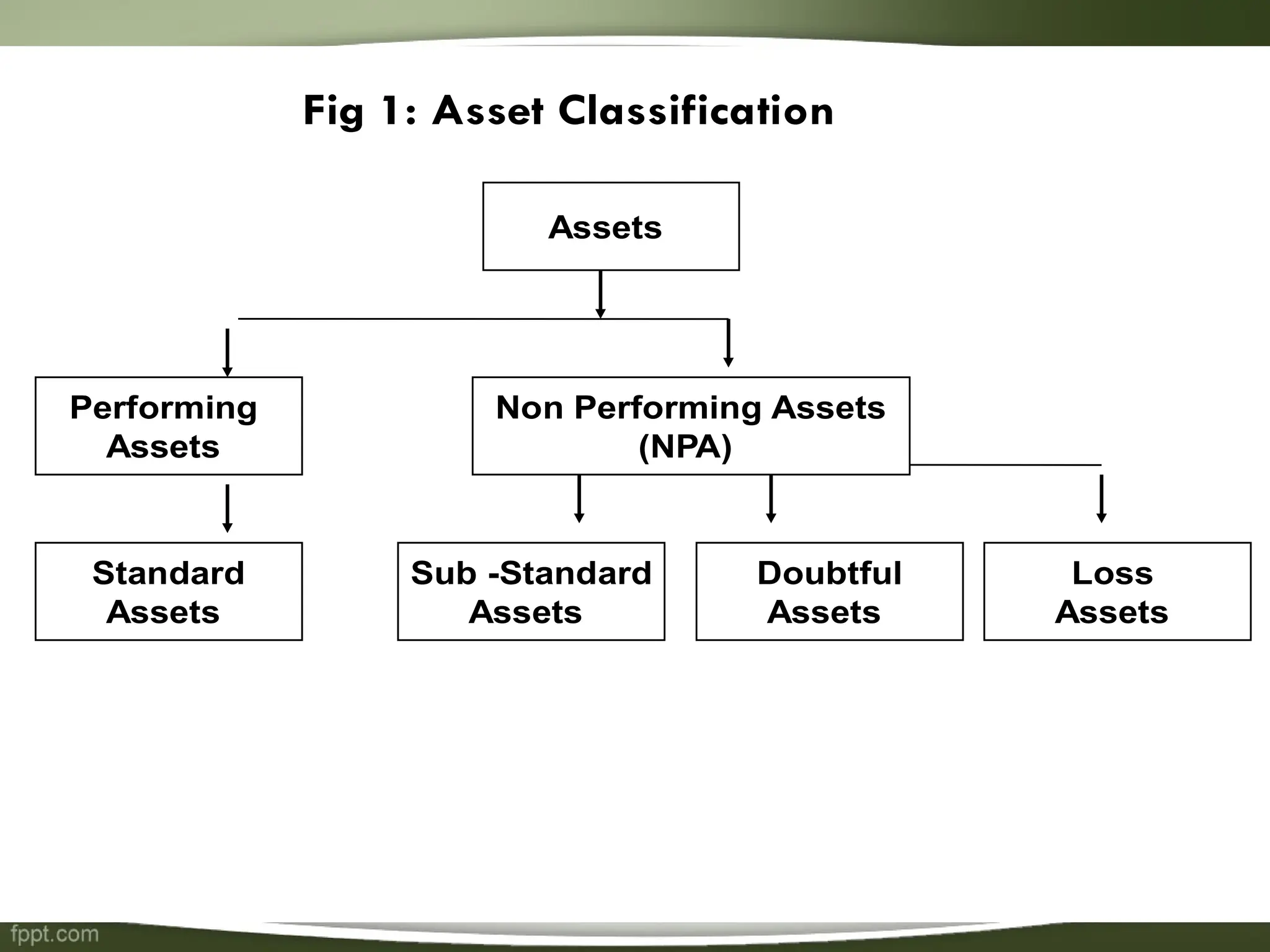

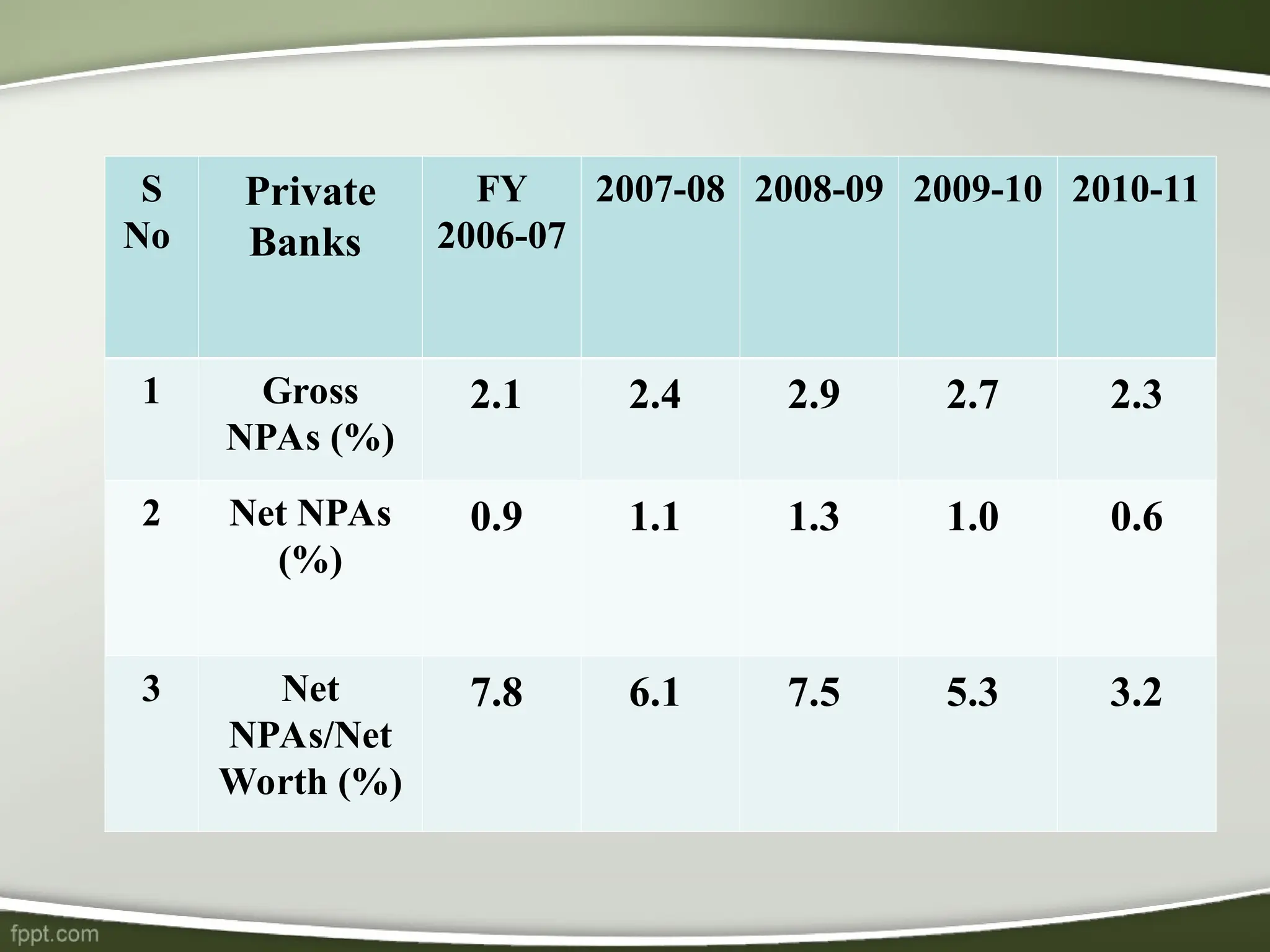

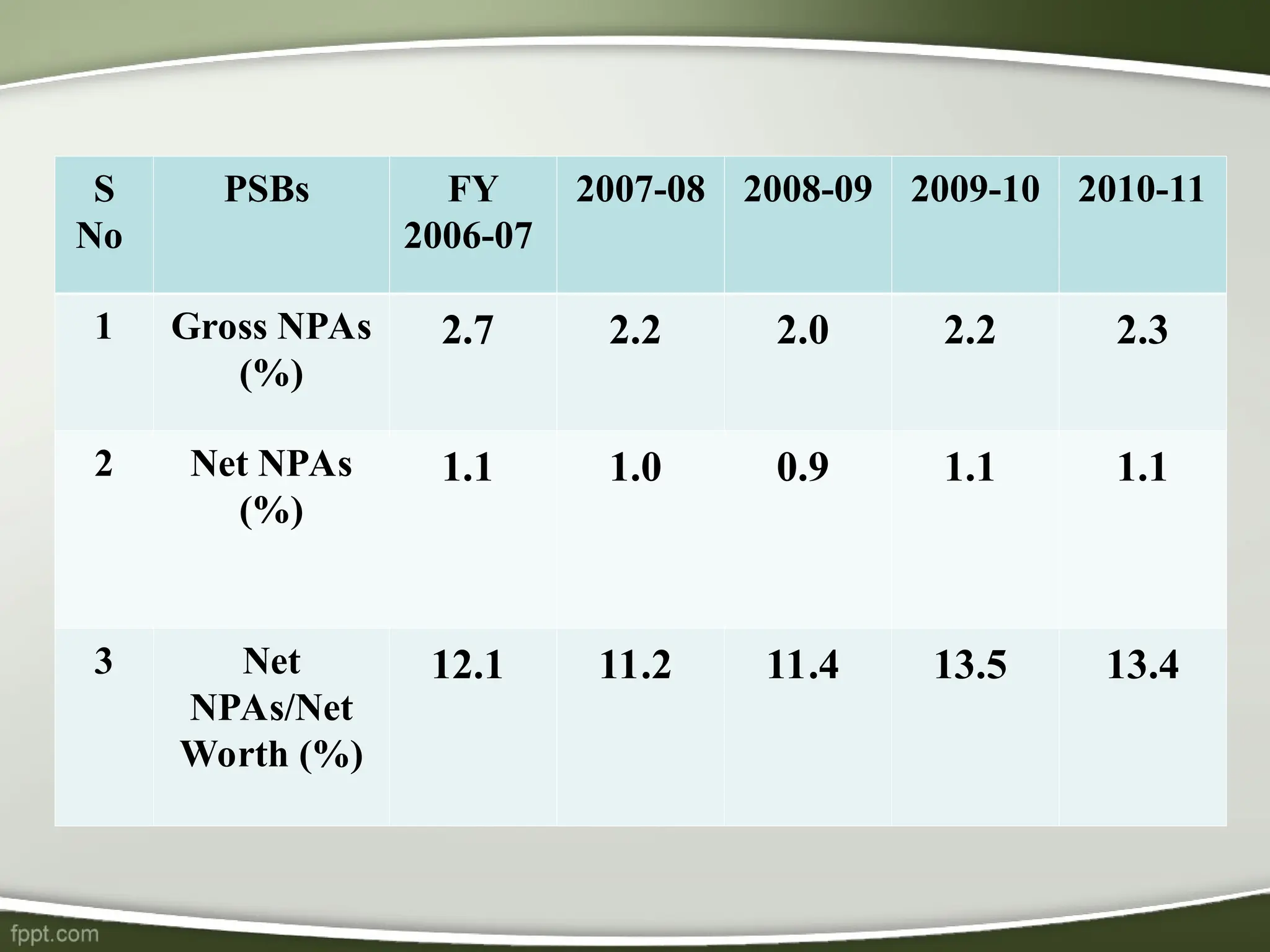

The document discusses Non-Performing Assets (NPAs) in banking, defining categories such as performing, sub-standard, doubtful, and loss assets, along with criteria for their classification according to RBI guidelines. It outlines the causes for the rise in NPAs, including poor loan assessment and external economic factors, while also presenting both preventive and curative management strategies for handling NPAs. Additionally, it explores various recovery mechanisms such as Debt Recovery Tribunals, the SARFAESI Act, and the Corporate Debt Restructuring process aimed at improving banks' asset quality.