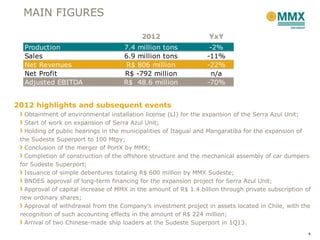

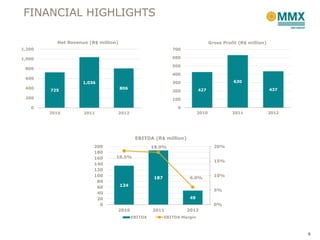

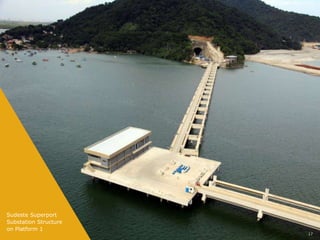

The document provides highlights from MMX Mineração e Metálicos S.A.'s 2012 results. It notes that production was 7.4 million tons, sales were 6.9 million tons, net revenues were R$806 million, and net profit was R$ -792 million. It also provides photos showing construction progress on the expansion of the Serra Azul Unit and the Sudeste Superport. The document concludes with investor relations contact information.